Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. For book 9781618531223, pg. 112. Step by step, how is inventory turnover ratio calculated & where to get-calculate opening inventory for 2012. Thanks. cricket

Hello. For book 9781618531223, pg. 112. Step by step, how is inventory turnover ratio calculated & where to get-calculate opening inventory for 2012.

Thanks.

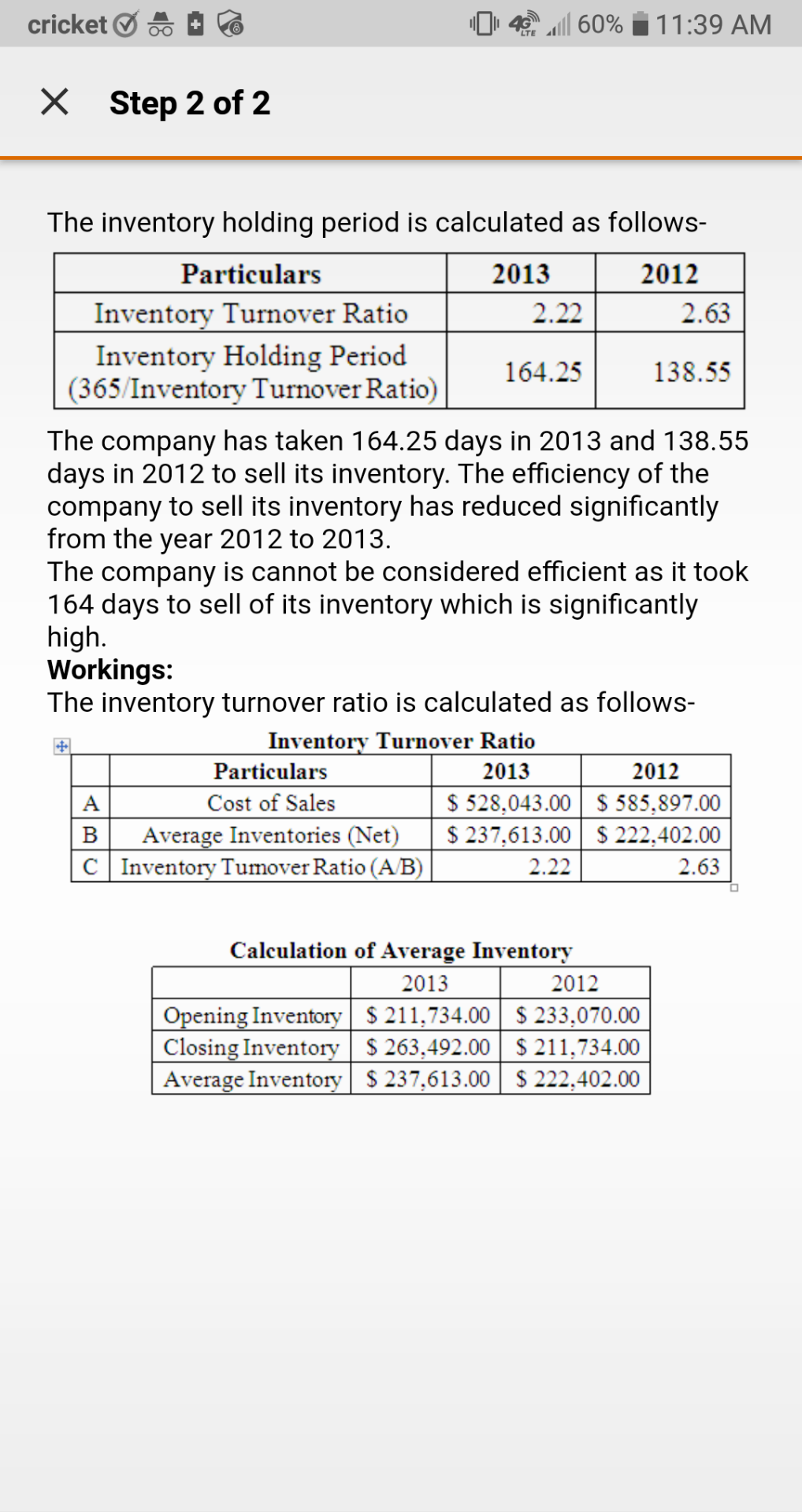

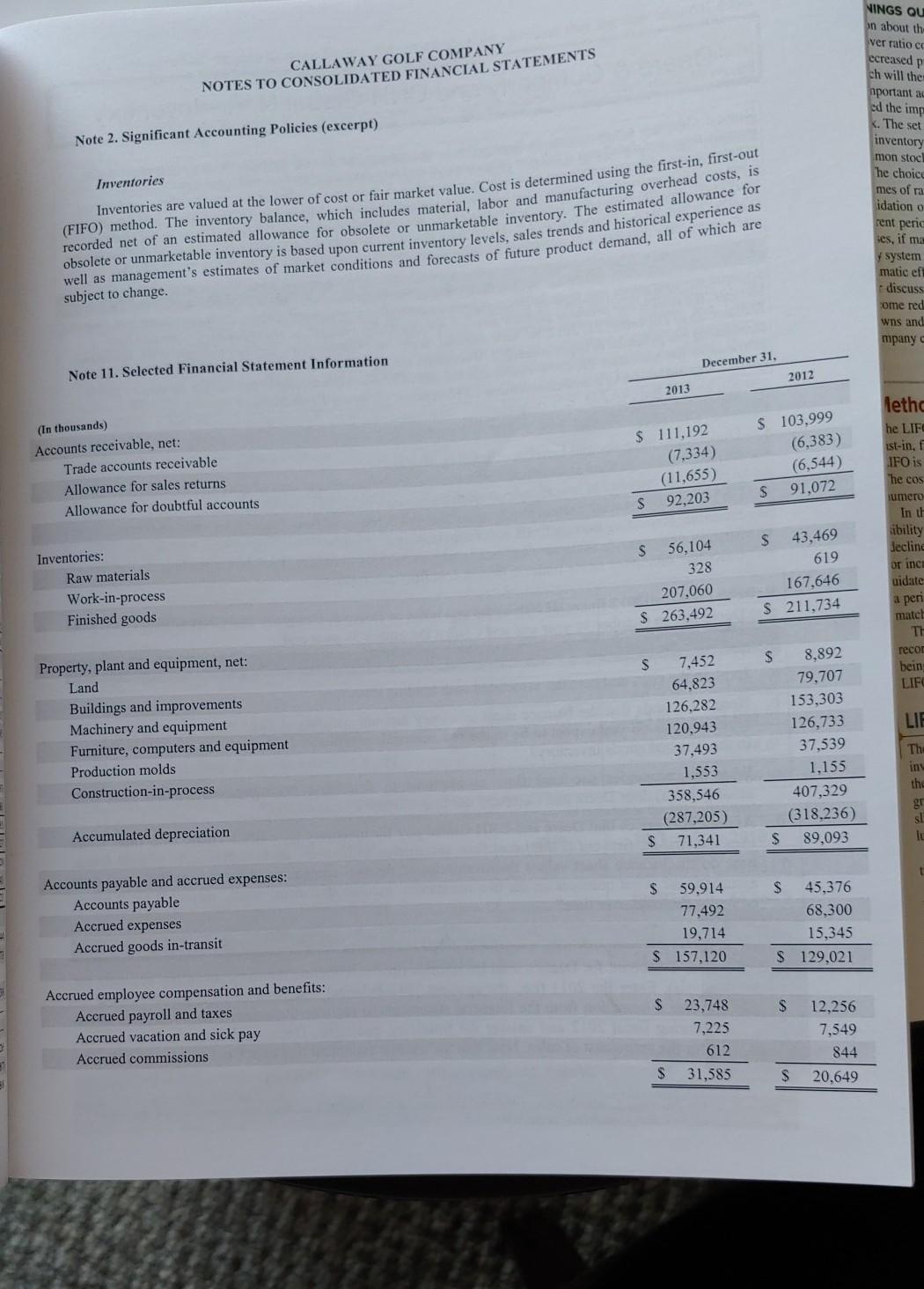

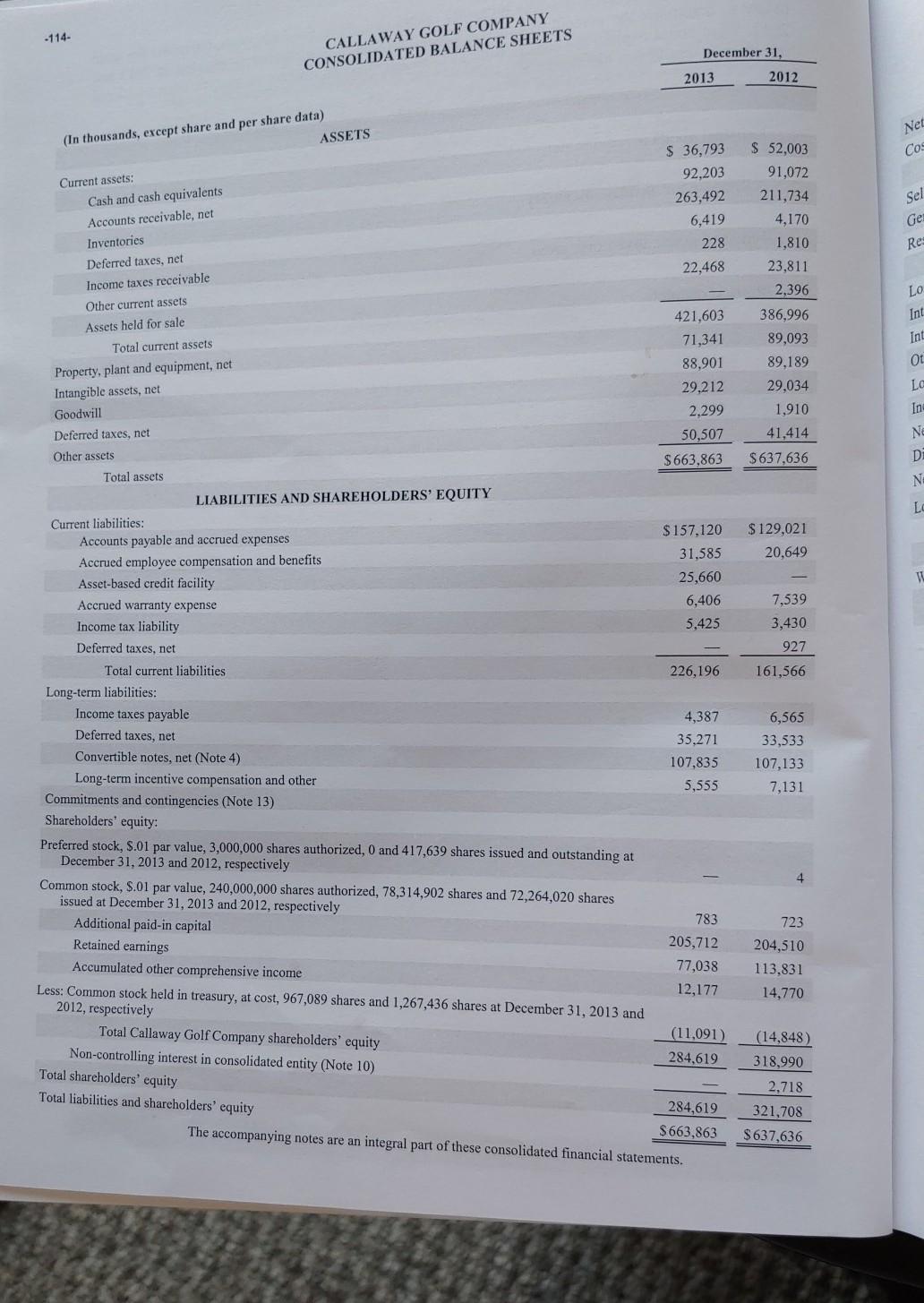

cricket 60 % 11:39 AM X Step 2 of 2 The inventory holding period is calculated as follows- Particulars 2013 2012 Inventory Turnover Ratio 2.22 2.63 Inventory Holding Period 164.25 138.55 (365/Inventory Turnover Ratio) The company has taken 164.25 days in 2013 and 138.55 days in 2012 to sell its inventory. The efficiency of the company to sell its inventory has reduced significantly from the year 2012 to 2013. The company is cannot be considered efficient as it took 164 days to sell of its inventory which is significantly high. Workings: The inventory turnover ratio is calculated as follows- Inventory Turnover Ratio Particulars 2013 2012 A Cost of Sales $ 528,043.00 $ 585,897.00 Average Inventories (Net) $ 237,613.00 $ 222,402.00 C Inventory Tumover Ratio (A/B) 2.22 2.63 B Calculation of Average Inventory 2013 2012 Opening Inventory $ 211,734.00 $ 233,070.00 Closing Inventory $ 263,492.00 $ 211,734.00 Average Inventory $ 237,613.00 $ 222,402.00 Inventories are valued at the lower of cost or fair market value. Cost is determined using the first-in, first-out CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Note 2. Significant Accounting Policies (excerpt) NINGS QU on about th ver ratio cc ecreased p ch will the nportant ac cd the imp K. The set inventory mon stoc he choice mes of ra idation o rent peric tes, if ma y system matic ef! discuss some red Inventories (FIFO) method. The inventory balance, which includes material, labor and manufacturing overhead costs, is recorded net of an estimated allowance for obsolete or unmarketable inventory. The estimated allowance for obsolete or unmarketable inventory is based upon current inventory levels, sales trends and