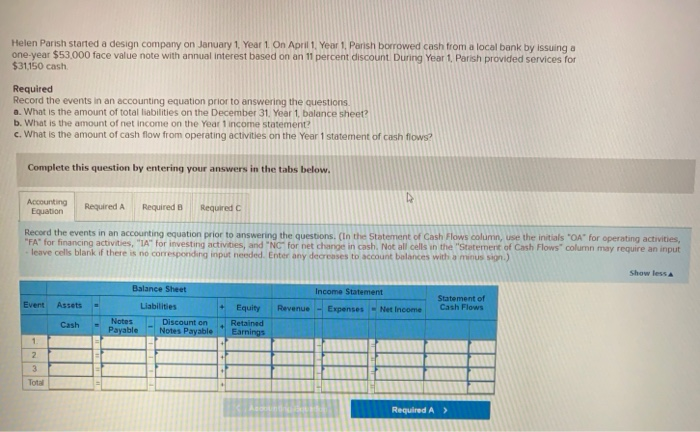

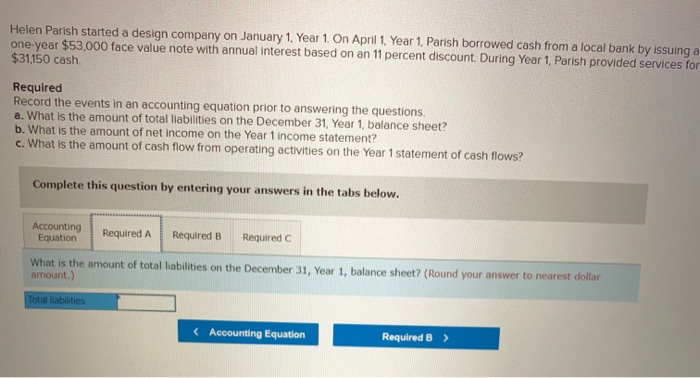

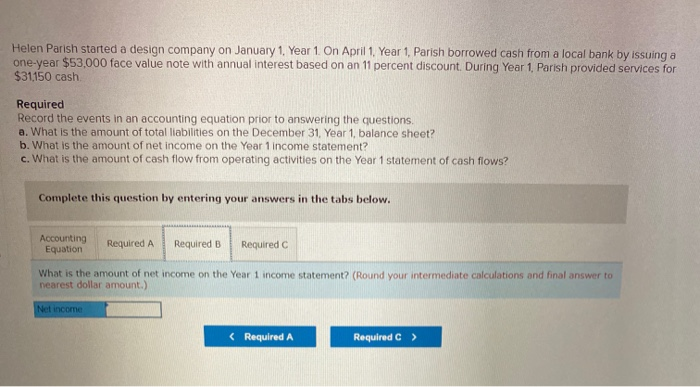

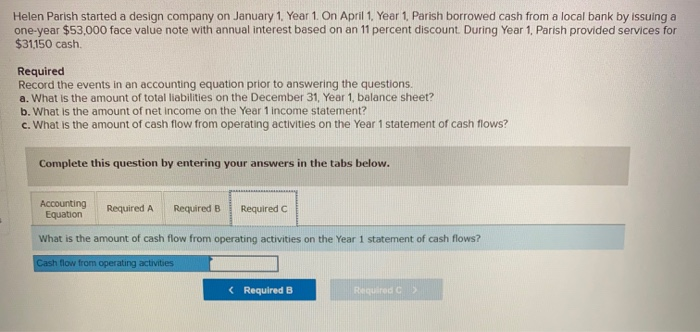

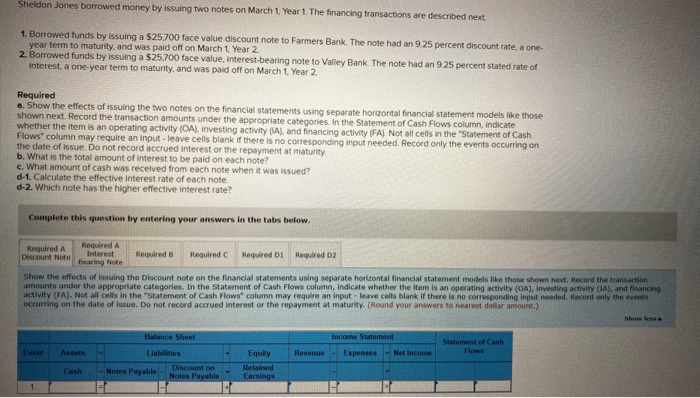

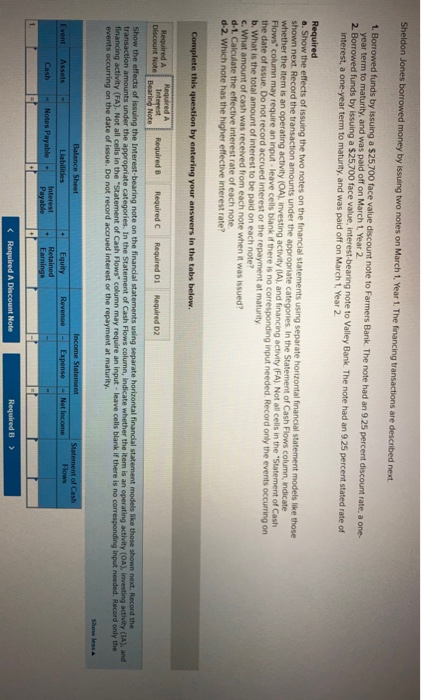

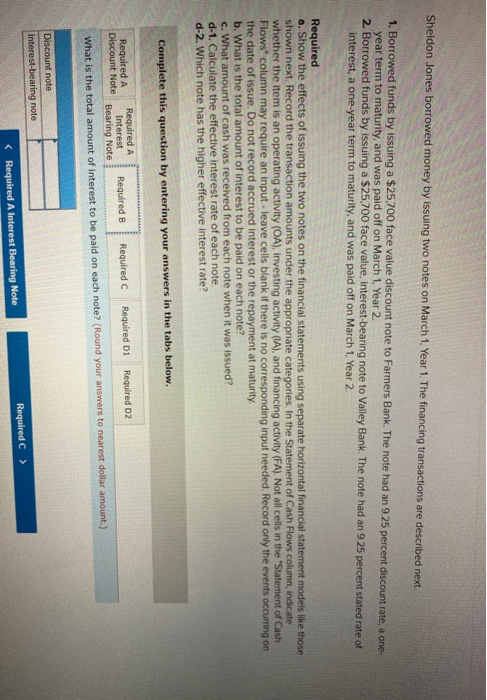

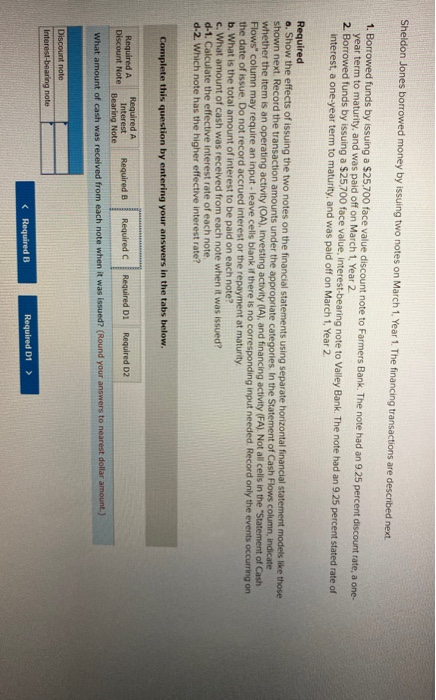

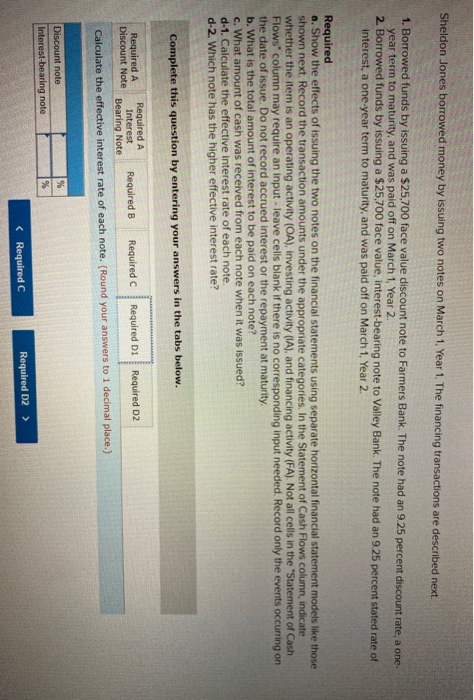

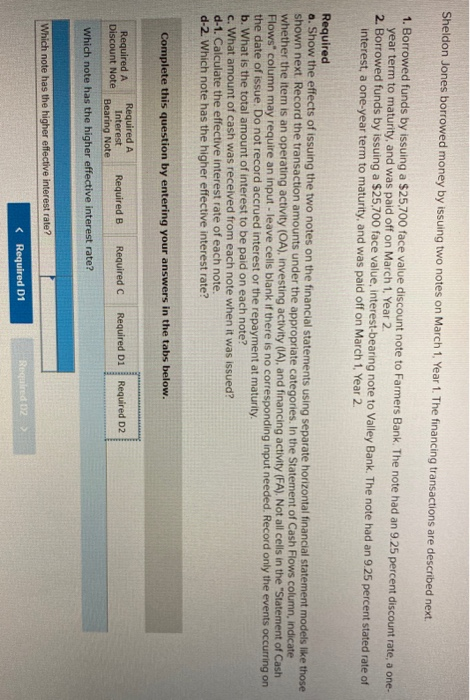

Helen Parish started a design company on January 1, Year 1 On April 1. Year 1. Parish borrowed cash from a local bank by issuing a one-year $53.000 face value note with annual interest based on an 11 percent discount Duning Year 1 Parish provided services for $31,150 cash Required Record the events in an accounting equation prior to answering the questions a. What is the amount of total liabilities on the December 31. Year 1 balance sheet? b. What is the amount of net income on the Year 1 income statement c. What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Complete this question by entering your answers in the tabs below. Accounting Required A Required B Required Equation Record the events in an accounting equation prior to answering the questions. (In the Statement of Cash Flows column, use the initials "OA" for operating activities, "FA" for financing activities, "IA" for investing activities, and "NC for net change in cash. Not all cells in the Statement of Cash Flows column may require an input leave cells blank if there is no corresponding input needed. Enter any decreases to account balances with a minus sign.) Show less Balance Sheet Income Statement Evert Assets Statement of Cash Flows Revenue Expenses - Net Income Liabilities Notes Discount on Payable Notes Payable Cash Equity Retained Earnings 1 2 3 Total Required A > Helen Parish started a design company on January 1, Year 1. On April 1. Year 1, Parish borrowed cash from a local bank by issuing a one-year $53,000 face value note with annual interest based on an 11 percent discount. During Year 1, Parish provided services for $31150 cash Required Record the events in an accounting equation prior to answering the questions, a. What is the amount of total liabilities on the December 31, Year 1, balance sheet? b. What is the amount of