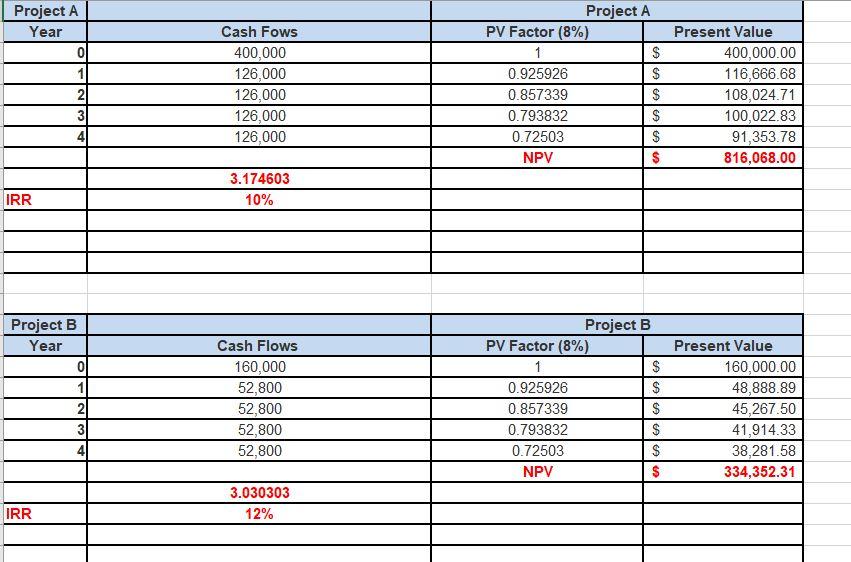

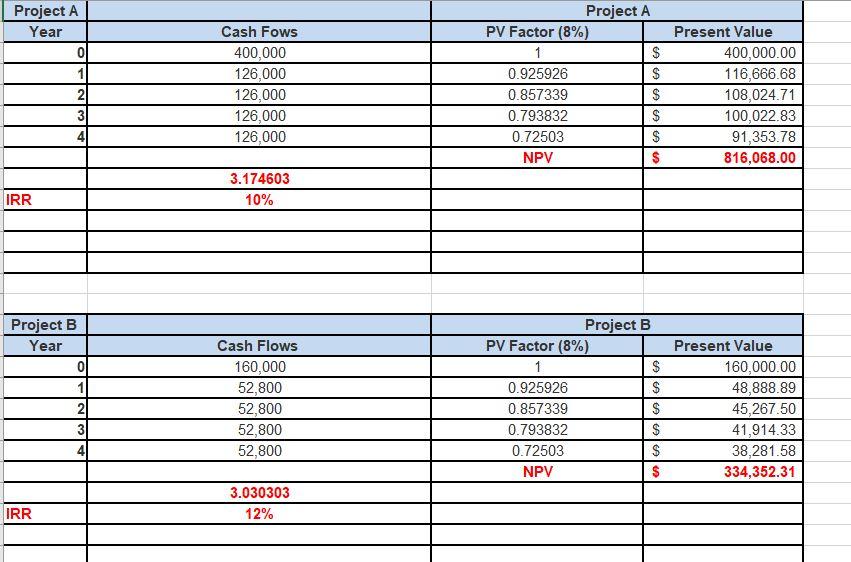

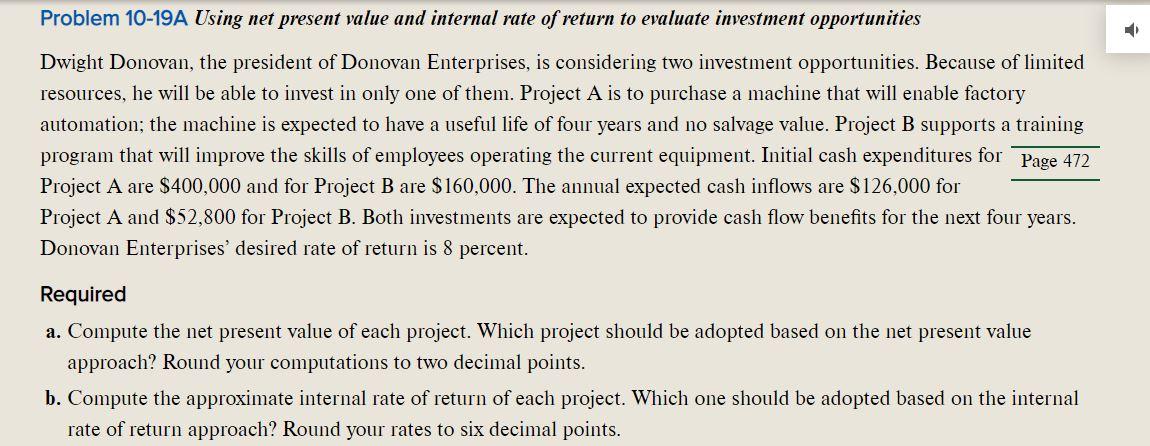

Hello, I am not getting the right number for the NPV for either Project A or B. Can someone assist please?

