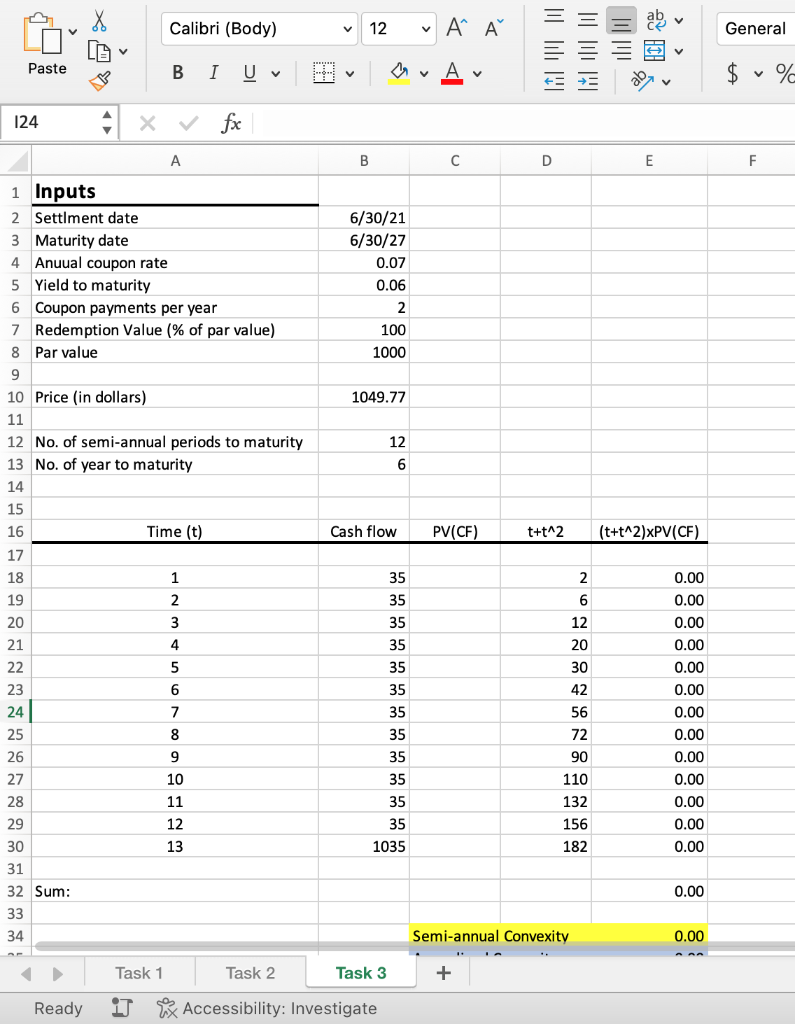

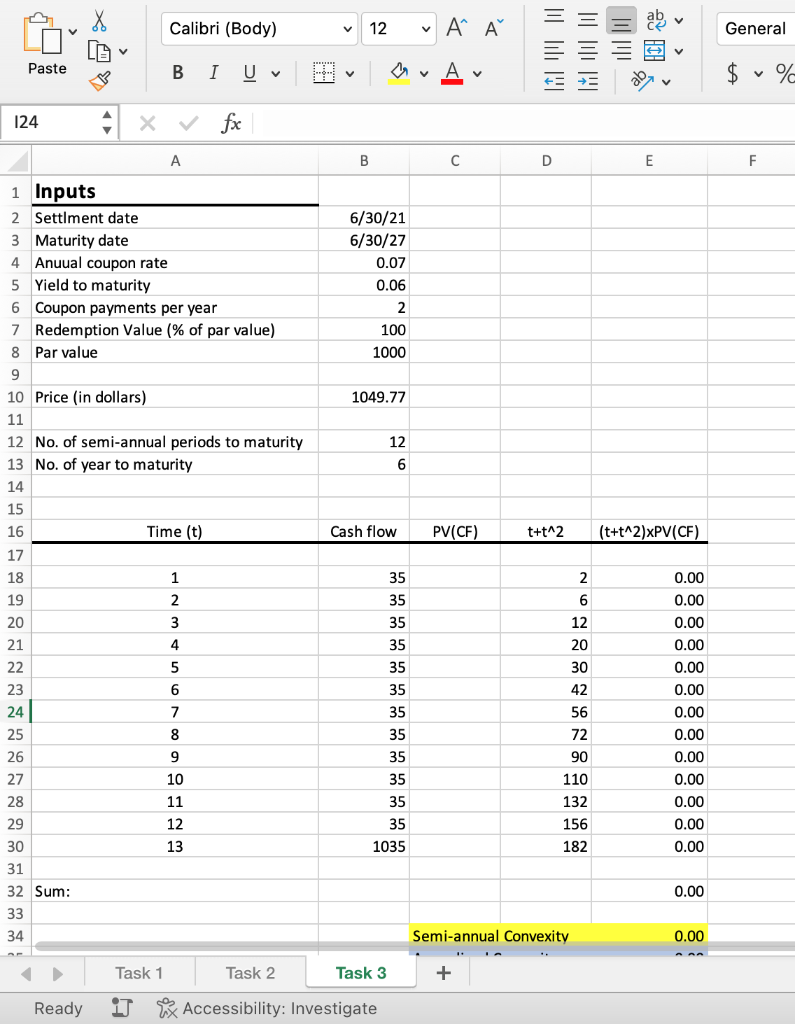

Hello, I can't figure how to calculate the cash flow and the PV(CF) which is preventing me to answer questions. Could you help me ?

Hello, I can't figure how to calculate the cash flow and the PV(CF) which is preventing me to answer questions. Could you help me ?