net income on the Year 1 income statement? c. What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Complete this question by entering your answers in the tabs below. Accounting Equation Required A Required B Required What is the amount of total liabilities on the December 31, Year 1, balance sheet? (Round your answer to nearest dollar amount.) Total liabilities Helen Parish started a design company on January 1. Year 1 On April 1. Year 1 Parish borrowed cash from a local bank by issuing a one-year $53,000 face value note with annual interest based on an 11 percent discount. During Year 1 Parish provided services for $31,150 cash Required Record the events in an accounting equation prior to answering the questions a. What is the amount of total liabilities on the December 31, Year 1, balance sheet? b. What is the amount of net income on the Year 1 income statement? c. What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Complete this question by entering your answers in the tabs below. Accounting Equation Required A Required B Required What is the amount of net income on the Year 1 income statement? (Round your intermediate calculations and final answer to nearest dollar amount.) Net income (Required A Required C > Helen Parish started a design company on January 1. Year 1 On April 1. Year 1. Parish borrowed cash from a local bank by issuing a one-year $53,000 face value note with annual interest based on an 11 percent discount. During Year 1, Parish provided services for $31,150 cash Required Record the events in an accounting equation prior to answering the questions. a. What is the amount of total liabilities on the December 31, Year 1, balance sheet? b. What is the amount of net income on the Year 1 income statement? c. What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Complete this question by entering your answers in the tabs below. Accounting Equation Required A Required B Required What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Cash flow from operating activities Sheldon Jones borrowed money by issuing two notes on March 1, Year 1. The financing transactions are described next. 1. Borrowed funds by issuing a $25,700 face value discount note to Farmers Bank. The note had an 9.25 percent