historical experience as well as management's estimates of market conditions and forecasts of future product demand, all of which are subject to change. wns and mpany December 31, Note 11. Selected Financial Statement Information 2012 2013 (In thousands) Accounts receivable, net: Trade accounts receivable Allowance for sales returns Allowance for doubtful accounts $ 111,192 (7,334) (11,655) $ 92,203 $ 103,999 (6,383) (6,544) S 91,072 lethd he LIFE ist-in, f IFO is The cos umero In th sibility decling or inci uidate a peni match Inventories: Raw materials Work-in-process Finished goods s 56,104 328 207,060 $ 263,492 $ 43,469 619 167,646 $ 211,734 recor S bein LIFE LIE Property, plant and equipment, net: Land Buildings and improvements Machinery and equipment Furniture, computers and equipment Production molds Construction-in-process 7,452 64,823 126,282 120,943 37,493 1,553 358,546 (287,205) 71,341 8,892 79,707 153,303 126,733 37,539 1.155 407,329 (318,236) 89,093 Th iny the gr sl lo Accumulated depreciation S S t Accounts payable and accrued expenses: Accounts payable Accrued expenses Accrued goods in-transit S 59,914 77,492 19,714 $ 157,120 S 45,376 68,300 15,345 $ 129,021 $ $ Accrued employee compensation and benefits: Accrued payroll and taxes Accrued vacation and sick pay Accrued commissions 23,748 7,225 612 31,585 12,256 7,549 844 S $ 20,649 -114- CALLAWAY GOLF COMPANY CONSOLIDATED BALANCE SHEETS December 31, 2013 2012 Net Cos Sel (In thousands, except share and per share data) ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Deferred taxes, net Income taxes receivable Other current assets Assets held for sale $ 36,793 92,203 263,492 6,419 228 22,468 Ger Res LO $ 52,003 91,072 211,734 4,170 1,810 23,811 2,396 386,996 89,093 89.189 29,034 1,910 41,414 $637,636 Int Int 01 Total current assets Property, plant and equipment, net Intangible assets, net Goodwill Deferred taxes, net Other assets 421,603 71,341 88,901 29,212 2,299 50,507 $663,863 La In NO D Total assets N LIABILITIES AND SHAREHOLDERS' EQUITY La $129,021 20,649 7,539 3,430 927 161,566 6,565 33,533 107,133 7,131 Current liabilities: $ 157,120 Accounts payable and accrued expenses 31,585 Accrued