Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello. I am looking for someone who is able to finish filling the spreadsheet for the attachmens. and to possibly let me know if I

hello. I am looking for someone who is able to finish filling the spreadsheet for the attachmens. and to possibly let me know if I did good so far

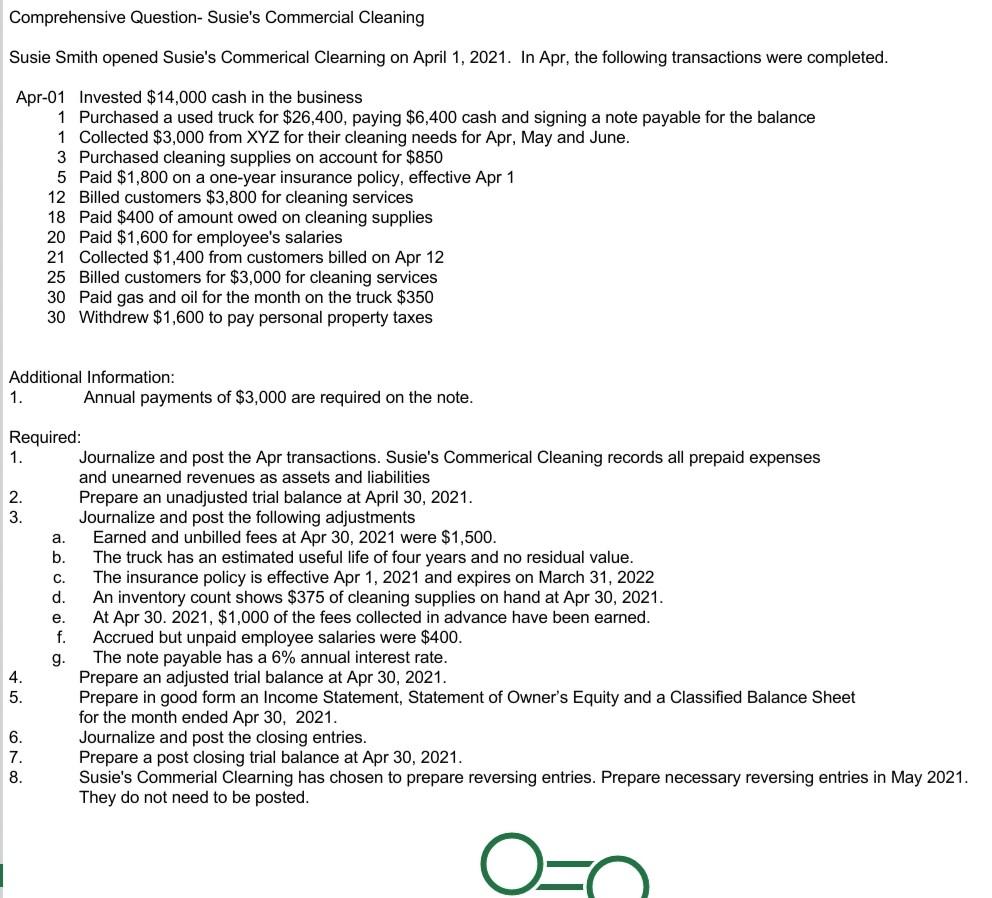

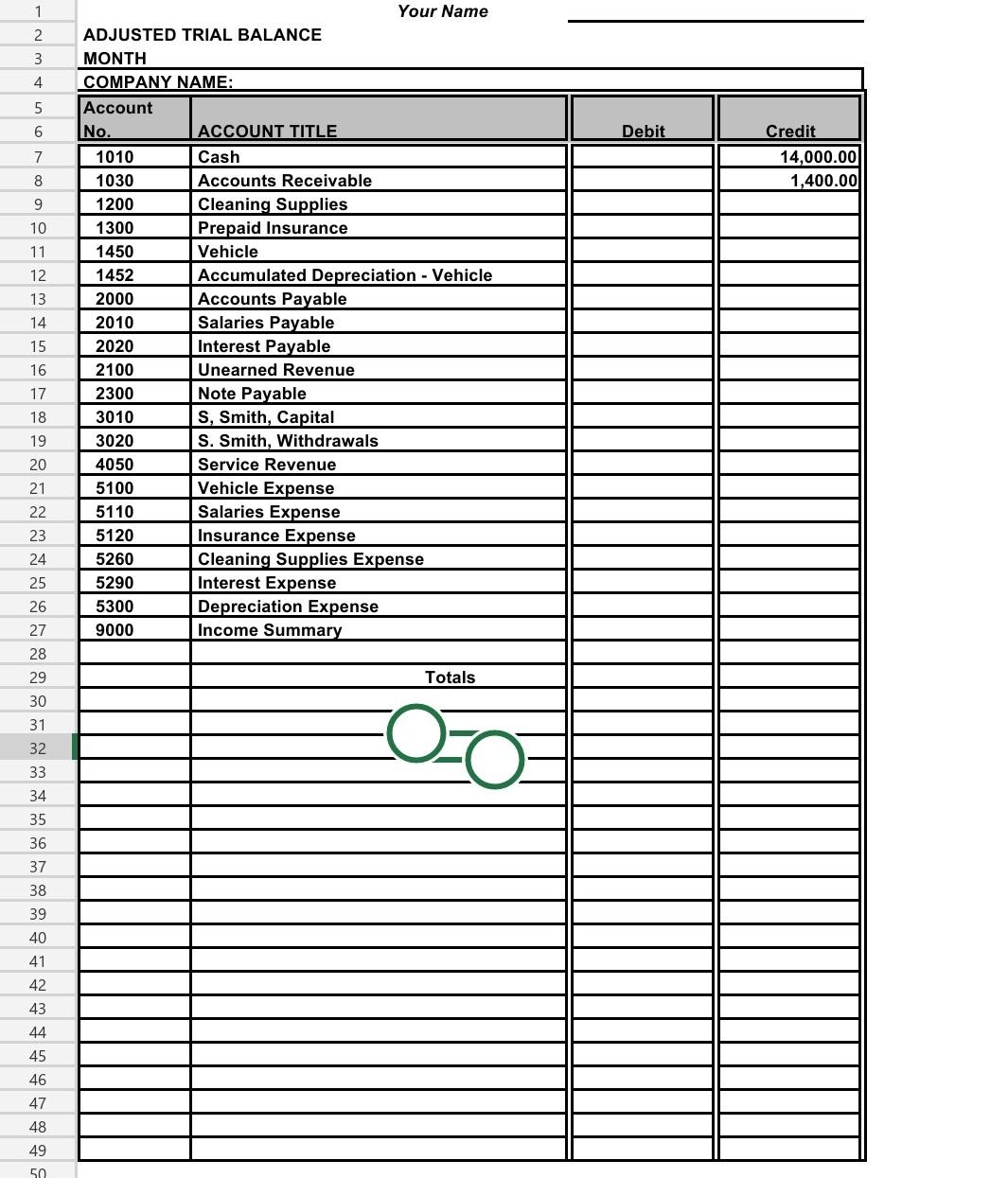

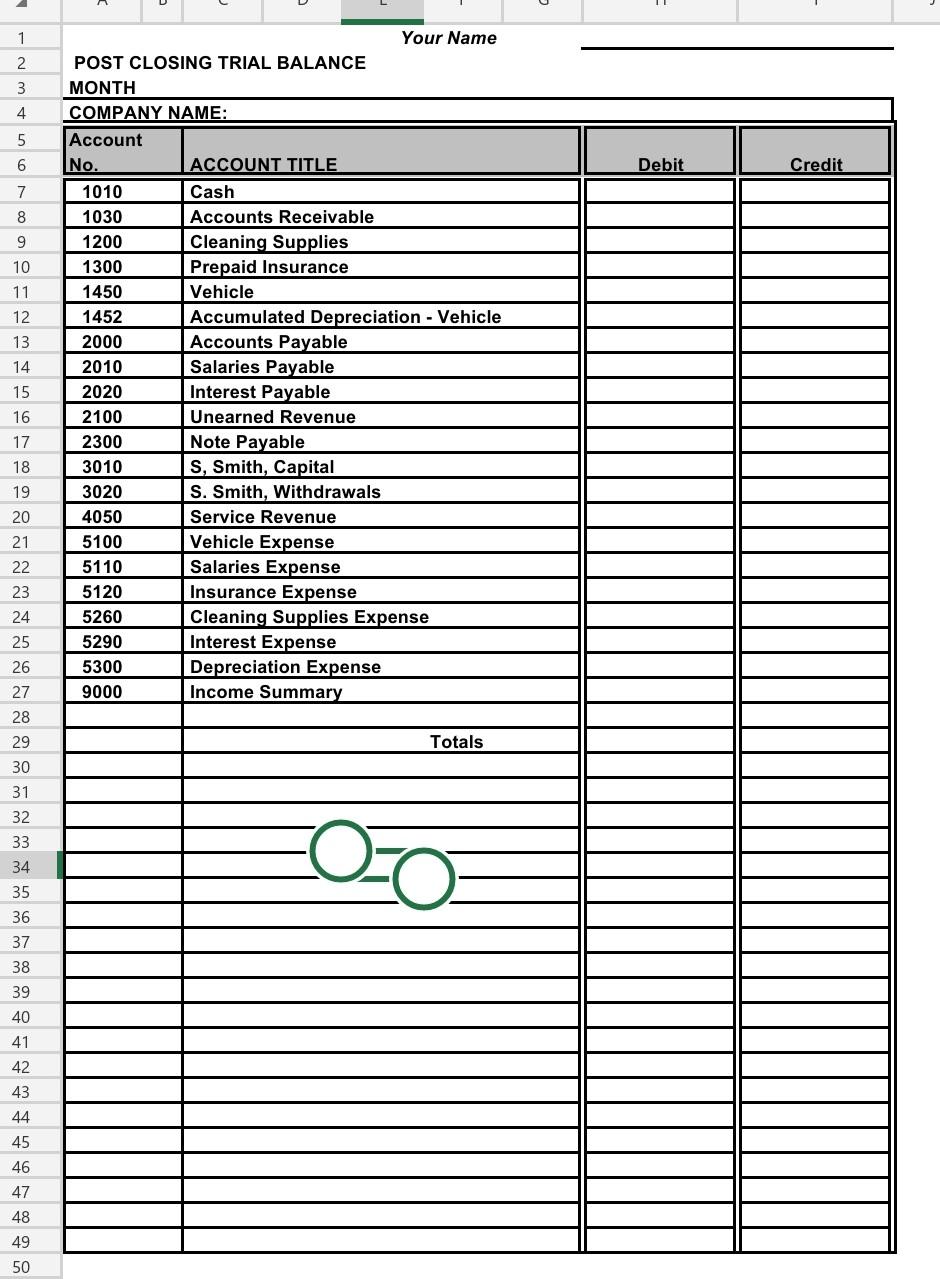

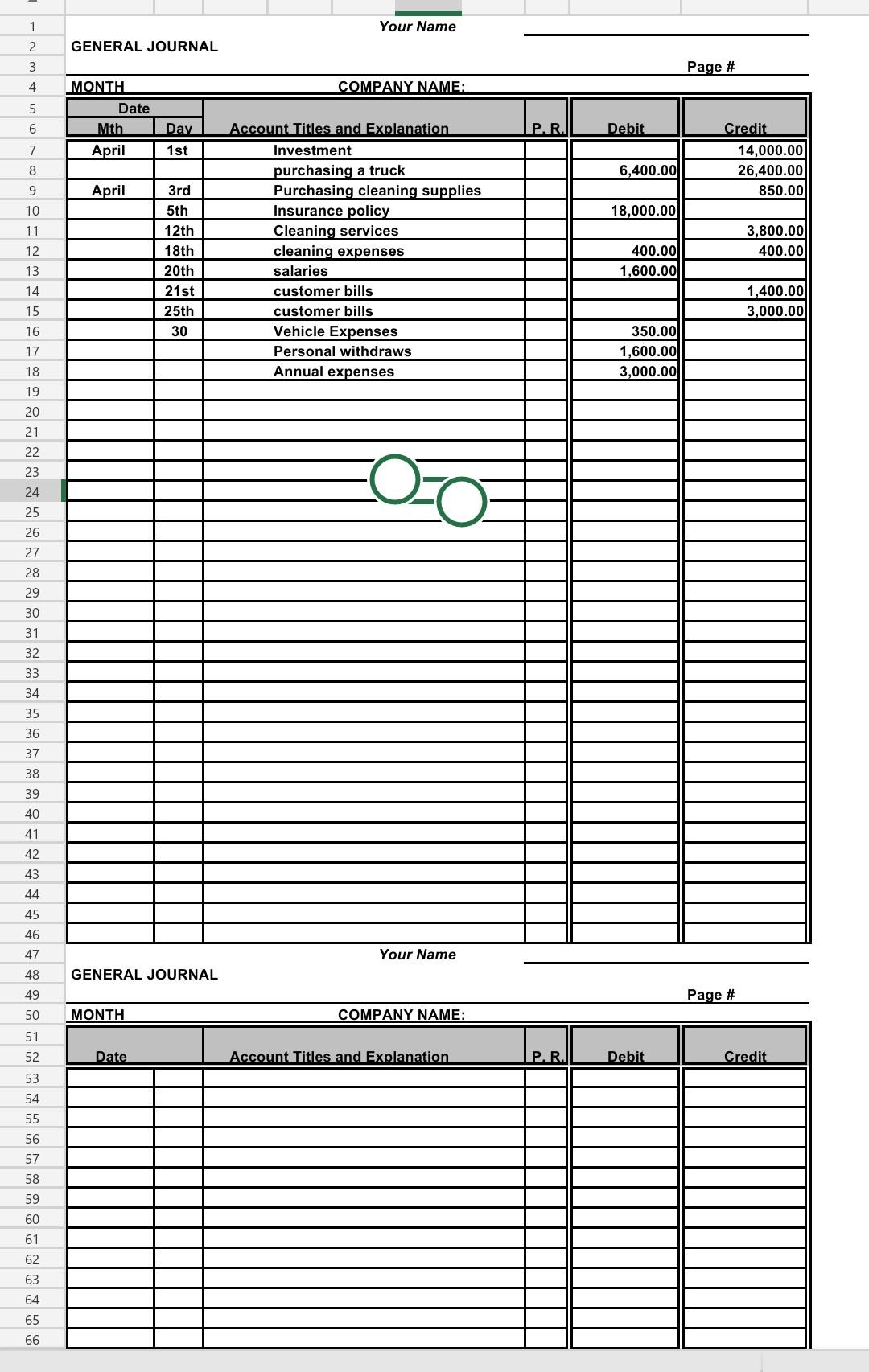

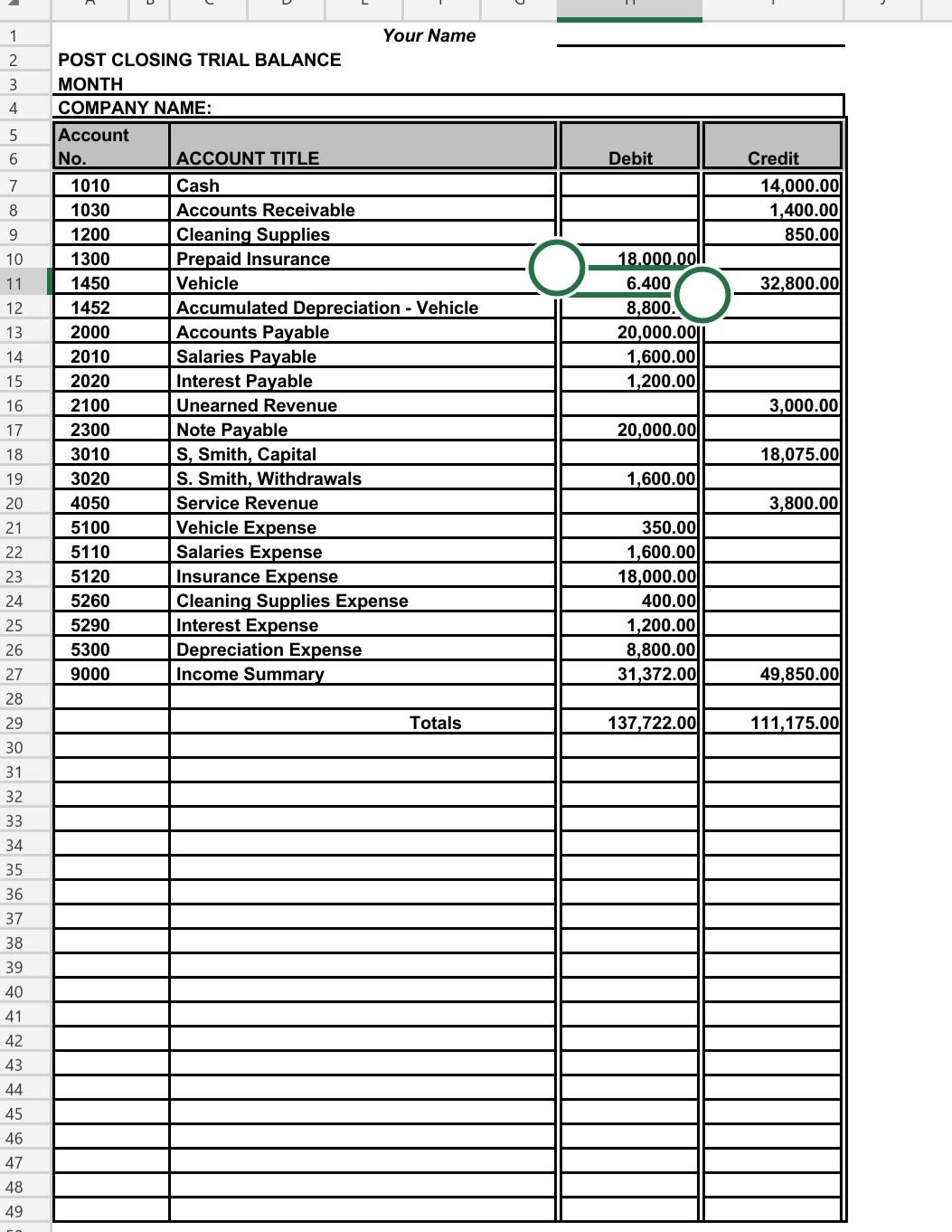

Comprehensive Question- Susie's Commercial Cleaning Susie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following transactions were completed. Apr-01 Invested $14,000 cash in the business 1 Purchased a used truck for $26,400, paying $6,400 cash and signing a note payable for the balance 1 Collected $3,000 from XYZ for their cleaning needs for Apr, May and June. 3 Purchased cleaning supplies on account for $850 5 