Hello, can i have a little of help with this please ?

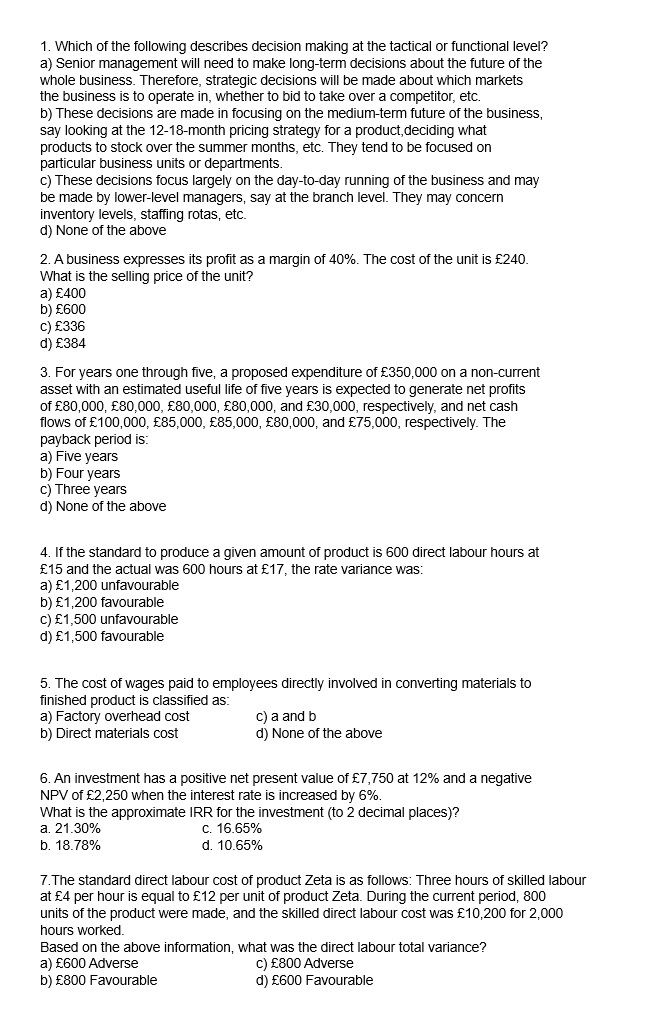

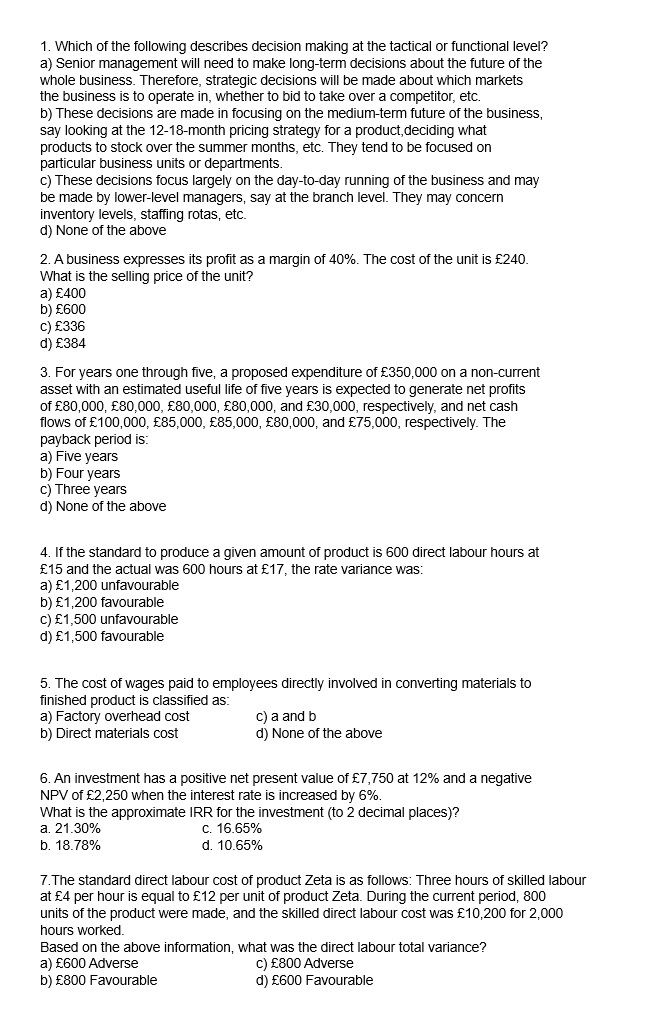

1. Which of the following describes decision making at the tactical or functional level? a) Senior management will need to make long-term decisions about the future of the whole business. Therefore, strategic decisions will be made about which markets the business is to operate in, whether to bid to take over a competitor, etc. b) These decisions are made in focusing on the medium-term future of the business, say looking at the 12-18-month pricing strategy for a product,deciding what products to stock over the summer months, etc. They tend to be focused on particular business units or departments. c) These decisions focus largely on the day-to-day running of the business and may be made by lower-level managers, say at the branch level. They may concern inventory levels, staffing rotas, etc. d) None of the above 2. A business expresses its profit as a margin of 40%. The cost of the unit is 240. What is the selling price of the unit? a) 400 b) 600 c) 336 d) 384 3. For years one through five, a proposed expenditure of 350,000 on a non-current asset with an estimated useful life of five years is expected to generate net profits of 80,000,80,000,80,000, 80,000, and 30,000, respectively, and net cash flows of 100,000,85,000,85,000,80,000, and 75,000, respectively. The payback period is: a) Five years b) Four years c) Three years d) None of the above 4. If the standard to produce a given amount of product is 600 direct labour hours at 15 and the actual was 600 hours at 17, the rate variance was: a) 1,200 unfavourable b) 1,200 favourable c) 1,500 unfavourable d) 1,500 favourable 5. The cost of wages paid to employees directly involved in converting materials to finished product is classified as: a) Factory overhead cost c) a and b b) Direct materials cost d) None of the above 6. An investment has a positive net present value of 7,750 at 12% and a negative NPV of 2,250 when the interest rate is increased by 6%. What is the approximate IRR for the investment (to 2 decimal places)? a. 21.30% c. 16.65% b. 18.78% d. 10.65% 7. The standard direct labour cost of product Zeta is as follows: Three hours of skilled labour at 4 per hour is equal to 12 per unit of product Zeta. During the current period, 800 units of the product were made, and the skilled direct labour cost was 10,200 for 2,000 hours worked. Based on the above information, what was the direct labour total