Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hel hello i need help with the worksheet and the income statement :) ( balance sheet income statement) I appreciate the help :) I will

hel

hello i need help with the worksheet and the income statement :) ( balance sheet income statement) I appreciate the help :) I will like :)

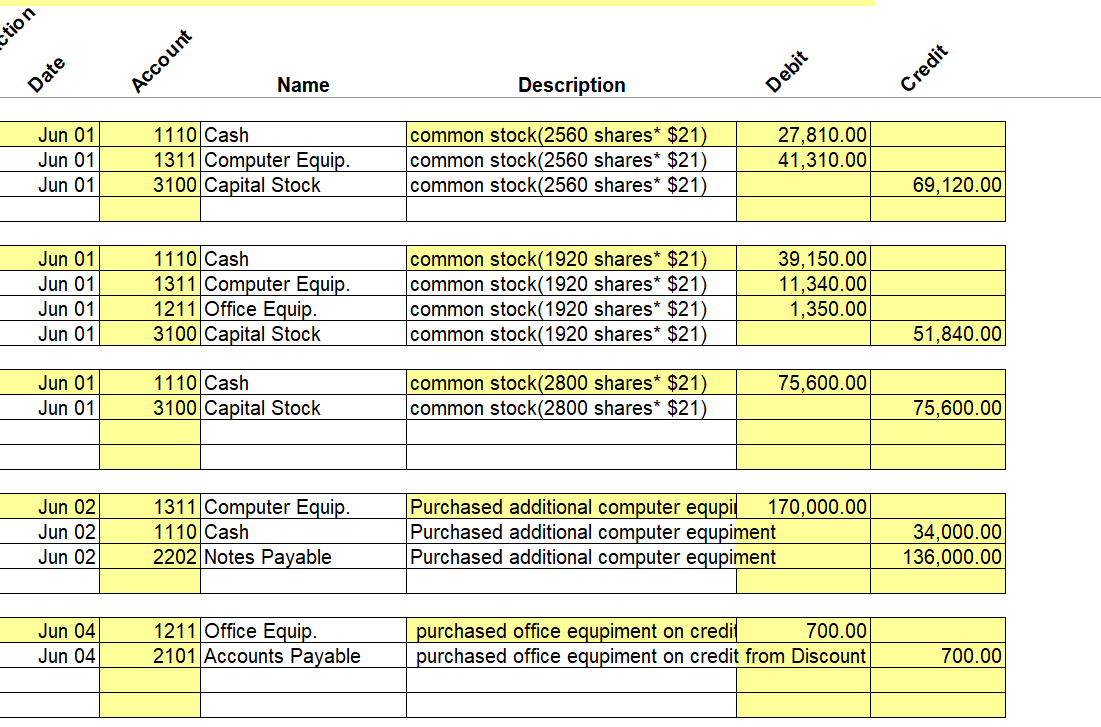

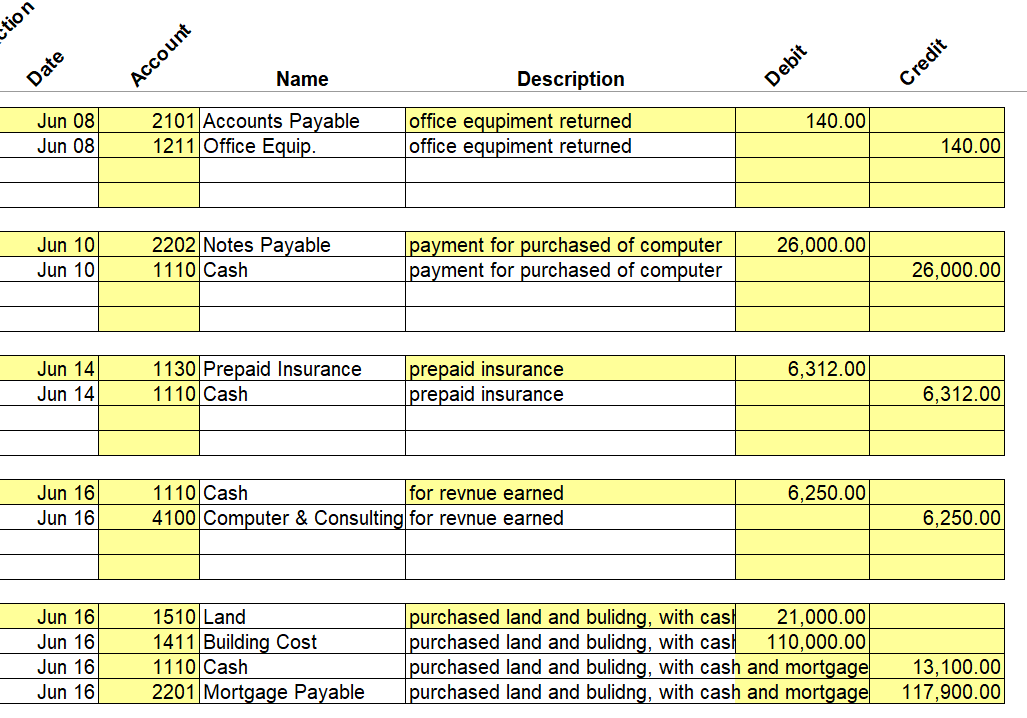

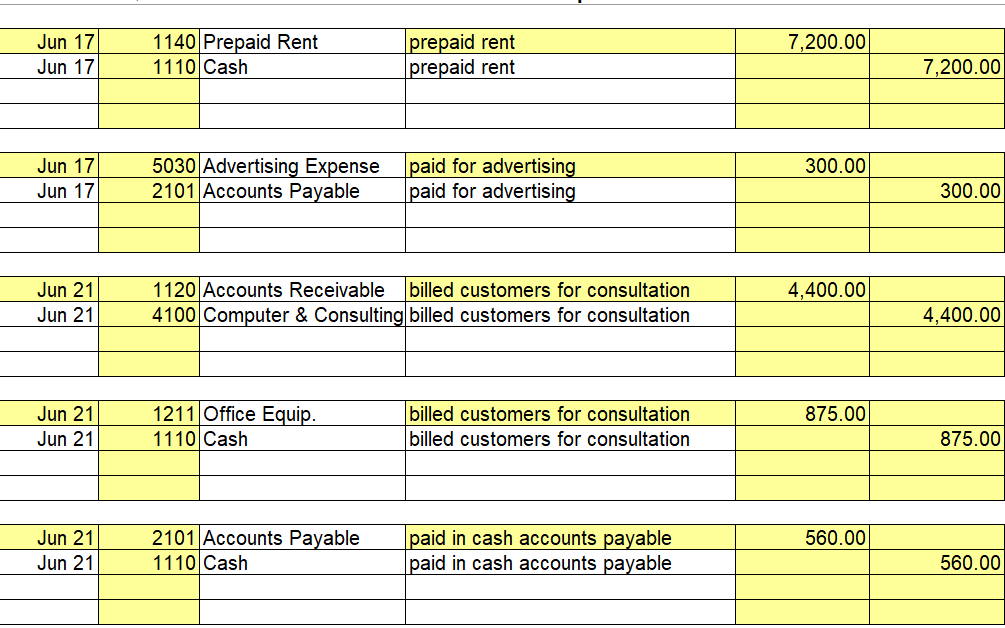

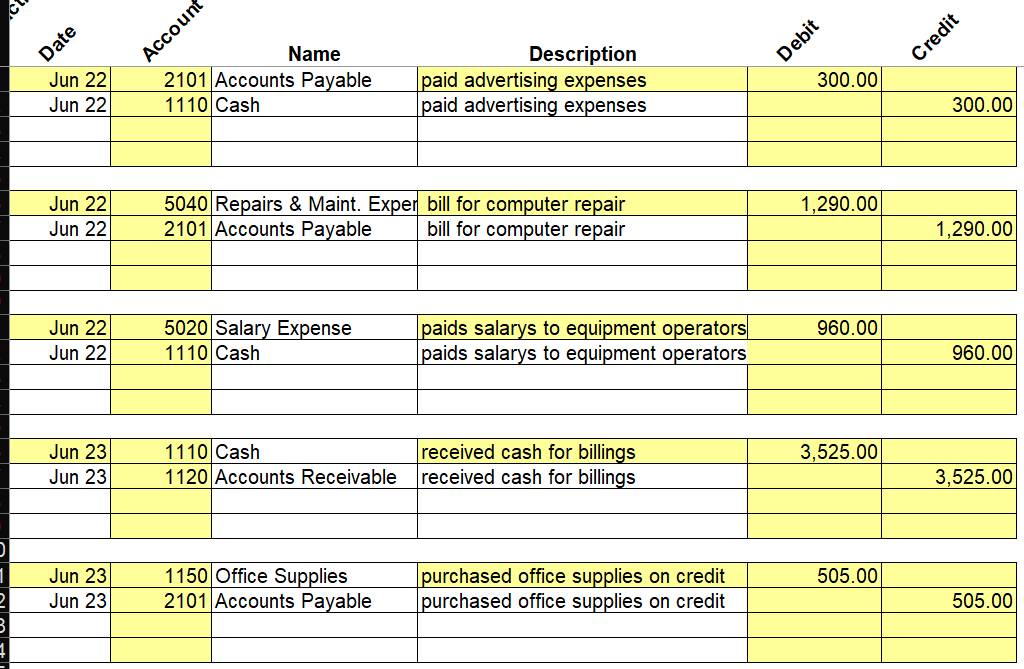

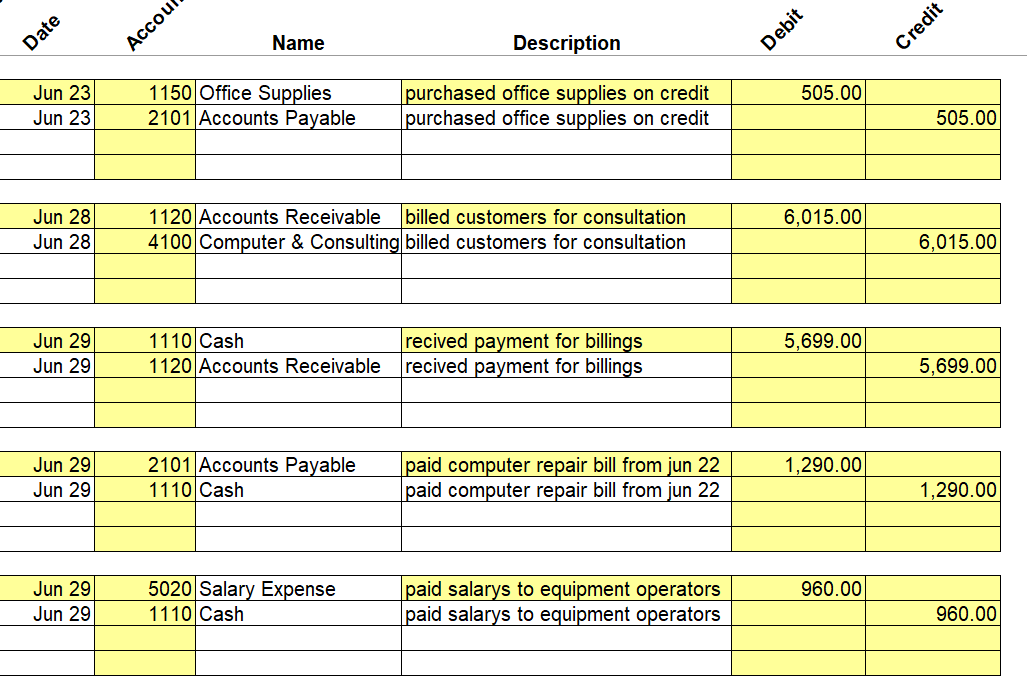

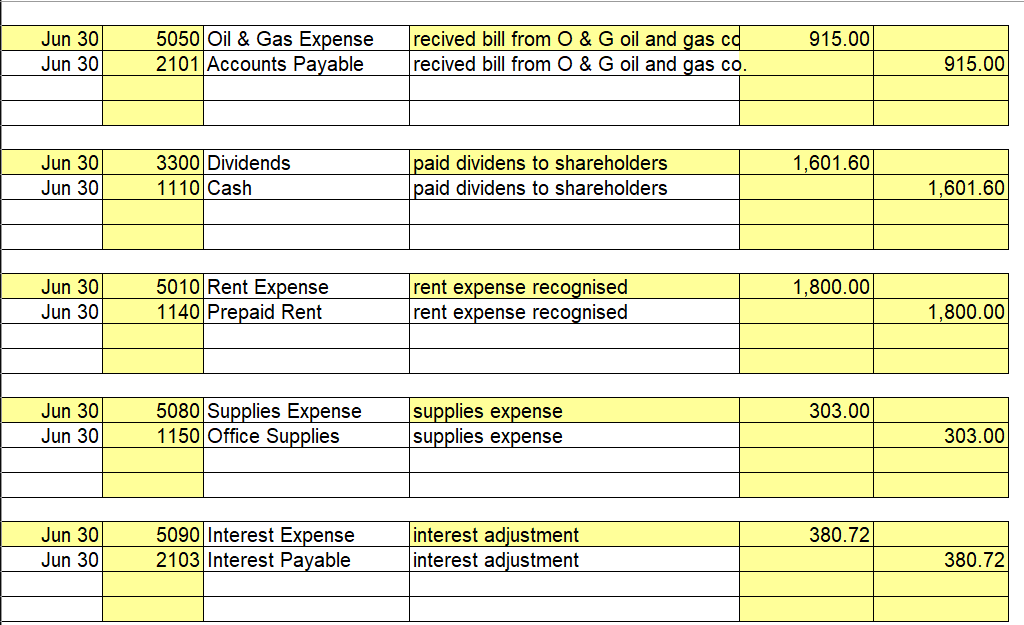

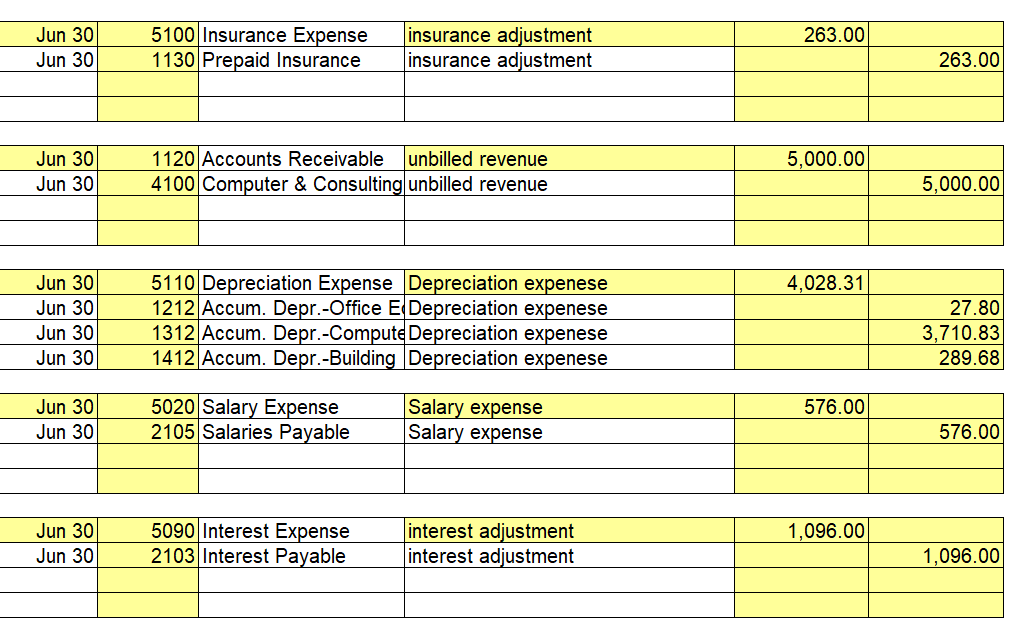

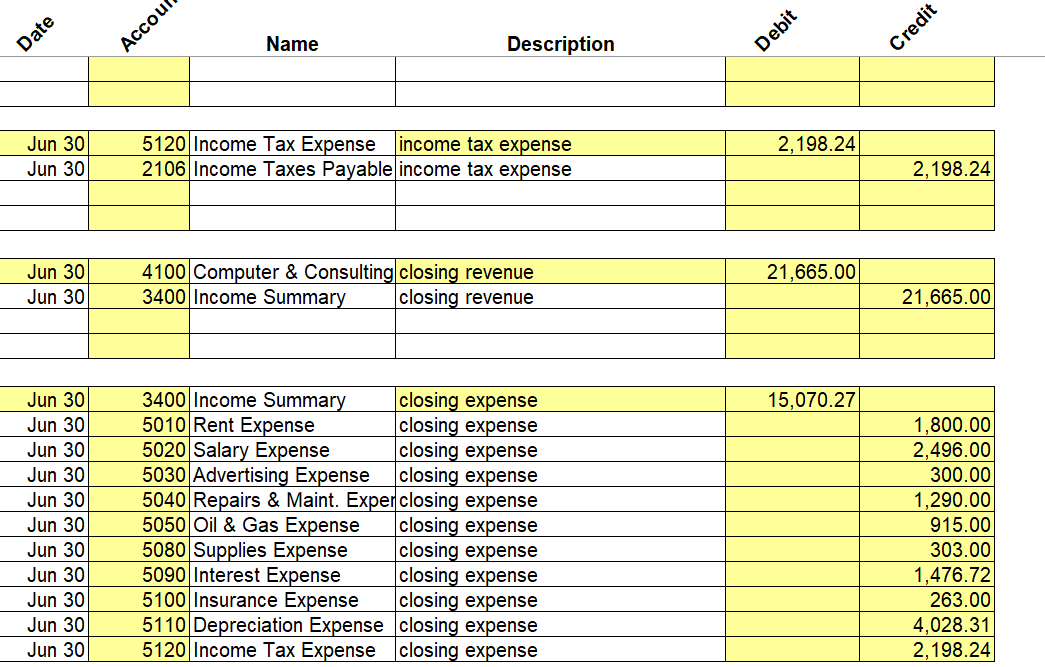

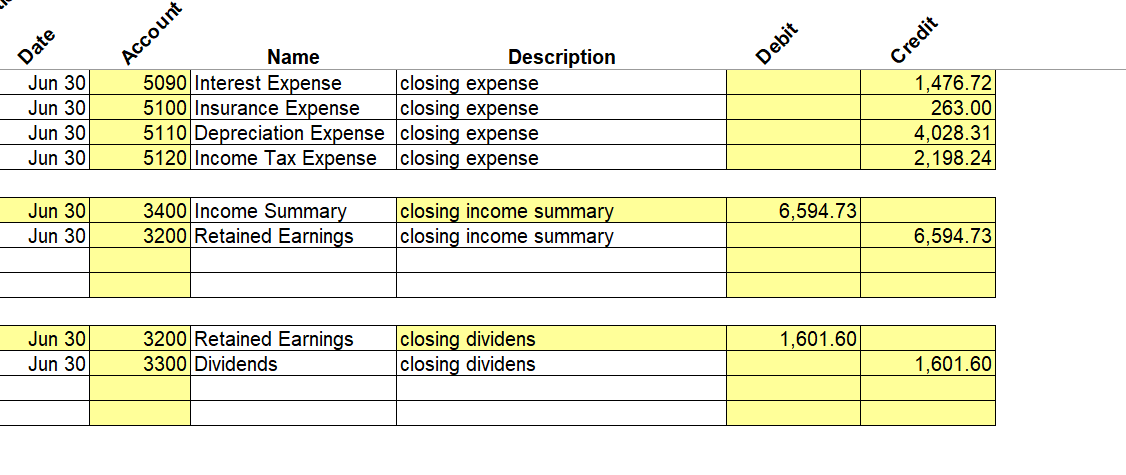

\begin{tabular}{|r|r|l|l|r|r|} \hline Jun 01 & 1110 & Cash & common stock (1920 shares $1) & 39,150.00 & \\ \hline Jun 01 & 1311 & Computer Equip. & common stock (1920 shares $21) & 11,340.00 & \\ \hline Jun 01 & 1211 & Office Equip. & common stock (1920 shares $21) & 1,350.00 & \\ \hline Jun 01 & 3100 & Capital Stock & common stock (1920 shares $21) & & 51,840.00 \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 01 & 1110 & Cash & common stock (2800 shares $21) & 75,600.00 & \\ \hline Jun 01 & 3100 & Capital Stock & common stock (2800 shares $21) & & 75,600.