Paid $1,800 on a one-year insurance policy, effective Apr 1 12 Billed customers $3,800 for cleaning services 18 Paid $400 of amount owed on cleaning supplies 20 Paid $1,600 for employee's salaries 21 Collected $1,400 from customers billed on Apr 12 25 Billed customers for $3,000 for cleaning services 30 Paid gas and oil for the month on the truck $350 30 Withdrew $1,600 to pay personal property taxes Additional Information: 1. Annual payments of $3,000 are required on the note. Required: 1. Journalize and post the Apr transactions. Susie's Commerical Cleaning records all prepaid expenses and unearned revenues as assets and liabilities 2. Prepare an unadjusted trial balance at April 30, 2021. 3. Journalize and post the following adjustments a. Earned and unbilled fees at Apr 30, 2021 were $1,500. b. The truck has an estimated useful life of four years and no residual value. The insurance policy is effective Apr 1, 2021 and expires on March 31, 2022 An inventory count shows $375 of cleaning supplies on hand at Apr 30, 2021. At Apr 30. 2021, $1,000 of the fees collected in advance have been earned. f. Accrued but unpaid employee salaries were $400. g. The note payable has a 6% annual interest rate. 4. Prepare an adjusted trial balance at Apr 30, 2021. 5. Prepare in good form an Income Statement, Statement of Owner's Equity and a Classified Balance Sheet for the month ended Apr 30, 2021. 6. Journalize and post the closing entries. 7. Prepare a post closing trial balance at Apr 30, 2021. 8. Susie's Commerial Clearning has chosen to prepare reversing entries. Prepare necessary reversing entries in May 2021. They do not need to be posted. OUDO d. e. 1 2 3 4 Debit 5 6 7 8 Credit 14,000.00 1,400.00 9 10 11 12 13 14 Your Name ADJUSTED TRIAL BALANCE MONTH COMPANY NAME: Account No. ACCOUNT TITLE 1010 Cash 1030 Accounts Receivable 1200 Cleaning Supplies 1300 Prepaid Insurance 1450 Vehicle 1452 Accumulated Depreciation - Vehicle 2000 Accounts Payable 2010 Salaries Payable 2020 Interest Payable 2100 Unearned Revenue 2300 Note Payable 3010 S, Smith, Capital 3020 S. Smith, Withdrawals 4050 Service Revenue 5100 Vehicle Expense 5110 Salaries Expense 5120 Insurance Expense 5260 Cleaning Supplies Expense 5290 Interest Expense 5300 Depreciation Expense 9000 Income Summary 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Totals 29 30 31 Oo 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 1 2 3 4 5 6 Debit Credit 7 8 9 10 11 12 13 14 Your Name POST CLOSING TRIAL BALANCE MONTH COMPANY NAME: Account No. ACCOUNT TITLE 1010 Cash 1030 Accounts Receivable 1200 Cleaning Supplies 1300 Prepaid Insurance 1450 Vehicle 1452 Accumulated Depreciation - Vehicle 2000 Accounts Payable 2010 Salaries Payable 2020 Interest Payable 2100 Unearned Revenue 2300 Note Payable 3010 S, Smith, Capital 3020 S. Smith, Withdrawals 4050 Service Revenue 5100 Vehicle Expense 5110 Salaries Expense 5120 Insurance Expense 5260 Cleaning Supplies Expense 5290 Interest Expense 5300 Depreciation Expense 9000 Income Summary 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Totals 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Your Name 2 GENERAL JOURNAL Page # 3 4 MONTH COMPANY NAME: 5 6 Date Mth P.R. Debit Day 1st 7 April Credit 14,000.00 26,400.00 850.00 6,400.00 April 18,000.00 8 9 10 11 12 13 14 Account Titles and Explanation Investment purchasing a truck Purchasing cleaning supplies Insurance policy Cleaning services cleaning expenses salaries customer bills customer bills Vehicle Expenses Personal withdraws Annual expenses 3rd 5th 12th 18th 20th 21st 25th 30 3,800.00 400.00 400.00 1,600.00 1,400.00 3,000.00 15 16 17 18 350.00 1,600.00 3,000.00 19 20 21 22 23 24 25 OT 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Your Name GENERAL JOURNAL Page # MONTH COMPANY NAME: 51 52 Date Account Titles and Explanation P.R. Debit Credit 53 54 55 