Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, hope everything is well. This is one question but it has 15 parts to it. I really need your help with this one. Greatly

hello, hope everything is well. This is one question but it has 15 parts to it. I really need your help with this one. Greatly appreciate it and thank you in advance!

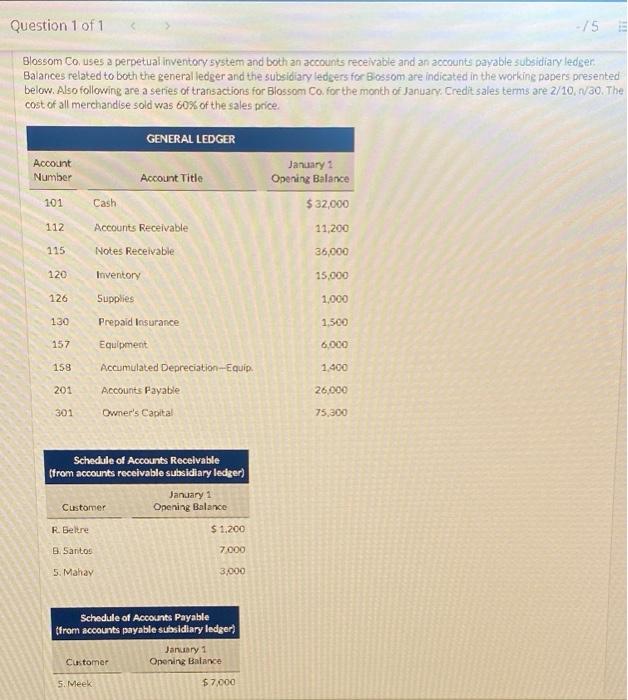

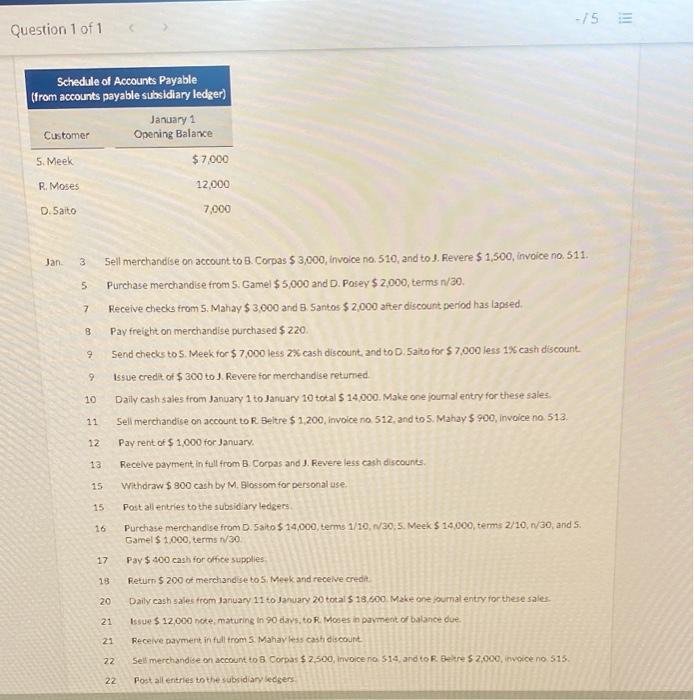

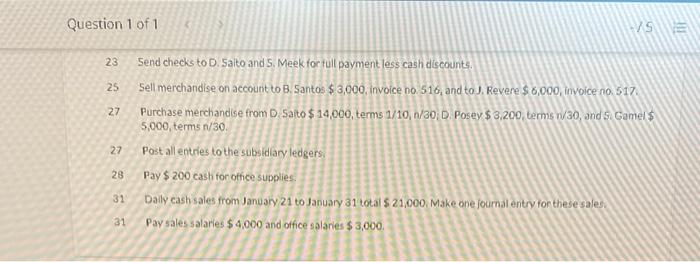

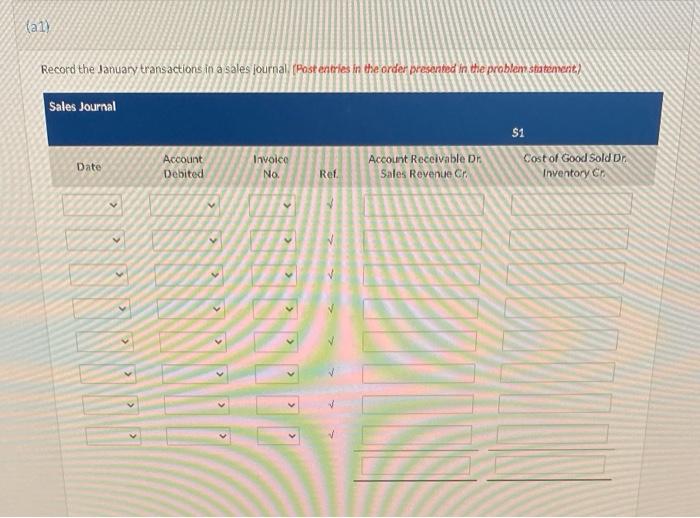

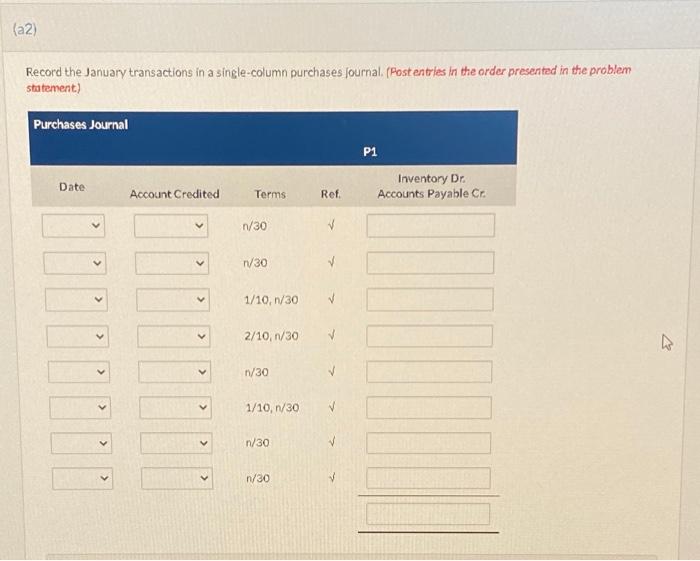

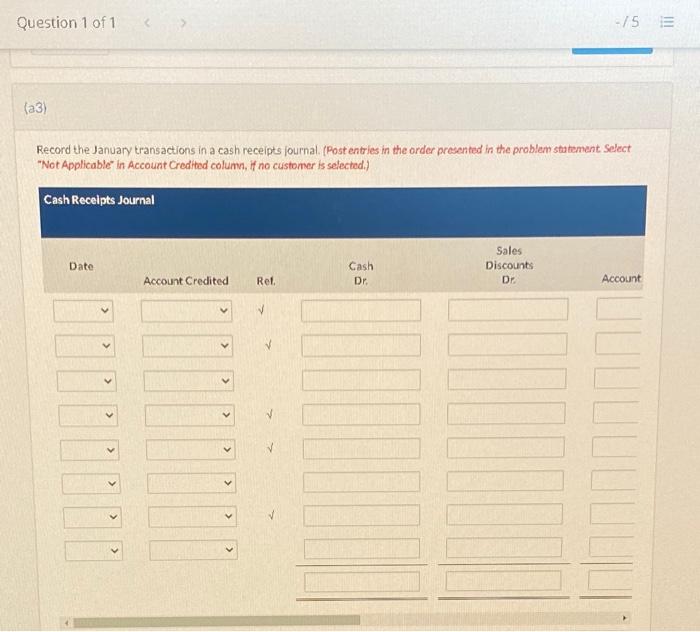

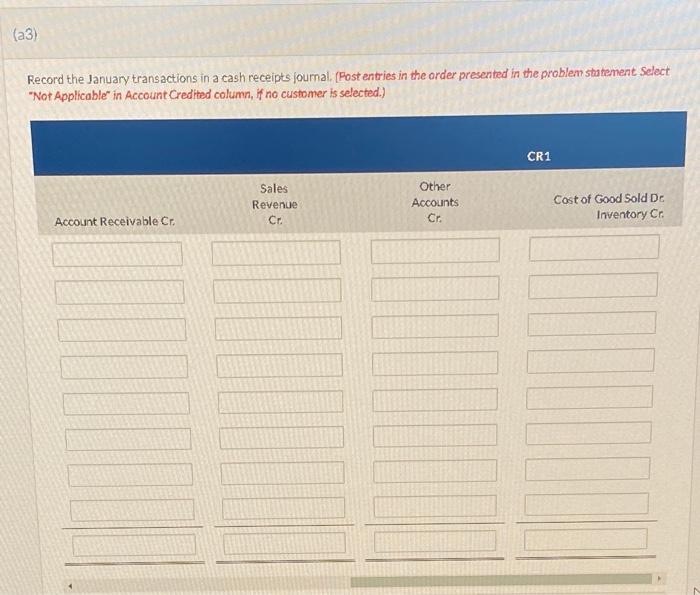

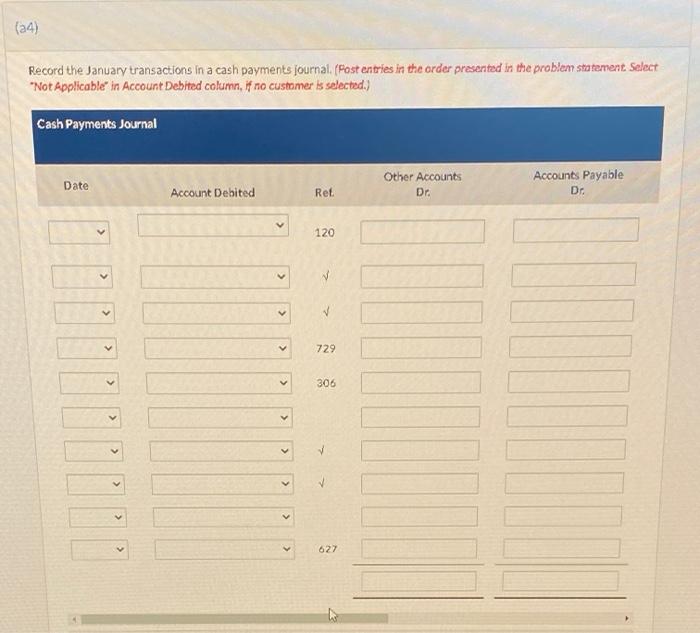

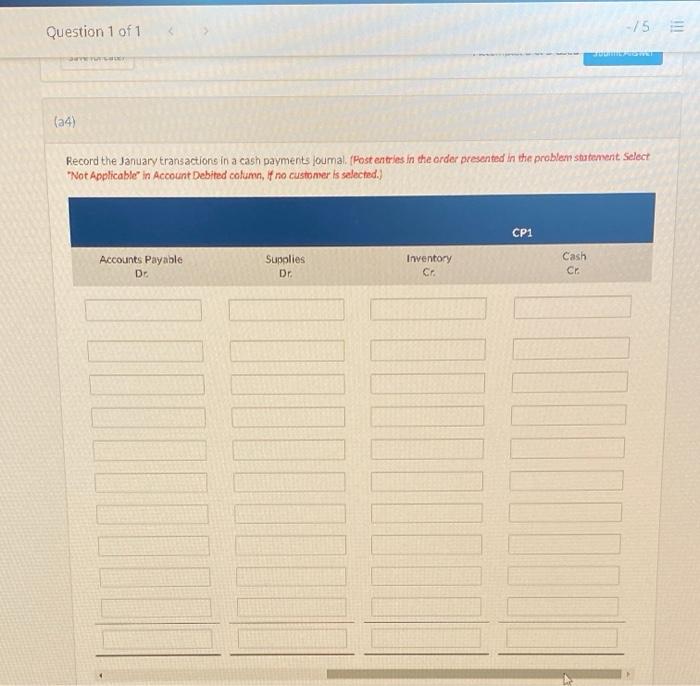

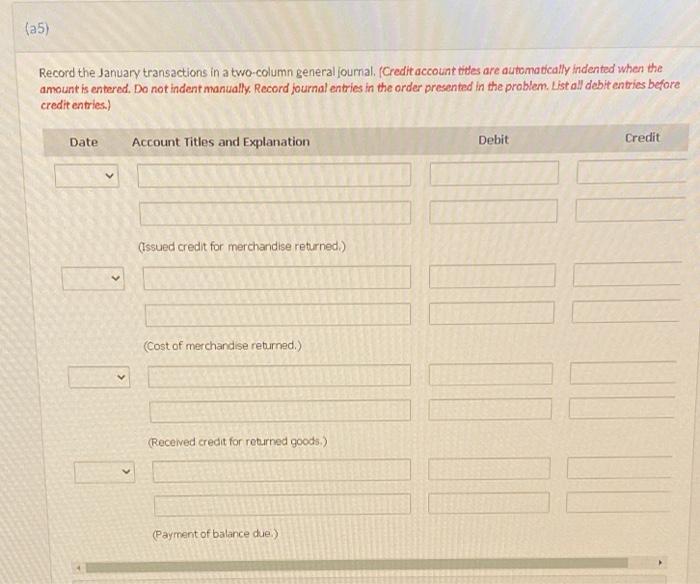

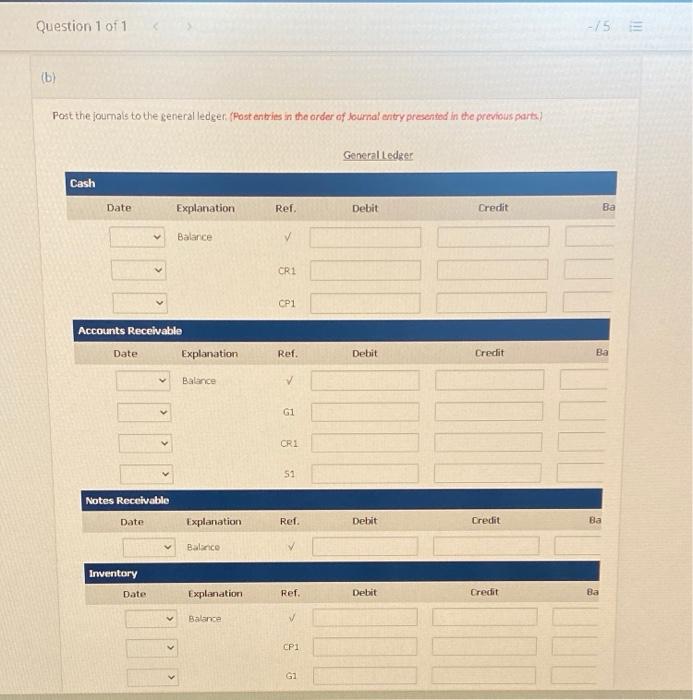

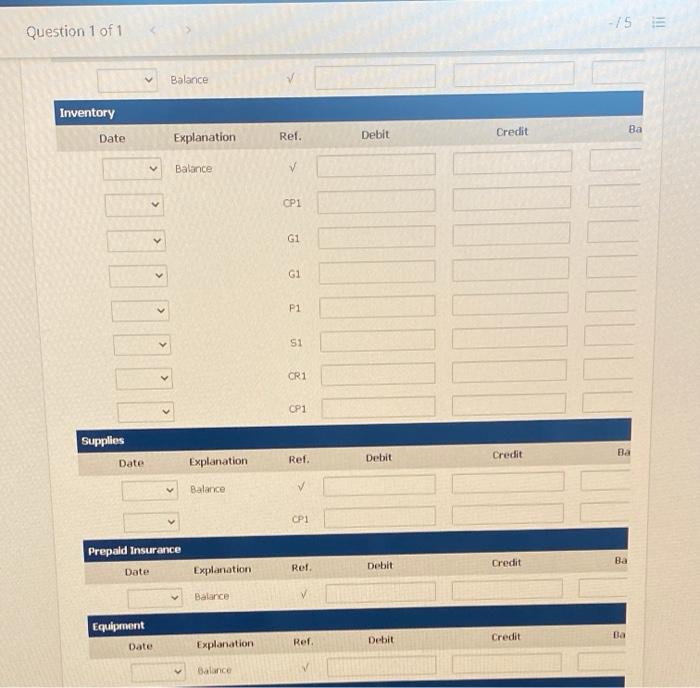

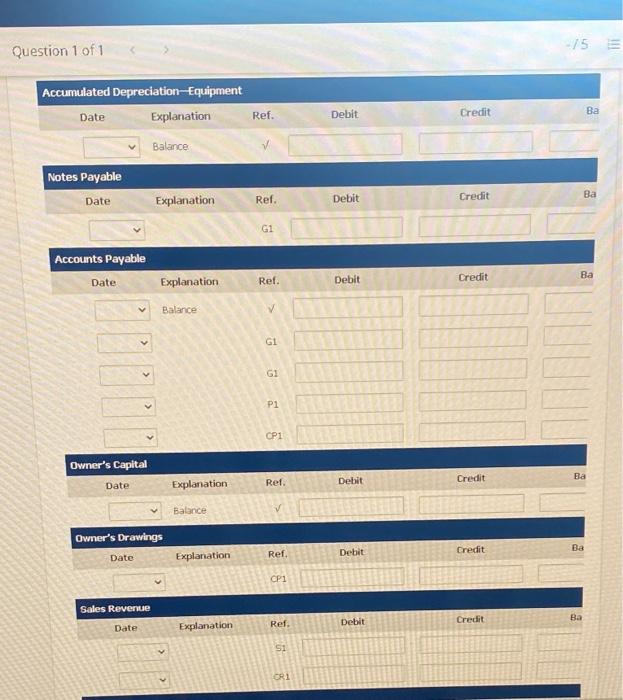

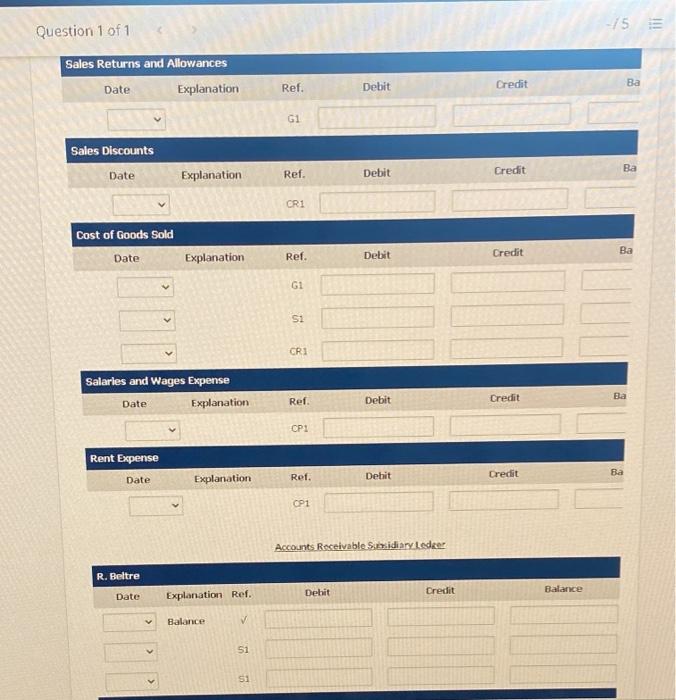

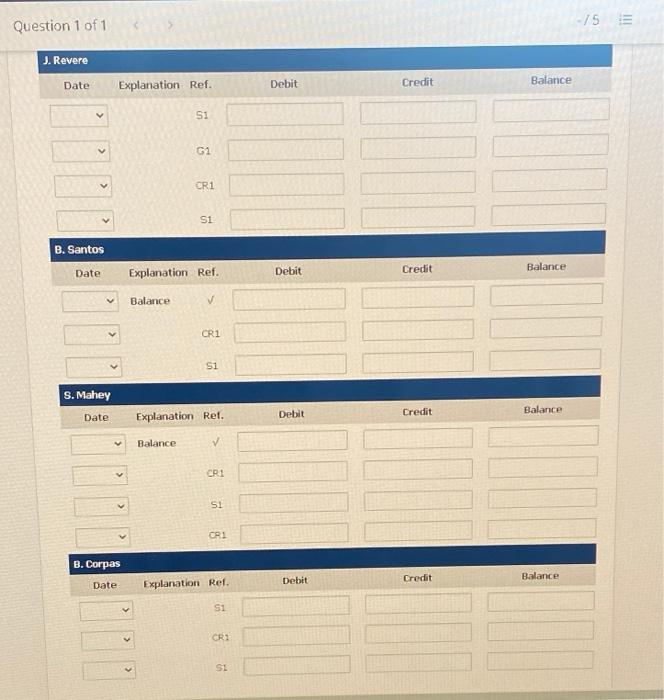

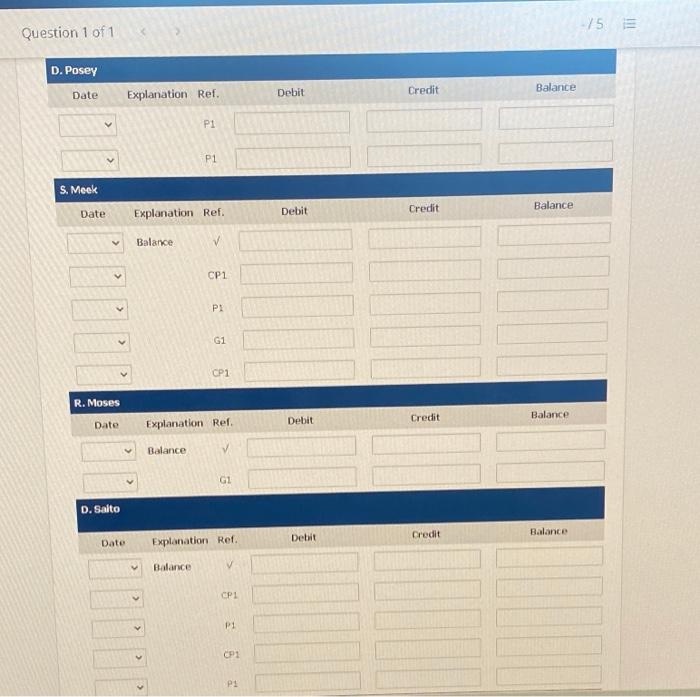

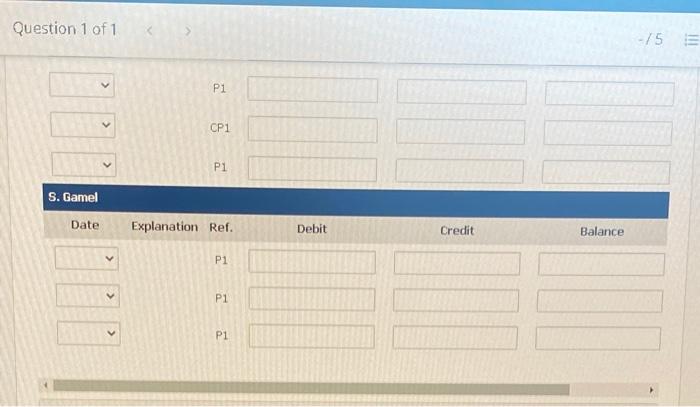

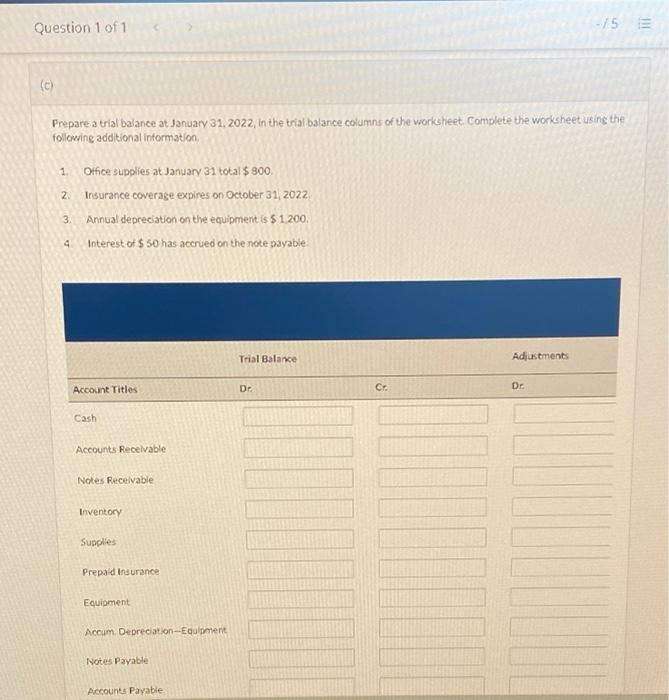

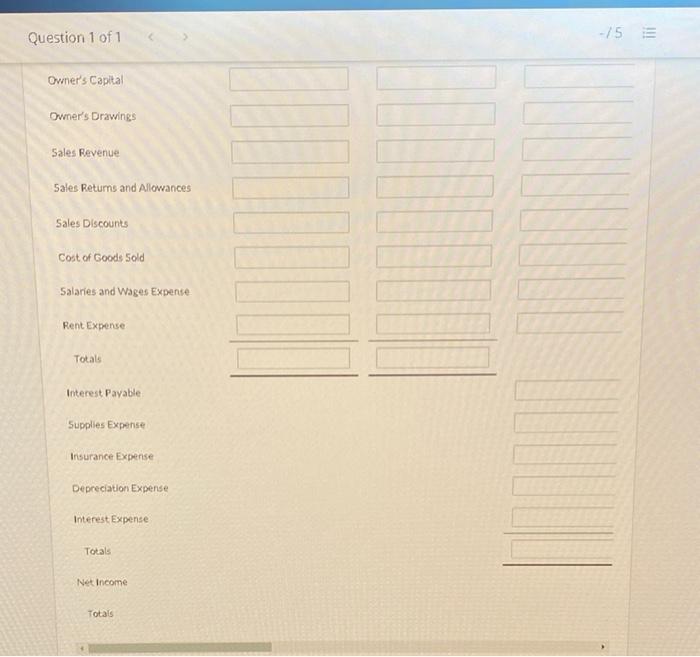

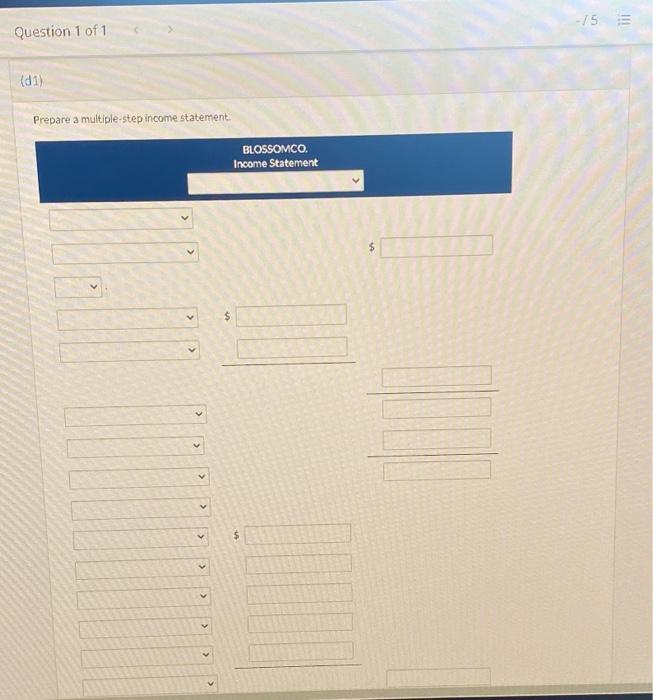

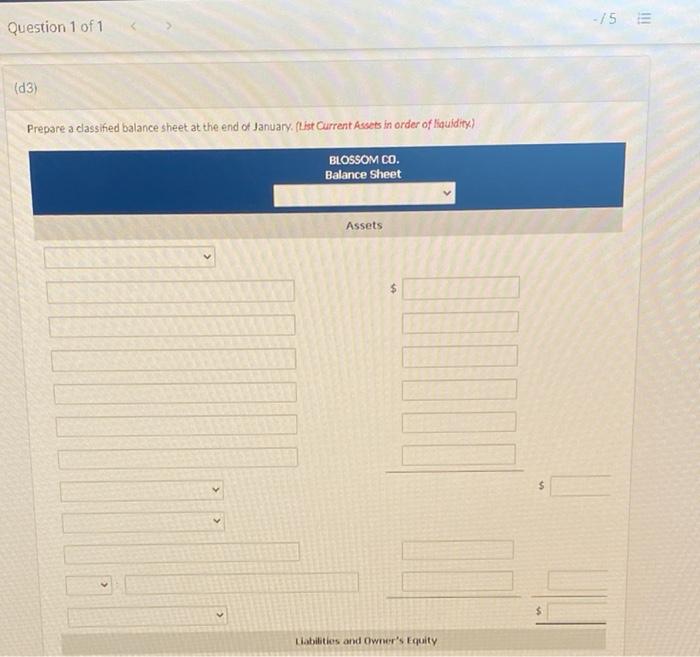

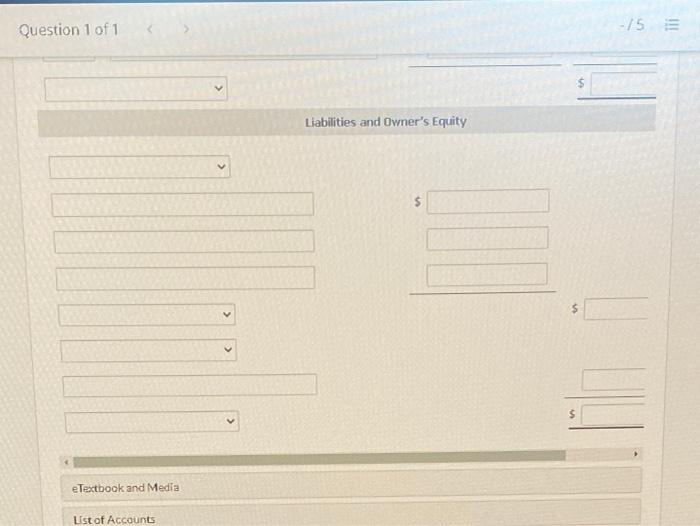

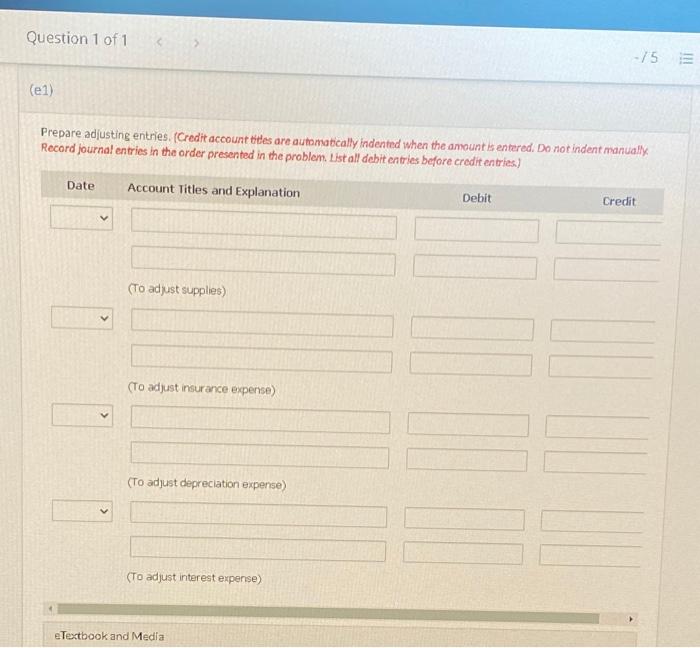

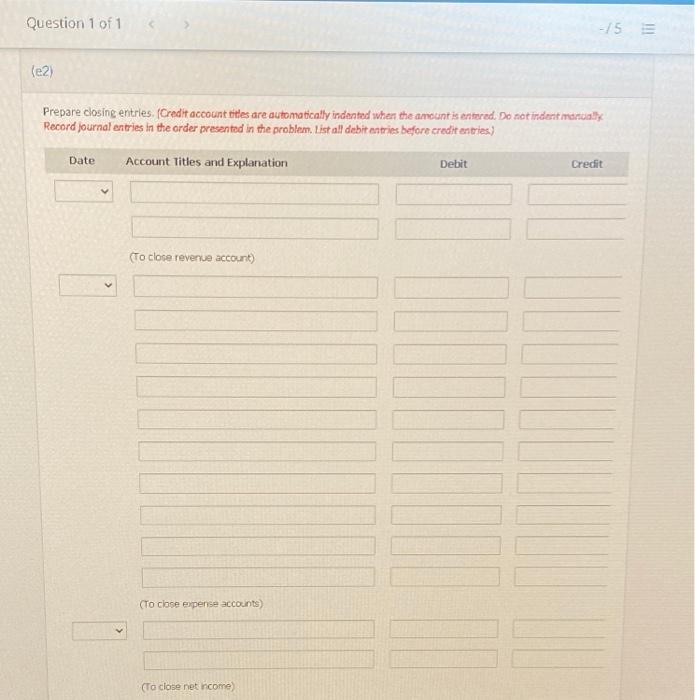

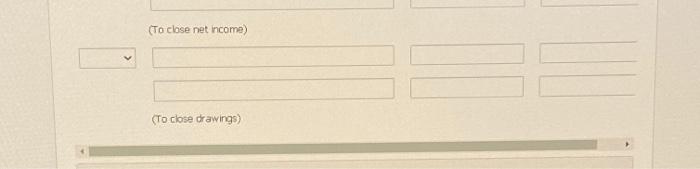

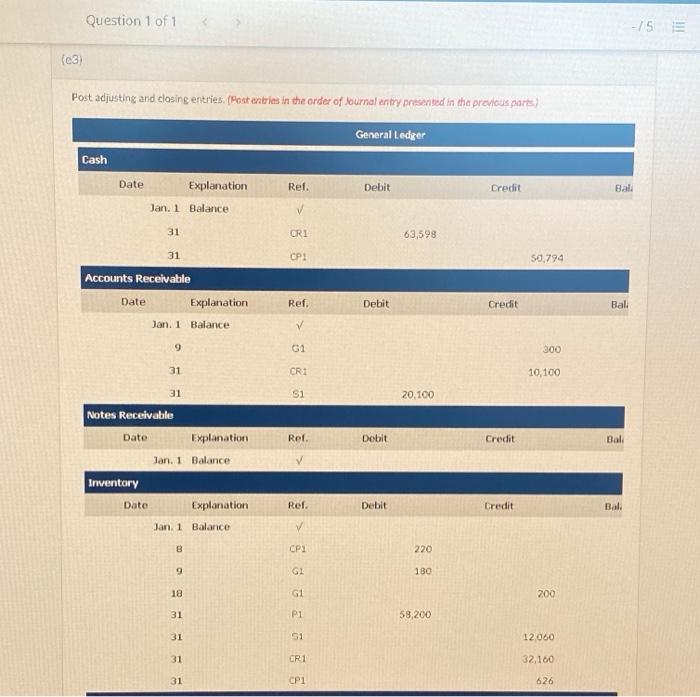

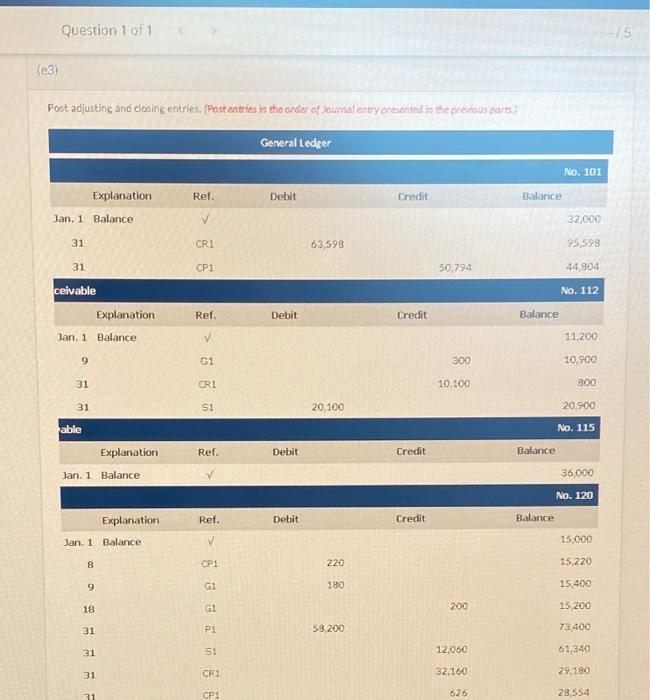

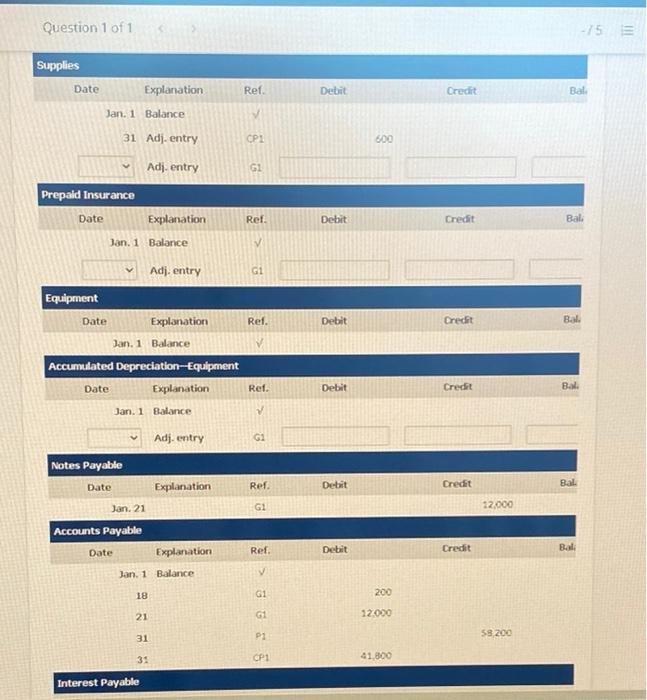

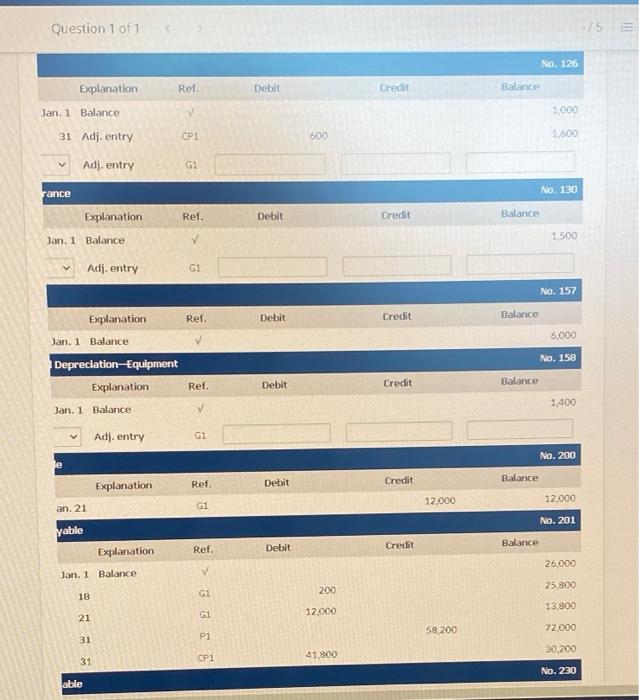

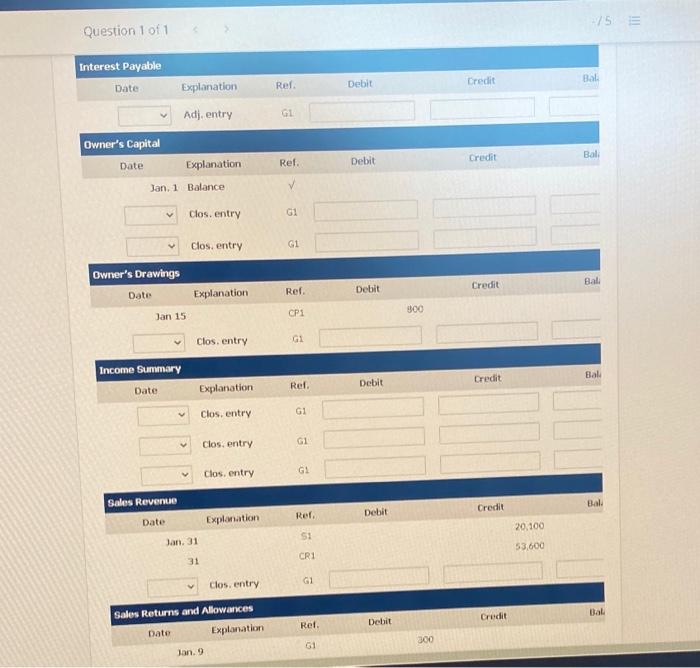

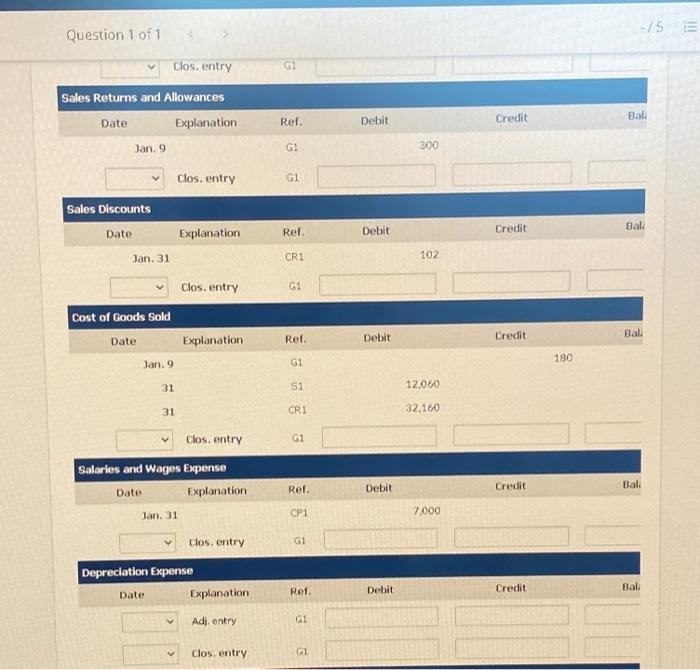

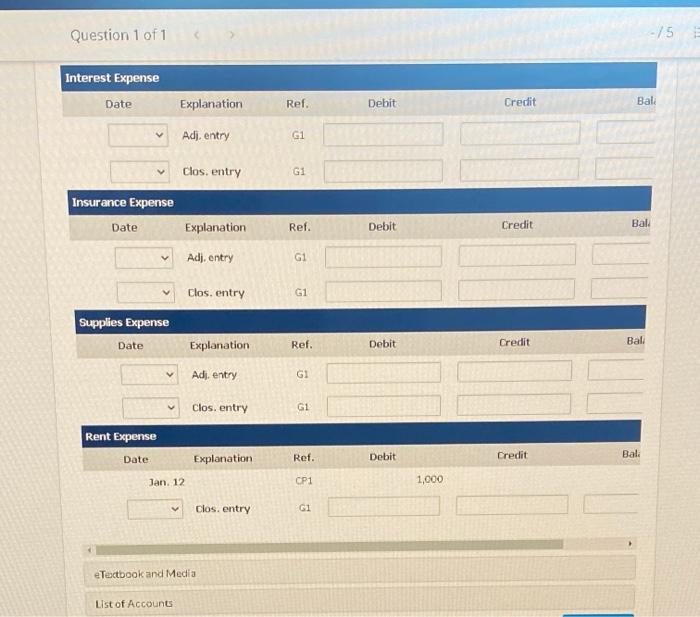

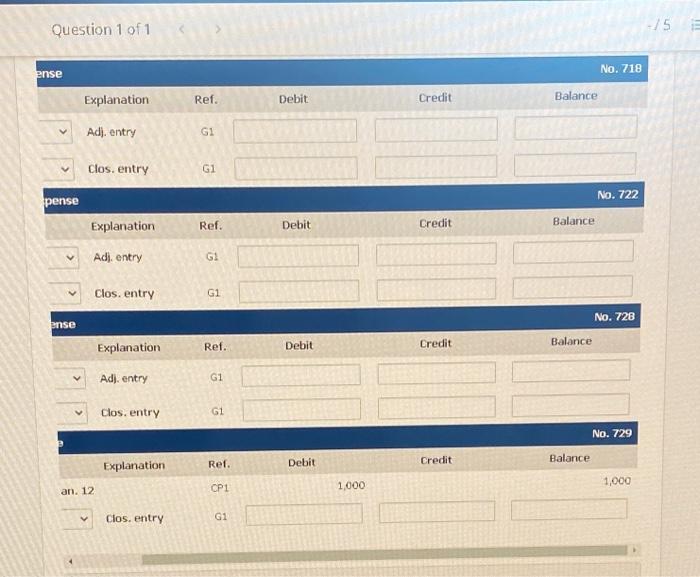

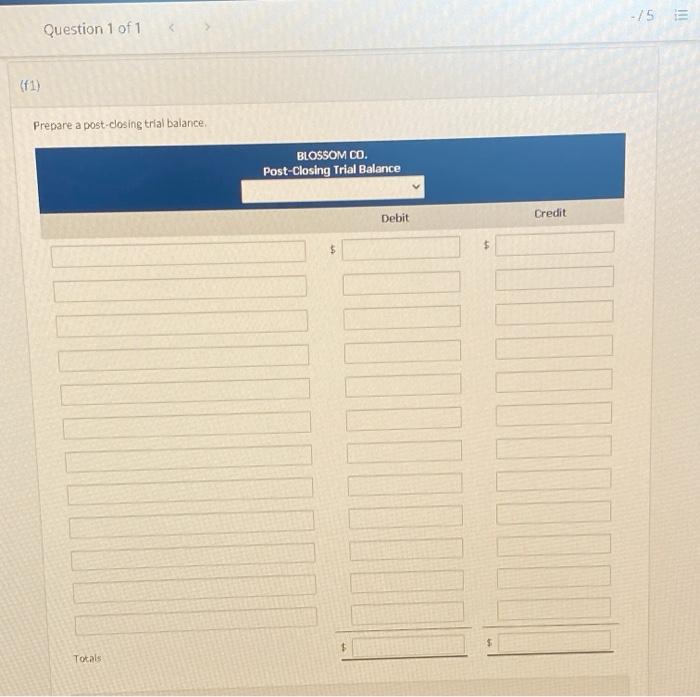

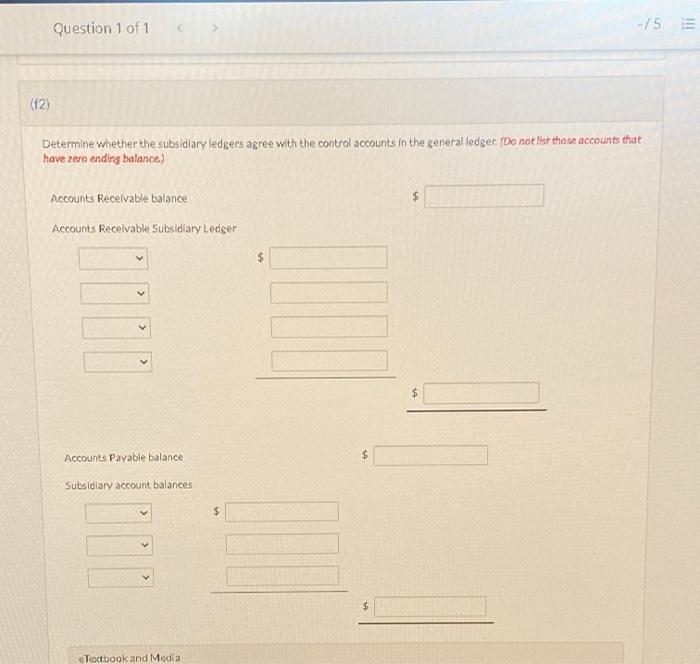

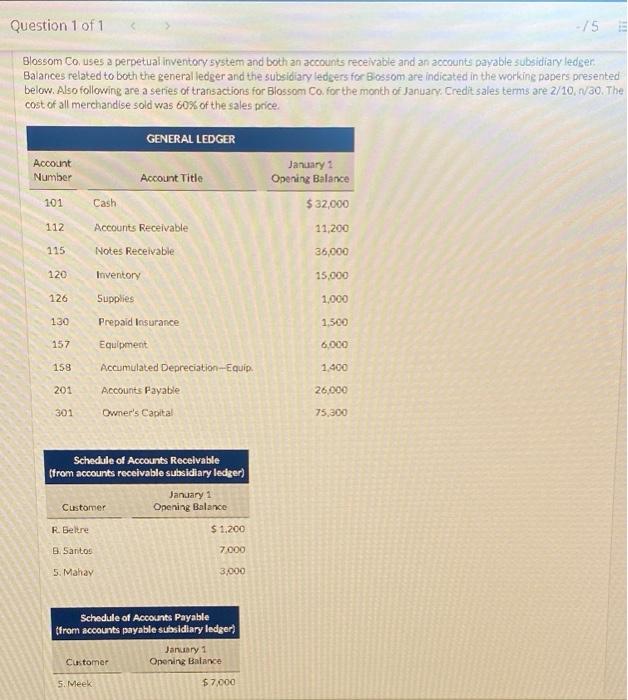