employee compensation and benefits 25,660 Asset-based credit facility 6,406 Accrued warranty expense 5,425 Income tax liability Deferred taxes, net 226,196 Total current liabilities Long-term liabilities: 4,387 Income taxes payable 35,271 Deferred taxes, net Convertible notes, net (Note 4) 107,835 5,555 Long-term incentive compensation and other Commitments and contingencies (Note 13) Shareholders' equity: Preferred stock, S.01 par value, 3,000,000 shares authorized, 0 and 417,639 shares issued and outstanding at December 31, 2013 and 2012, respectively Common stock, $.01 par value, 240,000,000 shares authorized, 78,314,902 shares and 72,264,020 shares issued at December 31, 2013 and 2012, respectively 783 Additional paid-in capital 205,712 Retained earnings 77,038 Accumulated other comprehensive income 12,177 Less: Common stock held in treasury, at cost, 967,089 shares and 1,267,436 shares at December 31, 2013 and 2012, respectively (11.091) Total Callaway Golf Company shareholders' equity 284,619 Non-controlling interest in consolidated entity (Note 10) Total shareholders' equity Total liabilities and shareholders' equity 284,619 $663,863 The accompanying notes are an integral part of these consolidated financial statements. 4 723 204,510 113,831 14,770 (14,848) 318,990 2,718 321,708 $637,636 cricket 60 % 11:39 AM X Step 2 of 2 The inventory holding period is calculated as follows- Particulars 2013 2012 Inventory Turnover Ratio 2.22 2.63 Inventory Holding Period 164.25 138.55 (365/Inventory Turnover Ratio) The company has taken 164.25 days in 2013 and 138.55 days in 2012 to sell its inventory. The efficiency of the company to sell its inventory has reduced significantly from the year 2012 to 2013. The company is cannot be considered efficient as it took 164 days to sell of its inventory which is significantly high. Workings: The inventory turnover ratio is calculated as follows- Inventory Turnover Ratio Particulars 2013 2012 A Cost of Sales $ 528,043.00 $ 585,897.00 Average Inventories (Net) $ 237,613.00 $ 222,402.00 C Inventory Tumover Ratio (A/B) 2.22 2.63 B Calculation of Average Inventory 2013 2012 Opening Inventory $ 211,734.00 $ 233,070.00 Closing Inventory $ 263,492.00 $ 211,734.00 Average Inventory $ 237,613.00 $ 222,402.00 Inventories are valued at the lower of cost or fair market value. Cost is determined using the first-in, first-out CALLAWAY GOLF COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Note 2. Significant Accounting Policies (excerpt) NINGS QU on about th ver ratio cc ecreased p ch will the nportant ac cd the imp K. The set inventory mon stoc he choice mes of ra idation o rent peric tes, if ma y system matic ef! discuss some red Inventories (FIFO) method. The inventory balance, which includes material, labor and manufacturing overhead costs, is recorded net of an estimated allowance for obsolete or unmarketable inventory. The estimated allowance for obsolete or unmarketable inventory is based upon current inventory levels, sales trends and historical experience as well as management's estimates of market conditions and forecasts of future product demand, all of which are subject to change. wns and mpany December 31, Note 11. Selected Financial Statement Information 2012 2013 (In thousands) Accounts receivable, net: Trade accounts receivable Allowance for sales returns Allowance for doubtful accounts $ 111,192 (7,334) (11,655) $ 92,203 $ 103,999 (6,383) (6,544) S 91,072 lethd he LIFE ist-in, f IFO is The cos umero In th sibility decling or inci uidate a peni match Inventories: Raw materials Work-in-process Finished goods s 56,104 328 207,060 $ 263,492 $ 43,469 619 167,646 $ 211,734 recor S bein LIFE LIE Property, plant and equipment, net: Land Buildings and improvements Machinery and equipment Furniture, computers and equipment Production molds Construction-in-process 7,452 64,823 126,282 120,943 37,493 1,553 358,546 (287,205) 71,341 8,892 79,707 153,303 126,733 37,539 1.155 407,329 (318,236) 89,093 Th iny the gr sl lo Accumulated depreciation S S t Accounts payable and accrued expenses: Accounts payable Accrued expenses Accrued goods in-transit S 59,914 77,492 19,714 $ 157,120 S 45,376 68,300 15,345 $ 129,021 $ $ Accrued employee compensation and benefits: Accrued payroll and taxes Accrued vacation and sick pay Accrued commissions 23,748 7,225 612 31,585 12,256 7,549 844 S $ 20,649 -114- CALLAWAY