Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello! i am struggling to fill some of these out! hope you can help :) Vinson Co. Manufactures and sells one product. Assume the selling

hello! i am struggling to fill some of these out! hope you can help :)

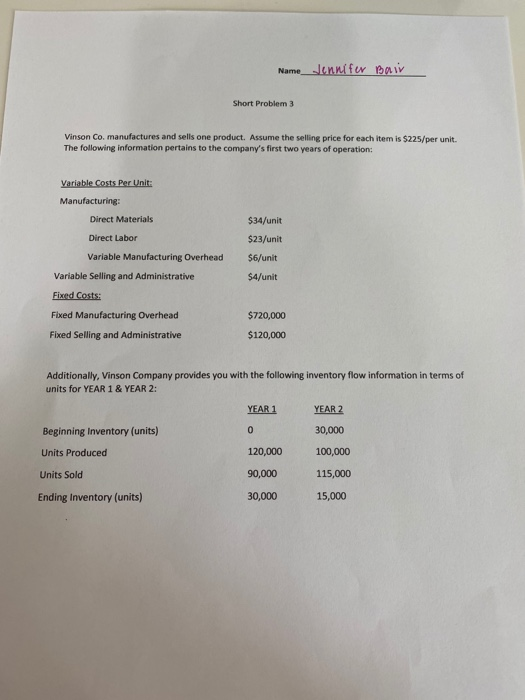

Vinson Co. Manufactures and sells one product. Assume the selling price for each item is $225/per unit. The following information pertains to the companies first two years of operation:

