Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heimlich, Inc. purchased an investment in bonds on July 1st, 2021. The bonds have a face value of $1,000,000 and a stated interest of

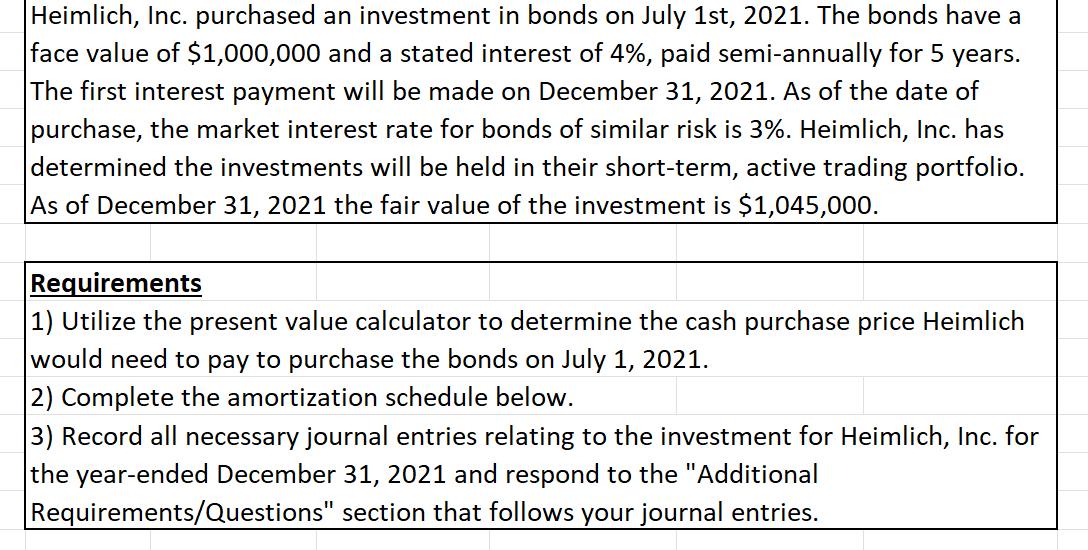

Heimlich, Inc. purchased an investment in bonds on July 1st, 2021. The bonds have a face value of $1,000,000 and a stated interest of 4%, paid semi-annually for 5 years. The first interest payment will be made on December 31, 2021. As of the date of purchase, the market interest rate for bonds of similar risk is 3%. Heimlich, Inc. has determined the investments will be held in their short-term, active trading portfolio. As of December 31, 2021 the fair value of the investment is $1,045,000. Requirements 1) Utilize the present value calculator to determine the cash purchase price Heimlich would need to pay to purchase the bonds on July 1, 2021. 2) Complete the amortization schedule below. 3) Record all necessary journal entries relating to the investment for Heimlich, Inc. for the year-ended December 31, 2021 and respond to the "Additional Requirements/Questions" section that follows your journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started