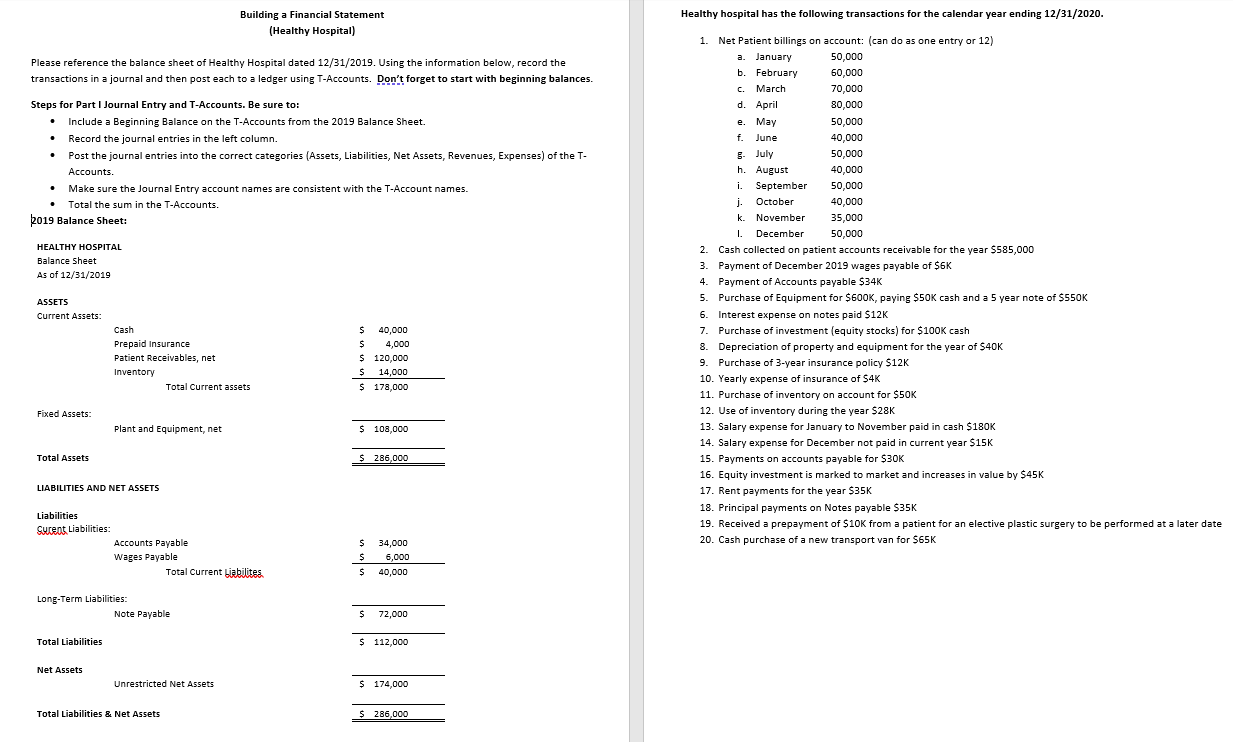

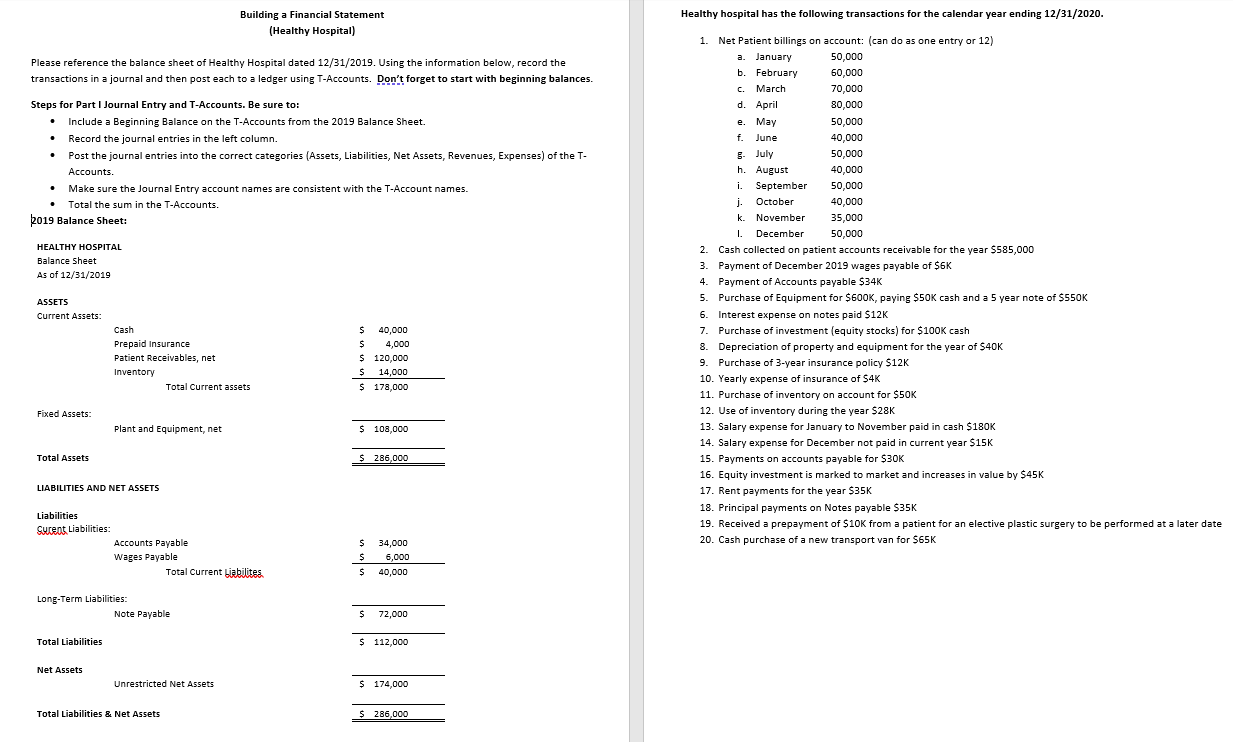

Healthy hospital has the following transactions for the calendar year ending 12/31/2020. Building a Financial Statement (Healthy Hospital) Please reference the balance sheet of Healthy Hospital dated 12/31/2019. Using the information below, record the transactions in a journal and then post each to a ledger using T-Accounts. Don't forget to start with beginning balances. C. March e. Steps for Part I Journal Entry and T-Accounts. Be sure to: Include a Beginning Balance on the T-Accounts from the 2019 Balance Sheet. Record the journal entries in the left column. Post the journal entries into the correct categories (Assets, Liabilities, Net Assets, Revenues, Expenses) of the T- Accounts. Make sure the Journal Entry account names are consistent with the T-Account names. Total the sum in the T-Accounts. -. 2019 Balance Sheet: HEALTHY HOSPITAL Balance sheet As of 12/31/2019 4. 1. Net Patient billings on account: (can do as one entry or 12) a. January 50,000 b b. February 60,000 70,000 d. April 80,000 80.000 M. FOOD May 50,000 f. June 40,000 5 July 50,000 h. August 40,000 i. September 50,000 20.00 j. October 40,000 k. November 25 00 35,000 L December 50,000 2. Cash collected on patient accounts receivable for the year $585,000 3. Payment of December 2019 wages payable of $6K Payment of Accounts payable $34K 