Answered step by step

Verified Expert Solution

Question

1 Approved Answer

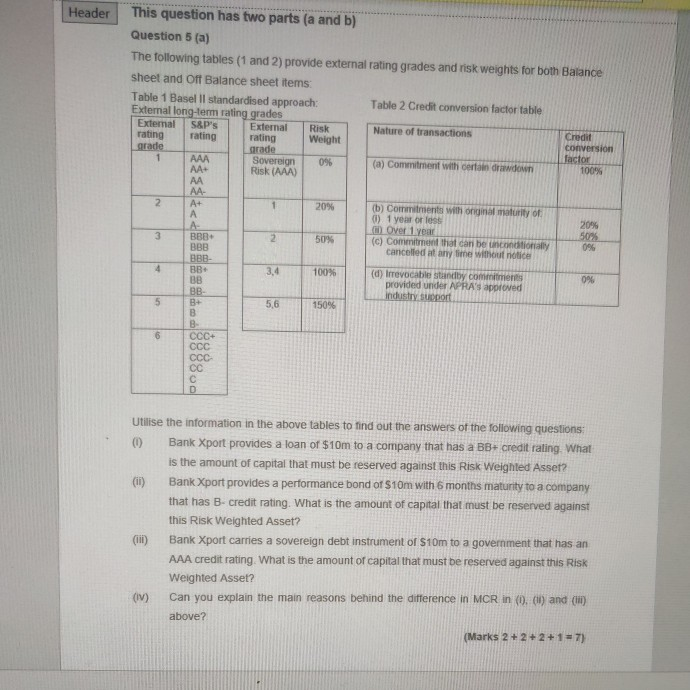

Header 1 This question has two parts (a and b) Question 5 (a) The following tables (1 and 2) provide external rating grades and risk

Header 1 This question has two parts (a and b) Question 5 (a) The following tables (1 and 2) provide external rating grades and risk weights for both Balance sheet and Off Balance sheet items: Table 1 Basel Il standardised approach: Table 2 Credit conversion factor table External long-term rating grades External S&P's External Risk Nature of transactions rating rating rating Credit Weight grade grade conversion AAA factor Sovereign 0% (a) Commitment with certain drawdown AA+ 100% Risk (AAA) AA AA- 2 A+ 20% (b) Commitments with orginal maturity of 0) 1 year or loss 20% A- Over 1 year 3 50% BBB 2 50% (c) Commitment that can be inconditionally 0% BBB cancelled at any time without notice BBB 4 BB 3,4 100% (d) Irrevocable standby commitments 0% BB provided under APRA's approved BB- industry support 5 B+ 5,6 150% B B. 6 + CCC CC D 1 Utilise the information in the above tables to find out the answers of the following questions: 0 Bank Xport provides a loan of $10m to a company that has a BB+ credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (11) Bank Xport provides a performance bond of $10m with 6 months maturity to a company that has B-credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (III) Bank Xport carries a sovereign debt instrument or $10m to a government that has an AAA credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (IV) Can you explain the main reasons behind the difference in MCR in (0.01and (H) above? (Marks 2+2+2+1 =7) Header 1 This question has two parts (a and b) Question 5 (a) The following tables (1 and 2) provide external rating grades and risk weights for both Balance sheet and Off Balance sheet items: Table 1 Basel Il standardised approach: Table 2 Credit conversion factor table External long-term rating grades External S&P's External Risk Nature of transactions rating rating rating Credit Weight grade grade conversion AAA factor Sovereign 0% (a) Commitment with certain drawdown AA+ 100% Risk (AAA) AA AA- 2 A+ 20% (b) Commitments with orginal maturity of 0) 1 year or loss 20% A- Over 1 year 3 50% BBB 2 50% (c) Commitment that can be inconditionally 0% BBB cancelled at any time without notice BBB 4 BB 3,4 100% (d) Irrevocable standby commitments 0% BB provided under APRA's approved BB- industry support 5 B+ 5,6 150% B B. 6 + CCC CC D 1 Utilise the information in the above tables to find out the answers of the following questions: 0 Bank Xport provides a loan of $10m to a company that has a BB+ credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (11) Bank Xport provides a performance bond of $10m with 6 months maturity to a company that has B-credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (III) Bank Xport carries a sovereign debt instrument or $10m to a government that has an AAA credit rating. What is the amount of capital that must be reserved against this Risk Weighted Asset? (IV) Can you explain the main reasons behind the difference in MCR in (0.01and (H) above? (Marks 2+2+2+1 =7)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started