Question

Trevor has owned a large block of land for 3 years and has just decided to subdivide this large block into three allotments and

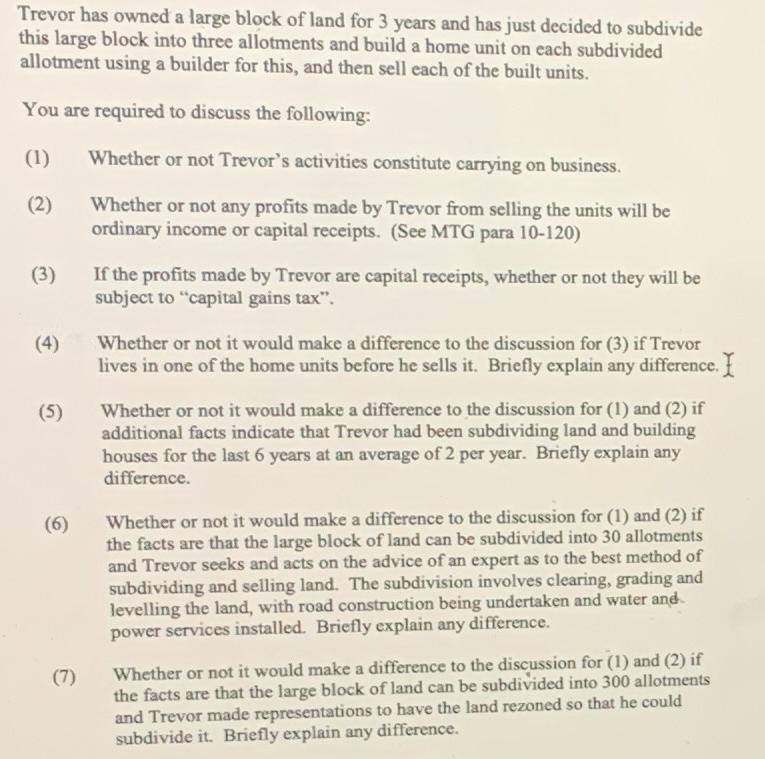

Trevor has owned a large block of land for 3 years and has just decided to subdivide this large block into three allotments and build a home unit on each subdivided allotment using a builder for this, and then sell each of the built units. You are required to discuss the following: (1) Whether or not Trevor's activities constitute carrying on business. (2) Whether or not any profits made by Trevor from selling the units will be ordinary income or capital receipts. (See MTG para 10-120) (3) (4) (5) (6) (7) If the profits made by Trevor are capital receipts, whether or not they will be subject to "capital gains tax". Whether or not it would make a difference to the discussion for (3) if Trevor lives in one of the home units before he sells it. Briefly explain any difference. I Whether or not it would make a difference to the discussion for (1) and (2) if additional facts indicate that Trevor had been subdividing land and building houses for the last 6 years at an average of 2 per year. Briefly explain any difference. Whether or not it would make a difference to the discussion for (1) and (2) if the facts are that the large block of land can be subdivided into 30 allotments and Trevor seeks and acts on the advice of an expert as to the best method of subdividing and selling land. The subdivision involves clearing, grading and levelling the land, with road construction being undertaken and water and power services installed. Briefly explain any difference. Whether or not it would make a difference to the discussion for (1) and (2) if the facts are that the large block of land can be subdivided into 300 allotments and Trevor made representations to have the land rezoned so that he could subdivide it. Briefly explain any difference.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Business Tax GST Tutorial No 2 2021 1 Whether or not Trevors activities constitute carrying on business To determine whether Trevors activities constitute carrying on a business several factors need t...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started