Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heidi bought a mountain chalet in 2 0 1 8 for $ 1 5 0 , 0 0 0 and sold it in 2 0

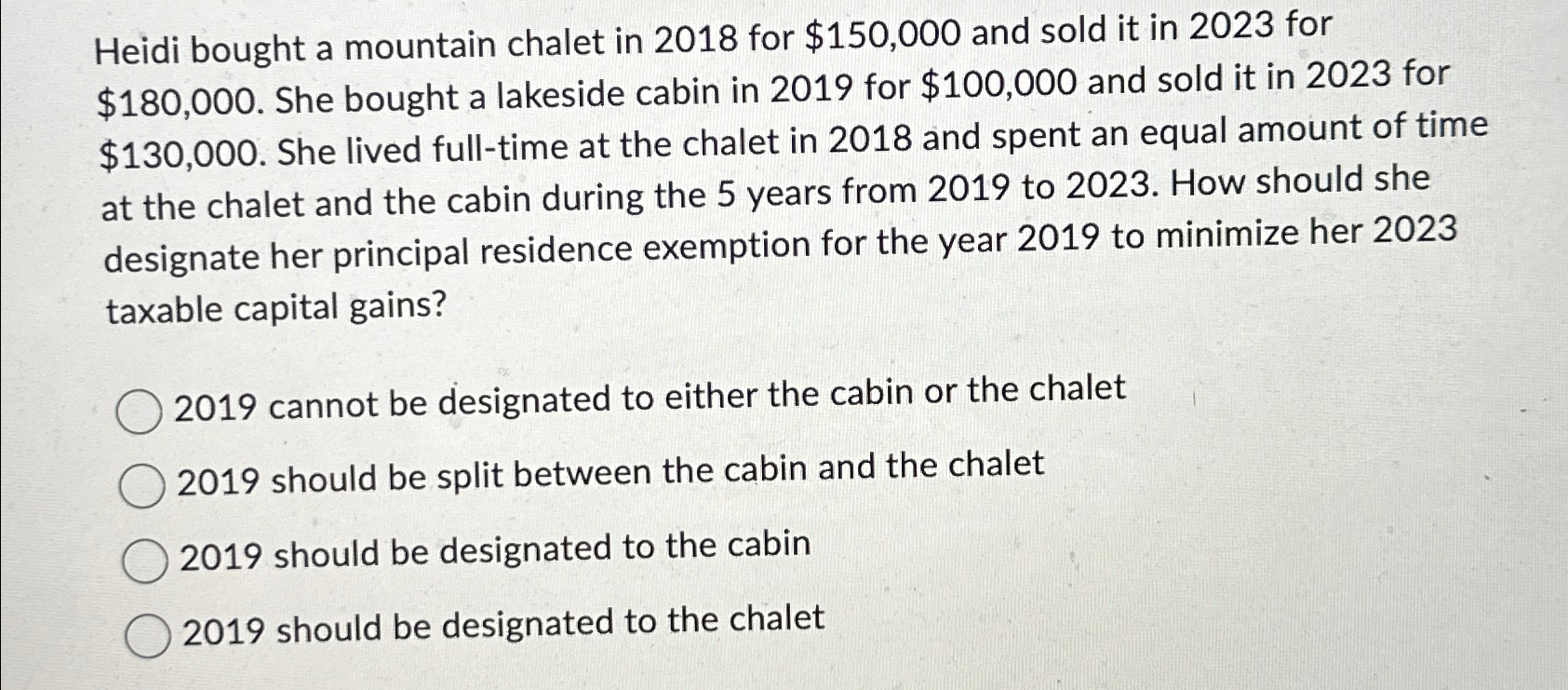

Heidi bought a mountain chalet in for $ and sold it in for $ She bought a lakeside cabin in for $ and sold it in for $ She lived fulltime at the chalet in and spent an equal amount of time at the chalet and the cabin during the years from to How should she designate her principal residence exemption for the year to minimize her taxable capital gains? cannot be designated to either the cabin or the chalet should be split between the cabin and the chalet should be designated to the cabin should be designated to the chalet

Heidi bought a mountain chalet in for $ and sold it in for $ She bought a lakeside cabin in for $ and sold it in for $ She lived fulltime at the chalet in and spent an equal amount of time at the chalet and the cabin during the years from to How should she designate her principal residence exemption for the year to minimize her taxable capital gains?

cannot be designated to either the cabin or the chalet

should be split between the cabin and the chalet

should be designated to the cabin

should be designated to the chalet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started