Question

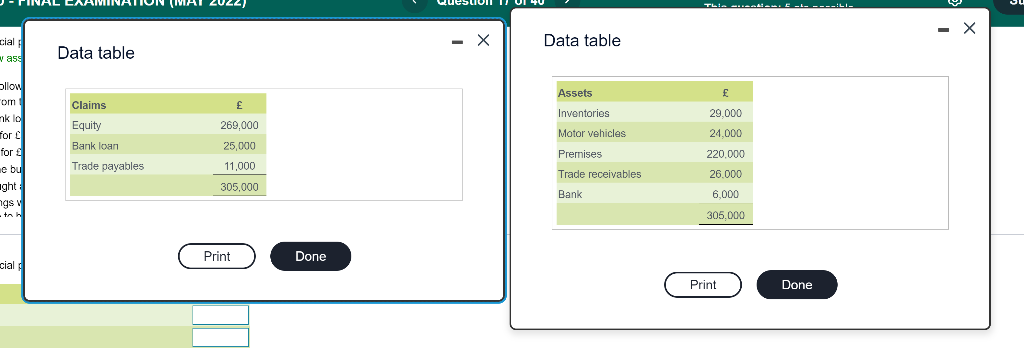

he statement of financial position of Dornier & Co at the start of the month is as follows: LOADING... (Click here to view assets table.)

he statement of financial position of Dornier & Co at the start of the month is as follows:

LOADING...

(Click here to view assets table.)

LOADING...

(Click here to view claims table.)

During the month the following transactions take place:

| (a) | Received cash from trade receivables totalling 14,000 |

| (b) | 3,500 of the bank loan was repaid. |

| (c) | Inventories sold for 14,000 cash; these inventories had cost8,750 |

| (d) | Sold inventories for 17,000 on credit; these inventories had cost10,200 |

| (e) | The owners of the business withdrew 5,000 for their personal use. |

| (f) | The owners brought a computer, valued at 2,500, into the business. |

| (g) | Fixtures and fittings were purchased costing 11,000. Half of the amount due was paid during the month and the remainder is due to be paid next month. |

| (h) | Paid trade payables 9,000. |

| (i) | Bought inventories on credit for 20,000. |

Required:

Show the statement of financial position at the end of the month after all of the above transactions have been taken into account.

(Fill in the relevant cells with their corresponding figures.)

Question content area bottom

Part 1

The statement of financial position of Dornier & Co at the end of the month is as follows:

| Assets |

|

| Premises |

|

| Motor vehicles |

|

| Fixtures and fittings |

|

| Computer |

|

| Inventories |

|

| Trade receivables |

|

| Bank |

|

|

|

|

Part 2

| Claims |

|

| Equity (or capital) |

|

| Bank loan |

|

| Trade payables |

|

| Other payables |

|

|

| |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started