hello, i am having trouble understanding Sensitiviy Analysis, below is all number given as well as correct answer for sensitivity analysis

please show formulas and all work as to how to determine sensitivity portion as well as use the answer to conduct a breakeven analysis showing all work

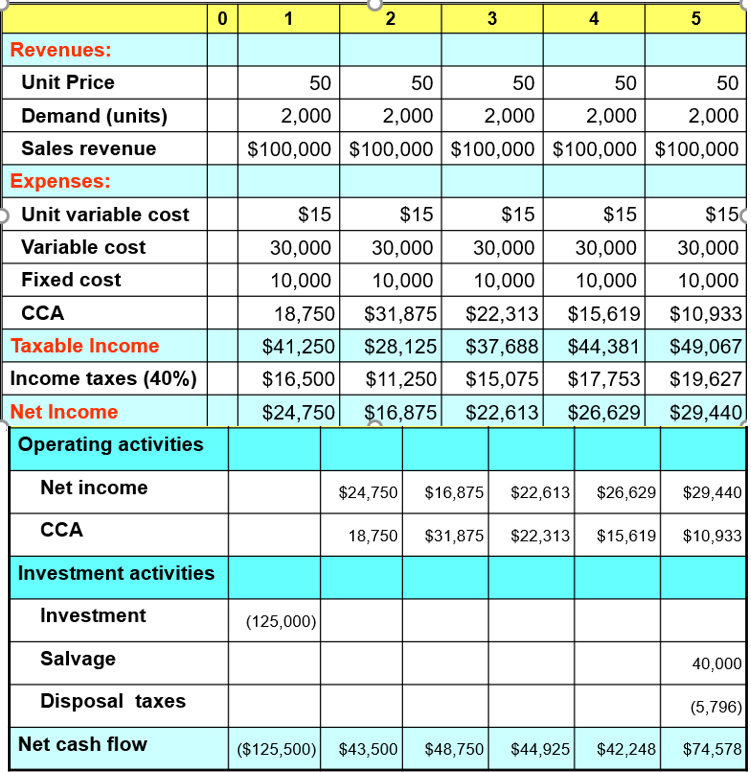

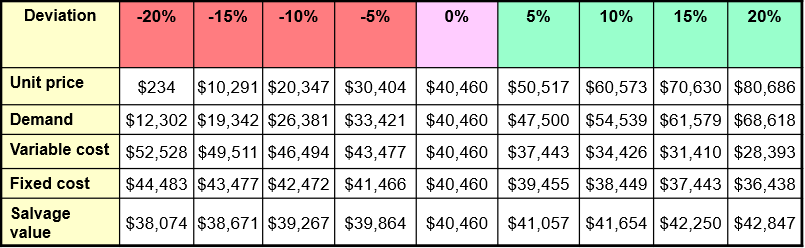

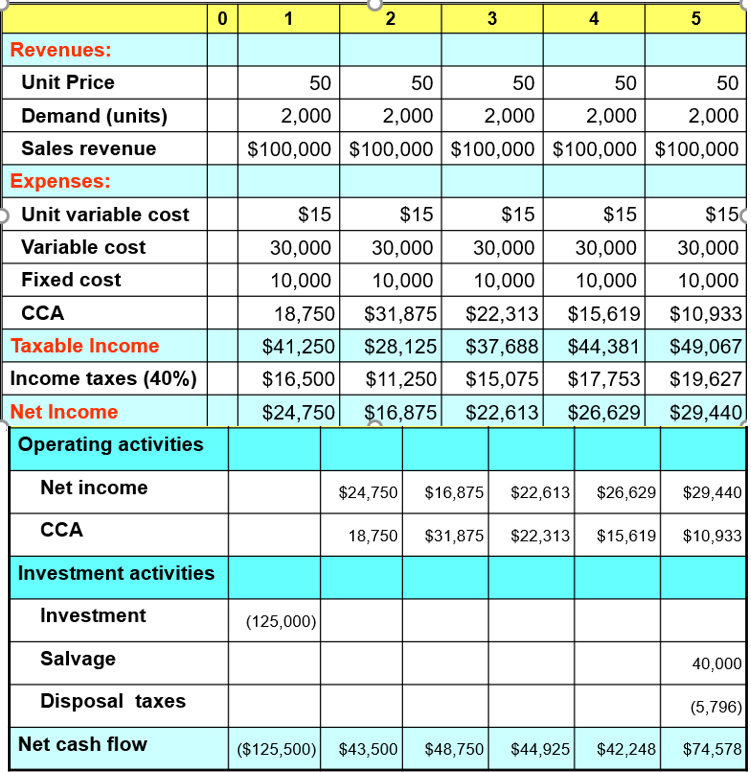

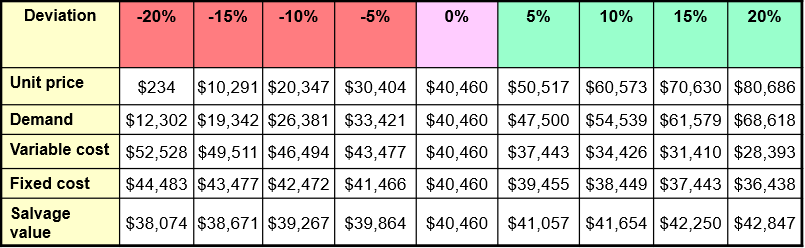

0 1 2 3 4 5 Revenues: Unit Price 50 50 50 50 50 2,000 2,000 2,000 2,000 2,000 $100,000 $100,000 $100,000 $100,000 $100,000 Demand (units) Sales revenue Expenses: Unit variable cost Variable cost Fixed cost $15 $15 $15 $15 $15 CCA 30,000 10,000 18,750 $41,250 $16,500 $24,750 30,000 10,000 $31,875 $28,125 $11,250 $16,875 30,000 10,000 $22,313 $37,688 $15,075 $22,613 30,000 10,000 $15,619 $44,381 $17,753 $26,629 30,000 10,000 $10,933 $49,067 $19,627 $29,440 Taxable Income Income taxes (40%) Net Income Operating activities Net income $24,750 $16,875 $22,613 $26,629 $29,440 CCA 18,750 $31,875 $22,313 $15,619 $10,933 Investment activities Investment (125,000) Salvage 40,000 Disposal taxes (5,796) Net cash flow ($125,500) $43,500 $48,750 $44,925 $42,248 $74,578 Deviation -20% -15% -10% -5% 0% 5% 10% 15% 20% Unit price $234 $10,291 $20,347 $30,404 $40,460 $50,517 $60,573 $70,630 $80,686 Demand $12,302 $19,342 $26,381 $33,421 $40,460 $47,500 $54,539 $61,579 $68,618 Variable cost $52,528 $49,511 $46,494 $43,477 $40,460 $37,443 $34,426 $31,410 $28,393 Fixed cost $44,483 $43,477 $42,472 $41,466 $40,460 $39,455 $38,449 $37,443 $36,438 Salvage value $38,074 $38,671 $39,267 $39,864 $40,460 $41,057 $41,654 $42,250 $42,847 0 1 2 3 4 5 Revenues: Unit Price 50 50 50 50 50 2,000 2,000 2,000 2,000 2,000 $100,000 $100,000 $100,000 $100,000 $100,000 Demand (units) Sales revenue Expenses: Unit variable cost Variable cost Fixed cost $15 $15 $15 $15 $15 CCA 30,000 10,000 18,750 $41,250 $16,500 $24,750 30,000 10,000 $31,875 $28,125 $11,250 $16,875 30,000 10,000 $22,313 $37,688 $15,075 $22,613 30,000 10,000 $15,619 $44,381 $17,753 $26,629 30,000 10,000 $10,933 $49,067 $19,627 $29,440 Taxable Income Income taxes (40%) Net Income Operating activities Net income $24,750 $16,875 $22,613 $26,629 $29,440 CCA 18,750 $31,875 $22,313 $15,619 $10,933 Investment activities Investment (125,000) Salvage 40,000 Disposal taxes (5,796) Net cash flow ($125,500) $43,500 $48,750 $44,925 $42,248 $74,578 Deviation -20% -15% -10% -5% 0% 5% 10% 15% 20% Unit price $234 $10,291 $20,347 $30,404 $40,460 $50,517 $60,573 $70,630 $80,686 Demand $12,302 $19,342 $26,381 $33,421 $40,460 $47,500 $54,539 $61,579 $68,618 Variable cost $52,528 $49,511 $46,494 $43,477 $40,460 $37,443 $34,426 $31,410 $28,393 Fixed cost $44,483 $43,477 $42,472 $41,466 $40,460 $39,455 $38,449 $37,443 $36,438 Salvage value $38,074 $38,671 $39,267 $39,864 $40,460 $41,057 $41,654 $42,250 $42,847