Answered step by step

Verified Expert Solution

Question

1 Approved Answer

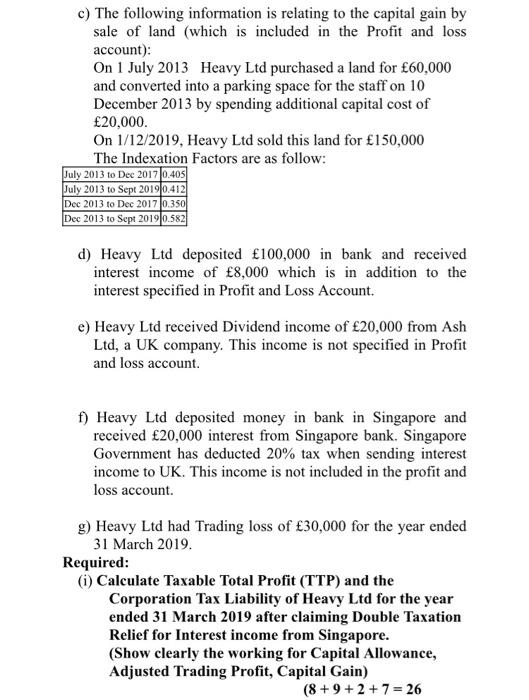

c) The following information is relating to the capital gain by sale of land (which is included in the Profit and loss account): On

c) The following information is relating to the capital gain by sale of land (which is included in the Profit and loss account): On 1 July 2013 Heavy Ltd purchased a land for 60,000 and converted into a parking space for the staff on 10 December 2013 by spending additional capital cost of 20,000. On 1/12/2019, Heavy Ltd sold this land for 150,000 The Indexation Factors are as follow: July 2013 to Dec 2017 0.405 July 2013 to Sept 2019 0.412 Dec 2013 to Dec 2017 0.350 Dec 2013 to Sept 2019 0.582 d) Heavy Ltd deposited 100,000 in bank and received interest income of 8,000 which is in addition to the interest specified in Profit and Loss Account. e) Heavy Ltd received Dividend income of 20,000 from Ash Ltd, a UK company. This income is not specified in Profit and loss account. f) Heavy Ltd deposited money in bank in Singapore and received 20,000 interest from Singapore bank. Singapore Government has deducted 20% tax when sending interest income to UK. This income is not included in the profit and loss account. g) Heavy Ltd had Trading loss of 30,000 for the year ended 31 March 2019. Required: (i) Calculate Taxable Total Profit (TTP) and the Corporation Tax Liability of Heavy Ltd for the year ended 31 March 2019 after claiming Double Taxation Relief for Interest income from Singapore. (Show clearly the working for Capital Allowance, Adjusted Trading Profit, Capital Gain) (8 +9+2 +7= 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Total Profit 18000 20000 30000 Total Profit 8000 Capital Allowance 20000 x 0350 7000 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started