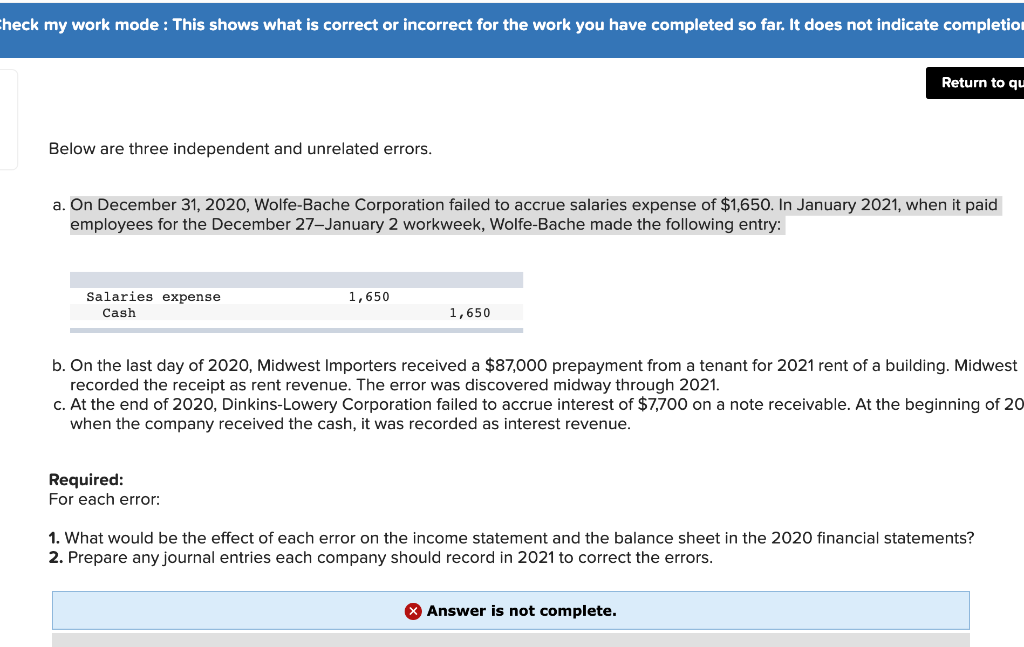

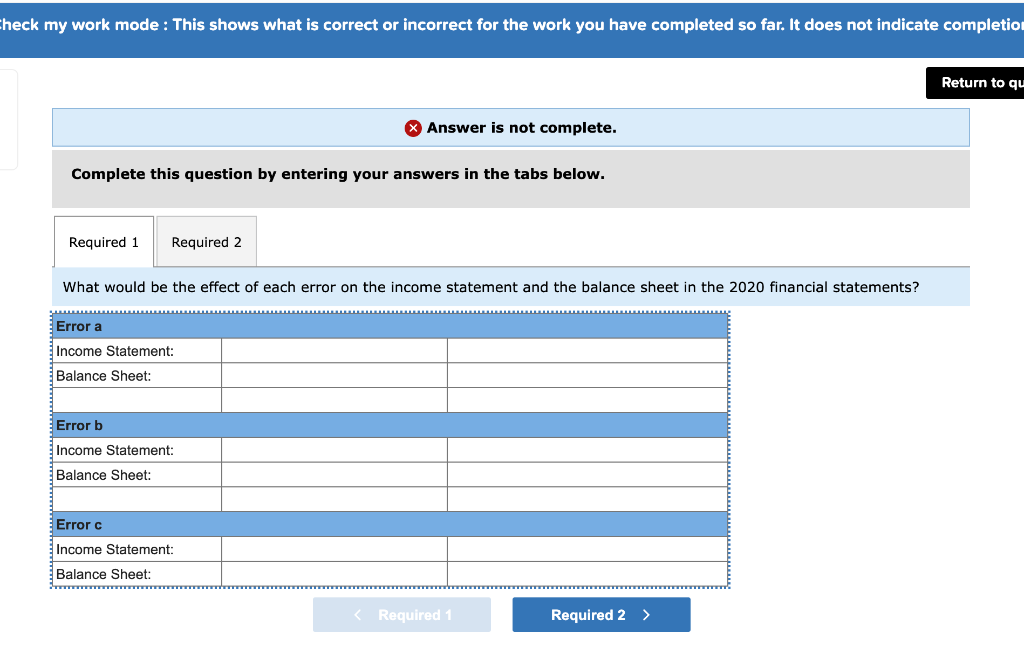

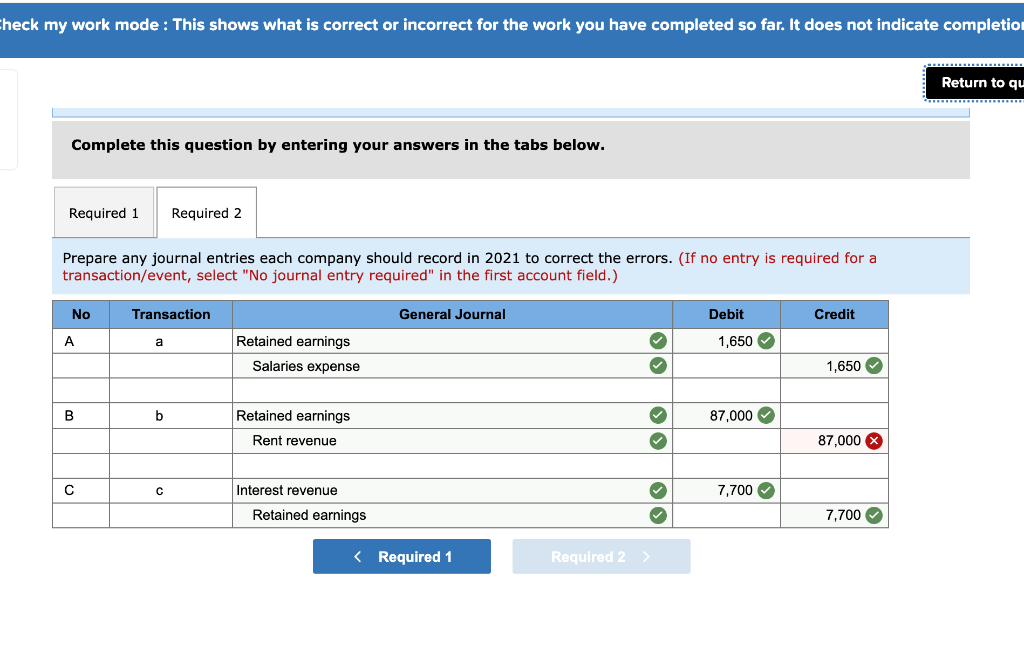

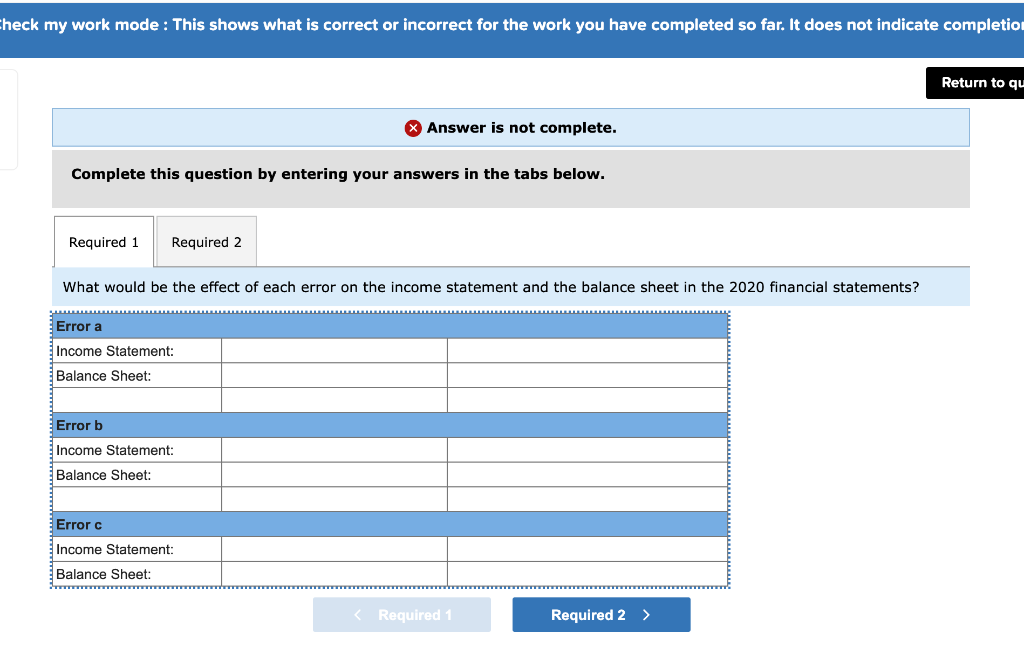

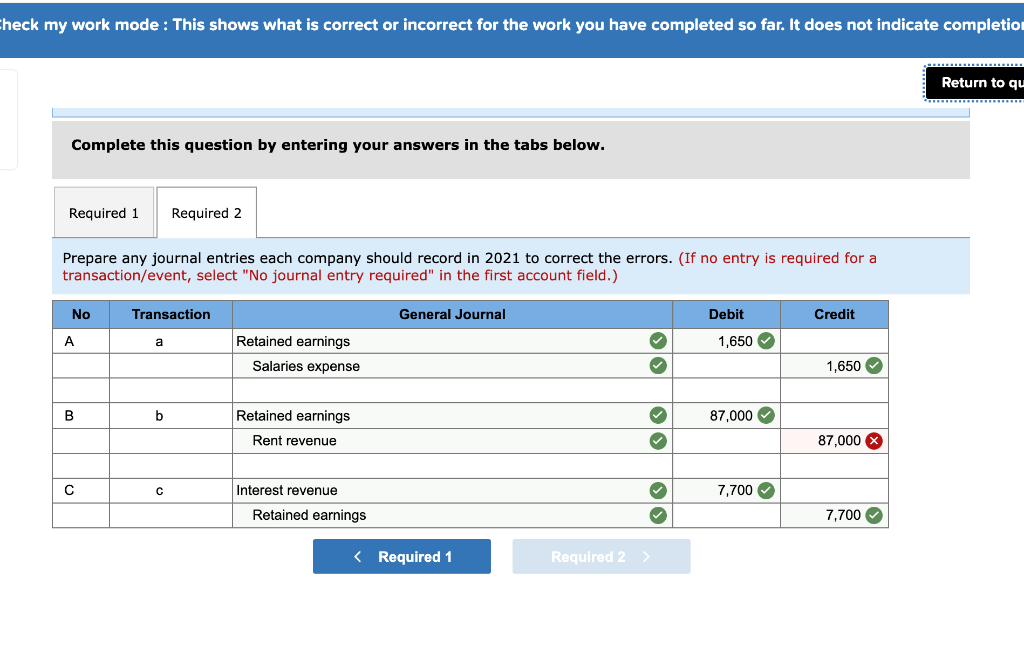

heck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to qu Below are three independent and unrelated errors. a. On December 31, 2020, Wolfe-Bache Corporation failed to accrue salaries expense of $1,650. In January 2021, when it paid employees for the December 27-January 2 workweek, Wolfe-Bache made the following entry: Salaries expense Cash 1,650 1,650 b. On the last day of 2020, Midwest Importers received a $87,000 prepayment from a tenant for 2021 rent of a building. Midwest recorded the receipt as rent revenue. The error was discovered midway through 2021. c. At the end of 2020, Dinkins-Lowery Corporation failed to accrue interest of $7,700 on a note receivable. At the beginning of 20 when the company received the cash, it was recorded as interest revenue. Required: For each error: 1. What would be the effect of each error on the income statement and the balance sheet in the 2020 financial statements? 2. Prepare any journal entries each company should record in 2021 to correct the errors. Answer is not complete. heck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to qu Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What would be the effect of each error on the income statement and the balance sheet in the 2020 financial statements? : Error a Income Statement: Balance Sheet: Error b Income Statement: Balance Sheet: : Error c Income Statement: Balance Sheet: heck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to qu Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare any journal entries each company should record in 2021 to correct the errors. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit A 1,650 Retained earnings Salaries expense 1,650 B b 87,000 Retained earnings Rent revenue 87,000 X 7,700 Interest revenue Retained earnings 7,700