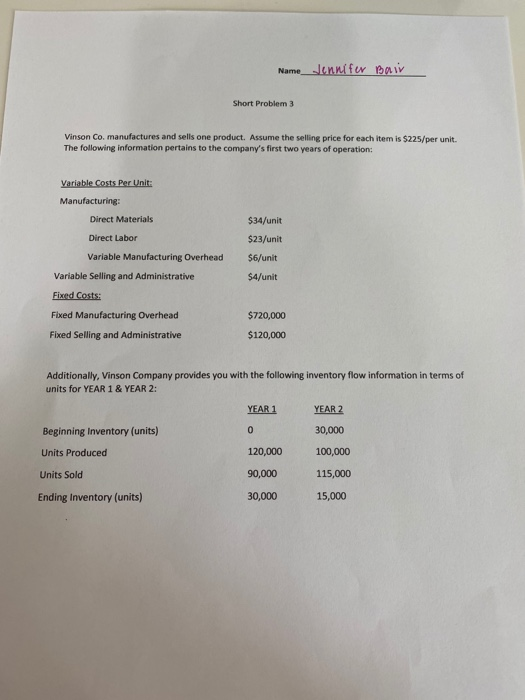

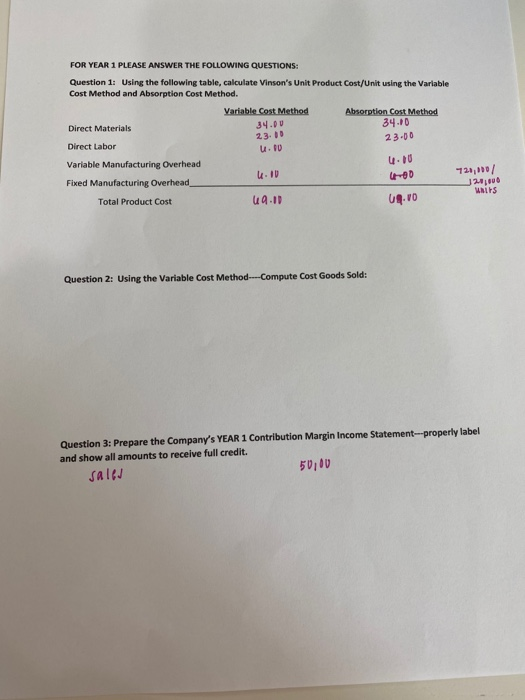

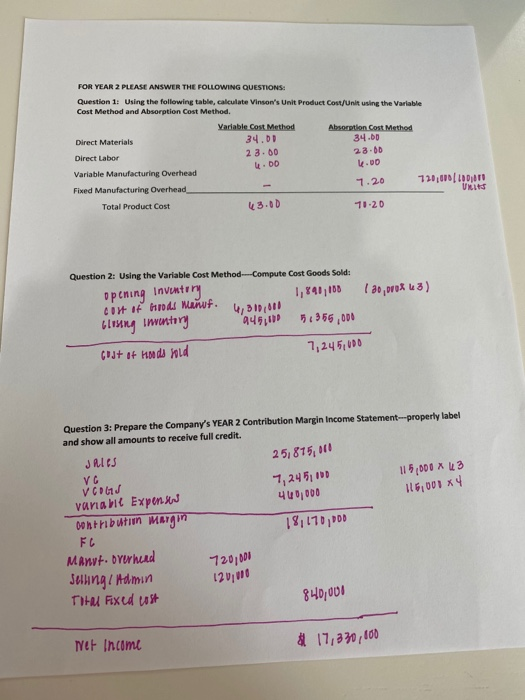

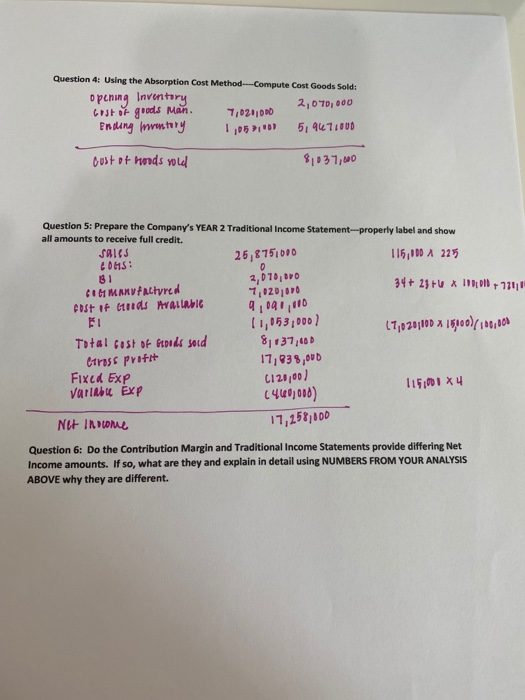

Name_Jennifer Bar Short Problem 3 Vinson Co. manufactures and sells one product. Assume the selling price for each item is $225/per unit. The following information pertains to the company's first two years of operation: Variable costs Per Unit: Manufacturing: $34/unit $23/unit $6/unit Direct Materials Direct Labor Variable Manufacturing Overhead Variable Selling and Administrative Fixed Costs: Fixed Manufacturing Overhead Fixed Selling and Administrative $4/unit $720,000 $120,000 Additionally, Vinson Company provides you with the following inventory flow information in terms of units for YEAR 1 & YEAR 2: YEAR 1 YEAR 2 Beginning Inventory (units) 0 30,000 Units Produced 120,000 100,000 Units Sold 90,000 115,000 Ending Inventory (units) 30,000 15,000 FOR YEAR 1 PLEASE ANSWER THE FOLLOWING QUESTIONS: Question 1: Using the following table, calculate Vinson's Unit Product Cost/Unit using the Variable Cost Method and Absorption Cost Method. Variable Cost Method Absorption Cost Method Direct Materials 34.00 34.0 Direct Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Total Product Cost 19.10 23.00 u. 10 720,000/ J20,000 BITS U.TO Question 2: Using the Variable Cost Method ----Compute Cost Goods Sold: Question 3: Prepare the Company's YEAR 1 Contribution Margin Income Statement-properly label and show all amounts to receive full credit. sale 50,00 Question 4: Using the Absorption Cost Method Compute Cost Goods Sold: Question 5: Prepare the Company's YEAR 1 Traditional Income Statement properly label and show all amounts to receive full credit. sales 20,290,00 061: 0 BT cost of the MANTA 8,270, DIO COST OF Monds AVAILAVIC 8,29110D ET Total 1013 4, 2100 ir pritit 14,040,100 Fixed Expenses [120,000) variabu Expenses (40 Net orating Income 13,04D10D 12,070,07 Question 6: Do the Contribution Margin and Traditional Income Statements provide differing Net Income amounts. If so, what are they and explain in detail using NUMBERS FROM YOUR ANALYSIS ABOVE why they are different. FOR YEAR 2 PLEASE ANSWER THE FOLLOWING QUESTIONS: Question 1: Using the following table, calculate Vinson's Unit Product Cost/Unit using the Variable Cost Method and Absorption Cost Method. Variable Cost Method Absorption Cost Method Direct Materials 34.00 34.0D Direct Labor 23.00 23.00 k.00 Variable Manufacturing Overhead 1.2.0 720,000[loDjon Fixed Manufacturing Overhead URS Total Product Cost 10-20 6.00 3.00 Question 2: Using the Variable Cost Method --Compute Cost Goods Sold: opening Inventory 1,840,100 Cum of Al Manuf. 1a0,0043) 4, 31.011 Gliung Inventory 949, 5:366,000 Codt it had hold 7,245,000 : 116,001 X4 Question 3: Prepare the Company's YEAR 2 Contribution Margin Income Statement-properly label and show all amounts to receive full credit. Jales 25,815, 011 VG 7,245,00 115,000 X 43 variant Expensiv 400,000 contribution margin FC 18,170, DDD Mannt. Dyerhed 720,000 Selling Admin 120.000 840,000 Tha Fixed Lost Net Income # 17,830,000 Question 4: Using the Absorption Cost Method --Compute Cost Goods Sold: opening Inventory cost of goods man 7,020,000 2,070,000 Ending www.tory 1,05), 5,9471000 Out of hoods you 81037,600 0 Question 5: Prepare the Company's YEAR 2 Traditional Income Statement-properly label and show all amounts to receive full credit. SAICS 26,875,000 OS: 116,000 A 225 CIG MANUFAchyred 2,070, TO 7,0201010 34+ 25+ A DODDID + 7711 Post It tuds palabIC 9,091,00 BI 11,053,000) 17,020710 X 15000/100,00 Total cost of Guds sord 8,037,400 Ctrass profit 17,838,00D Fixed Exp C120,00) Variabu Exp (46000) 119,00 14 Net Ihowie 17,258,000 Question 6: Do the Contribution Margin and Traditional Income Statements provide differing Net Income amounts. If so, what are they and explain in detail using NUMBERS FROM YOUR ANALYSIS ABOVE why they are different Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started