Answered step by step

Verified Expert Solution

Question

1 Approved Answer

headline in The New York Times on August 16, 2017 read: Hartford (Connecticut), With inances in Disarray, Veers Toward Bankruptcy. The article said, among other

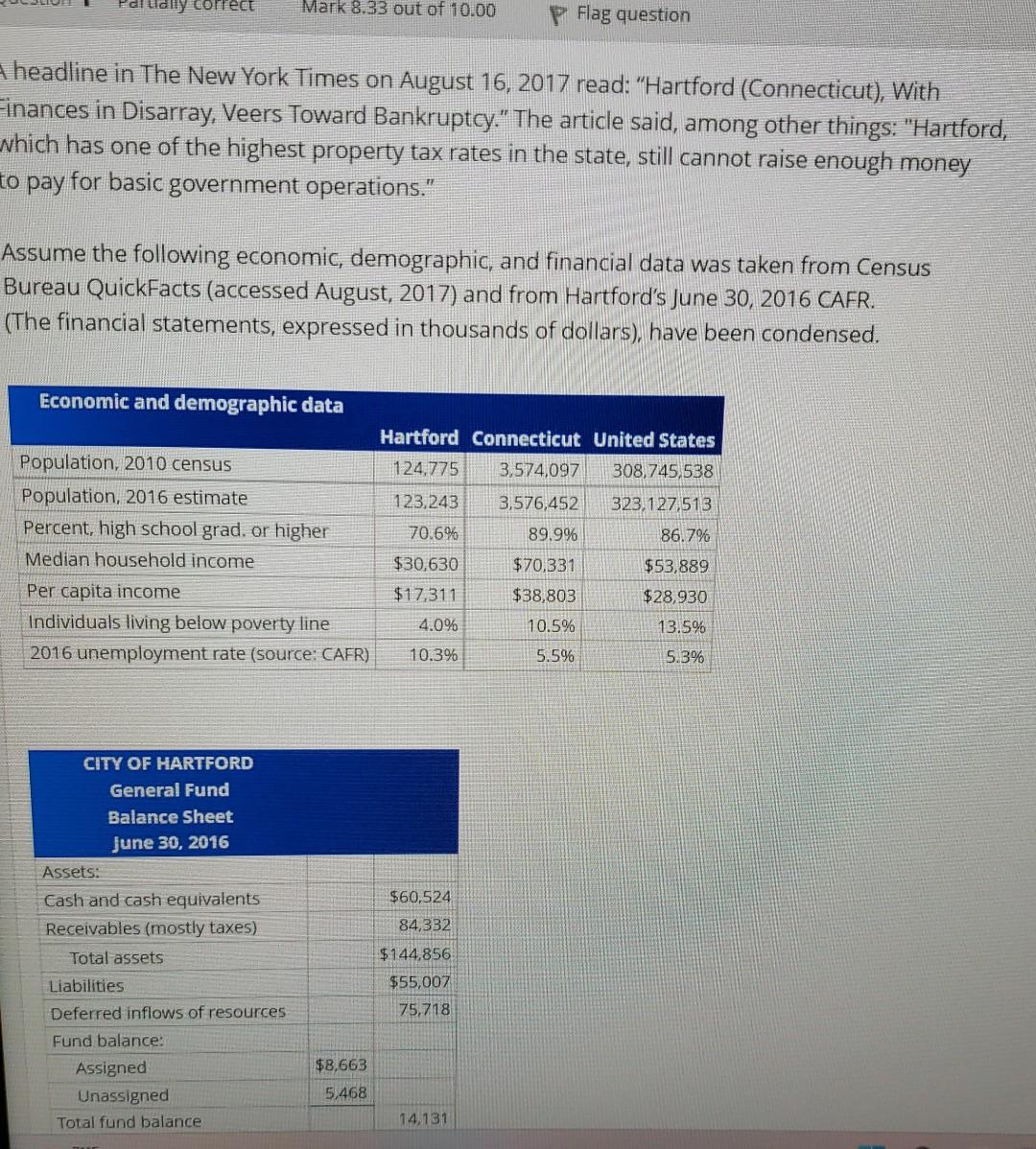

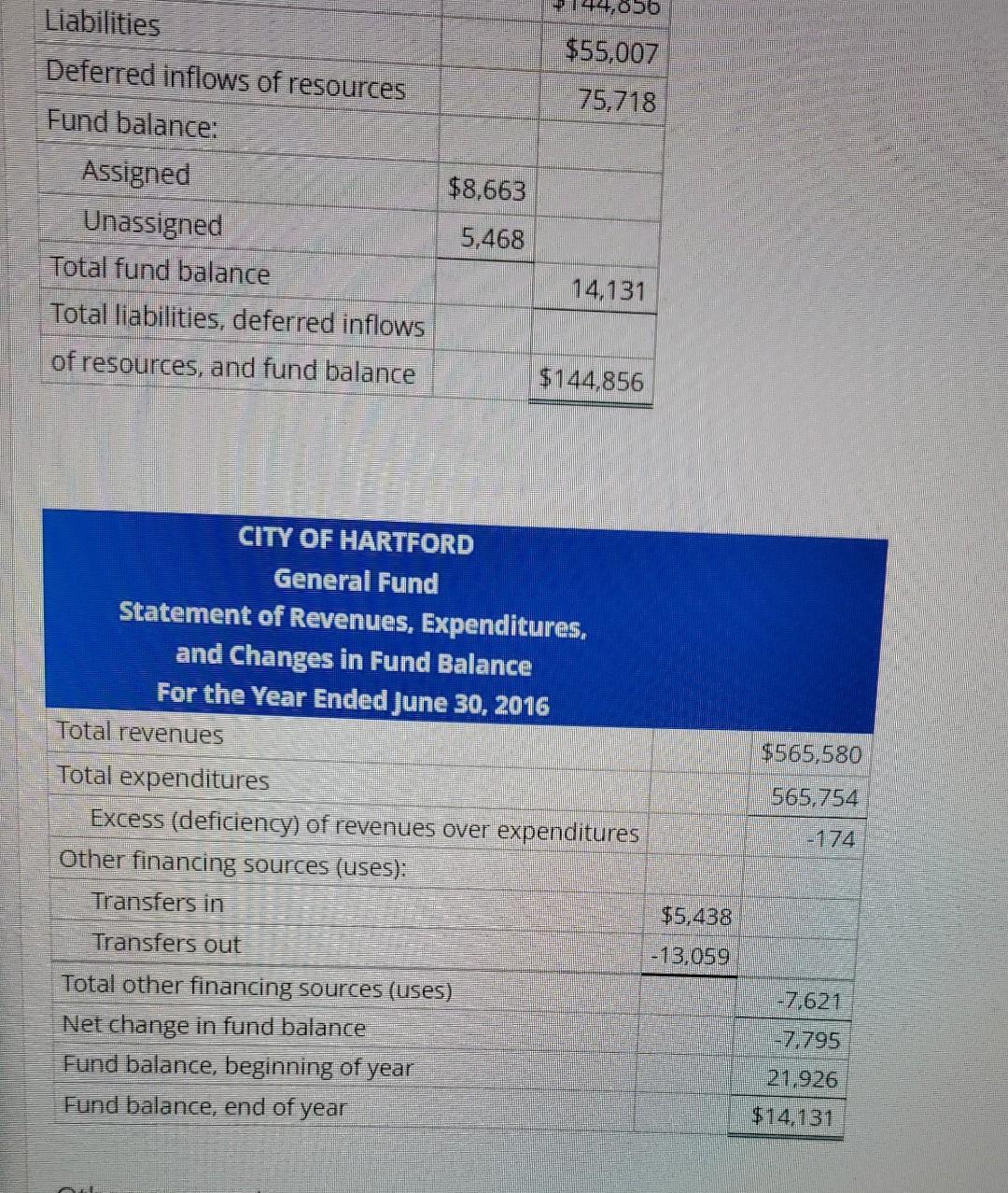

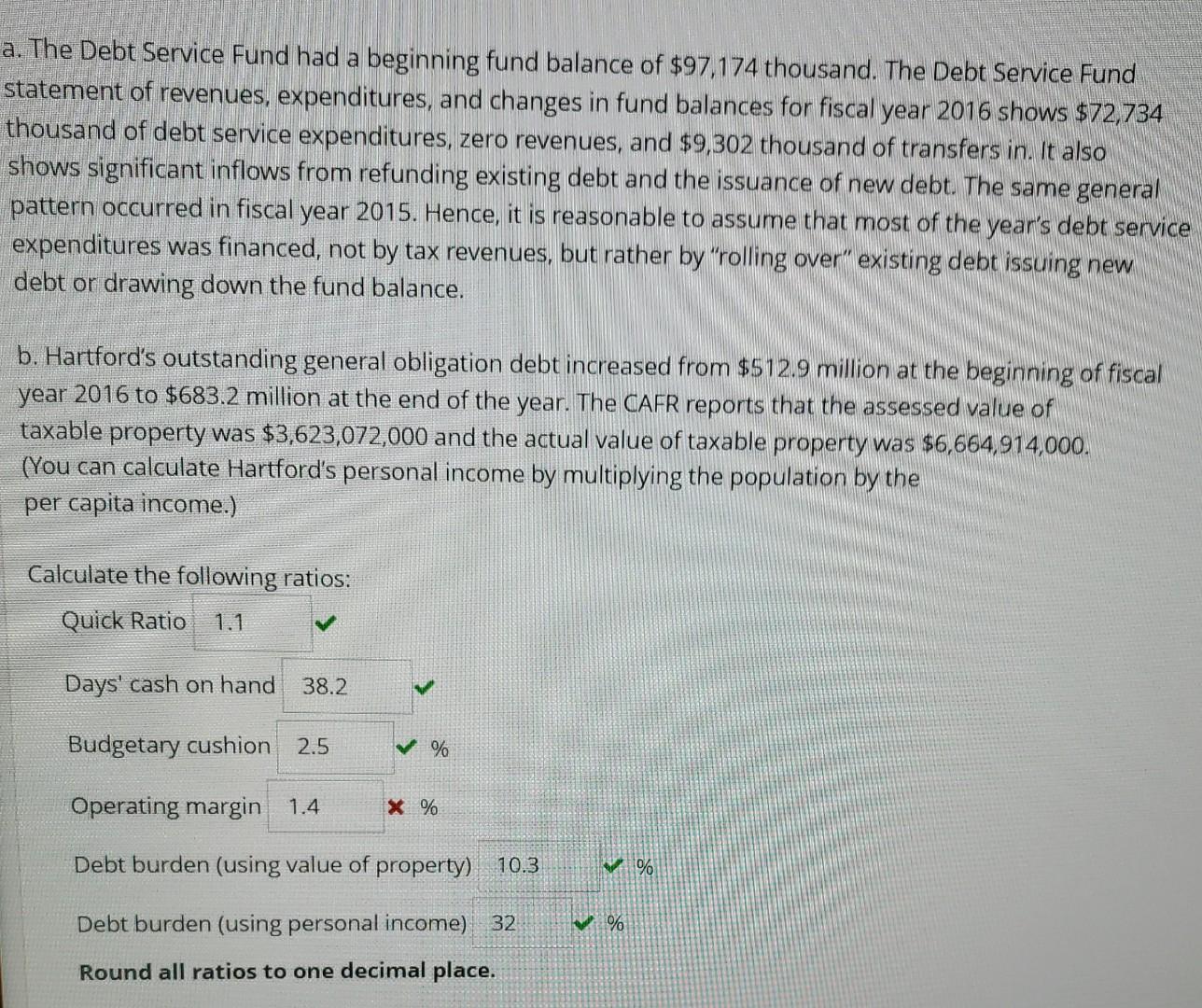

headline in The New York Times on August 16, 2017 read: "Hartford (Connecticut), With inances in Disarray, Veers Toward Bankruptcy." The article said, among other things: "Hartford, which has one of the highest property tax rates in the state, still cannot raise enough money io pay for basic government operations." Assume the following economic, demographic, and financial data was taken from Census Bureau QuickFacts (accessed August, 2017) and from Hartford's June 30, 2016 CAFR. (The financial statements, expressed in thousands of dollars), have been condensed. The Debt Service Fund had a beginning fund balance of $97,174 thousand. The Debt Service Fund statement of revenues, expenditures, and changes in fund balances for fiscal year 2016 shows \$72,734 thousand of debt service expenditures, zero revenues, and $9,302 thousand of transfers in. It