Question

Items 1 through 4 require use of present value tables. The following are the present value factors of $1 discounted at 8% for one to

Items 1 through 4 require use of present value tables. The following are the present value factors of $1 discounted at 8% for one to five periods. Each item is based on 8% interest compounded annually from day of deposit to day of withdrawal.

Present Value of $1

Discounted at

Periods 8% per Period

1 .......... 0.926

2 .......... 0.857

3 .......... 0.794

4 .......... 0.735

5 .......... 0.681

1. What amount should be deposited in a bank today to grow to $1,000 three years from today?

a. $1,000/0.794

b. $1,000 × 0.926 × 3

c. ($1,000 × 0.926) + ($1,000 × 0.857) + ($1,000 × 0.794)

d. $1,000 × 0.794

2. What amount should an individual have in his bank account today, before withdrawal, if he needs $2,000 each year for four years, with the first withdrawal to be made today and each subsequent withdrawal at one-year intervals? (He is to have exactly a zero balance in his bank account after the fourth withdrawal.)

a. $2,000 + ($2,000 × 0.926) + ($2,000 × 0.857) + ($2,000 × 0.794)

b. $2,000/0.735 × 4

c. ($2,000 × 0.926) + ($2,000 × 0.857) + ($2,000 × 0.794) + ($2,000 × 0.735)

d. $2,000/0.926 × 4

3. If an individual put $3,000 in a savings account today, what amount of cash will be available two years from today?

a. $3,000 × 0.857

b. $3,000 × 0.857 × 2

c. $3,000/0.857

d. $3,000/0.926 × 2

4. What is the present value today of $4,000 to be received six years from today?

a. $4,000 × 0.926 × 6

b. $4,000 × 0.794 × 2

c. $4,000 × 0.681 × 0.926

d. Cannot be determined from the information given

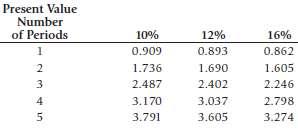

5. On January 1, 2007 Kern Company sold a machine to Burns Company. Burns signed a non-interest-bearing note requiring payment of $30,000 annually for seven years. The first payment was made on January 1, 2007. The prevailing rate of interest for this type of note at the date of issuance was 10%. Information on present value factors is as follows:

Kern should record the sale in January 2007 at

a. $107,100

b. $130,800

c. $146,100

d. $160,800

6. On May 1, 2007, a company purchased a new machine that it does not have to pay for until May 1, 2009. The total payment on May 1, 2009 will include both principal and interest. Assuming interest at a 10% rate, the cost of the machine would be the total payment multiplied by what time value of money concept?

a. Future value of annuity of 1

b. Future value of 1

c. Present value of annuity of 1

d. Present value of 1

7. An office equipment representative has a machine for sale or lease. If you buy the machine, the cost is $7,596. If you lease the machine, you will have to sign a noncancellable lease and make five payments of $2,000 each. The first payment will be paid on the first day of the lease. At the time of the last payment you will receive title to the machine. The present value of an ordinary annuity of $1 is as follows:

a. 10%

b. 12%

c. Between 10% and 12%

d. 16%

8. An accountant wishes to find the present value of an annuity of $1 payable at the beginning of each period at 10% for eight periods. He has only one present value table, which shows the present value of an annuity of $1 payable at the end of each period. To compute the present value factor he needs, the accountant would use the present value factor in the 10% column for

a. Seven periods

b. Seven periods and add 1

c. Eight periods

d. Nine periods and subtract 1

9. On July 1, 2007, James Rago signed an agreement to operate as a franchisee of Fast Foods, Inc., for an initial franchise fee of $60,000. Of this amount, $20,000 was paid when the agreement was signed and the balance is payable in four equal annual payments of $10,000 beginning July 1, 2008. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. Rago€™s credit rating indicates that he can borrow money at 14% for a loan of this type. Information on present and future value factors is as follows:

Present value of $1 at 14% for four periods .... 0.59

Future value of $1 at 14% for four periods ... 1.69

Present value of an ordinary annuity

of $1 at 14% for four periods ......... 2.91

Rago should record the acquisition cost of the franchise on July 1, 2007 at

a. $43,600

b. $49,100

c. $60,000

d. $67,600

10. For which of the following transactions would the use of the present value of an annuity due concept be appropriate in calculating the present value of the asset obtained or liability owed at the date of incurrence?

a. A capital lease is entered into with the initial lease payment due one month subsequent to the signing of the lease agreement.

b. A capital lease is entered into with the initial lease payment due upon the signing of the lease agreement.

c. A 10-year, 8% bond is issued on January 2, with interest payable semiannually on July 1 and January 1 yielding 7%.

d. A 10-year, 8% bond is issued on January 2, with interest payable semiannually on July 1 and January 1 yielding9%.

Present Value Number of Periods 1 2 3 5 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 16% 0.862 1.605 2.246 2.798 3.274

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Require...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dd679163cd_179286.pdf

180 KBs PDF File

635dd679163cd_179286.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started