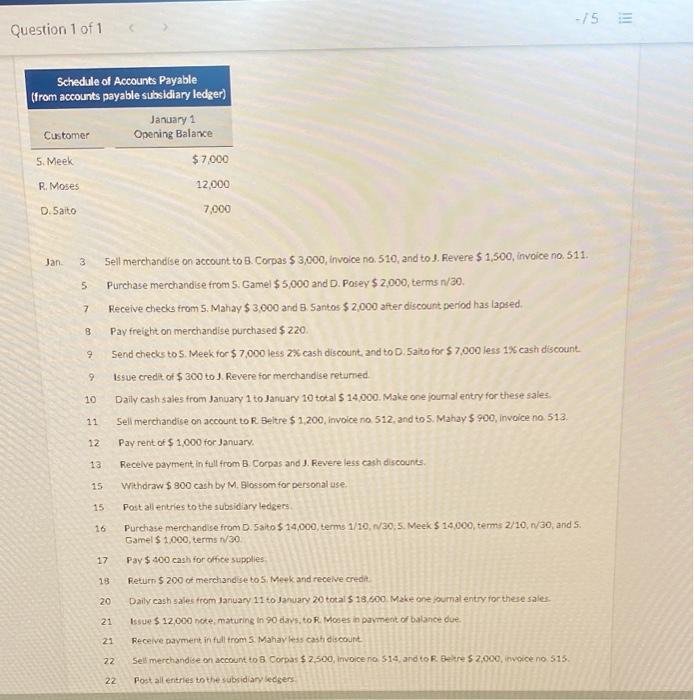

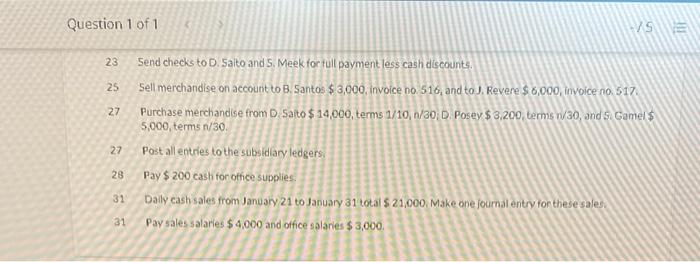

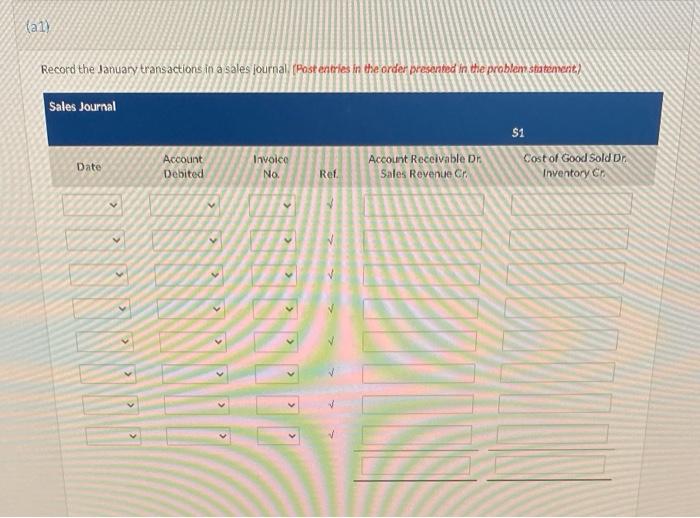

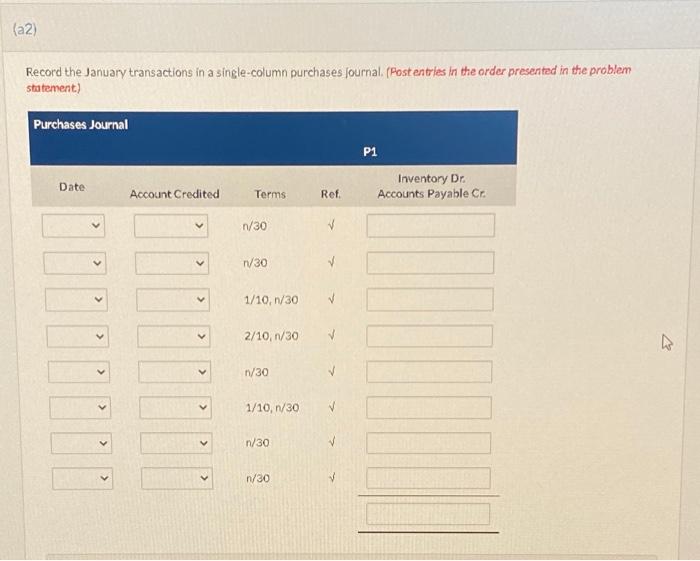

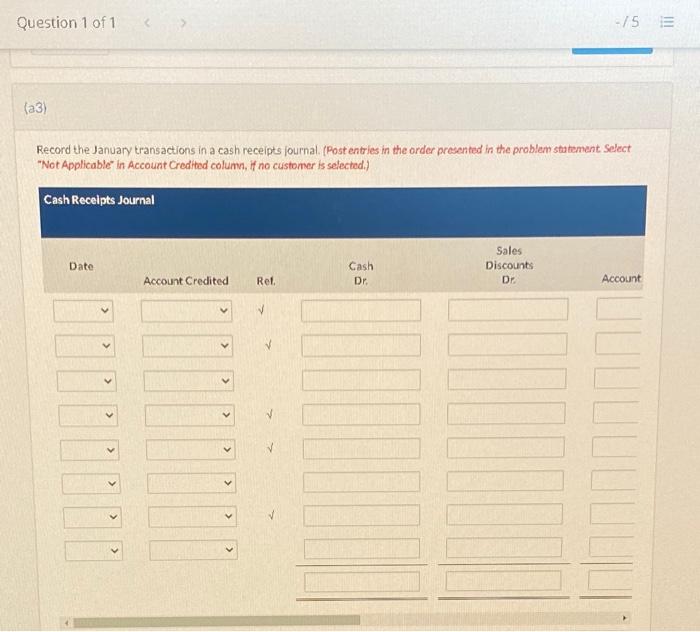

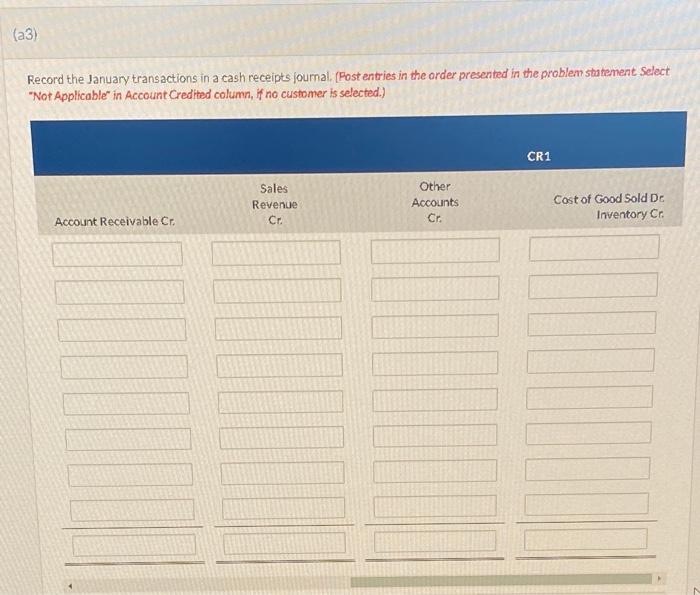

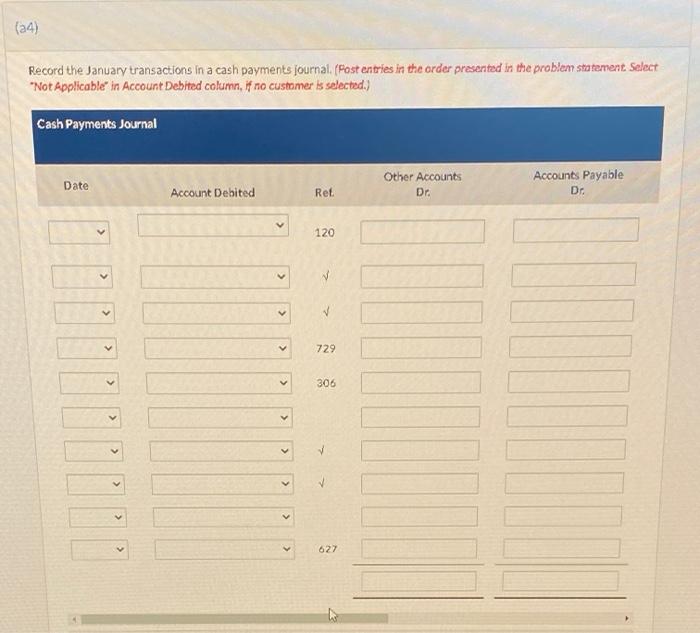

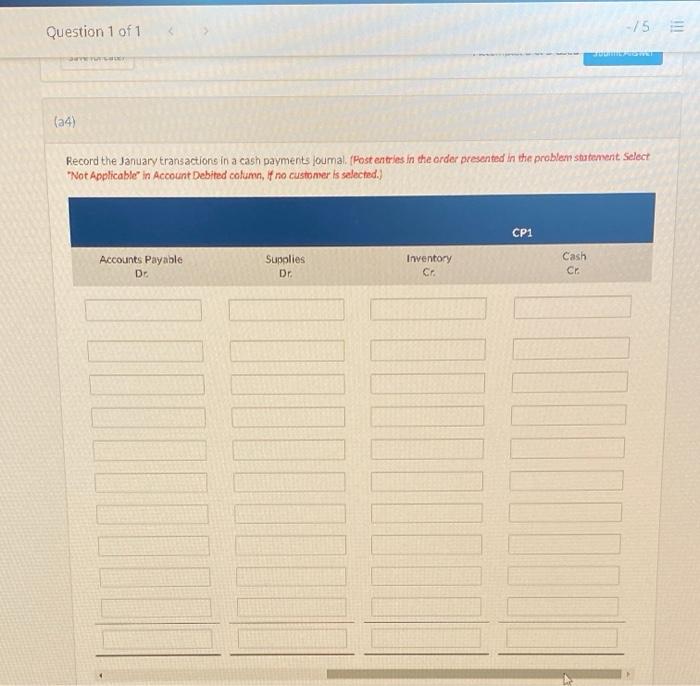

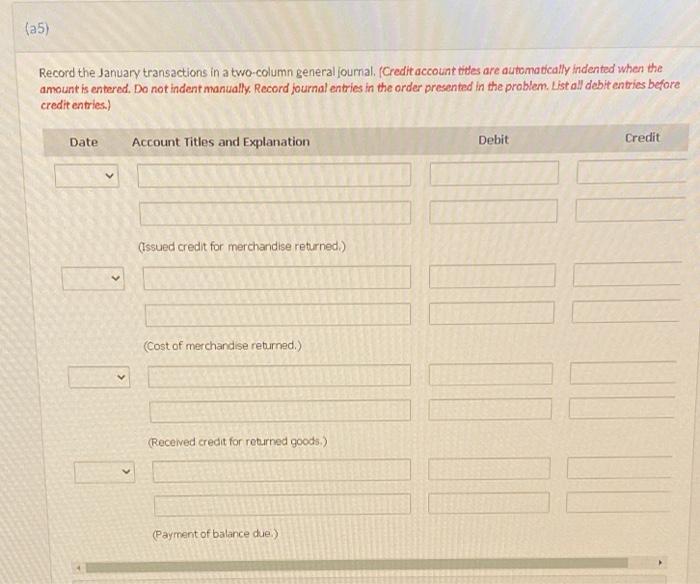

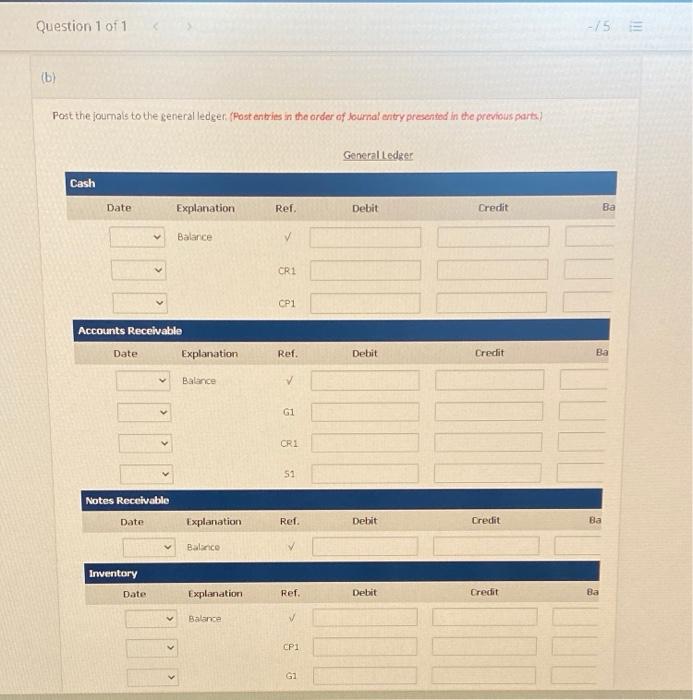

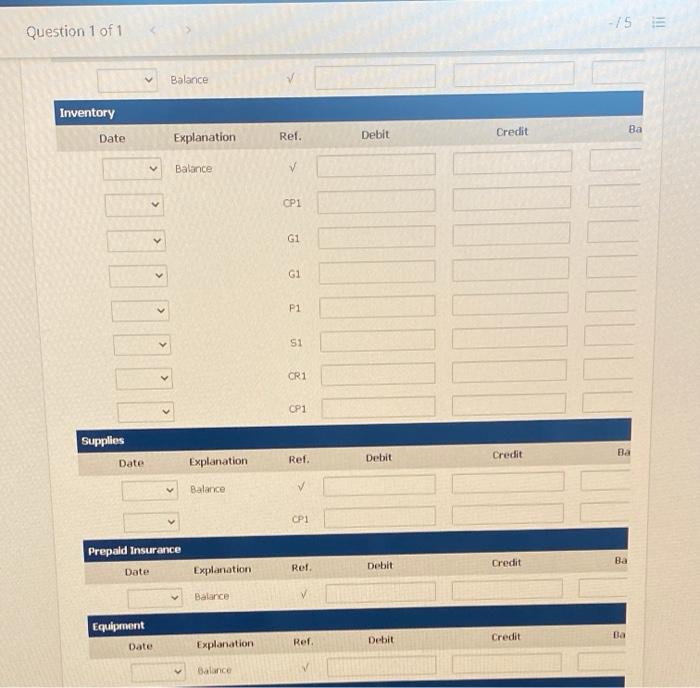

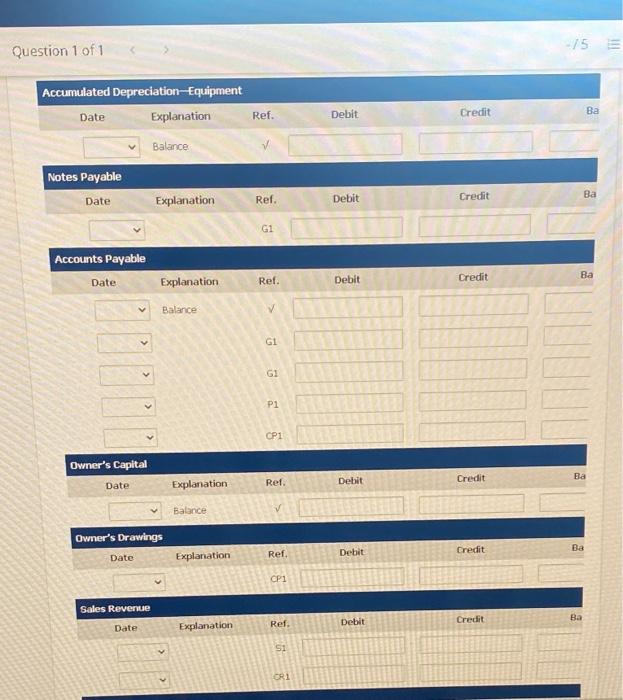

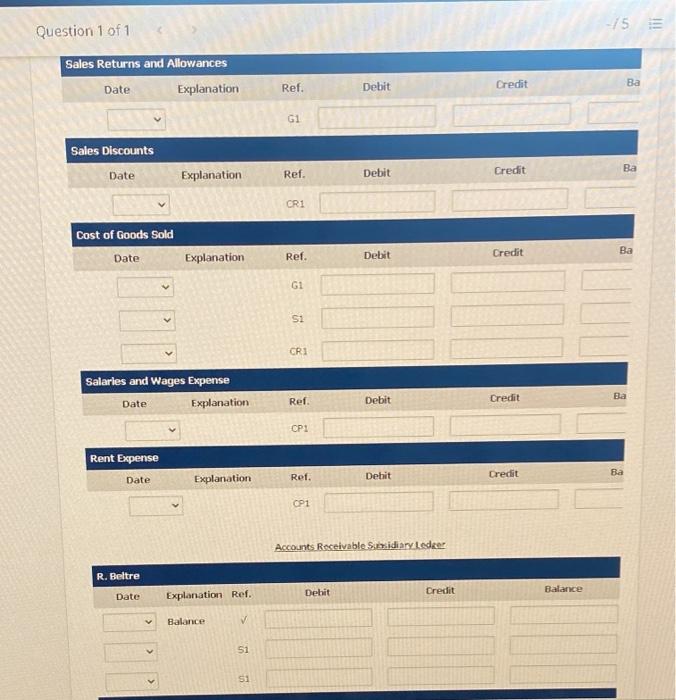

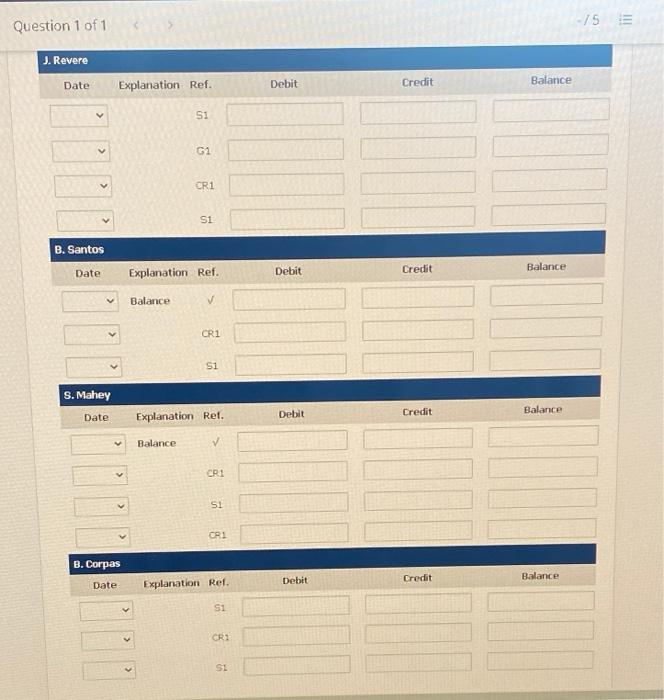

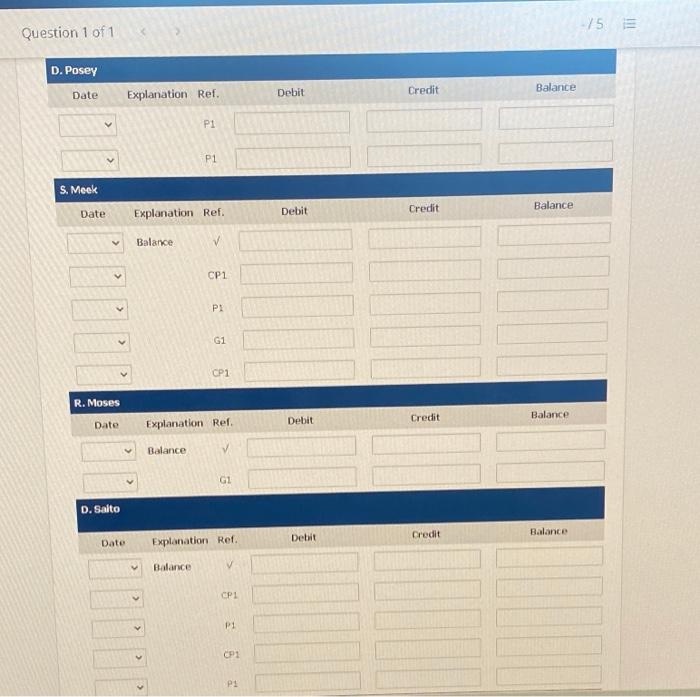

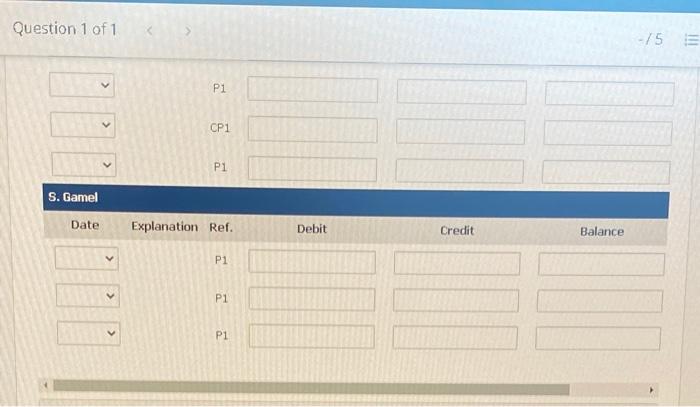

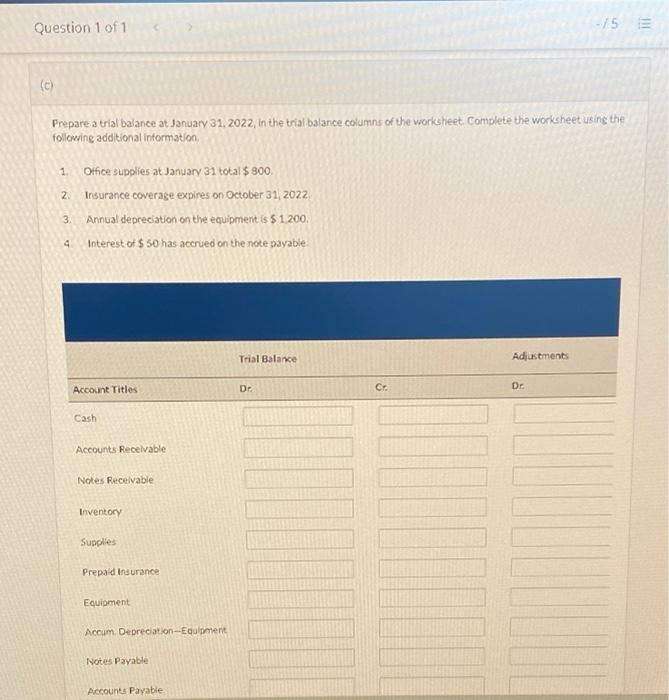

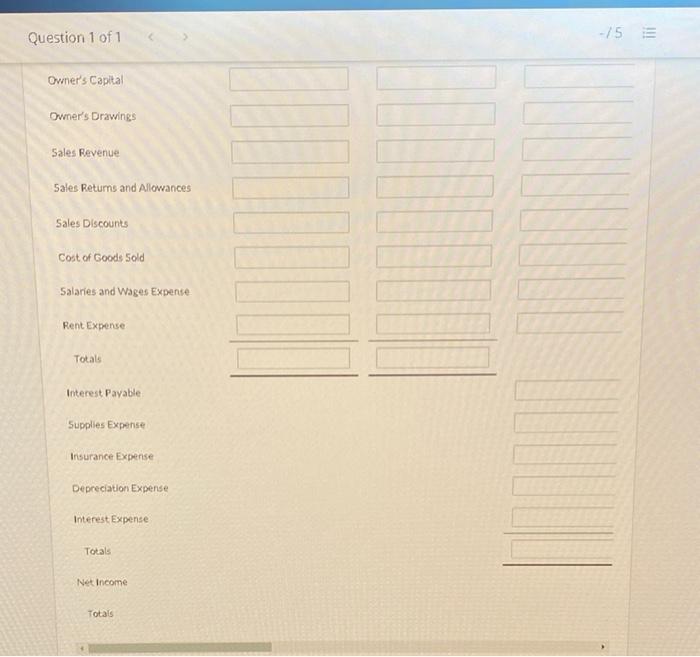

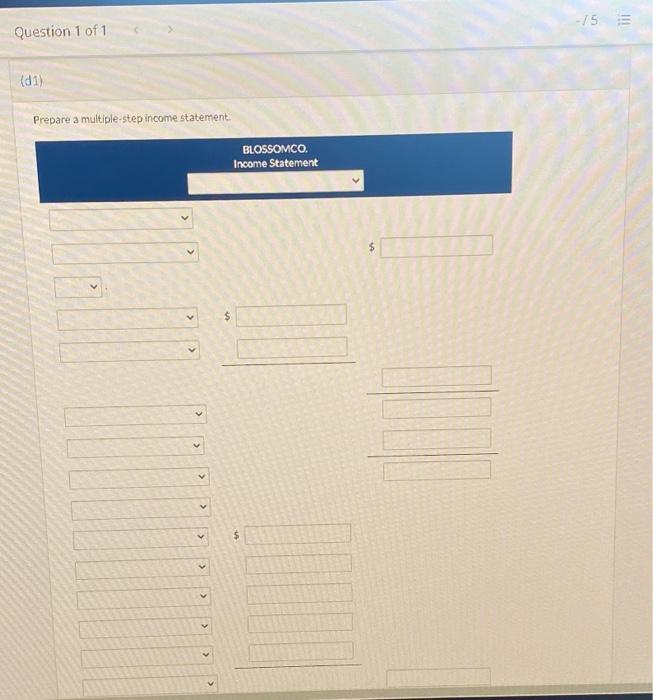

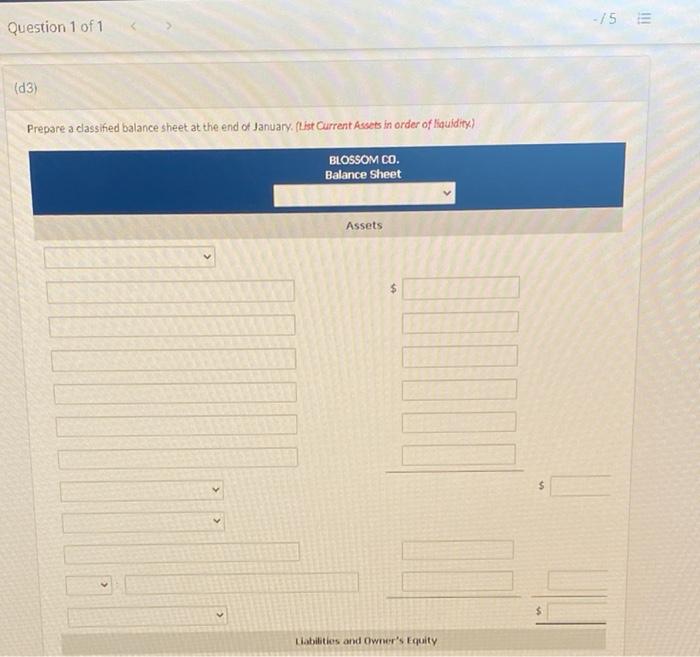

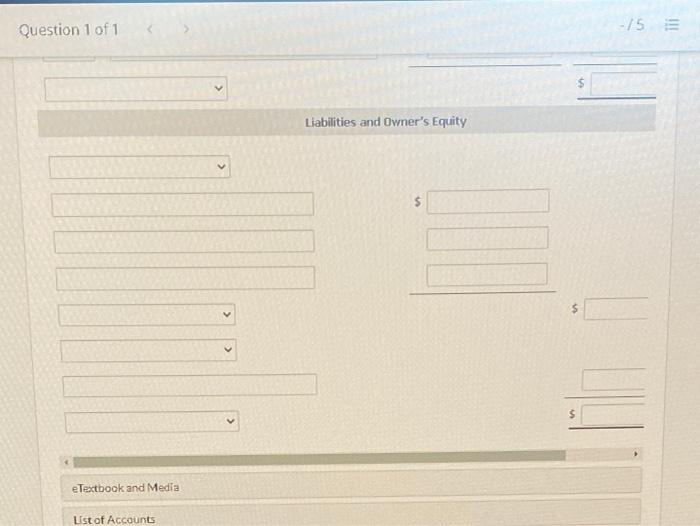

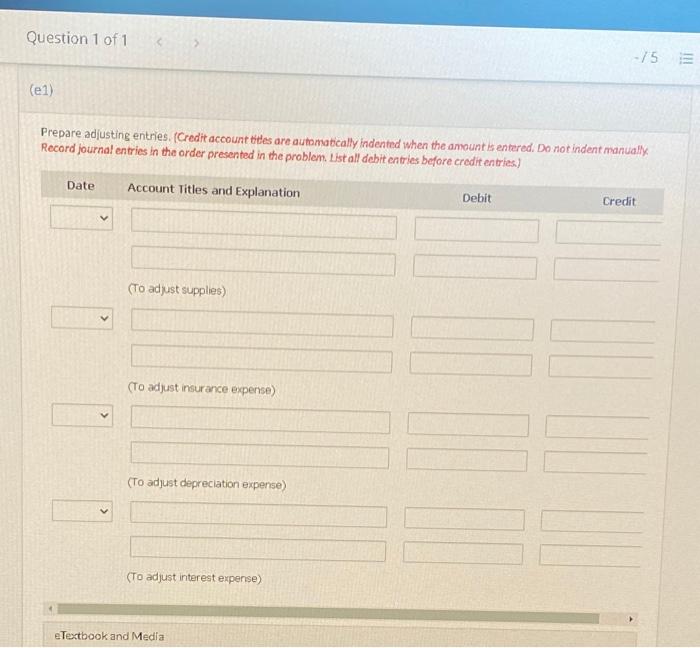

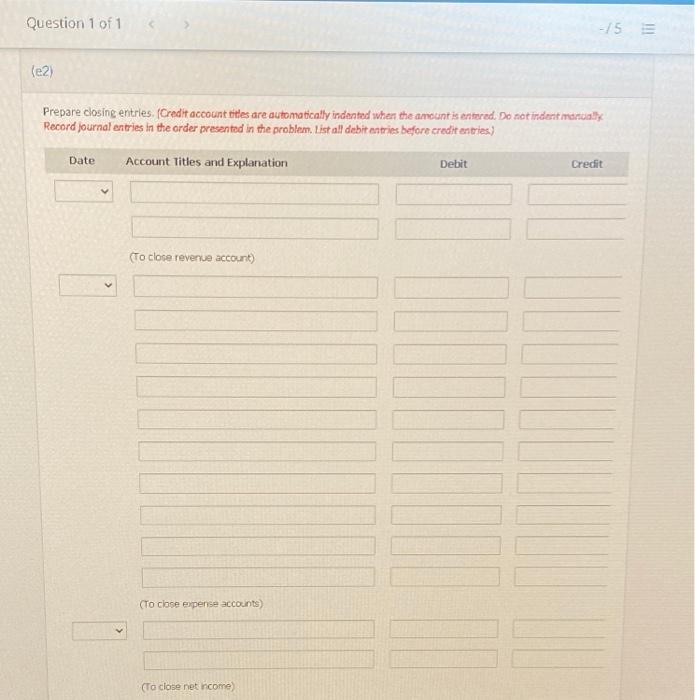

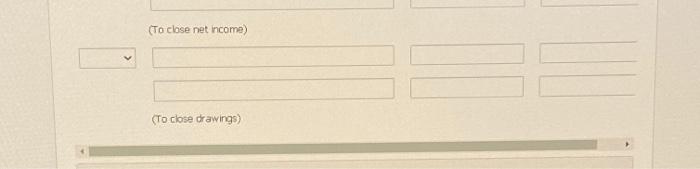

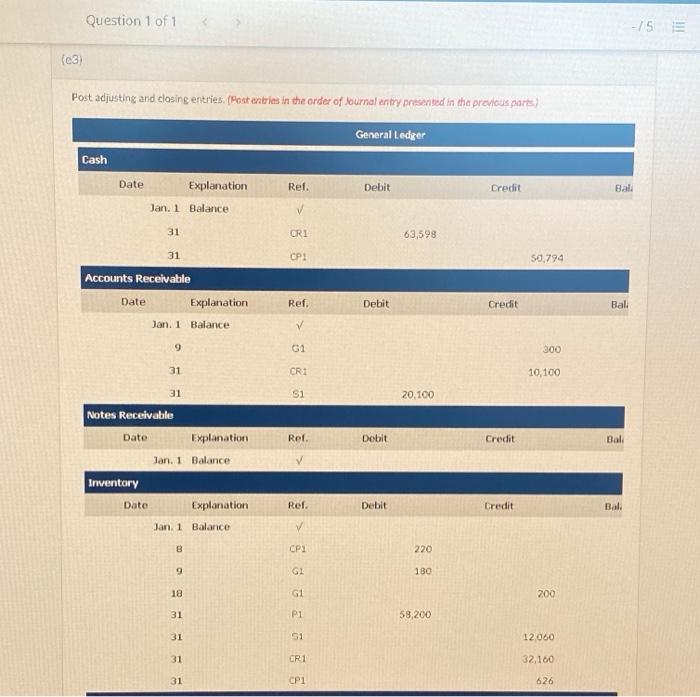

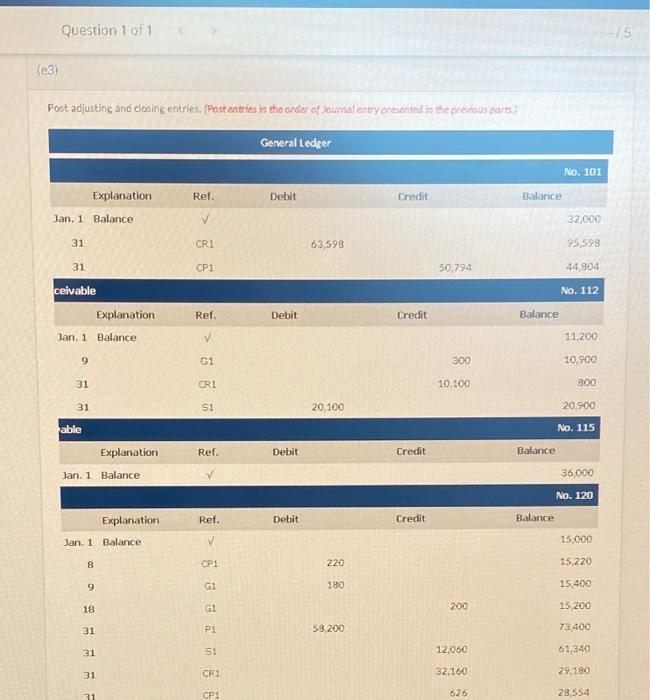

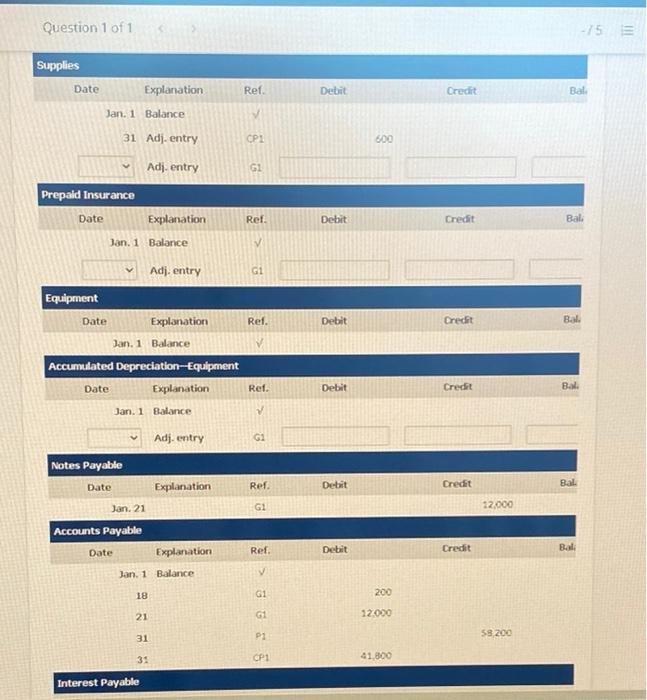

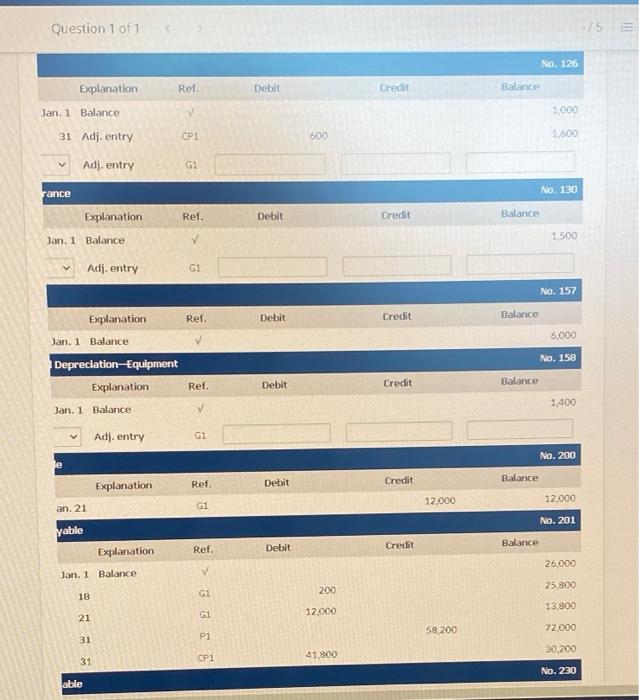

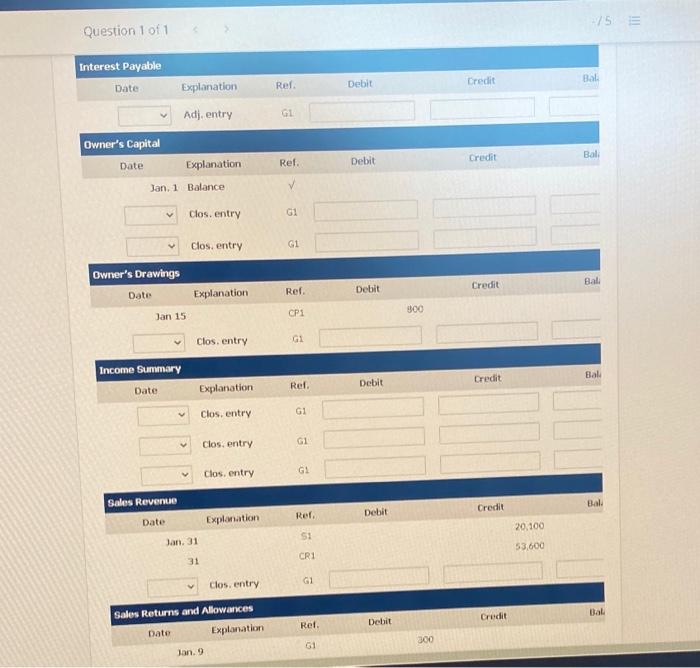

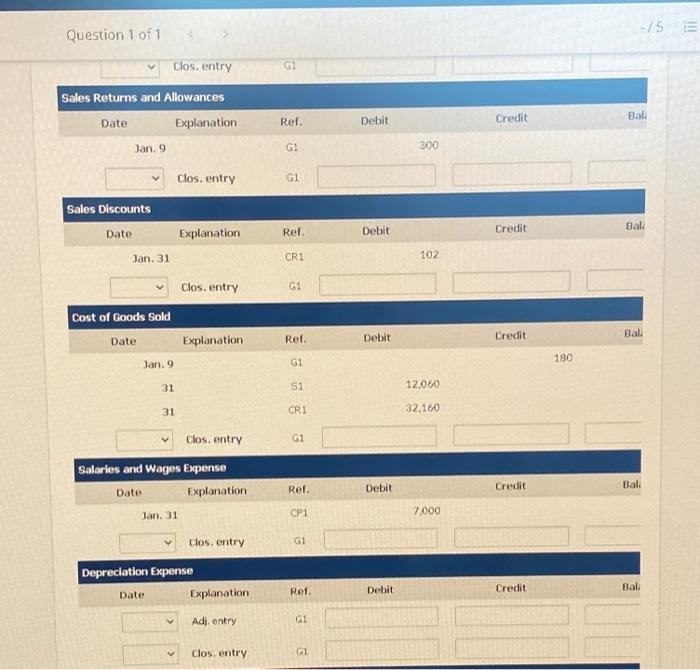

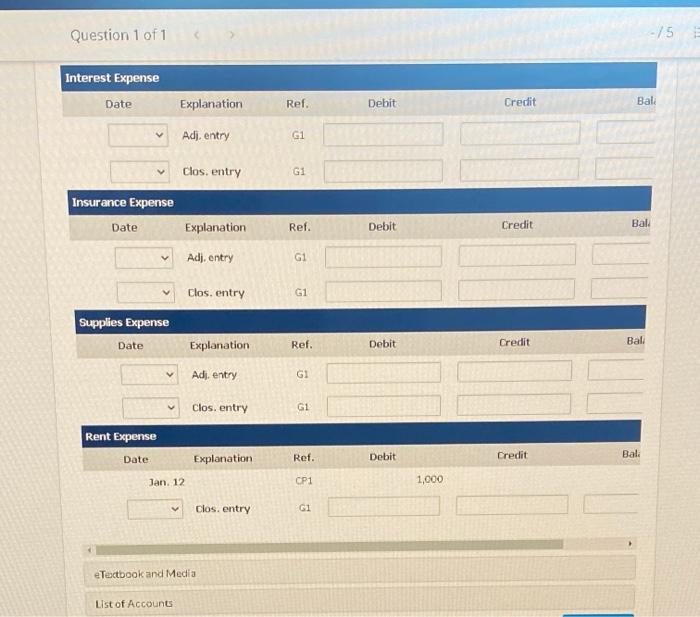

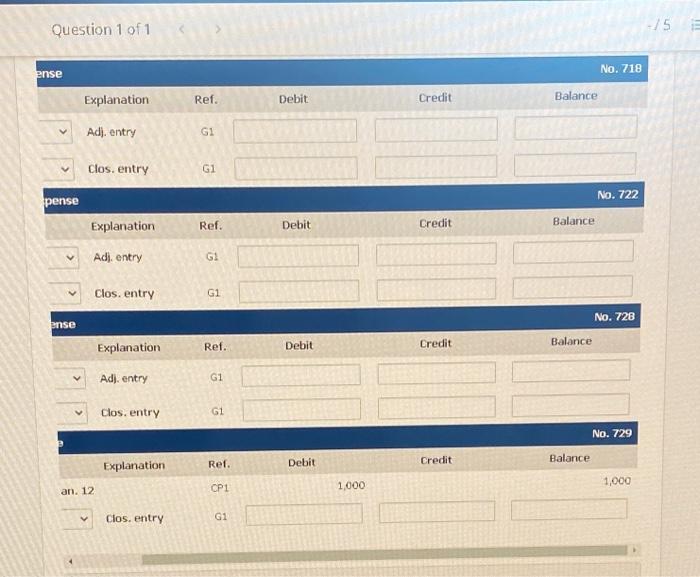

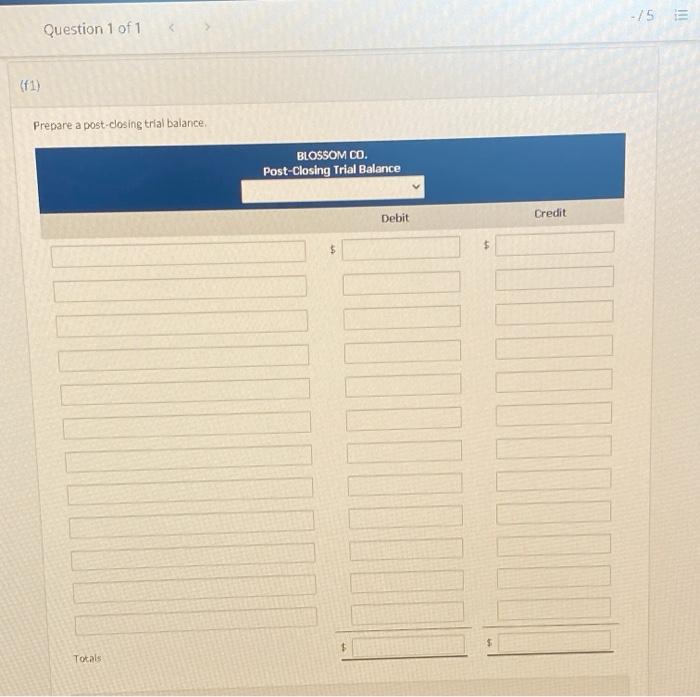

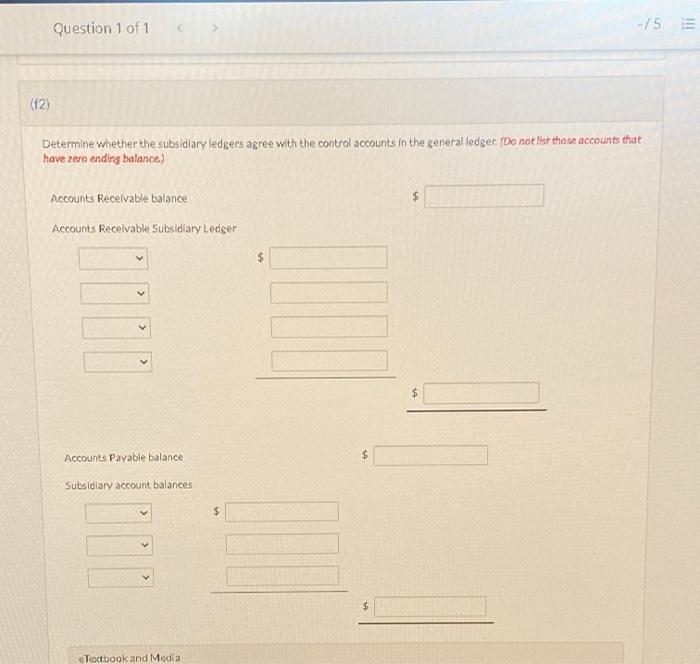

Question 1 of 1 -5 Blossom Co uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger Balances related to both the general ledger and the subsidiary ledgers for Bossom are indicated in the working papers presented below. Also following are a series of transactions for Blossom Co. for the month of January. Credit sales terms are 2/10, 1/30. The cost of all merchandise sold was 60% of the sales price GENERAL LEDGER Account Number