Hello, Can you help me with Question 5,6 &7

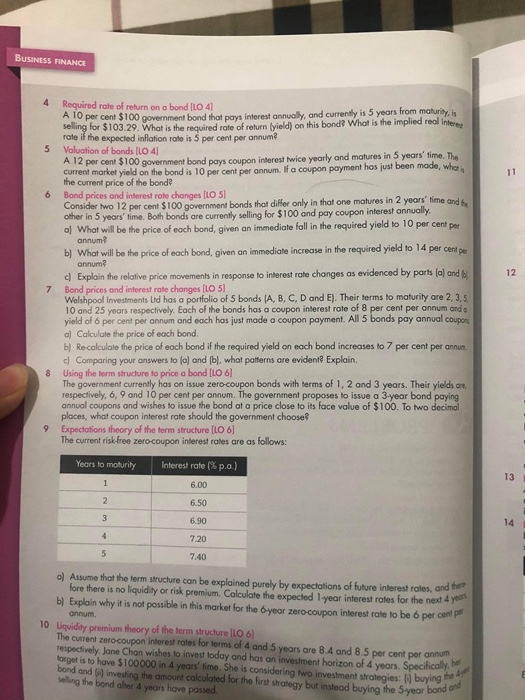

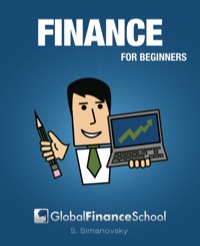

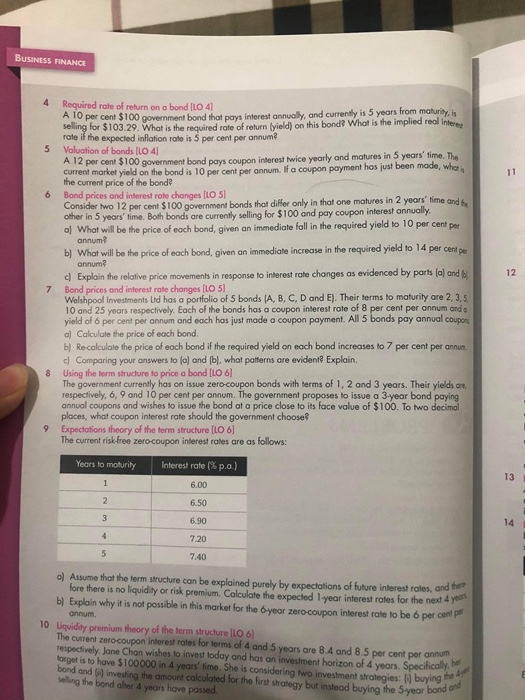

BUSINESS FINANCE 11 6 4 Required rate of return on a bond (LO 4 A 10 per cent $100 government bond that pays interest annually, and currently is 5 years from maturity, is selling for $103.29. What is the required rate of return yield) on this bond? What is the implied real interes rate if the expected inflation rate is 5 per cent per annum 5 Valuation of bonds [LO 41 A 12 per cent $100 government bond pays coupon interest twice yearly and matures in 5 years' time. The current market yield on the bond is 10 per cent per annum. If a coupon payment has just been made, whet the current price of the bond Bond prices and interest rate changes [LO 51 Consider two 12 per cent $100 government bonds that differ only in that one matures in 2 years' time and se other in 5 years' time. Both bonds are currently selling for $100 and pay coupon interest annually. al What will be the price of each bond, given an immediate fall in the required yield to 10 per cent per annum? b) What will be the price of each bond, given an immediate increase in the required yield to 14 per cent pe annum c) Explain the relative price movements in response to interest rate changes as evidenced by parts (a) and 7 Bond prices and interest rate changes (LO 51 Welshpool Investments Lid has a portfolio of 5 bonds (A, B, C, D and E). Their terms to maturity are 2,3,5 10 and 25 years respectively. Each of the bonds has a coupon interest rate of 8 per cent per annum anda yield of 6 per cent per annum and each has just made a coupon payment. All 5 bonds pay annual coupon a) Calculate the price of each bond. b) Recalculate the price of each bond if the required yield on each bond increases to 7 per cent per annun. dl Comparing your answers to (a) and (b), what patterns are evidente Explain. 8 Using the term structure to price a bond [LO 6] The government currently has on issue zero-coupon bonds with terms of 1, 2 and 3 years. Their yields are respectively, 6, 9 and 10 per cent per annum. The government proposes to issue a 3-year bond paying annual coupons and wishes to issue the bond at a price close to its foce value of $100. To two decimal places, what coupon interest rate should the government choose? Expectations theory of the term structure [LO 6] The current risk-free zero-coupon interest rates are as follows: 12 9 Years to maturity Interest rate (% p.) 6.00 13 1 2 6.50 3 6.90 14 4 7.20 7.40 onnum 5 al Assume that the term structure can be explained purely by expectations of future interest rates, and ter fore there is no liquidity or risk premium. Calculate the expected 1 year interest rates for the next 4 you b) Explain why it is not possible in this market for the year zero-coupon interest rate to be per cent per 10 Liquidity premium theory of the term structure LO 6) The current zero-coupon interest rates for terms of 4 and 5 years are 8.4 and 8.5 per cent per annum respectively, Jane Chan wishes to invest today and has an investment horizon of 4 forget is to have $100000 in 4 years' time. She is considering two investment strategies: buying the 4 bond and investing the amount calculated for the first strategy but instead buying the 5-year bond and waling the bond her 4 years have passed