Question

Health Harmony (Pty) Ltd(HH) is a company offering various health and wellness services and sells health supplements.The company issituated in Johannesburg and itsfinancial year ends

Health Harmony (Pty) Ltd (“HH”) is a company offering various health and wellness services and sells health

supplements. The company is situated in Johannesburg and its financial year ends on 31 March 2023. HH

owns a 25% shareholding in another company specialising in organic juices, OJuicy (Pty) Ltd (“OJuicy”). HH is

not a small business corporation as defined in section 12E the Income Tax Act. The company accountant

calculated the preliminary taxable income as R6 785 000. You may assume that this amount is correctly

calculated, however, the items listed below still needs to be taken into account:

Dividends received

OJuicy declared and paid dividends to its shareholders on 15 March 2023. HH’s 25% share of the gross

dividend amounted to R50 000. (You may ignore dividends tax).

2. Rental income & improvements

A lease agreement was entered into on 1 July 2022 between a personal trainer (a natural person) and HH

whereby the trainer will pay R15 000 monthly rent to use office space in HH’s property from 1 July 2022. In

terms of the agreement, the trainer needed to make improvements to the space for an amount of R100 000.

The improvements were all effected by the trainer and brought into use by 31 January 2023 at a cost of

R130 000.

Inventory transactions

Supplements for R1 789 000 were purchased during the year. The following was confirmed by the auditors

during the latest company stock takes:

Cost

Market value

Supplements - closing inventory 31 March 2022

R665 430

R690 000

Supplements - closing inventory 31 March 2023

R342 978

R300 670

On 1 March 2023, supplements which were about to expire and could not be sold to the public were sold

to HH’s staff family members for R12 800. The R12 800 is already included in the calculated taxable income

of R6 785 000. These supplements had a market value of R26 000.

4. Marketing expense

HH entered into a contract with a marketing company to handle all the company’s marketing. An upfront

payment of R90 000 was paid on 1 March 2023 for marketing services to be rendered from 1 March 2023

until 31 December 2023.

5. Patents & related costs

5.1 The term of a South African patent (patent S1) that HH owns on a supplement, was extended on

1 June 2022 for another two years for R35 000.

5.2 HH consulted with a foreign supplier regarding improvements to the supplement (patent S1). The foreign

supplier shared their valuable expertise and knowledge for a fee of R60 000 which was paid by HH on

1 October 2022.

6. Bad debts

The following amounts were written off by HH at the end of its 2023 year of assessment:

6.1 R58 000 in respect of product sales that were made in the previous year of assessment and are now

considered to be irrecoverable.

6.2 R13 000 in respect of a loan made to an employee. R12 000 was loaned to the employee and R1 000

interest accrued on this loan amount in previous years of assessments. The employee absconded from

work during April 2022 and cannot be traced. The full amount is regarded as irrecoverable by HH.

7. Restraint of trade expense

HH employed a well known life coach two years ago, who resigned on 31 July 2022. An amount of

R1 000 000 was paid to the life coach in order to restrain the coach to work in Johannesburg for a period

of one year.

REQUIRED:

Calculate the normal tax liability of Health Harmony (Pty) Ltd for the 2023 year of assessment.

Provide reasons for your answer in respect of the marketing expense as well as for all amounts

that are not taxable and/or not deductible.

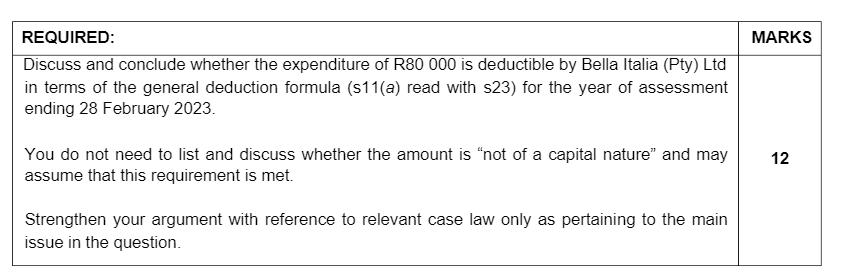

Bella Italia (Pty) Ltd operates as a franchise restaurant in a busy shopping mall in Pretoria. According to the

contract between them and the franchisor, the restaurant must pay monthly franchise fees for various franchise

services received. In addition, R80 000 must be paid each year by 30 April if a (verified and audited) turnover

of more than R4million for the financial year was reached.

The accountant decided to be prudent and paid the R80 000 on 26 February 2023 without knowing the annual

turnover amount and deducted it for the purposes of calculating the taxable income for the 28 February 2023

year of assessment .

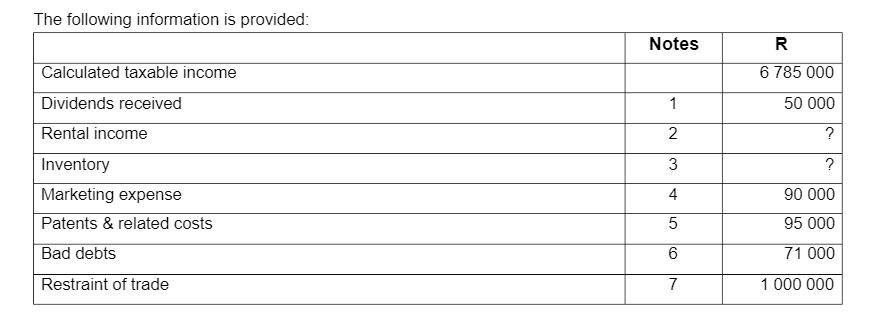

The following information is provided: Calculated taxable income Dividends received Rental income Inventory Marketing expense Patents & related costs Bad debts Restraint of trade Notes 1 2 3 4 5 6 7 R 6 785 000 50 000 ? ? 90 000 95 000 71 000 1 000 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PART A Calculation of Health Harmony Pty Ltds Normal Tax Liability for the 2023 Year of Assessment Calculated Taxable Income R6785000 Dividends Received R50000 Now lets address each of the items and d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started