Account Title January 1 Opening Balance $32,000 101 Cash 112 11,200 Accounts Receivable Notes Receivable 115 36,000 120 Inventory 15,000 126 Supplies 1.000 130 Prepaid Insurance 1,500 157 Equipment 6.000 158 1.400 Accumulated Depreciation ---Equip Accounts Payable 201 26.000 301 Owner's Capital 75,300 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Opening Balance Customer R. Beltre $ 1.200 8. Santos 7 000 5. Mahay 3,000 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance 5. Meek $7,000 -15 Question 1 of 1 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance 5. Meek $ 7.000 R Moses 12.000 D. Saito 7,000 Jan 3 7 8 9 Sell merchandise on account to B. Corpas $3,000, invoice no. 510, and to J. Revere $ 1.500, invoice no. 511. 5 Purchase merchandise from S. Gamel $5,000 and D. Posey $ 2.000, terms n/20. Receive checks from 5. Mahay $ 3.000 and B. Santos $ 2.000 after discount period has lapsed Pay freight on merchandise purchased $ 220 9 Send checks to 5. Meek for $7,000 less zx cash discount, and to D. Saito for $ 7.000 less 1% cash discount Issue credit of $ 300 to J. Revere for merchandise returned 10 Daily cash sales from January 1 to January 10 total $ 14,000. Make one journal entry for these sales. 11 Sell merchandise on account to R Beltre $ 1,200, invoice no 512 and to S. Mahay $ 900, invoice no 513 12 Pay rent of $1,000 for January 13 Receive payment in full from B Corpas and J. Revere less cash discounts. Withdraw $ 800 cash by M. Blossom for personal use. 15 Post all entries to the subsidiary ledgers 16 Purchase merchandise from D. Saito $ 14,000, termo 1/10, 1/30.5. Meek $ 19.000, terms 2/10, 1/30, and S. Gamel $1,000, terms 1/30 17 Pay $ 400 cash for office supplies 15 18 20 Return $ 200 of merchandise to S. Meek and receive credit Daily cash sales from January 11 to January 20 total s 18,600 Make one