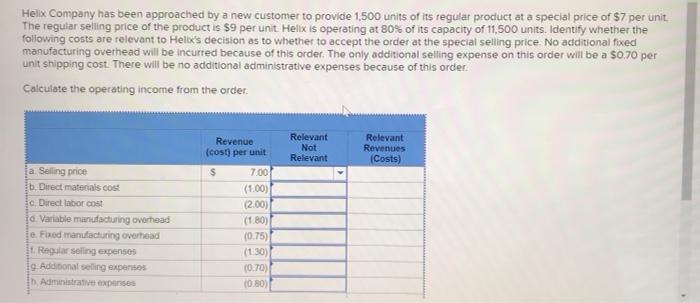

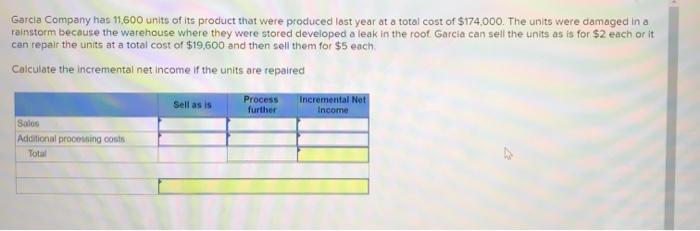

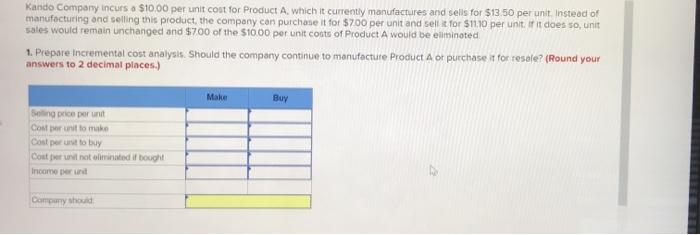

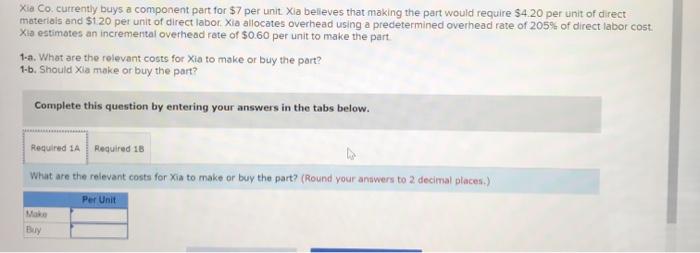

Helix Company has been approached by a new customer to provide 1,500 units of its regular product at a special price of $7 per unit The regular selling price of the product is $9 per unit Helix is operating at 80% of its capacity of 11,500 units. Identify whether the following costs are relevant to Hella's decision as to whether to accept the order at the special selling price. No additional fixed manufacturing overhead will be incurred because of this order. The only additional selling expense on this order will be a $0.70 per unit shipping cost. There will be no additional administrative expenses because of this order. Calculate the operating income from the order Revenue (cos) per unit Relevant Not Relevant Relevant Revenues (Costs) $ a. Selling price b. Direct materials cost e Direct labor cost ja. Variable manufacturing overhead e Fixod manufacturing overhead Regar selling expenses 19. Additional seling expertes in Administrative expenses 7.00 (1.00) (2.00) (1.80) (0.75) (130) 0.70) 10.80) Garcia Company has 11.600 units of its product that were produced last year at a total cost of $174.000. The units were damaged in a rainstorm because the warehouse where they were stored developed a leak in the root Garcia can sell the units as is for $2 each or it can repair the units at a total cost of $19,600 and then sell them for $5 each Calculate the incremental net income if the units are repaired Sell as is Process further Incremental Net Income Salos Additional processing costs Total Kando Company incurs a $10.00 per unit cost for Product A which it currently manufactures and sells for $13.50 per unit. Instead of manufacturing and selling this product, the company can purchase it for $700 per unit and sell it for $11.10 per unit. If it does so, unit sales would remain unchanged and $700 of the $10.00 per unit costs of Product A would be eliminated 1. Prepare Incremental cost analysis. Should the company continue to manufacture Product A or purchase it for resele? (Round your answers to 2 decimal places.) Make Buy Sing price por unit Cost per unit tomuke Con perust to buy Cost not liminated if bought Income per un Company should Xia Co. currently buys a component part for $7 per unit Xia belleves that making the part would require $4.20 per unit of direct materials and $120 per unit of direct labor. Xia allocates overhead using a predetermined overhead rate of 205% of direct labor cost. Xia estimates an incremental overhead rate of $0.60 per unit to make the part 1-a. What are the relevant costs for Xia to make or buy the part? 1-6. Should Xia make or buy the part? Complete this question by entering your answers in the tabs below. Required 1A Required 18 What are the relevant costs for Xia to make or buy the part? (Round your answers to 2 decimal places) Per Unit Buy