Answered step by step

Verified Expert Solution

Question

1 Approved Answer

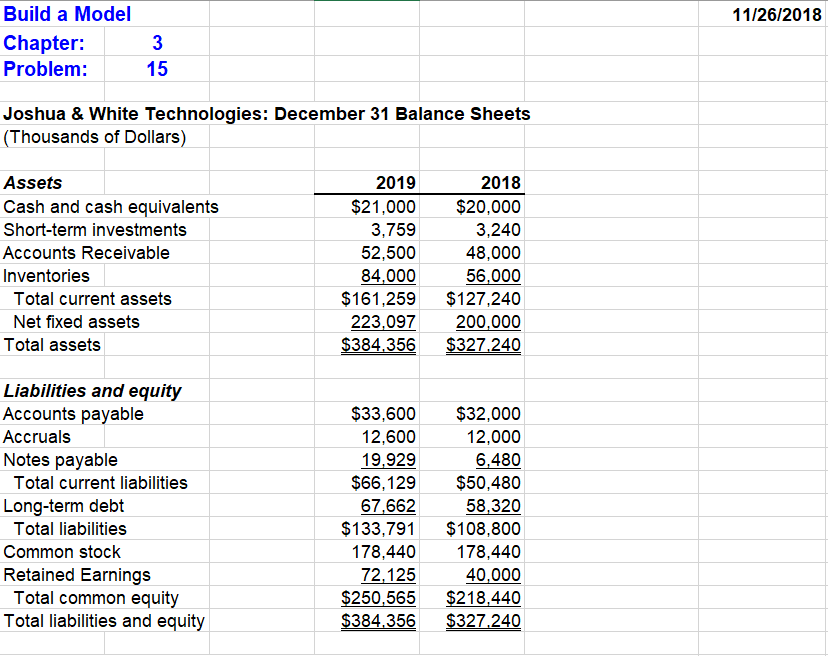

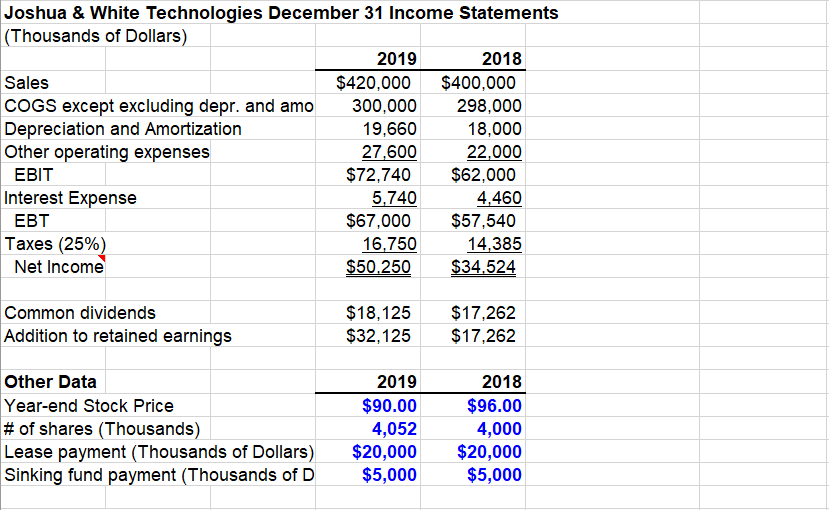

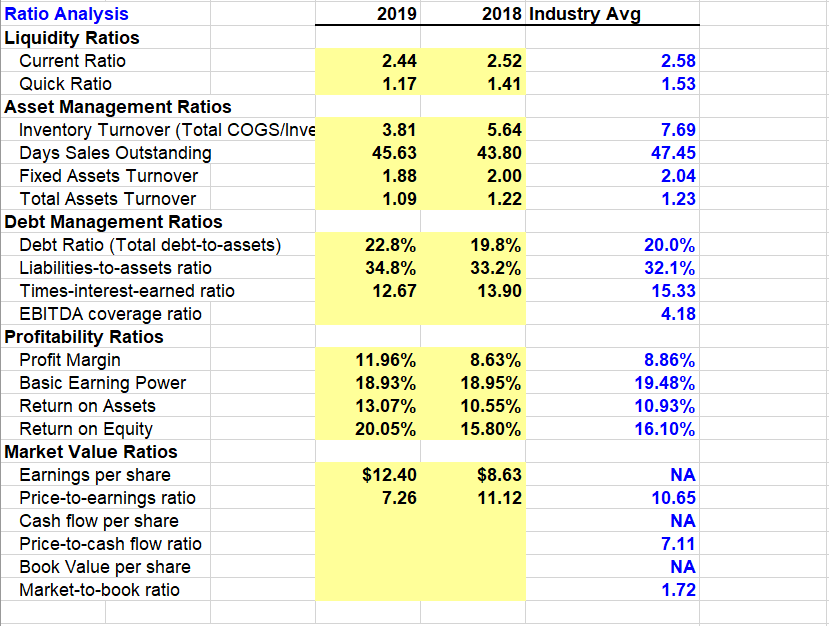

Hello fellow Chegg users, I'm having trouble with my assignment for my Basic Business Finance class and I was wondering if you could help me

Hello fellow Chegg users, I'm having trouble with my assignment for my Basic Business Finance class and I was wondering if you could help me out. Primarily, the last few ratios as well as the EBITDA Coverage Ratio which are the hardest to understand and answer. Any help would be appreciated and please don't forget to explain how you got the solution for me to better understand so that I can apply it to future assignments too. Thank you so much!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started