Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! I am looking for some help with this finance question! I am really stuck! Thank you so much! ook Problem 3-13 Comprehensive Ratio Analysis

Hello! I am looking for some help with this finance question! I am really stuck! Thank you so much!

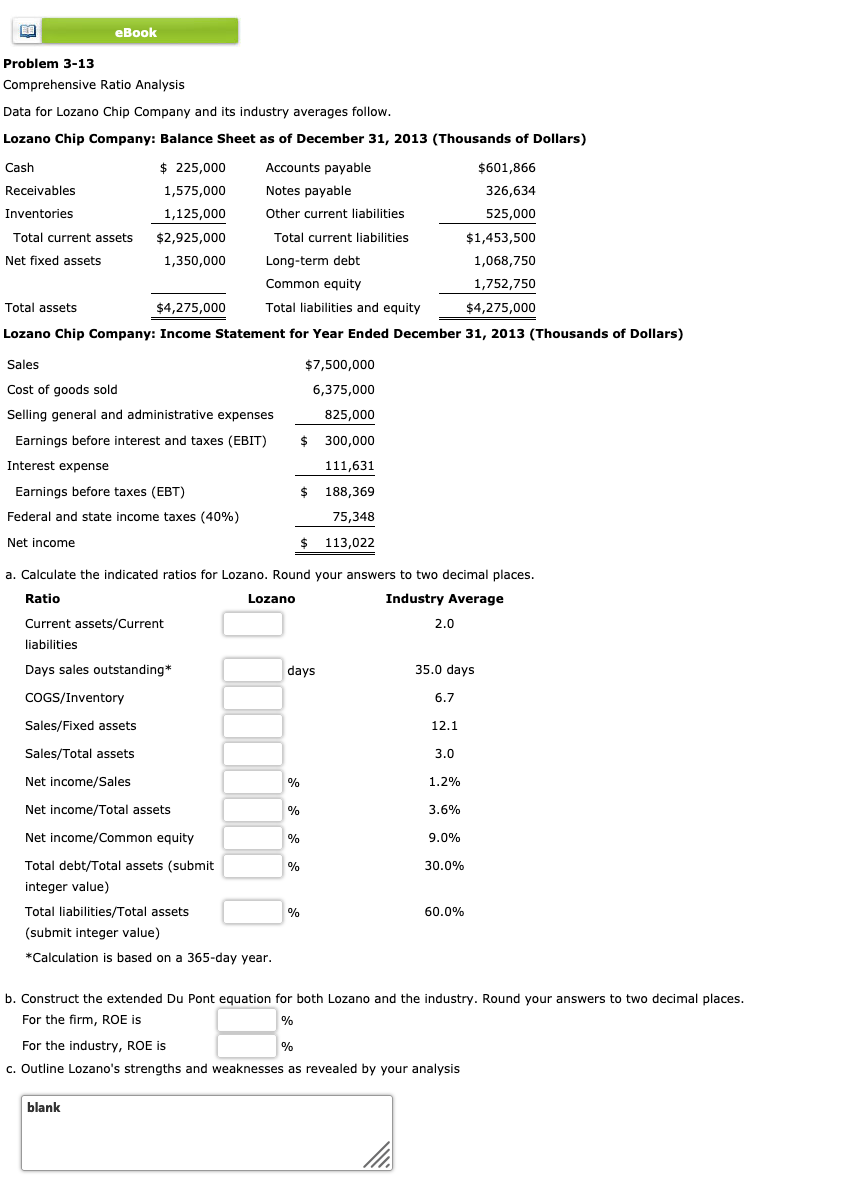

ook Problem 3-13 Comprehensive Ratio Analysis Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2013 (Thousands of Dollars) Accounts payable 225,000 $601,866 Cash Notes payable Receivables 326,634 1,575,000 1,125,000 Other current liabilities Inventories 525,000 Total current assets $2,925,000 Total current liabilities $1,453,500 Net fixed assets Long-term debt 1,350,000 1,068,750 Common equity 1,752,750 Total assets $4,275,000 Total liabilities and equity $4,275,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2013 (Thousands of Dollars) $7,500,000 Sales Cost of goods sold 6,375,000 Selling general and administrative expenses 825,000 Earnings before interest and taxes (EBIT) 300,000 Interest expense 111,631 $188,369 Earnings before taxes (EBT) 75,348 Federal and state income taxes (40%) $ 113,022 Net income $ a. Calculate the indicated ratios for Lozano. Round your answers to two decimal places Industry Average Ratio Lozano Current assets/Current 2.0 liabilities Days sales outstanding 35.0 days days COGS/Inventory 6.7 12.1 Sales/Fixed assets Sales/Total assets 3.0 1.2% Net income/Sales Net income/Total assets 3.6% Net income/Common equity 9.0% Total debt/Total assets (submit 30.0% % integer value) Total liabilities/Total assets 60.0% % (submit integer value) Calculation is based on a 365-day year. b. Construct the extended Du Pont equation for both Lozano and the industry. Round your answers to two decimal places For the firm, ROE is For the industry, ROE is c. Outline Lozano's strengths and weaknesses as revealed by your analysis blankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started