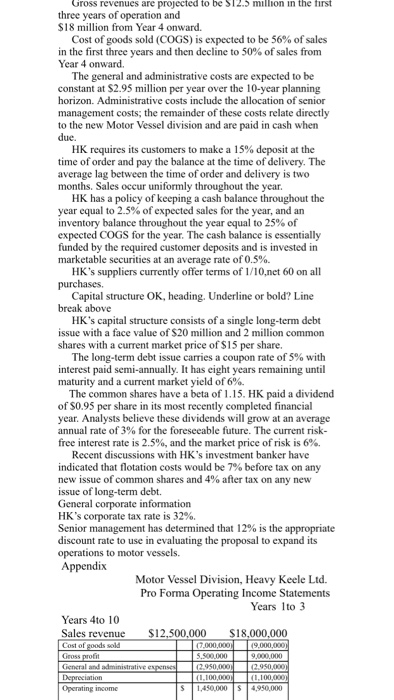

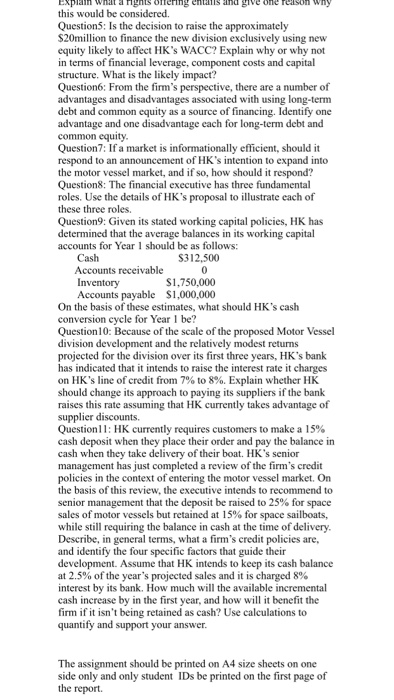

Heavy Keele Ltd.(HK) has a long-standing reputation as a manufacturer of quality sailboats. HK currently produces two different models of sailboat from a single production facility- the HK41 and the HK49.The past several years have seen a 25% decline in demand for HK's sailboats and a significant increase in interest within the boating community for motor vessels. Given this shift in attitudes, HK is now considering a proposal to introduce a motor vessel into its product line- theHKMV55 If the proposal is accepted, senior management has decided to restructure the firm into two separate divisions for operational purposes-the Sailboat division and the Motor Vessel division. Under the proposal, all current personnel will remain with the Sailboat division and the senior management team will remain unchanged. For accounting purposes, however, the $2 million annual cost of the senior management team will be allocated equally between the two divisions. HK will then seek an entire new management team to oversee the Motor Vessel division. Management has also decided that the new division should operate out of its own production facility It can be built on the block of land adjacent to the current facility that HK already owns. Senior management has decided that the appropriate planning horizon for the proposed new Motor Vessel division is 10 years. You work in the controller's office of HK and have been asked to perform a series of analyses on this proposal. To facilitate your analysis, you have been provided with the Motor Vessel division's projected income statements over the next 10 years, as well as the following information. Capital expenditures The block of land on which the new production facility will be built was purchased by HK three years ago at a cost of S2.5 million. It has a current market value of S3 million, and it is expected that the value of the land will remain at S3million when the project is complete. Management expects that the production facility will cost S10 million to build. It has an estimated useful life of 20 years and will be depreciated on a straight-line basis to an estimated salvage value of SImillion for accounting purposes. It belongs to an asset class with a CCA rate of 7.5%. At the end of the 10- year planning horizon, the facility will have an estimated market value of S3 milion. The new equipment required for the production of the HKMV55 will cost $7million and has an estimated useful life of 10 years. For accounting purposes, this equipment will also be depreciated on a straight-line basis, It belongs to an asset class with a CCA rate of 10% and has an estimated salvage value of S500,000 at the end of its useful life. The new Motor Vessel division requires an initial investment in net working capital of $750,000 Operating revenues and expenses, and working capital accounts Heading? If so, perhaps underline or bold. At least have a line break before this line. Data from the divisional pro forma operating income Heavy Keele Ltd.(HK) has a long-standing reputation as a manufacturer of quality sailboats. HK currently produces two different models of sailboat from a single production facility the HK41 and the HK49.The past several years have seen a 25% decline in demand for HK's sailboats and a significant increase in interest within the boating community for motor vessels, Given this shift in attitudes, HK is now considering a proposal to introduce a motor vessel into its product line theHKMVss If the proposal is accepted, senior management has decided to restructure the firm into two separate divisions for operational purposes the Sailboat division and the Motor Vessel division. Under the proposal, all current personnel will remain with the Sailboat division and the senior management team will remain unchanged. For accounting purposes, however, the $2 million annual cost of the senior management team will be allocated equally between the two divisions. HK will then seek an entire new management team to oversee the Motor Vessel division. Management has also decided that the new division should operate out of its own production facility It can be built on the block of land adjacent to the current facility that HK already owns. Senior management has decided that the appropriate planning horizon for the proposed new Motor Vessel division is 10 years. You work in the controller's office of HK and have been asked to perform a series of analyses on this proposal. To facilitate your analysis, you have been provided with the Motor Vessel division's projected income statements over the next 10 years, as well as the following information. Capital expenditures The