Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, Everything with a RED X is wrong!! Please can you help me find a correct answer The following information as to earnings and deductions

Hello, Everything with a RED X is wrong!! Please can you help me find a correct answer

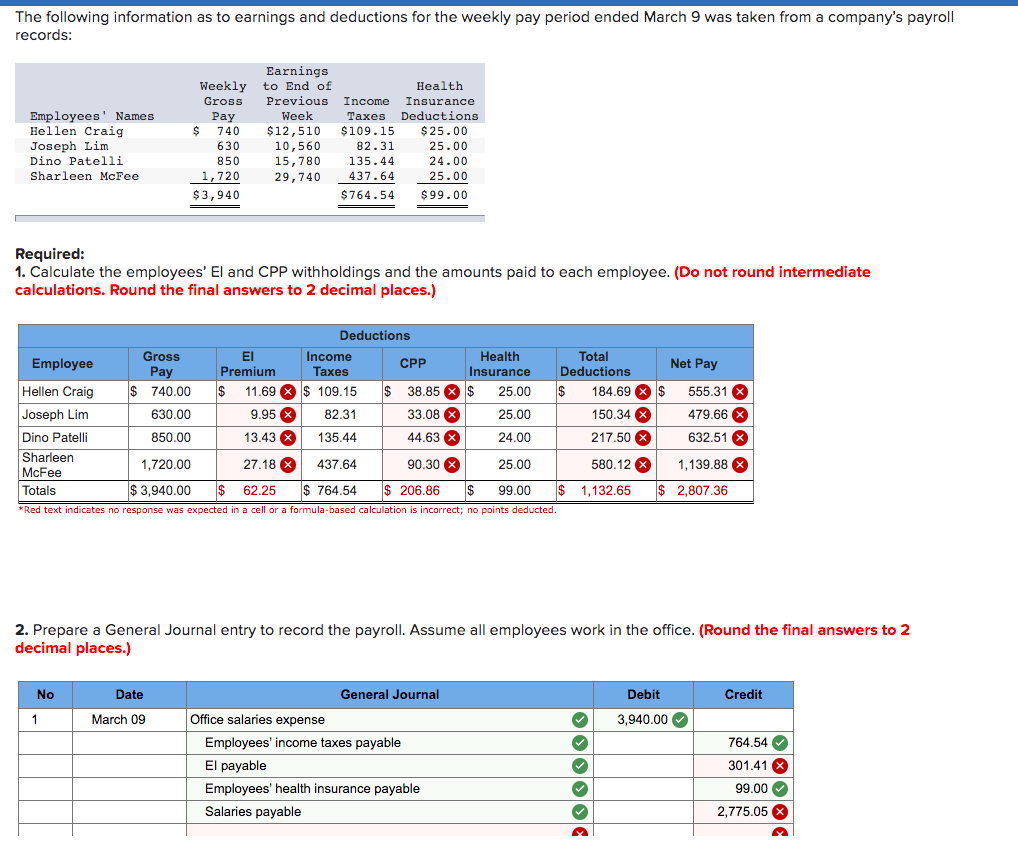

The following information as to earnings and deductions for the weekly pay period ended March 9 was taken from a company's payroll records: Employees' Names Hellen Craig Joseph Lim Dino Patelli Sharleen McFee Earnings Weekly to End of Health Gross Previous Income Insurance Pay Week Taxes Deductions $ 740 $12,510 $109.15 $25.00 630 10,560 82.31 25.00 850 15, 780 135.44 24.00 1,720 29,740 437.64 25.00 $ 3,940 $ 764.54 $99.00 Required: 1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Deductions Gross EI Income Employee Total Health CPP Pay Premium Taxes Insurance Deductions Net Pay Hellen Craig $ 740.00 $ 11.69 X $ 109.15 $ 38.85 * $ 25.00 $ 184.69 $ 555.31 Joseph Lim 630.00 9.95 X 82.31 33.08 X 25.00 150.34 X 479.66 Dino Patelli 850.00 13.43 X 135.44 44.63 X 24.00 217.50 X 632.51 % Sharleen 1,720.00 27.18 X 437.64 90.30 X 25.00 580.12 x 1,139.88 McFee Totals $ 3,940.00 $ 62.25 $ 764.54 $ 206.86 $ 99.00 $ 1,132.65 $ 2,807.36 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 2. Prepare a General Journal entry to record the payroll. Assume all employees work in the office. (Round the final answers to 2 decimal places.) No Date General Journal Debit Credit 1 1 March 09 3,940.00 Office salaries expense Employees' income taxes payable El payable Employees' health insurance payable Salaries payable 764.54 301.41 X 99.00 2,775.05 The following information as to earnings and deductions for the weekly pay period ended March 9 was taken from a company's payroll records: Employees' Names Hellen Craig Joseph Lim Dino Patelli Sharleen McFee Earnings Weekly to End of Health Gross Previous Income Insurance Pay Week Taxes Deductions $ 740 $12,510 $109.15 $25.00 630 10,560 82.31 25.00 850 15, 780 135.44 24.00 1,720 29,740 437.64 25.00 $ 3,940 $ 764.54 $99.00 Required: 1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Deductions Gross EI Income Employee Total Health CPP Pay Premium Taxes Insurance Deductions Net Pay Hellen Craig $ 740.00 $ 11.69 X $ 109.15 $ 38.85 * $ 25.00 $ 184.69 $ 555.31 Joseph Lim 630.00 9.95 X 82.31 33.08 X 25.00 150.34 X 479.66 Dino Patelli 850.00 13.43 X 135.44 44.63 X 24.00 217.50 X 632.51 % Sharleen 1,720.00 27.18 X 437.64 90.30 X 25.00 580.12 x 1,139.88 McFee Totals $ 3,940.00 $ 62.25 $ 764.54 $ 206.86 $ 99.00 $ 1,132.65 $ 2,807.36 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 2. Prepare a General Journal entry to record the payroll. Assume all employees work in the office. (Round the final answers to 2 decimal places.) No Date General Journal Debit Credit 1 1 March 09 3,940.00 Office salaries expense Employees' income taxes payable El payable Employees' health insurance payable Salaries payable 764.54 301.41 X 99.00 2,775.05Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started