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 02 & 1311 & Computer Equip. & Purchased additional computer equpil 170,000.00 & \\ \hline Jun 02 & 1110 & Cash & Purchased additional computer equpiment & 34,000.00 \\ \hline Jun 02 & 2202 & Notes Payable & Purchased additional computer equpiment & 136,000.00 \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 04 & 1211 & Office Equip. & purchased office equpiment on credil & 700.00 & \\ \hline Jun 04 & 2101 & Accounts Payable & purchased office equpiment on credit from Discount & 700.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Name Description \begin{tabular}{|r|r|l|l|l|l|} \hline Jun 08 & 2101 & Accounts Payable & office equpiment returned & 140.00 & \\ \hline Jun 08 & 1211 & Office Equip. & office equpiment returned & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 10 & 2202 & Notes Payable & payment for purchased of computer & 26,000.00 & \\ \hline Jun 10 & 1110 & Cash & payment for purchased of computer & 26,000.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 14 & 1130 & Prepaid Insurance & prepaid insurance & 6,312.00 & \\ \hline Jun 14 & 1110 & Cash & prepaid insurance & & 6,312.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 16 & 1110 & Cash & for revnue earned & 6,250.00 & \\ \hline Jun 16 & 4100 & Computer \& Consulting & for revnue earned & & 6,250.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 17 & 1140 & Prepaid Rent & prepaid rent & 7,200.00 & \\ \hline Jun 17 & 1110 & Cash & prepaid rent & & 7,200.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|r|} \hline Jun 17 & 5030 & Advertising Expense & paid for advertising & 300.00 & \\ \hline Jun 17 & 2101 & Accounts Payable & paid for advertising & & 300.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{} \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 21 & 1211 & Office Equip. & billed customers for consultation & 875.00 & \\ \hline Jun 21 & 1110 & Cash & billed customers for consultation & & 875.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 21 & 2101 & Accounts Payable & paid in cash accounts payable & 560.00 & \\ \hline Jun 21 & 1110 & Cash & paid in cash accounts payable & & 560.