block of land on which the new production facility will be built was purchased by HK three years ago at a cost of S2.5 million. It has a current market value of $3 million, and it is expected that the value of the land will remain at S3million when the project is complete. Management expects that the production facility will cost S10 million to build. It has an estimated useful life of 20 years and will be depreciated on a straight-line basis to an estimated salvage value of SImillion for accounting purposes. It belongs to an asset class with a CCA rate of 7.5%. At the end of the 10. year planning horizon, the facility will have an estimated market value of S3 million The new equipment required for the production of the HKMV55 will cost S7million and has an estimated useful life of 10 years. For accounting purposes, this equipment will also be depreciated on a straight-line basis. It belongs to an asset class with a CCA rate of 10% and has an estimated salvage value of S500,000 at the end of its useful life. The new Motor Vessel division requires an initial investment in net working capital of $750,000. Operating revenues and expenses, and working capital accounts Heading? If so, perhaps underline or bold. At least have a line break before this line. Data from the divisional pro forma operating income statements (see Appendix): Gross revenues are projected to be ST2.S million in the first three years of operation and $18 million from Year 4 onward. Cost of goods sold (COGS) is expected to be 56% of sales in the first three years and then decline to 50% of sales from Year 4 onward. The general and administrative costs are expected to be constant at $2.95 million per year over the 10-year planning horizon. Administrative costs include the allocation of senior management costs; the remainder of these costs relate directly to the new Motor Vessel division and are paid in cash when due. HK requires its customers to make a 15% deposit at the time of order and pay the balance at the time of delivery. The average lag between the time of order and delivery is two months. Sales occur uniformly throughout the year. HK has a policy of keeping a cash balance throughout the year equal to 2.5% of expected sales for the year, and an inventory balance throughout the year equal to 25% of expected COGS for the year. The cash balance is essentially funded by the required customer deposits and is invested in marketable securities at an average rate of 0.5%. HK's suppliers currently offer terms of 1/10.net 60 on all purchases. Capital structure OK, heading. Underline or bold? Line break above HK's capital structure issue with a face value of $20 million and 2 million common consists of a single long-term shares with a current market price of S15 per share. The long-term debt issue carries a coupon rate of 5% with interest paid semi-annually. It has eight years remaining until maturity and a current market yield of 6%. The common shares have a beta of 1.15. HK paid a dividend of S0.95 per share in its most recently completed financial year. Analysts believe these dividends will grow at an average annual rate of 3% for the foreseeable future. The current risk free interest rate is 2.5%, and the market price of risk is 6%. Recent discussions with HK's investment banker have indicated that flotation costs would be 7% before tax on any new issue of common shares and 4% after tax on any new issue of long-term debt. General corporate information HK's corporate tax rate is 32%. Senior management has determined that 12% is the appropriate discount rate to use in evaluating the proposal to expand its operations to motor vessels. Appendix Motor Vessel Division, Heavy Keele Ltd. Pro Forma Operating Income Statements Years 1to 3 Years 4to 10 Sales revenue$12,500,000 $18,000,000 S 1,450,000S 4,950,000 Based on the information above, answer the following questions. Questi: What is the current market price of each S100 face value bond of HK's long-term debt issue? Round your final answer to two decimal places. Question2: Calculate the required rate of return on HK's common shares if internally generated funds will be sufficient to finance the equity portion of any new financing and: The capital asset pricing model (CAPM) is used to determine their required rate of return The constant growth dividend discount model is used to determine their required rate of return Question3: What is HK's weighted average cost of capital (WACC) assuming its cost of common equity will be determined using the CAPM and it will issue new common shares? Round market values to the nearest thousand. Question4: HK's senior management has decided to finance the new Motor Vessel division exclusively using new common equity. One