discount rate, a one year term to maturity, and was paid off on March 1, Year 2 2. Borrowed funds by issuing a $25,700 face value interest-bearing note to Valley Bank. The note had an 9.25 percent stated rate of interest, a one-year term to maturity, and was paid off on March 1, Year 2 Required a. Show the effects of issuing the two notes on the financial statements using separate horizontal financial statement models like those shown next. Record the transaction amounts under the appropriate categories. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), and financing activity (FA). Not all cells in the Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed. Record only the events occurring on the date of issue. Do not record accrued interest or the repayment at maturity b. What is the total amount of interest to be paid on each note? c. What amount of cash was received from each note when it was issued? d-1. Calculate the effective interest rate of each note. d-2. Which note has the higher effective interest rate? Complete this question by entering your answers in the tabs below. Required A Required A Interest Discount Note Required B Required Di Required Required D2 Bearing Note What is the total amount of interest to be paid on each note? (Round your answers to nearest dollar amount.) Discount note Interest-bearing note Required C > Sheldon Jones borrowed money by issuing two notes on March 1, Year 1. The financing transactions are described next. 1. Borrowed funds by issuing a $25,700 face value discount note to Farmers Bank. The note had an 9.25 percent discount rate, a one- year term to maturity, and was paid off on March 1, Year 2. 2. Borrowed funds by issuing a $25,700 face value, interest-bearing note to Valley Bank. The note had an 9.25 percent stated rate of interest, a one-year term to maturity, and was paid off on March 1, Year 2. Required a. Show the effects of issuing the two notes on the financial statements using separate horizontal financial statement models like those shown next. Record the transaction amounts under the appropriate categories. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), and financing activity (FA). Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed. Record only the events occurring on the date of issue. Do not record accrued interest or the repayment at maturity b. What is the total amount of interest to be paid on each note? c. What amount of cash was received from each note when it was issued? d-1. Calculate the effective interest rate of each note. d-2. Which note has the higher effective interest rate? Complete this question by entering your answers in the tabs below. Required A Required A Interest Required B Discount Note Required Required D2 Required D1 Bearing Note Calculate the effective interest rate of each note. (Round your answers to 1 decimal place.) Discount note Interest-bearing note Sheldon Jones borrowed money by issuing two notes on March 1, Year 1. The financing transactions are described next. 1. Borrowed funds by issuing a $25,700 face value discount note to Farmers Bank. The note had an 925 percent discount rate, a one- year term to maturity, and was paid off on March 1. Year 2 2. Borrowed funds by issuing a $25,700 face value, interest-bearing note to Valley Bank. The note had an 9.25 percent stated rate of interest, a one-year term to maturity, and was paid off on March 1, Year 2. Required a. Show the effects of issuing the two notes on the financial statements using separate horizontal financial statement models like those shown next. Record the transaction amounts under the appropriate categories. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), and financing activity (FA). Not all cells in the "Statement of Cash Flows column may require an input - leave cells blank if there is no corresponding input needed. Record only the events occurring on the date of issue. Do not record accrued interest or the repayment at maturity. b. What is the total amount of interest to be paid on each note? c. What amount of cash was received from each note when it was issued? d-1. Calculate the effective interest rate of each note. d-2. Which note has the higher effective interest rate? Complete this question by entering your answers in the tabs below. Required D1 Required D2 Required A Required A Discount Note Interest Required B Required C Bearing Note Which note has the higher effective interest rate? Which note has the higher effective interest rate?