5. Purchase of Equipment for $600K, paying $50K cash and a 5 year note of $550K 6. Interest expense on notes paid $12K 7. Purchase of investment (equity stocks) for $100K cash 8. Depreciation of property and equipment for the year of $40K 9. Purchase of 3-year insurance policy $12K . 10. Yearly expense of insurance of $4K 11. Purchase of inventory on account for $50K 12. Use of inventory during the year $28K 13. Salary expense for January to November paid in cash $180K 14. Salary expense for December not paid in current year $15K 15. Payments on accounts payable for $30K 16. Equity investment is marked to market and increases in value by $45K 17. Rent payments for the year $35K 18. Principal payments on Notes payable $35K 19. Received a prepayment of $10K from a patient for an elective plastic surgery to be performed at a later date 20. Cash purchase of a new transport van for $65K ASSETS Current Assets Cash Prepaid Insurance Patient Receivables, net Inventory Total Current assets s 40,000 $ 4,000 $ 120,000 $ 14,000 $ 178,000 Fixed Assets Plant and Equipment, net $ 108,000 Total Assets $ 286,000 LIABILITIES AND NET ASSETS Liabilities Sucent Liabilities: Accounts Payable Wages Payable Total Current biabilites. $ 34,000 $ 6,000 $ $ 40,000 Long-Term Liabilities: Note Payable $ 72,000 Total Liabilities $ 112,000 Net Assets Unrestricted Net Assets $ 174,000 Total Liabilities & Net Assets $ 286,000