Journal entry for these sales. Issue $ 12.000 note, maturing in 90 days to R. Moses in payment of balance due Receive payment in full trom S. Mahaves cash discount 21 21 22 Sell merchandise on account to 8 Corpas $2.500, invoice no 514, and to tre $ 2.000, invoice no 515 22 Post all entries to the subsidiary edgers Question 1 of 1 VS 23 25 27 Send checks to D. Saito and S. Meek for full payment less cash discounts Sell merchandise on account to B. Santos $3,000, invoice no. 516, and to J. Revere $ 6,000 invoice no. 517. Purchase merchandise from D Salto $ 14,000, terms 1/10, 1/30, D. Posey $3,200 terms 1/30, and s Camel 5,000 terms 1/30 Post all entries to the subsidiary ledgers Pay $ 200 cash for office supplies. Dally cash sales from Janualy 21 to January 31 total $ 21,000. Make one journal entry for these sales. Pay sales salaries $ 4,000 and office salaries $ 3,000 27 28 31 31 (al) Record the January transactions in a sales journal (Post entries in the order presented in the problem statement) Sales Journal $1 Date Account Debited Invoice No. Account Receivable Dr Sales Revenue CM Cost of Good Sold Dr. Inventory Ref. > > > > > (82) Record the January transactions in a single-column purchases Journal (Post entries in the order presented in the problem statement) Purchases Journal P1 Date Inventory Dr. Accounts Payable Cr. Account Credited Terms Ref n/30 > 1/30 1/10, 1/30 V > n/30 > n/30 306 > > G1 P1 Si CR1 CP1 > Supplies Ba Date Credit Explanation Ref. Debit V Balance CP1 Prepaid Insurance Debit Credit Ba Date Explanation Ref. Balance Equipment Date Credit Da Explanation Debit Ref Balance -75 Question 1 of 1 Accumulated Depreciation Equipment Date Explanation Ref. Debit Ba Credit Balance Notes Payable Date Explanation Ref. Debit Credit Ba G1 Accounts Payable Date Ba Explanation Ref. Debit Credit Balance GI > P1 CP1 Owner's