56 57 58 59 60 61 62 63 64 65 66 1 2 3 4 5 6 Debit 7 Credit 14,000.00 1,400.00 850.00 8 9 10 11 32,800.00 12 13 14 15 Your Name POST CLOSING TRIAL BALANCE MONTH COMPANY NAME: Account No. ACCOUNT TITLE 1010 Cash 1030 Accounts Receivable 1200 Cleaning Supplies 1300 Prepaid Insurance 1450 Vehicle 1452 Accumulated Depreciation - Vehicle 2000 Accounts Payable 2010 Salaries Payable 2020 Interest Payable 2100 Unearned Revenue 2300 Note Payable 3010 S, Smith, Capital 3020 S. Smith, Withdrawals 4050 Service Revenue 5100 Vehicle Expense 5110 Salaries Expense 5120 Insurance Expense 5260 Cleaning Supplies Expense 5290 Interest Expense 5300 Depreciation Expense 9000 Income Summary 18.000.00ll 6.400 8,800. 20,000.00 1,600.000 1,200.00 3,000.00 20,000.00 16 17 18 19 20 18,075.000 1,600.00 3,800.00 21 22 23 24 350.00 1,600.00 18,000.00 400.00 1,200.00 8,800.00 31,372.00 49,850.00 Totals 137,722.00 111,175.000 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started