Question

Hello, I am working on an accounting problem and I got stock. I am not understanding the differences in the T account entries for the

Hello,

I am working on an accounting problem and I got stock. I am not understanding the differences in the T account entries for the Bad Debt Expense financial statement and the Allowance for Doubtful Account balance sheet. I am also stuck on the writ offs. Could you please help me understand this problem step by step.

The problem reads:

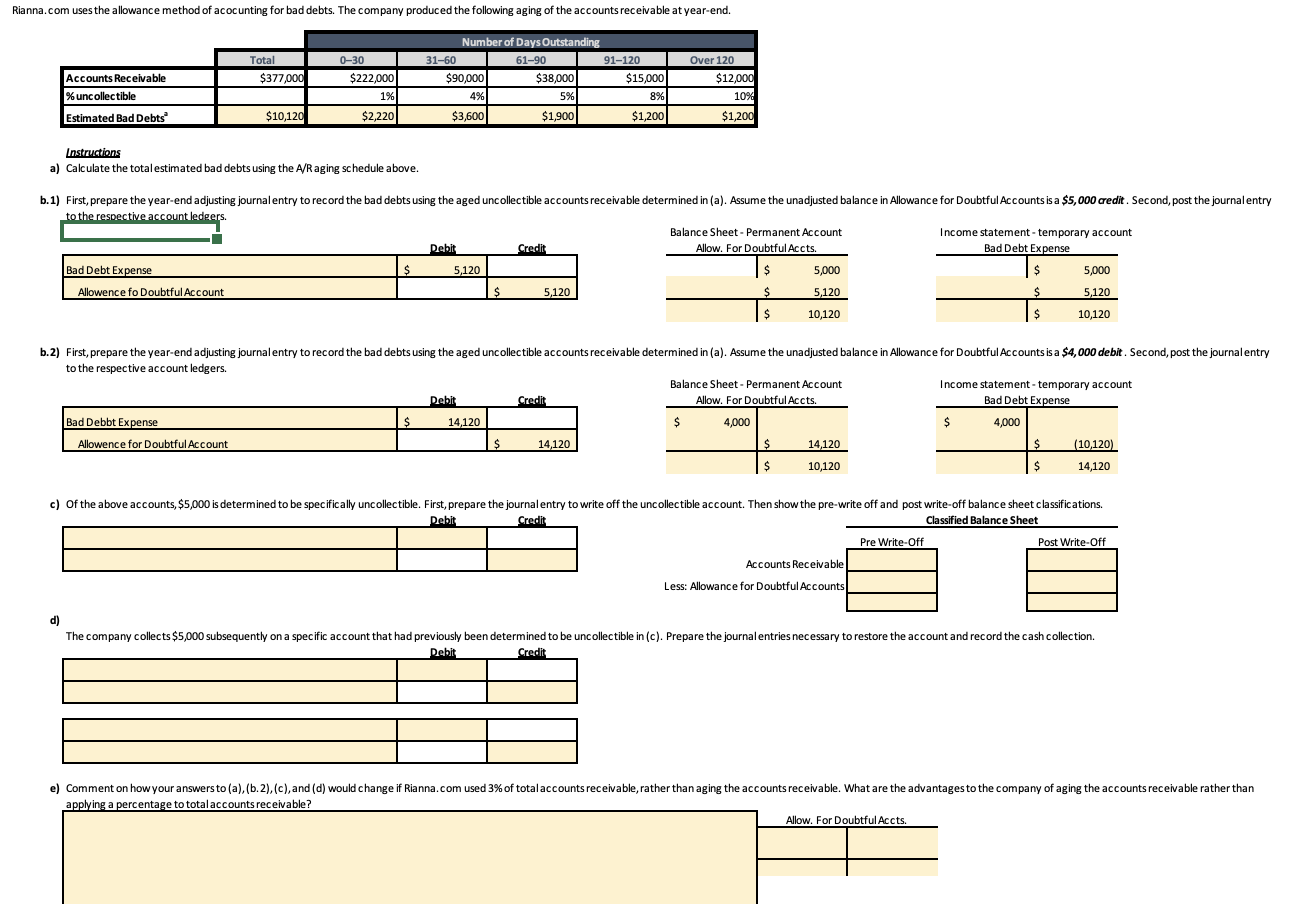

| Rianna.com uses the allowance method of accounting for bad debts. The company produced the following aging of the accounts receivable at year-end. |

| First, prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in (a). Assume the unadjusted balance in Allowance for Doubtful Accounts is a $5,000 credit. Second, post the journal entry to the respective account ledgers. |

Next, prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in (a). Assume the unadjusted balance in Allowance for Doubtful Accounts is a $4,000 debit. Second, post the journal entry to the respective account ledgers.

Of the above accounts, $5,000 is determined to be specifically uncollectible. First, prepare the journal entry to write off the uncollectible account. Then show the pre-write off and post write-off balance sheet classifications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started