Capital Ba Date Credit Explanation Ref. Debit Balance Owner's Drawings Credit Ba Debit Date Explanation Ref. CP1 Sales Revenue Date Credit Ba Debit Explanation Ref. SI ORI -15 = Question 1 of 1 Sales Returns and Allowances Date Explanation Ref. Debit Ba Credit Gi Sales Discounts Date Ba Credit Explanation Ref. Debit CR1 Cost of Goods Sold Date Credit Ba Explanation Ref. Debit GI Si CRI Salaries and Wages Expense Explanation Date Rer Debit Debit Ba Credit CP1 Rent Expense Explanation Debit Ba Date Ref. Credit CP1 Accounts Receivable Subsidiary Ledger R. Beltre Credit Date Debit Balance Explanation Ref. Balance 51 Si -75 Question 1 of 1 J. Revere Date Debit Explanation Ref. Credit Balance > S1 > 61 CR1 S1 B. Santos Date Debit Balance Explanation Ref. Credit Balance CR1 SI -75 Question 1 of 1 D. Posey Date Debit Balance Explanation Ref. Credit P1 P1 S. Meek Credit Balance Date Debit Explanation Ref. V Balance CP1 PI G1 CP1 R. Moses Credit Balance Date Explanation Ref. Debit Debit Balance G1 D. Salto Debit Credit Balance Date Explanation Ref. Balance V CPI P1 C. CP P1 > Question 1 of 1 -/5 = CP1 Pi S. Gamel Date Explanation Ref. Debit Credit P1 P1 > P1 Question 1 of 1 -75 (C) Prepare a trial balance at January 31, 2022 in the trial balance columns of the worksheet Complete the worksheet using the following additional information 2 1. Office supplies at January 31 total $ 900 Insurance coverage expires on October 31, 2022 Annual depreciation on the equipment is $ 1.200. Interest of $ 50 has accrued on the note payable 3 4 Trial Balance Adjustments Account Titles DF Cr Dr. Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accum Depreciation Equipment Notes Payable Accounts Payable Question 1 of 1 -15 E Owner's Capital Owner's Drawings Sales Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals Interest Payable Supplies Expense Insurance Expense Depreciation Expense Interest Expense Total Net Income Totals -75 Question 1 of 1 (81) Prepare a multiple-step income statement: BLOSSOMCO. Income Statement > $ v > > > > $ A A -75 Question 1 of 1 (d3) Prepare a classified balance sheet at the end of January (List Current Assets in order of liquidity) BLOSSOM CO. Balance Sheet Assets $ Liabilities and Owner's Equity Question 1 of 1 -/5 Liabilities and Owner's Equity $ > eTextbook and Media List of Accounts Question 1 of 1 -75 TH (el) Prepare adjusting entries. (Credit account des are automatically indented when the amount is entered. Do not indent manually Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit (To adjust supplies) (To adjust insurance expense) (To adjust depreciation expense) (To adjust interest expense) eTextbook and Media Question 1 of 1 -15 (e2) Prepare closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Record journal entries in the order presented in the problem. List all debitantries before credit entries) Date Account Titles and Explanation Debit Credit (To close revenue account) (To close expense accounts) To close net ncome (To close net income) (To close drawings) Question 1 of 1 -/5 (3) Post adjusting and closing entries. (Post entries in the order of journal entry presented in the previous parts General Ledger Cash Date Explanation Ref. Debit Credit Bali Jan. 1 Balance 31 ORI 63,598 31 CP: 50,794 Accounts Receivable Date Explanation Ref. Debit Credit Bali Jan. 1 Balance 9 G1 300 31 CR: 10,100 31 Si 20,100 Notes Receivable Date Ref. Dobit Dobit Credit Explanation Jan. 1 Balance Bali Inventory Date Explanation Ref. Debit Credit Bal Jan, 1 Balance B CPI 220 9 GI 180 18 G1 200 31 P1 58.200 31 51 12.060 31 CRI 32.100 31 CPI 626 Question 1 of 1 -75 (3) Post adjusting and closing entries. (Post entries in the order of Journal artery