proposal put forward was to make a rights offering. Explain what a rights offering entails and give one reason why this would be considered. Question5: Is the decision to raise the approximately S20million to finance the new division exclusively using new equity likely to affect HK's WACC? Explain why or why not in terms of financial leverage, component costs and capital structure. What is the likely impact? Question6: From the firm's perspective, there are a number of advantages and disadvantages associated with using long-term debt and common equity as a source of financing. Identify one advantage and one disadvantage each for long-term debt and common equity Question7: Ifa market is informationally efficient, should it respond to an announcement of HK's intention to expand into the motor vessel market, and if so, how should it respond? Question8: The financial executive has three fundamental roles. Use the details of HK's proposal to illustrate each of these three roles. Question9: Given its stated working capital policies, HK has determined that the average balances in its working capital accounts for Year 1 should be as follows: S312,500 Cash Accounts receivable Inventory S1,750,000 Accounts payable $1,000,000 On the basis of these estimates, what should HK's cash conversion cycle for Year1 be? Queston10: Because of the scale of the proposed Motor Vessel division development and the relatively modest returms projected for the division over its first three years, HK's bank has indicated that it intends to raise the interest rate it charges on HK's line of credit from 7% to 8%. Explain whether HK should change its approach to paying its suppliers if the bank raises this rate assuming that HK currently takes advantage of supplier discounts. Question 1 1 : HK currently requires customers to make a 15% cash deposit when they place their order and pay the balance in cash when they take delivery of their boat. HK's senior Explain whata rignts otering entalls and give one relson why this would be c Question5: Is the decision to raise the approximately $20million to finance the new division exclusively using new equity likely to affect HK's WACC? Explain why or why not in terms of financial leverage, component costs and capital structure. What is the likely impact? Question6: From the firm's perspective, there are a number of advantages and disadvantages associated with using long-term debt and common equity as a source of financing. Identify one advantage and one disadvantage cach for long-term debt and common equity Question7: If a market is informationally efficient, should it respond to an announcement of HK's intention to expand into the motor vessel market, and if so, how should it respond? Question8: The financial executive has three fundamental roles. Use the details of HK's proposal to illustrate each of these three roles. Question9: Given its stated working capital policies, HK has determined that the average balances in its working capital accounts for Year 1 should be as follows: Cash S312,500 Accounts receivable S1,750,000 Accounts payable $1,000,000 On the basis of these estimates, what should HK's cash conversion cycle for Year 1 be? Question10: Because of the scale of the proposed Motor Vessel division d projected for the division over its first three years, HK's bank has indicated that it intends to raise the interest rate it charges on HK's line of credit from 7% to 8%. Explain whether HK should change its approach to paying its suppliers if the bank raises this rate assuming that HK currently takes advantage of supplier discounts. Question 1 1 : HK currently requires customers to make a 15% cash deposit when they place their order and pay the balance in cash when they take delivery of their boat. HK's senior management has just completed a review of the firm's credit policies in the context of entering the motor vessel market. On the basis of this review, the executive intends to recommend to senior management that the deposit be raised to 25% for space sales of motor vessels but retained at l 5% for space sailboats, while still requiring the balance in cash at the time of delivery. Describe, in general terms, what a firm's credit policies are, and identify the four specific factors that guide their development. Assume that HK intends to keep its cash balance at 2.5% of the year's projected sales and it is charged 8% interest by its bank. How much will the available incremental cash increase by in the first year, and how it benefit the firm if it isn't being retained as cash? Use calculations to quantify and support your answer t and the relatively modest returns The assignment should be printed on A4 size sheets on one side only and only student IDs be printed on the first page of the report. Heavy Keele Ltd.