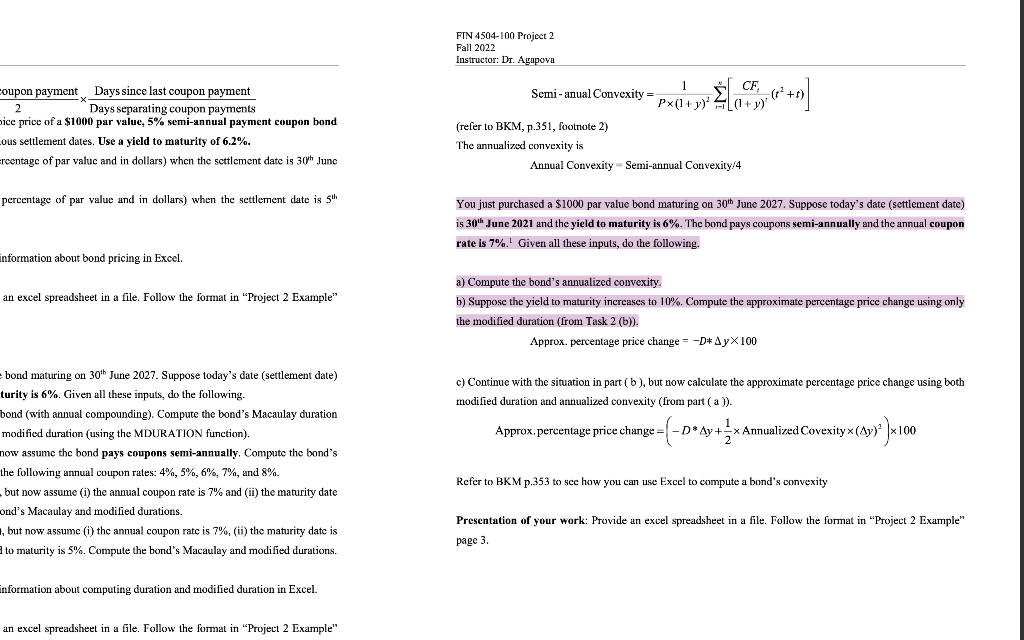

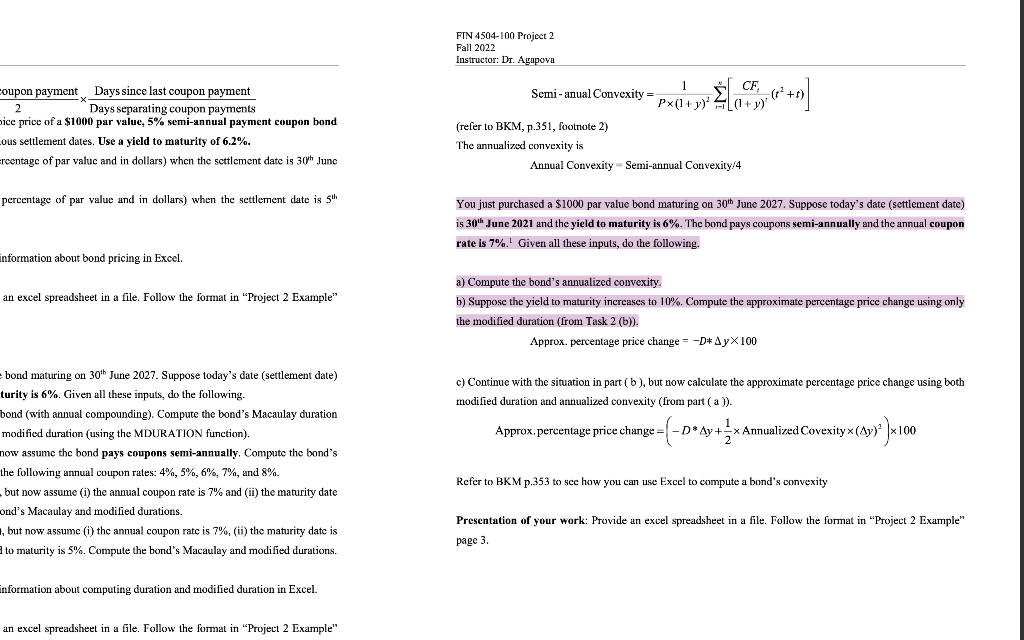

Ready $5ix Accessibility: Investigate FTN 4504-100 Project 2 Fall 2022 Instructor: Dr. Agapova 2ouponpaymentDaysseparatingcouponpaymentsDayssincelastcouponpayment Semi - anual Convexity =P(1+y)21i=1n[(1+y)2CFi(t2+t)] vice price of a $1000 par value, 5% semi-annual payment coupon bond (refer to BKM, p.351, footnote 2) ous settlement dates. Use a yield to maturity of 6.2%. The annualized convexity is reentage of par valuc and in dollars) when the settlement date is 30yh June Annual Convexity = Semi-annual Convexity/4 percentage of par value and in dollars) when the settlement date is 5th You just purchased a $1000 par value bond maturing on 30th June 2027. Suppose today's date (settlement date) is 30th June 2021 and the yield to maturity is 6%. The bond pays coupons semi-annually and the annual coupon rate is 7%.1 Given all these inputs, do the following. information about bond pricing in Excel. a) Compute the bond's annualized convexity. an excel spreadsheet in a file. Follow the format in "Project 2 Example" b) Suppose the yield to maturity increases to 10%. Compute the approximate percentage price change using only the modified duration (from Task 2 (b)). Approx. percentage price change =Dy100 bond maturing on 30th June 2027 . Suppose today's date (settlement date) c) Continue with the situation in part (b), but now calculate the approximate percentage price change using both turity is 6%. Given all these inputs, do the following. modified duration and annualized convexity (from part (a)). bond (with annual compounding). Compute the bond's Macaulay duration modified duration (using the MDURATION function). Approx, percentage price change =(Dy+21 Annualized Covexity (y)2)100 now assume the bond pays coupons semi-annually. Compute the bond's the following annual coupon rates: 4%,5%,6%,7%, and 8%. but now assume (i) the annual coupon rate is 7% and (ii) the maturity date Refer to BKM p.353 to see how you can use Excel to compute a bond's convexity ond's Macaulay and modified durations. 1, but now assume (i) the annual coupon rate is 7%, (ii) the maturity date is Presentation of your work: Provide an excel spreadsheet in a file. Follow the format in "Project 2 Example" to maturity is 5%. Compute the bond's Macaulay and modified durations. page 3. information about computing duration and modified duration in Excel. an excel spreadsheet in a file. Follow the format in "Project 2 Example

Hello, I can't figure how to calculate the cash flow and the PV(CF) which is preventing me to answer questions. Could you help me ?

Hello, I can't figure how to calculate the cash flow and the PV(CF) which is preventing me to answer questions. Could you help me ?