Answered step by step

Verified Expert Solution

Question

1 Approved Answer

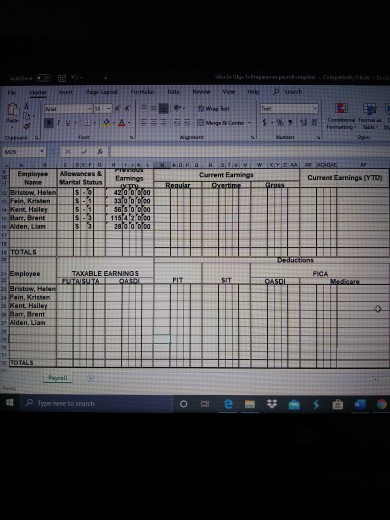

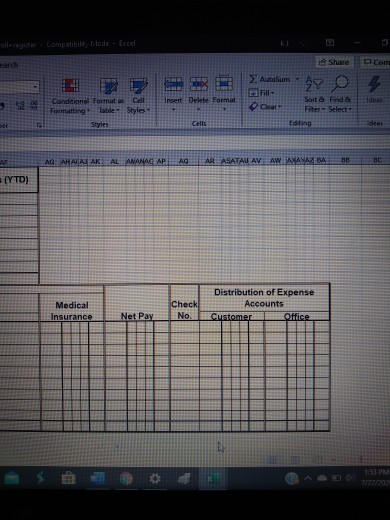

He Page Layou sko Hero 53 Tort 0-A Merge Center $ * Caretto tomating Ortod Aligt NUDI NOS 2 NOPIA RSDOM W XYZ LAAAAA Current

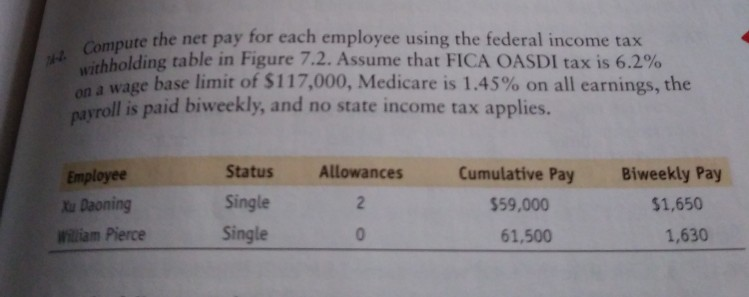

He Page Layou sko Hero 53 Tort 0-A Merge Center $ * Caretto tomating Ortod Aligt NUDI NOS 2 NOPIA RSDOM W XYZ LAAAAA Current Earnings Current Earnings (YT) Regular Overtime GROSS | | |B| = || G H I 15 L Employee Allowances & TWIN Name Marital Status Earnings wy Bristow. Helen 50 4200000 Fein, Kristen 3.0 33 000 14 Kent Halley 5-1 560 000 I Ban Brent 1622.00 Te Nden Lam 153 28 doo oo 1 TE 15 TOTALS Deductions 21 Employee TAXABLE EARNINGS FUTASUTA OAST FIT SIT FICA Me QASDI Bristow Helen 24 ein Kristen Kent Hailey Barr, Brent 22 Nden, Lam TOTALS Type to search O eller Compatibil Mode - Excel Bar Share Com Autosum AR Insert Delete Format Conditional Formatos Cell Formatting Table Styles Clear Sort & Find a Fiter Select - Styles Cells Eating ideas AG AHALAK AL ANANAG AP AG ARASATAU AV AW AXAWABA BB BC (YT) Medical Insurance Check No Distribution of Expense Accounts Customer Office Net Pay 1:51 PM H. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. Allowances Employee Xu Daoning William Pierce Status Single Single Cumulative Pay $59,000 2 Biweekly Pay $1,650 1,630 0 61,500 He Page Layou sko Hero 53 Tort 0-A Merge Center $ * Caretto tomating Ortod Aligt NUDI NOS 2 NOPIA RSDOM W XYZ LAAAAA Current Earnings Current Earnings (YT) Regular Overtime GROSS | | |B| = || G H I 15 L Employee Allowances & TWIN Name Marital Status Earnings wy Bristow. Helen 50 4200000 Fein, Kristen 3.0 33 000 14 Kent Halley 5-1 560 000 I Ban Brent 1622.00 Te Nden Lam 153 28 doo oo 1 TE 15 TOTALS Deductions 21 Employee TAXABLE EARNINGS FUTASUTA OAST FIT SIT FICA Me QASDI Bristow Helen 24 ein Kristen Kent Hailey Barr, Brent 22 Nden, Lam TOTALS Type to search O eller Compatibil Mode - Excel Bar Share Com Autosum AR Insert Delete Format Conditional Formatos Cell Formatting Table Styles Clear Sort & Find a Fiter Select - Styles Cells Eating ideas AG AHALAK AL ANANAG AP AG ARASATAU AV AW AXAWABA BB BC (YT) Medical Insurance Check No Distribution of Expense Accounts Customer Office Net Pay 1:51 PM H. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. Allowances Employee Xu Daoning William Pierce Status Single Single Cumulative Pay $59,000 2 Biweekly Pay $1,650 1,630 0 61,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started