(HK) has a long-standing reputation as a manufacturer of quality sailboats. HK currently produces two different models of sailboat from a single production facility- the HK41 and the HK49.The past several years have seen a 25% decline in demand for HK's sailboats and a significant increase in interest within the boating community for motor vessels. Given this shift in attitudes, HK is now considering a proposal to introduce a motor vessel into its product line- theHKMV55 If the proposal is accepted, senior management has decided to restructure the firm into two separate divisions for operational purposes-the Sailboat division and the Motor Vessel division. Under the proposal, all current personnel will remain with the Sailboat division and the senior management team will remain unchanged. For accounting purposes, however, the $2 million annual cost of the senior management team will be allocated equally between the two divisions. HK will then seek an entire new management team to oversee the Motor Vessel division. Management has also decided that the new division should operate out of its own production facility It can be built on the block of land adjacent to the current facility that HK already owns. Senior management has decided that the appropriate planning horizon for the proposed new Motor Vessel division is 10 years. You work in the controller's office of HK and have been asked to perform a series of analyses on this proposal. To facilitate your analysis, you have been provided with the Motor Vessel division's projected income statements over the next 10 years, as well as the following information. Capital expenditures The block of land on which the new production facility will be built was purchased by HK three years ago at a cost of S2.5 million. It has a current market value of S3 million, and it is expected that the value of the land will remain at S3million when the project is complete. Management expects that the production facility will cost S10 million to build. It has an estimated useful life of 20 years and will be depreciated on a straight-line basis to an estimated salvage value of SImillion for accounting purposes. It belongs to an asset class with a CCA rate of 7.5%. At the end of the 10- year planning horizon, the facility will have an estimated market value of S3 milion. The new equipment required for the production of the HKMV55 will cost $7million and has an estimated useful life of 10 years. For accounting purposes, this equipment will also be depreciated on a straight-line basis, It belongs to an asset class with a CCA rate of 10% and has an estimated salvage value of S500,000 at the end of its useful life. The new Motor Vessel division requires an initial investment in net working capital of $750,000 Operating revenues and expenses, and working capital accounts Heading? If so, perhaps underline or bold. At least have a line break before this line. Data from the divisional pro forma operating income Heavy Keele Ltd.(HK) has a long-standing reputation as a manufacturer of quality sailboats. HK currently produces two different models of sailboat from a single production facility the HK41 and the HK49.The past several years have seen a 25% decline in demand for HK's sailboats and a significant increase in interest within the boating community for motor vessels, Given this shift in attitudes, HK is now considering a proposal to introduce a motor vessel into its product line theHKMVss If the proposal is accepted, senior management has decided to restructure the firm into two separate divisions for operational purposes the Sailboat division and the Motor Vessel division. Under the proposal, all current personnel will remain with the Sailboat division and the senior management team will remain unchanged. For accounting purposes, however, the $2 million annual cost of the senior management team will be allocated equally between the two divisions. HK will then seek an entire new management team to oversee the Motor Vessel division. Management has also decided that the new division should operate out of its own production facility It can be built on the block of land adjacent to the current facility that HK already owns. Senior management has decided that the appropriate planning horizon for the proposed new Motor Vessel division is 10 years. You work in the controller's office of HK and have been asked to perform a series of analyses on this proposal. To facilitate your analysis, you have been provided with the Motor Vessel division's projected income statements over the next 10 years, as well as the following information. Capital expenditures The block of land on which the new production