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|r|l|l|r|r|} \hline Jun 23 & 1150 & Office Supplies & purchased office supplies on credit & 505.00 & \\ \hline Jun 23 & 2101 & Accounts Payable & purchased office supplies on credit & & 505.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 29 & 2101 & Accounts Payable & paid computer repair bill from jun 22 & 1,290.00 & \\ \hline Jun 29 & 1110 & Cash & paid computer repair bill from jun 22 & & 1,290.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|r|} \hline Jun 29 & 5020 & Salary Expense & paid salarys to equipment operators & 960.00 & \\ \hline Jun 29 & 1110 & Cash & paid salarys to equipment operators & & 960.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|l|r|} \hline Jun 30 & 5050 & Oil \& Gas Expense & recived bill from O \& G oil and gas cd & 915.00 & \\ \hline Jun 30 & 2101 & Accounts Payable & recived bill from O \& G oil and gas co. & 915.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 3300 & Dividends & paid dividens to shareholders & 1,601.60 & \\ \hline Jun 30 & 1110 & Cash & paid dividens to shareholders & & 1,601.60 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5010 & Rent Expense & rent expense recognised & 1,800.00 & \\ \hline Jun 30 & 1140 & Prepaid Rent & rent expense recognised & & 1,800.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5080 & Supplies Expense & supplies expense & 303.00 & \\ \hline Jun 30 & 1150 & Office Supplies & supplies expense & & 303.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5090 & Interest Expense & interest adjustment & 380.72 & \\ \hline Jun 30 & 2103 & Interest Payable & interest adjustment & & 380.72 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5100 & Insurance Expense & insurance adjustment & 263.00 & \\ \hline Jun 30 & 1130 & Prepaid Insurance & insurance adjustment & & 263.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 1120 & Accounts Receivable & unbilled revenue & 5,000.00 & \\ \hline Jun 30 & 4100 & Computer \& Consulting & unbilled revenue & & 5,000.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5110 & Depreciation Expense & Depreciation expenese & 4,028.31 & \\ \hline Jun 30 & 1212 & Accum. Depr.