Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello could you please solve this Q it is actually Q with A but can you explain it step by step and write the table

hello could you please solve this Q

it is actually Q with A

but can you explain it step by step and write the table and draw the daigram?

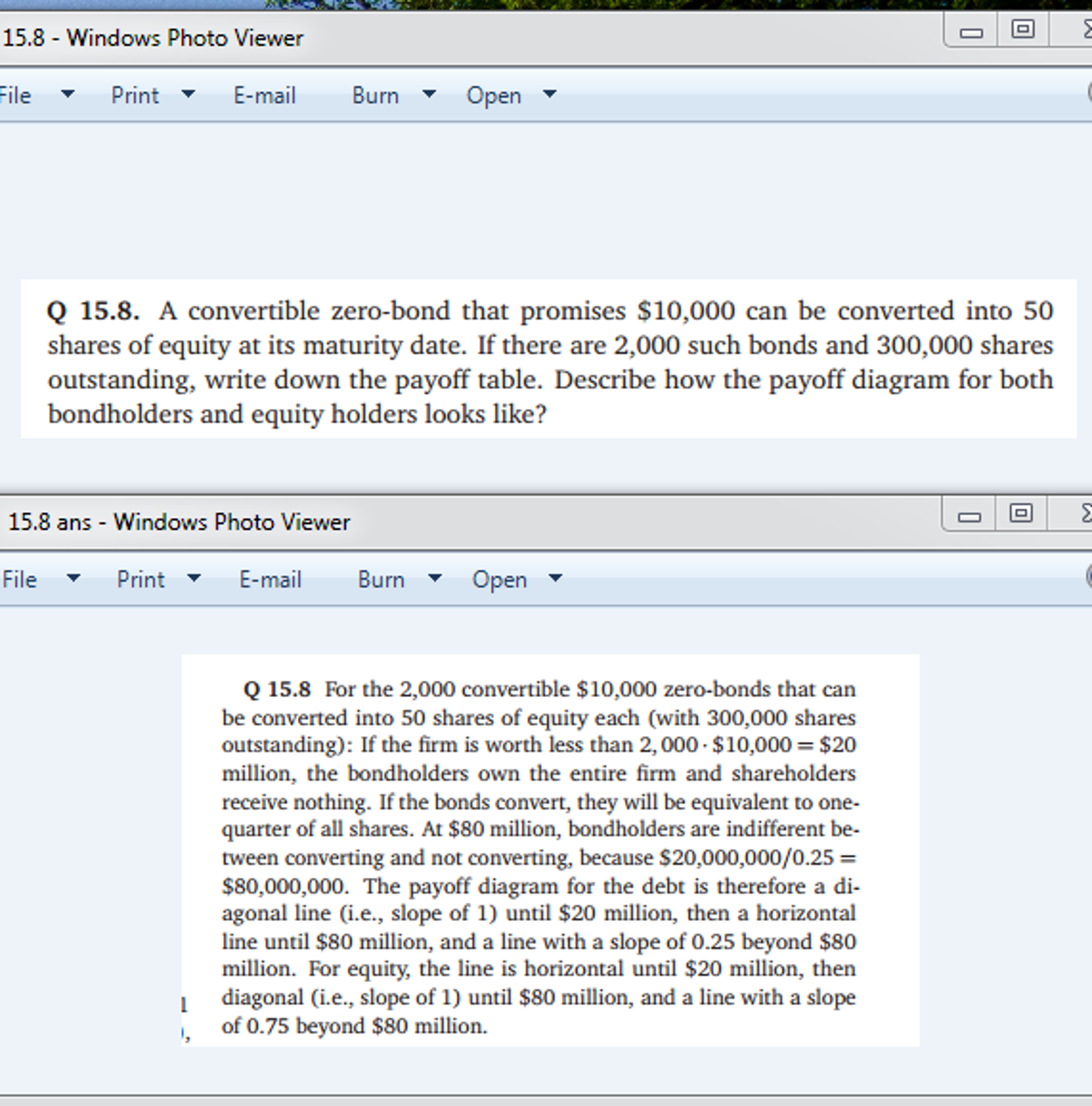

15.8 - Windows Photo Viewer ile Print E-mail Burn Open Q 15.8. A convertible zero-bond that promises $10,000 can be converted into 50 shares of equity at its maturity date. If there are 2,000 such bonds and 300,000 shares outstanding, write down the payoff table. Describe how the payoff diagram for both bondholders and equity holders looks like? 15.8 ans - Windows Photo Viewer Print E-mail Burn Open Q 15.8 For the 2,000 convertible $10,000 zero-bonds that can be converted into 50 shares of equity each (with 300,000 shares outstanding): If the firm is worth less than 2,000 $10,000 $20 million, the bondholders own the entire firm and shareholders receive nothing. If the bonds convert, they will be equivalent to one- quarter of all shares. At $80 million, bondholders are indifferent be tween converting and not converting, because $20,000,000/0.25 $80,000,000. The payoff diagram for the debt is therefore a di- agonal line (i.e., slope of 1) until $20 million, then a horizontal line until $80 million, and a line with a slope of 0.25 beyond $80 million. For equity, the line is horizontal until $20 million, then diagonal (i.e., slope of 1) until $80 million, and a line with a slope of 0.75 beyond $80 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started