facility will be built was purchased by HK three years ago at a cost of S2.5 million. It has a current market value of $3 million, and it is expected that the value of the land will remain at S3million when the project is complete. Management expects that the production facility will cost S10 million to build. It has an estimated useful life of 20 years and will be depreciated on a straight-line basis to an estimated salvage value of SImillion for accounting purposes. It belongs to an asset class with a CCA rate of 7.5%. At the end of the 10. year planning horizon, the facility will have an estimated market value of S3 million The new equipment required for the production of the HKMV55 will cost S7million and has an estimated useful life of 10 years. For accounting purposes, this equipment will also be depreciated on a straight-line basis. It belongs to an asset class with a CCA rate of 10% and has an estimated salvage value of S500,000 at the end of its useful life. The new Motor Vessel division requires an initial investment in net working capital of $750,000. Operating revenues and expenses, and working capital accounts Heading? If so, perhaps underline or bold. At least have a line break before this line. Data from the divisional pro forma operating income statements (see Appendix): Gross revenues are projected to be ST2.S million in the first three years of operation and $18 million from Year 4 onward. Cost of goods sold (COGS) is expected to be 56% of sales in the first three years and then decline to 50% of sales from Year 4 onward. The general and administrative costs are expected to be constant at $2.95 million per year over the 10-year planning horizon. Administrative costs include the allocation of senior management costs; the remainder of these costs relate directly to the new Motor Vessel division and are paid in cash when due. HK requires its customers to make a 15% deposit at the time of order and pay the balance at the time of delivery. The average lag between the time of order and delivery is two months. Sales occur uniformly throughout the year. HK has a policy of keeping a cash balance throughout the year equal to 2.5% of expected sales for the year, and an inventory balance throughout the year equal to 25% of expected COGS for the year. The cash balance is essentially funded by the required customer deposits and is invested in marketable securities at an average rate of 0.5%. HK's suppliers currently offer terms of 1/10.net 60 on all purchases. Capital structure OK, heading. Underline or bold? Line break above HK's capital structure issue with a face value of $20 million and 2 million common consists of a single long-term shares with a current market price of S15 per share. The long-term debt issue carries a coupon rate of 5% with interest paid semi-annually. It has eight years remaining until maturity and a current market yield of 6%. The common shares have a beta of 1.15. HK paid a dividend of S0.95 per share in its most recently completed financial year. Analysts believe these dividends will grow at an average annual rate of 3% for the foreseeable future. The current risk free interest rate is 2.5%, and the market price of risk is 6%. Recent discussions with HK's investment banker have indicated that flotation costs would be 7% before tax on any new issue of common shares and 4% after tax on any new issue of long-term debt. General corporate information HK's corporate tax rate is 32%. Senior management has determined that 12% is the appropriate discount rate to use in evaluating the proposal to expand its operations to motor vessels. Appendix Motor Vessel Division, Heavy Keele Ltd. Pro Forma Operating Income Statements Years 1to 3 Years 4to 10 Sales revenue$12,500,000 $18,000,000 S 1,450,000S 4,950,000 Based on the information above, answer the following questions. Questi: What is the current market price of each S100 face value bond of HK's long-term debt issue? Round your final answer to two decimal places. Question2: Calculate the required rate of return on HK's common shares if internally generated funds will be sufficient to finance the equity portion of any new financing and: The capital asset pricing model (CAPM) is used to determine their required rate of return The constant growth dividend discount model is used to determine their required rate of return Question3: What is HK's weighted average cost of capital (WACC) assuming its cost of common equity will be determined using the CAPM and it will issue new common shares? Round market values to the nearest thousand. Question4: HK's senior management has decided to finance the new Motor Vessel division exclusively using new common equity. One proposal put forward was to make a rights