presented in the previous parts) General Ledger No. 101 Explanation Ref. Debit Credit Balance Jan. 1 Balance 32,000 31 CR1 63,598 95,598 31 CP1 50,794 44 804 ceivable No. 112 Explanation Ref. Debit Credit Balance Jan. 1 Balance 11.200 9 G1 300 10.900 31 CR1 10,100 800 31 Si 20,100 20,900 able No. 115 Ref. Debit Credit Balance Explanation Jan. 1 Balance 36,000 No. 120 Explanation Ref. Debit Credit Balance Jan. 1 Balance 15,000 8 CP1 220 15,220 9 GI 180 15,400 18 GI 200 15200 31 PA 59,200 73,400 31 SI 12,060 61,340 31 CR1 32,160 29.180 31 CP1 626 29,554 Question 1 of 1 -75 Supplies Date Explanation Ref. Debit Debit Credit Bal Jan. 1 Balance 31 Adj. entry ! 800 Adj. entry GI Prepaid Insurance Date Ref. Debit Credit Bal Explanation Jan. 1 Balance Adj. entry G1 Ref. Debit Credit Bal Equipment Date Explanation Jan. 1 Balance Accumulated Depreciation Equipment Date Explanation Ref. Debit Credit Bali Jan. 1 Balance Adj. entry G Notes Payable Date Explanation Ref. Debit Bal. Credit GI 12.000 Jan. 21 Accounts Payable Date Explanation Ref. Debit B Credit Jan. 1 Balance 18 G1 200 21 G1 12.000 P1 58 200 31 31 CP: 41.800 Interest Payable Question 1 of 1 -75 No. 126 Explanation Ref. Debit Credit Balance Jan. 1 Balance 1.000 31 Adj. entry CPU 500 1,600 Adj. entry G1 rance NO. 130 Explanation Rel. Debit Credit Balance Jan. 1 Balance 1,500 Adj. entry GI No. 157 Debit Credit Balance 6,000 Explanation Ref. Jan. 1 Balance Depreciation Equipment Explanation Ref. No. 158 Debit Credit Balance 1,400 Jan. 1 Balance Adj. entry GI No. 200 le Balance Explanation Ref. Credit Debit Debit 12,000 12.000 an. 21 No. 201 yable Balance Ref. Debit Credit Explanation 26,000 Jan. 1 Balance 25,800 18 GI 200 13 900 21 G1 12,000 58 200 72.000 31 P1 30,200 31 CP1 41.800 No. 230 able -5 E Question 1 of 1 Interest Payable Date Debit Explanation Rel. Debit Credit BL