HEALTHCARE FINANCE TOPIC

I have answered these questions, but I need a second opinion. Please explain why you choose that answer!

Please answer all the questions below.

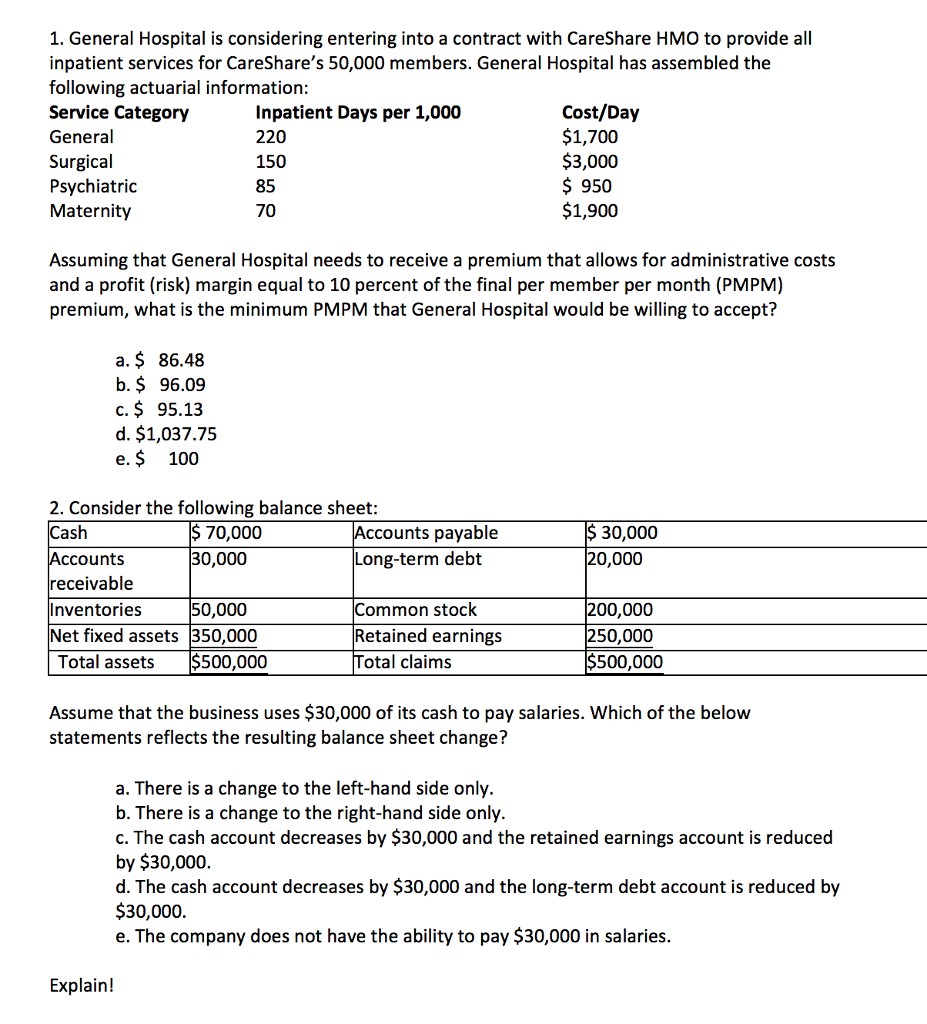

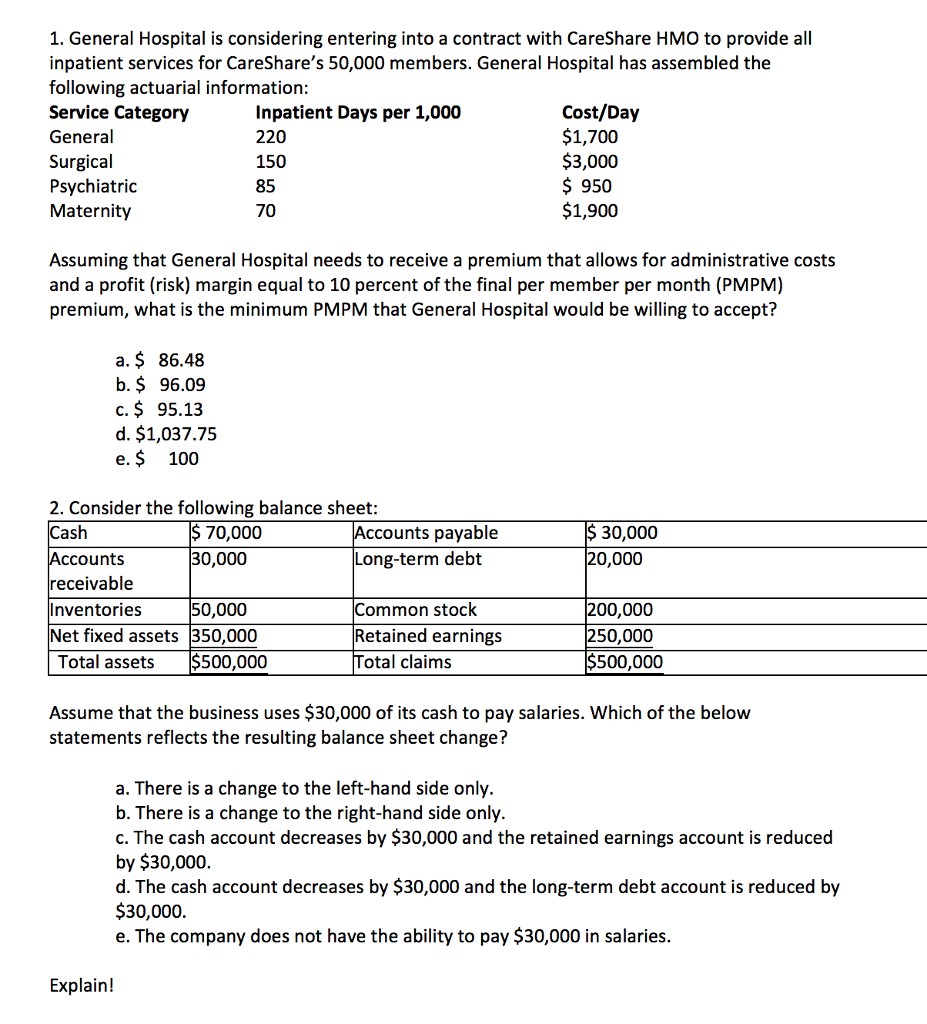

1. General Hospital is considering entering into a contract with CareShare HMO to provide all inpatient services for CareShare's 50,000 members. General Hospital has assembled the following actuarial information Service Category General Surgical Psychiatric Maternity Inpatient Days per 1,000 220 150 85 70 Cost/Day $1,700 $3,000 S 950 $1,900 Assuming that General Hospital needs to receive a premium that allows for administrative costs and a profit (risk) margin equal to 10 percent of the final per member per month (PMPM) premium, what is the minimum PMPM that General Hospital would be willing to accept? a. $ 86.48 b. $ 96.09 c. $ 95.1:3 d. $1,037.75 e. $ 100 2. Consider the following balance sheet: 30,000 50,000 70,000 Accounts payable Long-term debt 30,000 0,000 ash ccounts receivable Inventories Net fixed assets 350,000 Total assets $500,000 00,000 250,000 500,000 Common stock Retained earnings otal claims Assume that the business uses $30,000 of its cash to pay salaries. Which of the below statements reflects the resulting balance sheet change? a. There is a change to the left-hand side only. b. There is a change to the right-hand side only c. The cash account decreases by $30,000 and the retained earnings account is reduced by $30,000 d. The cash account decreases by $30,000 and the long-term debt account is reduced by $30,000 e. The company does not have the ability to pay $30,000 in salaries. Explain! 