Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I could really use help answering these questions below for Financial Management Principles that I am struggling with. Any help answering the question so

Hello. I could really use help answering these questions below for Financial Management Principles that I am struggling with. Any help answering the question so I can understand for future reference would be a great help.

Book reference if needed: Essentials of Corporate Finance, 11th edition, McGraw Hill, Author: Ross. These questions cover Chapter 12.

Image transcription text

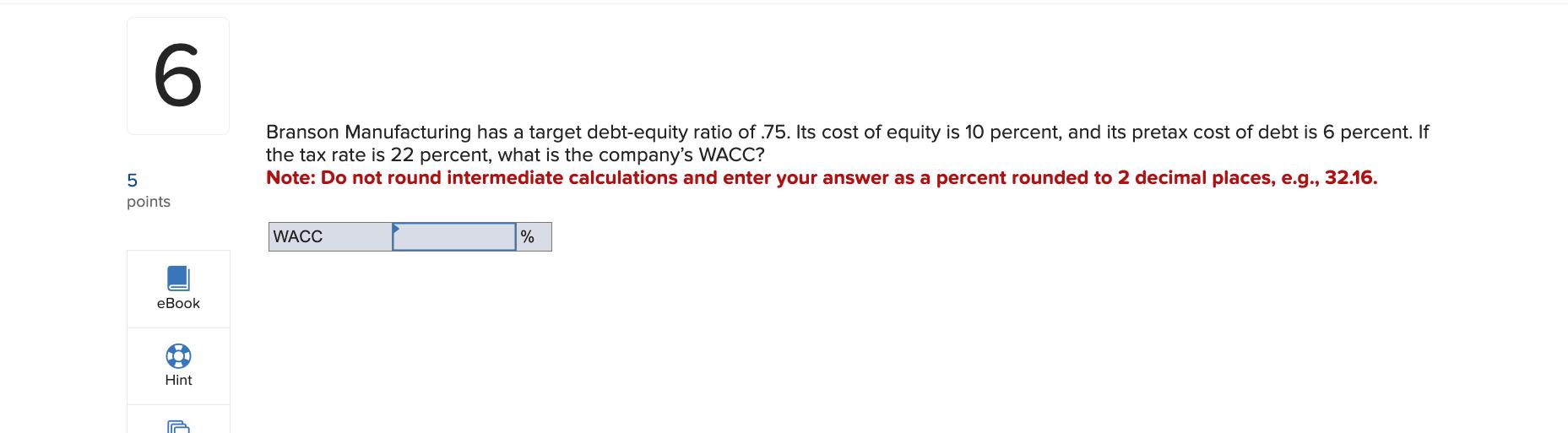

Branson Manufacturing has a target debt-equity ratio of 75. Its cost of equity is 10 percent, and its pretax cost of debt is 6 percent If the tax rate is 22 percent, what is the company's WACC? 5 Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. points we —% eBook Hmt