Adj. entry GI Owner's Capital Bal Debit Credit Date Rel. Explanation Jan. 1 Balance Clos. entry GI clos, entry GI Owner's Drawings Bali Debit Credit Date Explanation Ref. Pi 300 Jan 15 Clos, entry Gi Income Summary Credit Bali Debit Ref. Date Explanation Clos. entry GI Clos, entry G1 Clos, entry G: Sales Revenue Credit Bal Rer. Debit Date Explanation 20.100 SI Jan. 31 53,600 31 CR1 clos entry G1 Sales Returns and Allowances Bal Credit Ref. Debit Date Explanation 300 G1 Jan. 9 -/5 Question 1 of 1 1 Clos. entry Sales Returns and Allowances Date Explanation Rel. Debit Credit Bal Jan. 9 GI 300 Clos. entry G1 Sales Discounts Bali Date Credit Explanation Rer Debit Jan. 31 CR1 102 Clos. entry G1 Cost of Goods Sold Date Bal Explanation Ref. Debit Credit Jan. 9 G1 180 31 Si 12,060 31 CRI 32,160 G1 Clos, entry Salaries and Wages Expense Date Explanation Jan. 31 Ref. Debit Credit Bali CP1 7.000 G1 Clos. entry Depreciation Expense Date Explanation Ref. Bal. credit Debit Credit Adj, entry Gi Clos, entry GI Question 1 of 1 -75 No. 718 ense Explanation Ref. Debit Credit Balance Adj. entry GI Clos. entry G1 No. 722 pense Explanation Ref. Debit Credit Balance Adi entry G Clos. entry G1 No. 728 ense Explanation Balance Ref. Debit Credit Adj. entry G1 Clos. entry G1 No. 729 Explanation Rer. Debit Credit Balance 1.000 1,000 CP1 an. 12 Clos. entry G1 - /5 TII Question 1 of 1 (f1) Prepare a post-closing trial balance, BLOSSOM CO. Post-Closing Trial Balance Debit Credit $ $ Totals Question 1 of 1 - 75 (12) Determine whether the subsidiary ledgers agree with the control accounts in the general ledger. (Do not list those accounts that have zero ending balance.) Accounts Recevable balance Accounts Receivable Subsidiary Ledger $ > $ Accounts Payable balance Subsidiary account balances $ > $ e Tectbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started