variance? a) 600 Adverse c) 800 Adverse b) 800 Favourable d) 600 Favourable 1. Which of the following describes decision making at the tactical or functional level? a) Senior management will need to make long-term decisions about the future of the whole business. Therefore, strategic decisions will be made about which markets the business is to operate in, whether to bid to take over a competitor, etc. b) These decisions are made in focusing on the medium-term future of the business, say looking at the 12-18-month pricing strategy for a product,deciding what products to stock over the summer months, etc. They tend to be focused on particular business units or departments. c) These decisions focus largely on the day-to-day running of the business and may be made by lower-level managers, say at the branch level. They may concern inventory levels, staffing rotas, etc. d) None of the above 2. A business expresses its profit as a margin of 40%. The cost of the unit is 240. What is the selling price of the unit? a) 400 b) 600 c) 336 d) 384 3. For years one through five, a proposed expenditure of 350,000 on a non-current asset with an estimated useful life of five years is expected to generate net profits of 80,000,80,000,80,000, 80,000, and 30,000, respectively, and net cash flows of 100,000,85,000,85,000,80,000, and 75,000, respectively. The payback period is: a) Five years b) Four years c) Three years d) None of the above 4. If the standard to produce a given amount of product is 600 direct labour hours at 15 and the actual was 600 hours at 17, the rate variance was: a) 1,200 unfavourable b) 1,200 favourable c) 1,500 unfavourable d) 1,500 favourable 5. The cost of wages paid to employees directly involved in converting materials to finished product is classified as: a) Factory overhead cost c) a and b b) Direct materials cost d) None of the above 6. An investment has a positive net present value of 7,750 at 12% and a negative NPV of 2,250 when the interest rate is increased by 6%. What is the approximate IRR for the investment (to 2 decimal places)? a. 21.30% c. 16.65% b. 18.78% d. 10.65% 7. The standard direct labour cost of product Zeta is as follows: Three hours of skilled labour at 4 per hour is equal to 12 per unit of product Zeta. During the current period, 800 units of the product were made, and the skilled direct labour cost was 10,200 for 2,000 hours worked. Based on the above information, what was the direct labour total variance? a) 600 Adverse c) 800 Adverse b) 800 Favourable d) 600 Favourable