GOLF COMPANY CONSOLIDATED BALANCE SHEETS December 31, 2013 2012 Net Cos Sel (In thousands, except share and per share data) ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Deferred taxes, net Income taxes receivable Other current assets Assets held for sale $ 36,793 92,203 263,492 6,419 228 22,468 Ger Res LO $ 52,003 91,072 211,734 4,170 1,810 23,811 2,396 386,996 89,093 89.189 29,034 1,910 41,414 $637,636 Int Int 01 Total current assets Property, plant and equipment, net Intangible assets, net Goodwill Deferred taxes, net Other assets 421,603 71,341 88,901 29,212 2,299 50,507 $663,863 La In NO D Total assets N LIABILITIES AND SHAREHOLDERS' EQUITY La $129,021 20,649 7,539 3,430 927 161,566 6,565 33,533 107,133 7,131 Current liabilities: $ 157,120 Accounts payable and accrued expenses 31,585 Accrued employee compensation and benefits 25,660 Asset-based credit facility 6,406 Accrued warranty expense 5,425 Income tax liability Deferred taxes, net 226,196 Total current liabilities Long-term liabilities: 4,387 Income taxes payable 35,271 Deferred taxes, net Convertible notes, net (Note 4) 107,835 5,555 Long-term incentive compensation and other Commitments and contingencies (Note 13) Shareholders' equity: Preferred stock, S.01 par value, 3,000,000 shares authorized, 0 and 417,639 shares issued and outstanding at December 31, 2013 and 2012, respectively Common stock, $.01 par value, 240,000,000 shares authorized, 78,314,902 shares and 72,264,020 shares issued at December 31, 2013 and 2012, respectively 783 Additional paid-in capital 205,712 Retained earnings 77,038 Accumulated other comprehensive income 12,177 Less: Common stock held in treasury, at cost, 967,089 shares and 1,267,436 shares at December 31, 2013 and 2012, respectively (11.091) Total Callaway Golf Company shareholders' equity 284,619 Non-controlling interest in consolidated entity (Note 10) Total shareholders' equity Total liabilities and shareholders' equity 284,619 $663,863 The accompanying notes are an integral part of these consolidated financial statements. 4 723 204,510 113,831 14,770 (14,848) 318,990 2,718 321,708 $637,636

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started