Question

Health resources are finite. Therefore, it is incumbent on all health organizations to exercise responsible fiscal decision making when allocating their financial resources. As the

Health resources are finite. Therefore, it is incumbent on all health organizations to exercise responsible fiscal decision making when allocating their financial resources.

As the senior cost analyst for a local, nonprofit hospital, you are charged with determining the most appropriate use of financial resources and making recommendations. Your organization is seeking to secure a new CT Scan unit for the expanded emergency department. The hospital has the option of leasing the equipment or purchasing the equipment.

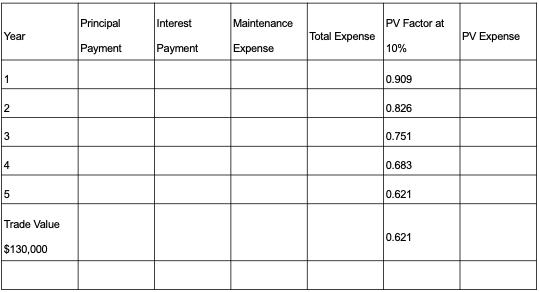

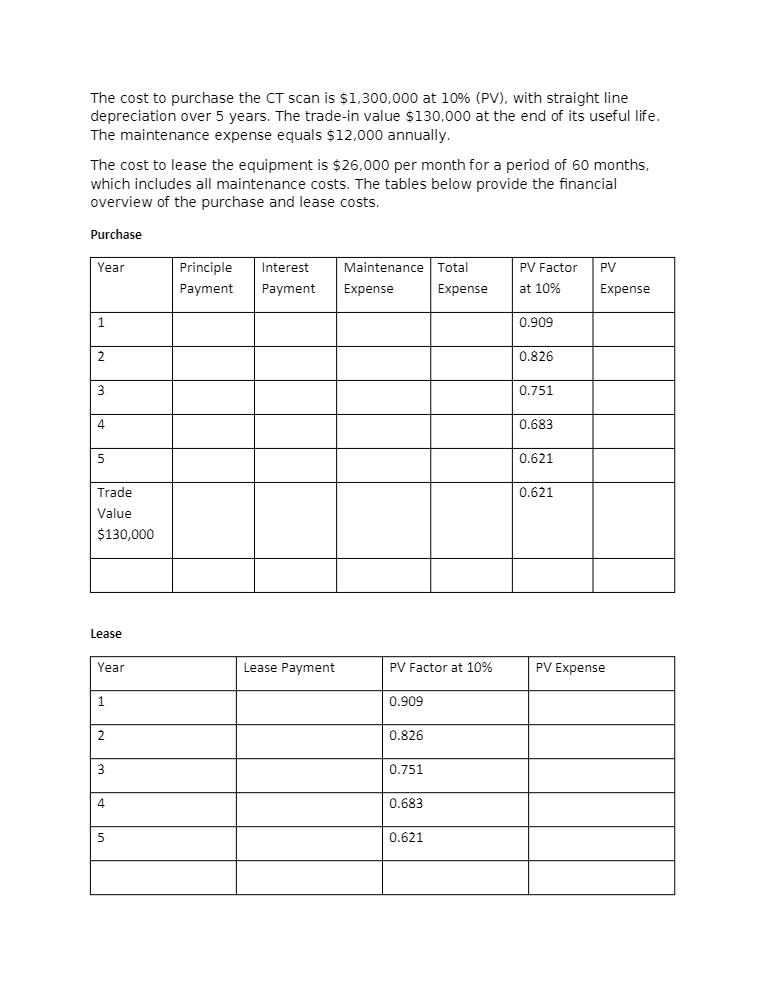

The cost to purchase the CT scan is $1,300,000 at 10% (PV), with straight line depreciation over 5 years. The trade-in value $130,000 at the end of its useful life. The maintenance expense equals $12,000 annually.

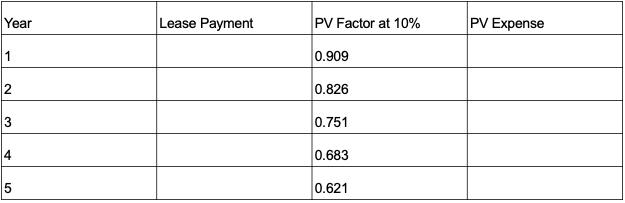

The cost to lease the equipment is $26,000 per month for a period of 60 months, which includes all maintenance costs. The tables below provide the financial overview of the purchase and lease costs.

Image transcription text

Principal Interest Maintenance PV Factor at Year Total Expense PV Expense Payment Payment Expense

10% 0.909 2 0.826 3 0.751 4 0.683 5 0.621 Trade Value 0.621 $130,000

In a written case analysis, use the figures provided in the tables to discuss the following:

- • Compare and contrast leasing versus purchasing. You may use the Rasmussen library to research articles addressing lease versus purchase decisions in order to support your assertions.

- • Calculate the figures relative to the principal payment, interest payment, maintenance expense, total expense, and PV expense and complete the tables below.

- • Provide a detailed explanation of the costs associated with leasing the equipment as depicted in the table.

- • Provide a detailed explanation of the costs associated with purchasing the equipment as depicted in the table.

- • Discuss the potential tax implications of leasing the equipment, assuming that the organization is a nonprofit.

- • Discuss the potential tax implications of purchasing the equipment, assuming that the organization is a nonprofit.

- • Recommend a course of action and the implications that your recommendation may have for the organization.

Image transcription text

The cost to purchase the CT scan is $1,300,000 at 10% (PV), with straight line depreciation over 5 years. The trade-in value $130,000 at the end of its useful life. The maintenance expense equals $12.000 annually. The cost to lease the equipment is $26.000 per month for a period of 60 months, which includes all maintenance costs. The tables below provide the financial overview of the purchase and lease costs. Purchase Principle Payment Value 130,000 Interest Maintenance | Total PV Factor | PV Payment Expense Expense Expense 0.909 T T T e e 1

Principal Interest Maintenance PV Factor at Year Total Expense PV Expense Payment Payment Expense 10% 1 0.909 2 0.826 3 0.751 4 0.683 5 0.621 Trade Value $130,000 0.621

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started