Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello! can you please explain the steps on how to do this? I've been referring to the textbook but am still confused. thank you!! Hahn

hello! can you please explain the steps on how to do this? I've been referring to the textbook but am still confused. thank you!!

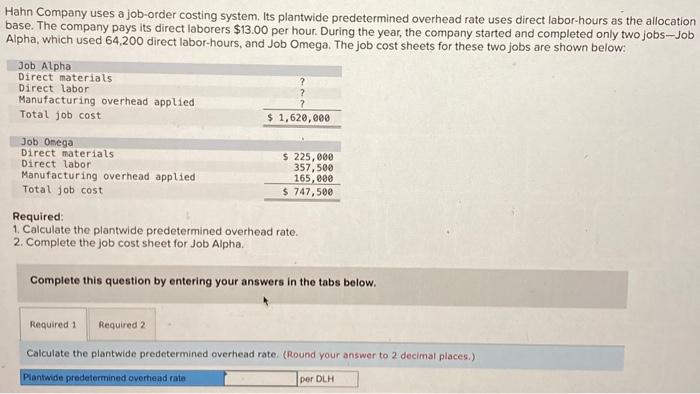

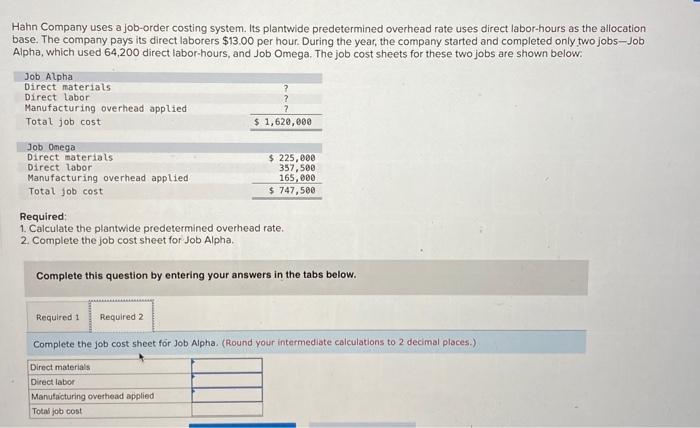

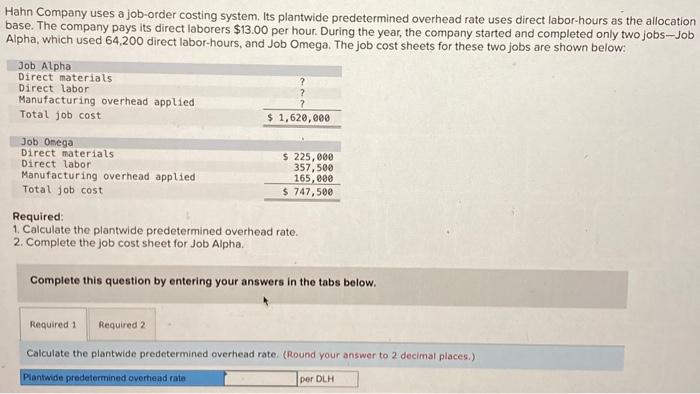

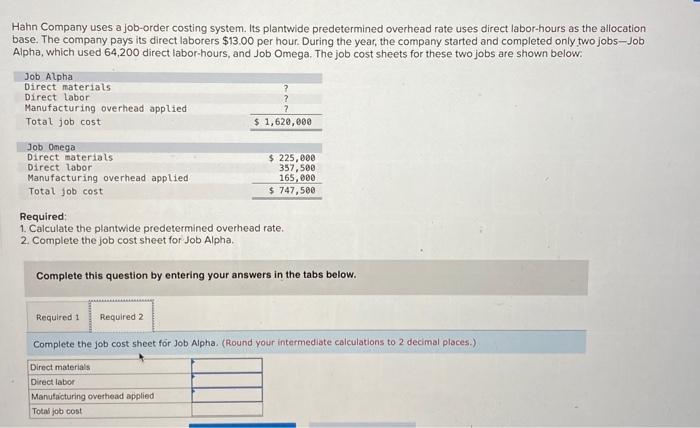

Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $13.00 per hour. During the year, the company started and completed only two jobs - Job Alpha, which used 64,200 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha. Complete this question by entering your answers in the tabs below. Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $13.00 per hour. During the year, the company started and completed only two jobs - Job Alpha, which used 64,200 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha. Complete this question by entering your answers in the tabs below. Complete the job cost sheet for Job Aipha. (Round your intermediate calculations to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started