Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whizzer Tech Ltd (WTL) operates two share-based payments schemes (Golden and Sliver) for its employees. WTL prepares its financial statements at 31 March each

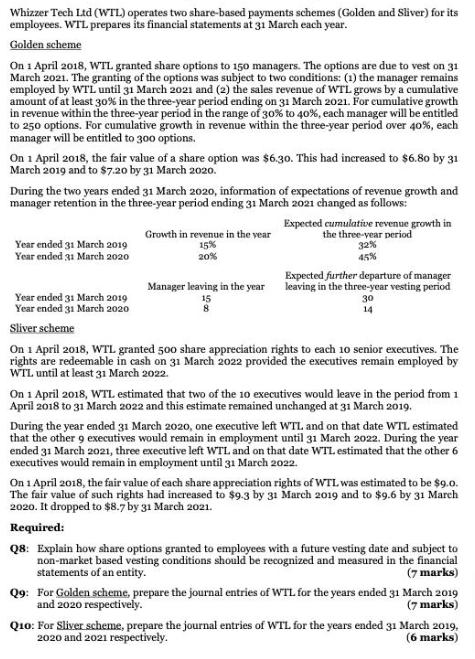

Whizzer Tech Ltd (WTL) operates two share-based payments schemes (Golden and Sliver) for its employees. WTL prepares its financial statements at 31 March each year. Golden scheme On 1 April 2018, WTL granted share options to 150 managers. The options are due to vest on 31 March 2021. The granting of the options was subject to two conditions: (1) the manager remains employed by WTL until 31 March 2021 and (2) the sales revenue of WTL grows by a cumulative amount of at least 30% in the three-year period ending on 31 March 2021. For cumulative growth in revenue within the three-year period in the range of 30% to 40%, each manager will be entitled to 250 options. For cumulative growth in revenue within the three-year period over 40%, each manager will be entitled to 300 options. On 1 April 2018, the fair value of a share option was $6.30. This had increased to $6.80 by 31 March 2019 and to $7.20 by 31 March 2020. During the two years ended 31 March 2020, information of expectations of revenue growth and manager retention in the three-year period ending 31 March 2021 changed as follows: Year ended 31 March 2019 Year ended 31 March 2020 Year ended 31 March 2019 Year ended 31 March 2020 Sliver scheme Growth in revenue in the year 15% 20% Expected cumulative revenue growth in the three-year period 32% 45% Expected further departure of manager Manager leaving in the year leaving in the three-year vesting period 30 14 On 1 April 2018, WTL granted 500 share appreciation rights to each 10 senior executives. The rights are redeemable in cash on 31 March 2022 provided the executives remain employed by WTL until at least 31 March 2022. On 1 April 2018, WTL estimated that two of the 10 executives would leave in the period from 1 April 2018 to 31 March 2022 and this estimate remained unchanged at 31 March 2019. During the year ended 31 March 2020, one executive left WTL and on that date WTI. estimated that the other 9 executives would remain in employment until 31 March 2022. During the year ended 31 March 2021, three executive left WTL and on that date WTL estimated that the other 6 executives would remain in employment until 31 March 2022. On 1 April 2018, the fair value of each share appreciation rights of WTL was estimated to be $9.0. The fair value of such rights had increased to $9.3 by 31 March 2019 and to $9.6 by 31 March 2020. It dropped to $8.7 by 31 March 2021. Required: Q8: Explain how share options granted to employees with a future vesting date and subject to non-market based vesting conditions should be recognized and measured in the financial statements of an entity. (7 marks) Q9: For Golden scheme, prepare the journal entries of WTL for the years ended 31 March 2019 and 2020 respectively. (7 marks) Q10: For Sliver scheme, prepare the journal entries of WTL for the years ended 31 March 2019, 2020 and 2021 respectively. (6 marks)

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started