1. General Hospital is considering entering into a contract with CareShare HMO to provide all inpatient services for CareShare's 50,000 members. General Hospital has assembled the following actuarial information Service Category General Surgical Psychiatric Maternity Inpatient Days per 1,000 220 150 85 70 Cost/Day $1,700 $3,000 S 950 $1,900 Assuming that General Hospital needs to receive a premium that allows for administrative costs and a profit (risk) margin equal to 10 percent of the final per member per month (PMPM) premium, what is the minimum PMPM that General Hospital would be willing to accept? a. $ 86.48 b. $ 96.09 c. $ 95.1:3 d. $1,037.75 e. $ 100 2. Consider the following balance sheet: 30,000 50,000 70,000 Accounts payable Long-term debt 30,000 0,000 ash ccounts receivable Inventories Net fixed assets 350,000 Total assets $500,000 00,000 250,000 500,000 Common stock Retained earnings otal claims Assume that the business uses $30,000 of its cash to pay salaries. Which of the below statements reflects the resulting balance sheet change? a. There is a change to the left-hand side only. b. There is a change to the right-hand side only c. The cash account decreases by $30,000 and the retained earnings account is reduced by $30,000 d. The cash account decreases by $30,000 and the long-term debt account is reduced by $30,000 e. The company does not have the ability to pay $30,000 in salaries. Explain