offering. Explain what a rights offering entails and give one reason why this would be considered. Question5: Is the decision to raise the approximately S20million to finance the new division exclusively using new equity likely to affect HK's WACC? Explain why or why not in terms of financial leverage, component costs and capital structure. What is the likely impact? Question6: From the firm's perspective, there are a number of advantages and disadvantages associated with using long-term debt and common equity as a source of financing. Identify one advantage and one disadvantage each for long-term debt and common equity Question7: Ifa market is informationally efficient, should it respond to an announcement of HK's intention to expand into the motor vessel market, and if so, how should it respond? Question8: The financial executive has three fundamental roles. Use the details of HK's proposal to illustrate each of these three roles. Question9: Given its stated working capital policies, HK has determined that the average balances in its working capital accounts for Year 1 should be as follows: S312,500 Cash Accounts receivable Inventory S1,750,000 Accounts payable $1,000,000 On the basis of these estimates, what should HK's cash conversion cycle for Year1 be? Queston10: Because of the scale of the proposed Motor Vessel division development and the relatively modest returms projected for the division over its first three years, HK's bank has indicated that it intends to raise the interest rate it charges on HK's line of credit from 7% to 8%. Explain whether HK should change its approach to paying its suppliers if the bank raises this rate assuming that HK currently takes advantage of supplier discounts. Question 1 1 : HK currently requires customers to make a 15% cash deposit when they place their order and pay the balance in cash when they take delivery of their boat. HK's senior Explain whata rignts otering entalls and give one relson why this would be c Question5: Is the decision to raise the approximately $20million to finance the new division exclusively using new equity likely to affect HK's WACC? Explain why or why not in terms of financial leverage, component costs and capital structure. What is the likely impact? Question6: From the firm's perspective, there are a number of advantages and disadvantages associated with using long-term debt and common equity as a source of financing. Identify one advantage and one disadvantage cach for long-term debt and common equity Question7: If a market is informationally efficient, should it respond to an announcement of HK's intention to expand into the motor vessel market, and if so, how should it respond? Question8: The financial executive has three fundamental roles. Use the details of HK's proposal to illustrate each of these three roles. Question9: Given its stated working capital policies, HK has determined that the average balances in its working capital accounts for Year 1 should be as follows: Cash S312,500 Accounts receivable S1,750,000 Accounts payable $1,000,000 On the basis of these estimates, what should HK's cash conversion cycle for Year 1 be? Question10: Because of the scale of the proposed Motor Vessel division d projected for the division over its first three years, HK's bank has indicated that it intends to raise the interest rate it charges on HK's line of credit from 7% to 8%. Explain whether HK should change its approach to paying its suppliers if the bank raises this rate assuming that HK currently takes advantage of supplier discounts. Question 1 1 : HK currently requires customers to make a 15% cash deposit when they place their order and pay the balance in cash when they take delivery of their boat. HK's senior management has just completed a review of the firm's credit policies in the context of entering the motor vessel market. On the basis of this review, the executive intends to recommend to senior management that the deposit be raised to 25% for space sales of motor vessels but retained at l 5% for space sailboats, while still requiring the balance in cash at the time of delivery. Describe, in general terms, what a firm's credit policies are, and identify the four specific factors that guide their development. Assume that HK intends to keep its cash balance at 2.5% of the year's projected sales and it is charged 8% interest by its bank. How much will the available incremental cash increase by in the first year, and how it benefit the firm if it isn't being retained as cash? Use calculations to quantify and support your answer t and the relatively modest returns The assignment should be printed on A4 size sheets on one side only and only student IDs be printed on the first page of the report