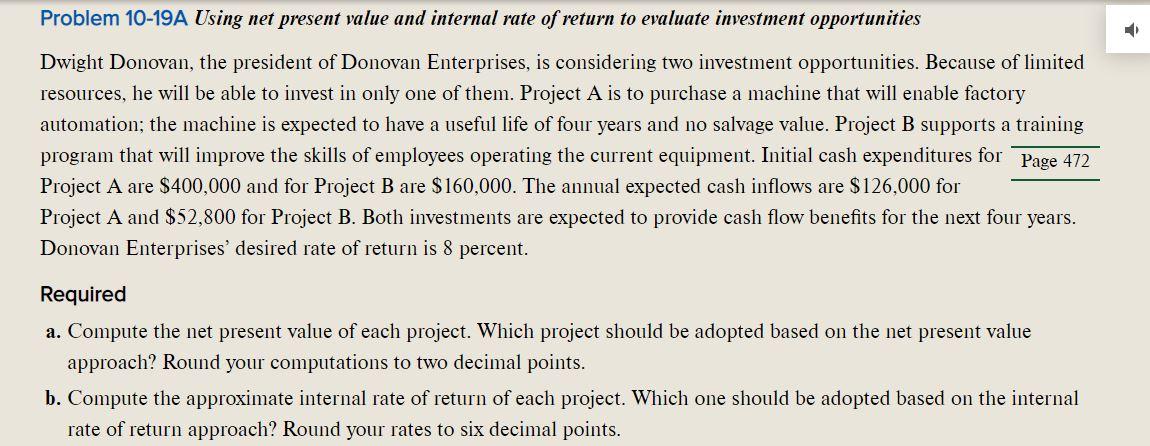

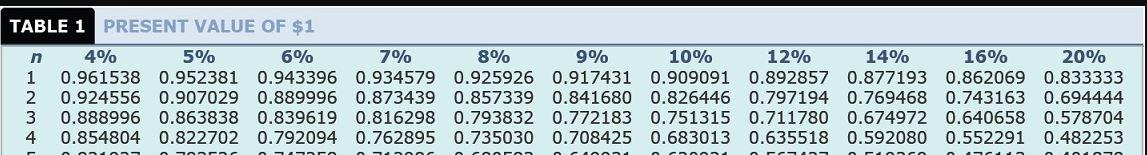

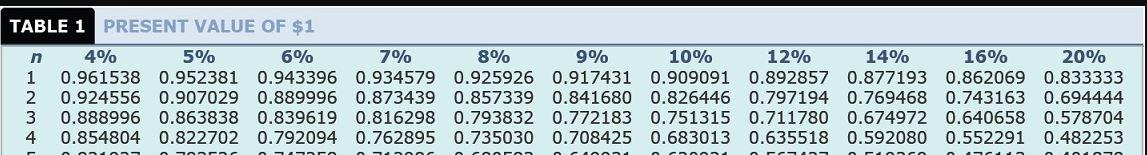

Project A Year 0 1 Cash Fows 400,000 126,000 126,000 126,000 126,000 Project A PV Factor (8%) 1 $ 0.925926 $ 0.857339 $ 0.793832 $ 0.72503 $ NPV $ 2 Present Value 400,000.00 116,666.68 108,024.71 100,022.83 91,353.78 816,068.00 3 3.174603 10% IRR Project B Year 0 Cash Flows 160,000 52,800 52,800 52,800 52,800 Project B PV Factor (8%) 1 $ 0.925926 $ 0.857339 $ 0.793832 $ 0.72503 $ NPV $ 2 Present Value 160,000.00 48,888.89 45,267.50 41,914.33 38,281.58 334,352.31 4 3.030303 12% IRR Problem 10-19A Using net present value and internal rate of return to evaluate investment opportunities Dwight Donovan, the president of Donovan Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Page 472 Project A are $400,000 and for Project B are $ 160,000. The annual expected cash inflows are $126,000 for Project A and $52,800 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Donovan Enterprises' desired rate of return is 8 percent. Required a. Compute the net present value of each project. Which project should be adopted based on the net present value approach? Round your computations to two decimal points. b. Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of return approach? Round your rates to six decimal points. 4% TABLE 1 PRESENT VALUE OF $1 n 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253