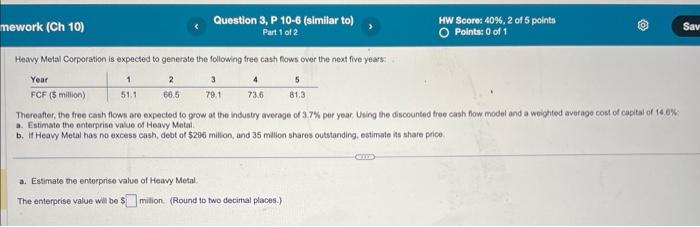

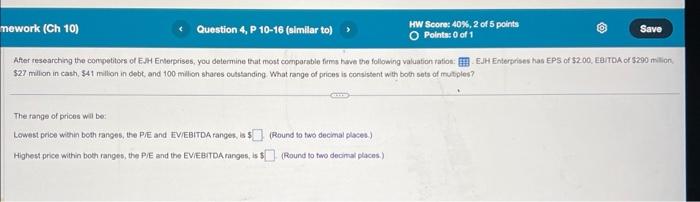

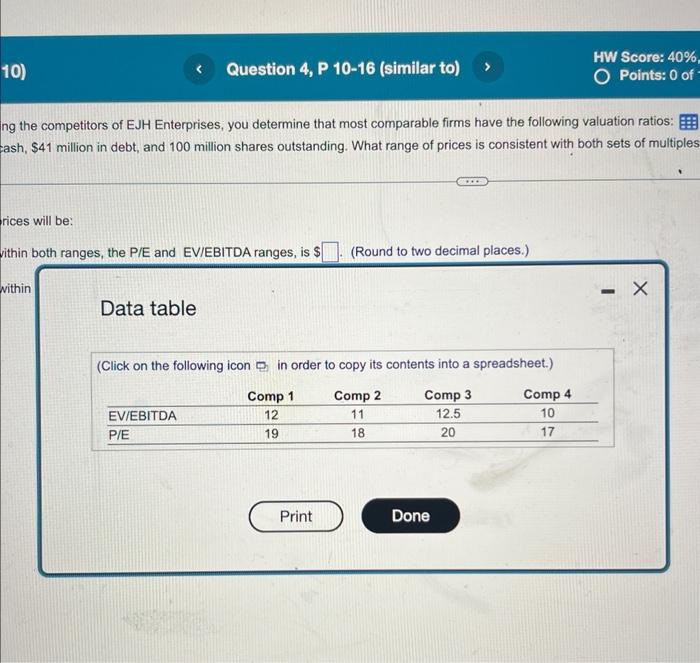

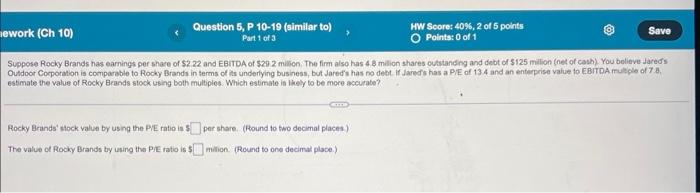

Heavy Metal Corporation is expected to generate the following free cast fows over the next five years: Thereafter, the free cash flows are expected to grow at the industry averoge of 3.7% per year. Using the discounted free cash fow model and a woighted average cost of captal of is. 6\%: a. Estimate the enterprise value of Heavy Metal b. If Heavy Metal has no excess cash, debt of $206 millon, and 35 milion shares outstanding, estimate ins share price. a. Estimate the enterprise valus of Heavy Metal. The enterprise value wil be s milion. (Round to two decimal places.) Ater researching the conpetitors of EJH Enleprises, you determine that most comparable fums hwe the following valuation ration: $27 milion in cach, $41 million in debt, and 100 milion shares outsanding. What range of prices is consistent with both sete of mutiples? The tange of prices wil be: Lowest price wehin both ranges, the PIE and IIVIEBITDA ranges, is I (Round to two decmal places) Highest price within both ranges, the P/E and the EVIEUTDA ranges, is: (Round to two decintal places.) ng the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: ash, $41 million in debt, and 100 million shares outstanding. What range of prices is consistent with both sets of multiples rices will be: ithin both ranges, the P/E and EVIEBITDA ranges, is $ (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Suppose Rocky Brands has earnings per share of $2.22 and EBITDA of $20.2 milion. The firm also has 4.8 milion shares cubstanding and debt of $125 milion (net of cash) You believe Jareds Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jareds has no debt if Jared's has a P.E of 13.4 and an entepprise value to EBITDA trutple of 7.8 , estimate the value of Rocky Brands slock cbing both multiples. Which estimate is lhely to be more accurate? Rocky Brands' slock value by using the PIE ratio is 4 per share. (Hound to two decimal places) The value of Rocky Brands by using the PJ rato is: milion. (Round to one decimal place.)