Answered step by step

Verified Expert Solution

Question

1 Approved Answer

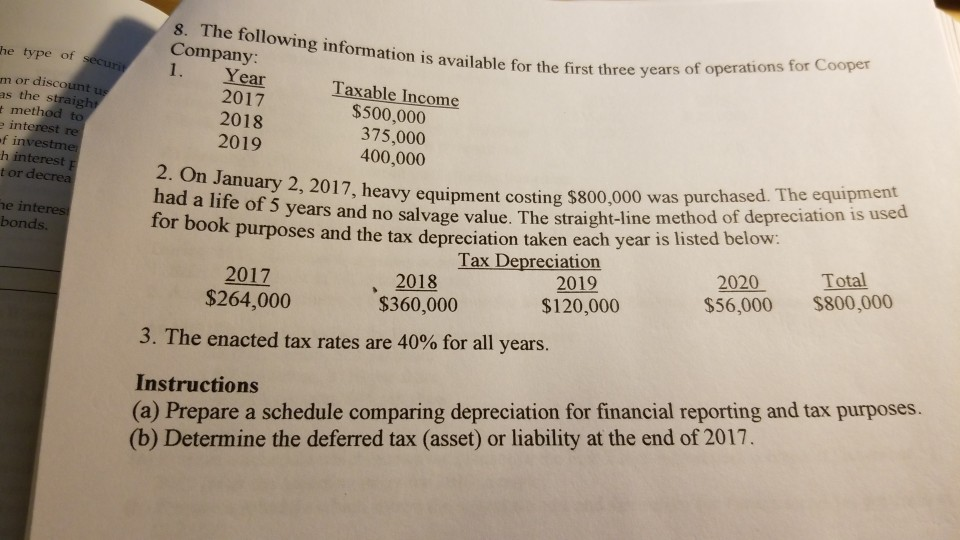

he type of securi 8. The following information is available for th Company: Taxable Income $500,000 2018 375,000 vallable for the first three years of

he type of securi 8. The following information is available for th Company: Taxable Income $500,000 2018 375,000 vallable for the first three years of operations for Cooper Year 2017 m or discount us as the straight method to e interest re of investme h interest tor decrea 2019 400,000 2. On January 2, 2017, heavy equipment cost had a life of 5 years and no salvage value he interes bonds. neavy equipment costing $800,000 was purchased. The equipment als and no salvage value. The straight-line method of depreciation is used OOK purposes and the tax depreciation taken each year is listed below: Tax Depreciation 2017 2018 2019 2020 Total $264,000 $360,000 $120,000 $56,000 $800,000 3. The enacted tax rates are 40% for all years. Instructions (a) Prepare a schedule comparing depreciation for financial reporting and tax purposes (b) Determine the deferred tax (asset) or liability at the end of 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started