Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heavy Metal Corporation (HMC) is a leader in ship building industry. It is considering building a new shipyard facility. Currently, there is no outstanding

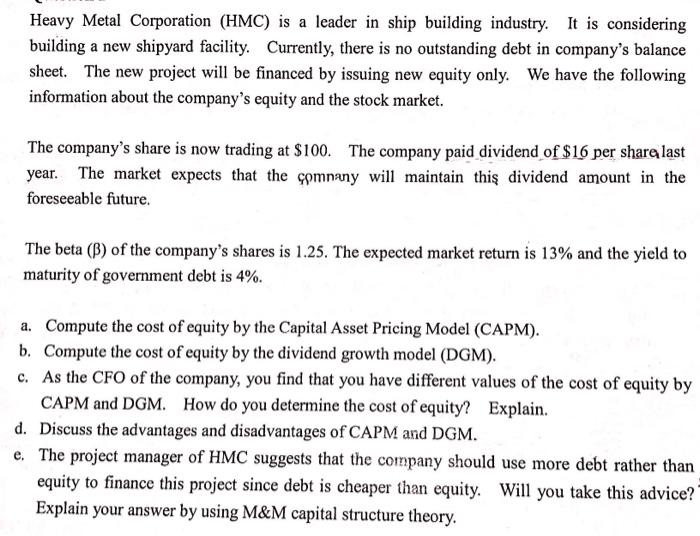

Heavy Metal Corporation (HMC) is a leader in ship building industry. It is considering building a new shipyard facility. Currently, there is no outstanding debt in company's balance sheet. The new project will be financed by issuing new equity only. We have the following information about the company's equity and the stock market. The company's share is now trading at $100. The company paid dividend of $16 per share last year. The market expects that the comnany will maintain this dividend amount in the foreseeable future. The beta (B) of the company's shares is 1.25. The expected market return is 13% and the yield to maturity of government debt is 4%. a. Compute the cost of equity by the Capital Asset Pricing Model (CAPM). b. Compute the cost of equity by the dividend growth model (DGM). c. As the CFO of the company, you find that you have different values of the cost of equity by CAPM and DGM. How do you determine the cost of equity? Explain. d. Discuss the advantages and disadvantages of CAPM and DGM. e. The project manager of HMC suggests that the company should use more debt rather than equity to finance this project since debt is cheaper than equity. Will you take this advice?" Explain your answer by using M&M capital structure theory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Compute the cost of equity by the Capital Asset Pricing Model CAPM The CAPM formula is Cost of equity Riskfree rate Beta Expected market return Riskfree rate Given information Riskfree rate yield to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started