Question

Hello! I already did #1, I just need help with the income statement. I attached the required template for the income statement and the unadjusted

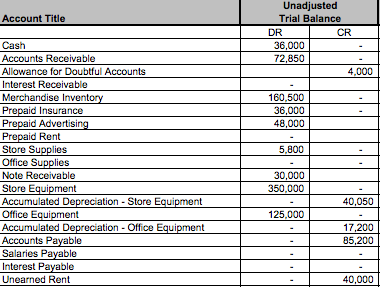

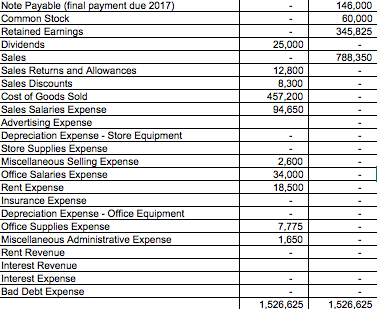

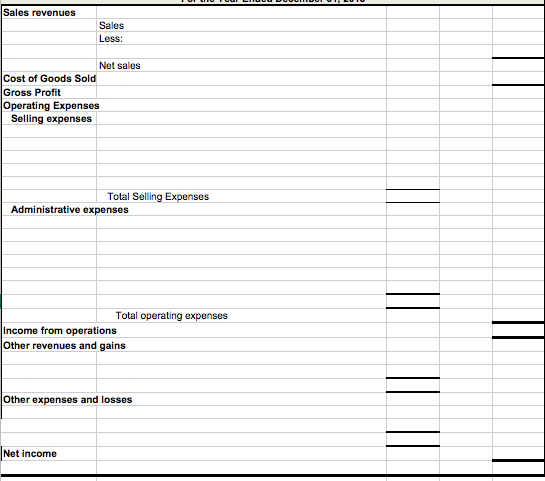

Hello! I already did #1, I just need help with the income statement. I attached the required template for the income statement and the unadjusted trial balance. Please follow the template. Thank you!

1.On the designated worksheet, prepare in journal entry form the adjusting journal entries for the following items. (Round all numbers to the nearest dollar, 0.2 points each)

a. On April 1, 2013 a 24-month insurance policy was purchased for $36,000.

b. On January 1, 2013 Hullie & Oates paid Gretsky Advertising $48,000 for three years of advertising services. Equal services are provided each year.

c. Hullie & Oates needed some additional storage space so on November 1, 2013 they rented a unit for an annual rate of $18,500. The entire amount was expensed when paid.

d. $5,800 of store supplies were purchased during the year and the asset store supplies was increased. $3,200 of these supplies were used during the year.

e. $7,775 of office supplies were purchased during the year and were immediately expensed. $1,200 of these supplies remained at the end of 2013.

f. On July 1, 2013, Hullie & Oates issued a 9-month note receivable to Shanahan Co. at an annual interest rate of 6%. Principle and interest will be paid at the end of the 9-months. The note was recorded in Notes Receivable and is the only note outstanding.

g. Depreciation for the year is based on the following:

h. Straight line depreciation

-Store equipment Assets were held for the entire year; Residual Value = $10,000; Service life is estimated to be 10 years.

-Office equipment Assets were held for the entire year; Residual Value = $7,000; Service life is estimated to be 3 years.

-Sales salaries of $8,400 and office salaries of $6,500 remained unpaid at 12/31/13.

i.On October 1, 2013, Hullie & Oates rented a portion of one store to Twist & Chase Co. The contract was for 6 months and Hullie & Oates required the 6 months of cash upfront on October 1st. The rent is being earned equally over the next 6 months. When cash was received, unearned rent was appropriately recorded.

j. The note payable was outstanding the entire year and a 6.5% interest rate exists on the note. No interest has been recorded for the year.

k. Based on past experience, Hullie & Oates calculates bad debt expense at 1% of net sales for the year.

2. Prepare a multiple-step income statement on the proper worksheet. Your Income Statement should be in good form (proper titles, etc., use examples from your book) and well formatted. Do your best designating between selling and administrative expenses. You should use formulas in all cells, not constant numbers. (That means, your income statement should be linked to the adjusted numbers on your worksheet.)

Unadjusted Trial Balance Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Merchandise I Prepaid Insurance Prepaid Advertisi 36,000 72,850 4.000 160,500 36,000 48,000 id Rent 5.800 Store Supplies Office Supplies Note Receivable Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation Office Equi Accounts Payable Salaries Interest Payable Unearned Rent 30,000 350,000 40,050 125,000 17,200 85 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started