-Office E Depreciation expenese & & 27.80 \\ \hline Jun 30 & 1312 & Accum. Depr.-Compute Depreciation expenese & & 3,710.83 \\ \hline Jun 30 & 1412 & Accum. Depr.-Building & Depreciation expenese & & 289.68 \\ \hline \multicolumn{6}{|l|}{} \\ \hline Jun 30 & 5020 & Salary Expense & Salary expense & 576.00 & 576.00 \\ \hline Jun 30 & 2105 & Salaries Payable & Salary expense & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5090 & Interest Expense & interest adjustment & 1,096.00 & \\ \hline Jun 30 & 2103 & Interest Payable & interest adjustment & & 1,096.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 5120 & Income Tax Expense & income tax expense & 2,198.24 & \\ \hline Jun 30 & 2106 & Income Taxes Payable income tax expense & & 2,198.24 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 4100 & Computer \& Consulting & closing revenue & 21,665.00 & \\ \hline Jun 30 & 3400 & Income Summary & closing revenue & & 21,665.00 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 3400 & Income Summary & closing expense & 15,070.27 & \\ \hline Jun 30 & 5010 & Rent Expense & closing expense & 1,800.00 \\ \hline Jun 30 & 5020 & Salary Expense & closing expense & 2,496.00 \\ \hline Jun 30 & 5030 & Advertising Expense & closing expense & 300.00 \\ \hline Jun 30 & 5040 & Repairs \& Maint. Expen & & 1,290.00 \\ \hline Jun 30 & 5050 & Oil \& Gas Expense & closing expense & 915.00 \\ \hline Jun 30 & 5080 & Supplies Expense & closing expense & & 303.00 \\ \hline Jun 30 & 5090 & Interest Expense & closing expense & & 1,476.72 \\ \hline Jun 30 & 5100 & Insurance Expense & closing expense & & 263.00 \\ \hline Jun 30 & 5110 & Depreciation Expense & closing expense & & 4,028.31 \\ \hline Jun 30 & 5120 & Income Tax Expense & closing expense & & 2,198.24 \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 3400 & Income Summary & closing income summary & 6,594.73 & \\ \hline Jun 30 & 3200 & Retained Earnings & closing income summary & & 6,594.73 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|l|l|r|r|} \hline Jun 30 & 3200 & Retained Earnings & closing dividens & 1,601.60 & \\ \hline Jun 30 & 3300 & Dividends & closing dividens & & 1,601.60 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started