Answered step by step

Verified Expert Solution

Question

1 Approved Answer

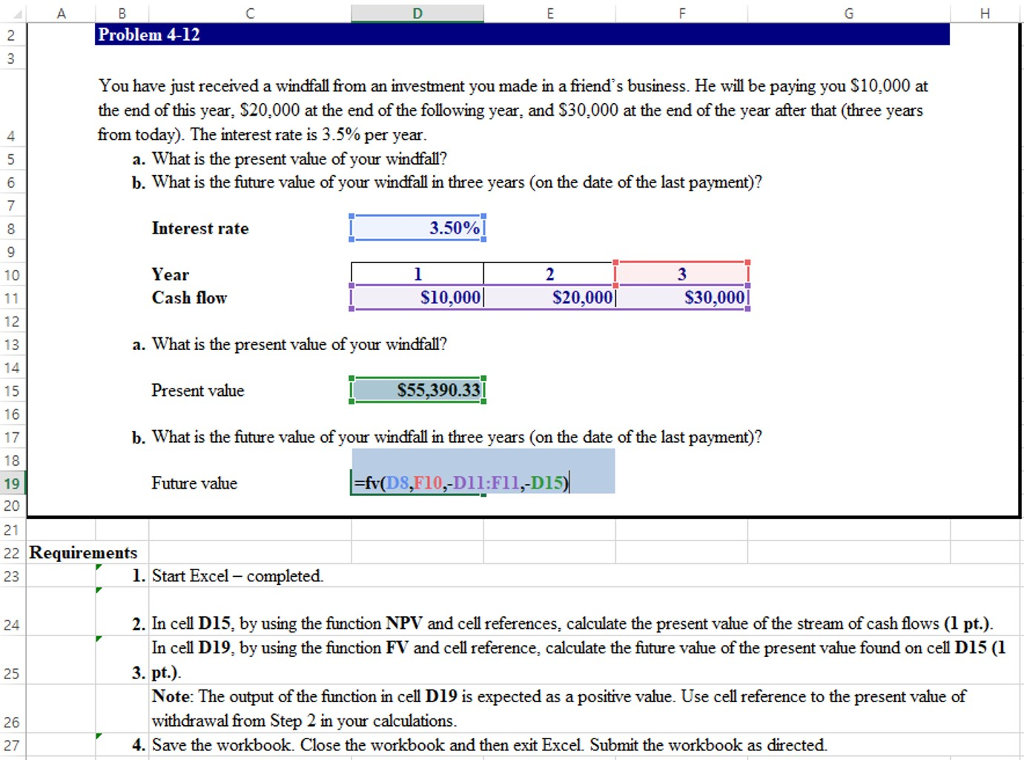

Hello, I am trying anything to get the FV value in the future value blank, but I cannot get it. I think this question is

Hello,

I am trying anything to get the FV value in the future value blank, but I cannot get it.

I think this question is something wrong.

If I do that in the FV function I get $92,474.50 which is wrong.

I believe the correct answer has to be $61,412, which I have no idea how possibly I can get by using FV function.

Could you please tell me the solution in this excel?

Thanks much!!

Problem 4-12 You have just received a windfall from an investment you made in a friend's business. He will be paying you S10,000 at the end of this year, S20,000 at the end of the following year, and S30,000 at the end of the year after that (three years from today) The interest rate is 3.5% per year 4 a. What is the present value of your windfall? b. What is the future value of your windfall in three years (on the date of the last payment)? Interest rate 3.50%! 10 ear Cash flow $10,000 $20,0001 S30,000 13 a. What is the present value of your windfall? Present value $55,390.33 b. What is the future value of your windfall in three years (on the date of the last payment)? Future value =fv(DS,F10,-D11:F11,-D15) 19 20 21 22 Requirements 23 1. Start Excel - completed. 2. In cell D15, by using the function NPV and cell references, calculate the present value of the stream of cash flows (1 pt.) 3. pt.) 24 In cell D19, by using the function FV and cell reference, calculate the future value of the present value found on cell D15 (1 25 Note: The output of the function in cell D19 is expected as a positive value. Use cell reference to the present value of withdrawal from Step 2 in your calculations 26 27 4. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started