also shows significant inflows from refunding existing debt and the issuance of new debt. The same general pattern occurred in fiscal year 2015. Hence, it is reasonable to assume that most of the year's debt service expenditures was financed, not by tax revenues, but rather by "rolling over" existing debt issuing new debt or drawing down the fund balance. b. Hartford's outstanding general obligation debt increased from $512.9 million at the beginning of fiscal year 2016 to $683.2 million at the end of the year. The CAFR reports that the assessed value of taxable property was $3,623,072,000 and the actual value of taxable property was $6,664,914,000. (You can calculate Hartford's personal income by multiplying the population by the per capita income.) headline in The New York Times on August 16, 2017 read: "Hartford (Connecticut), With inances in Disarray, Veers Toward Bankruptcy." The article said, among other things: "Hartford, which has one of the highest property tax rates in the state, still cannot raise enough money io pay for basic government operations." Assume the following economic, demographic, and financial data was taken from Census Bureau QuickFacts (accessed August, 2017) and from Hartford's June 30, 2016 CAFR. (The financial statements, expressed in thousands of dollars), have been condensed. The Debt Service Fund had a beginning fund balance of $97,174 thousand. The Debt Service Fund statement of revenues, expenditures, and changes in fund balances for fiscal year 2016 shows \$72,734 thousand of debt service expenditures, zero revenues, and $9,302 thousand of transfers in. It also shows significant inflows from refunding existing debt and the issuance of new debt. The same general pattern occurred in fiscal year 2015. Hence, it is reasonable to assume that most of the year's debt service expenditures was financed, not by tax revenues, but rather by "rolling over" existing debt issuing new debt or drawing down the fund balance. b. Hartford's outstanding general obligation debt increased from $512.9 million at the beginning of fiscal year 2016 to $683.2 million at the end of the year. The CAFR reports that the assessed value of taxable property was $3,623,072,000 and the actual value of taxable property was $6,664,914,000. (You can calculate Hartford's personal income by multiplying the population by the per capita income.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started