Image transcription text

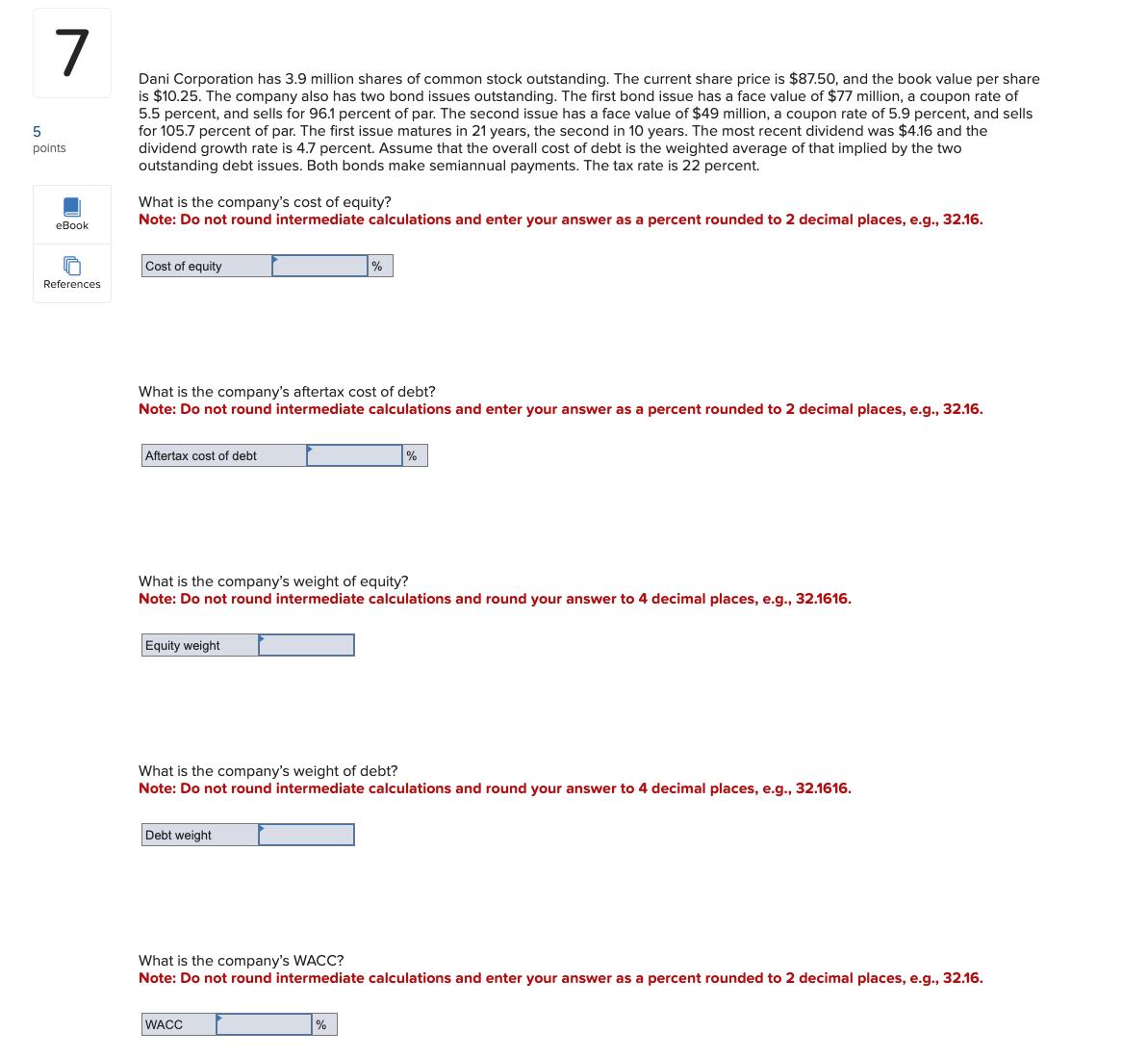

7 points eBook [E Refere nces Dani Corporation has 3.9 million shares of common stock outstanding. The current share price is $8150, and the book value per share is $10.25. The company also has two bond issues outstanding. The first bond issue has a face value of $7? million, a coupon rate of 5.5 percent, and sells for 96.1 percent of par. The second issue has a face value of $49 million, a coupon rate of 5.9 percent. and sells for 105.? percent of par. The first issue matures in 21 years, the second in 10 years. The most recent dividend was $4.16 and the dividend growth rate is 4.? percent. Assume that the overall cost of debt is the weighted average of that impiied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 22 percent. What is the company's cost of equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places. e.g.. 32.16. Cost of equity "Yo What is the company's aftertax cost of debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places. e.g.. 32.16. Afierlax Dost oi debt "Yo What is the company's weight of equity? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g.. 32.1616. Equity weight I I What is the company's weight of debt? Note: Do not round intermediate calculations and round your answer to 4 decimal places, e.g.. 32.1616. Debt weight I I What is the company's WACC? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places. e.g.. 32.16. WACC Va

Image transcription text

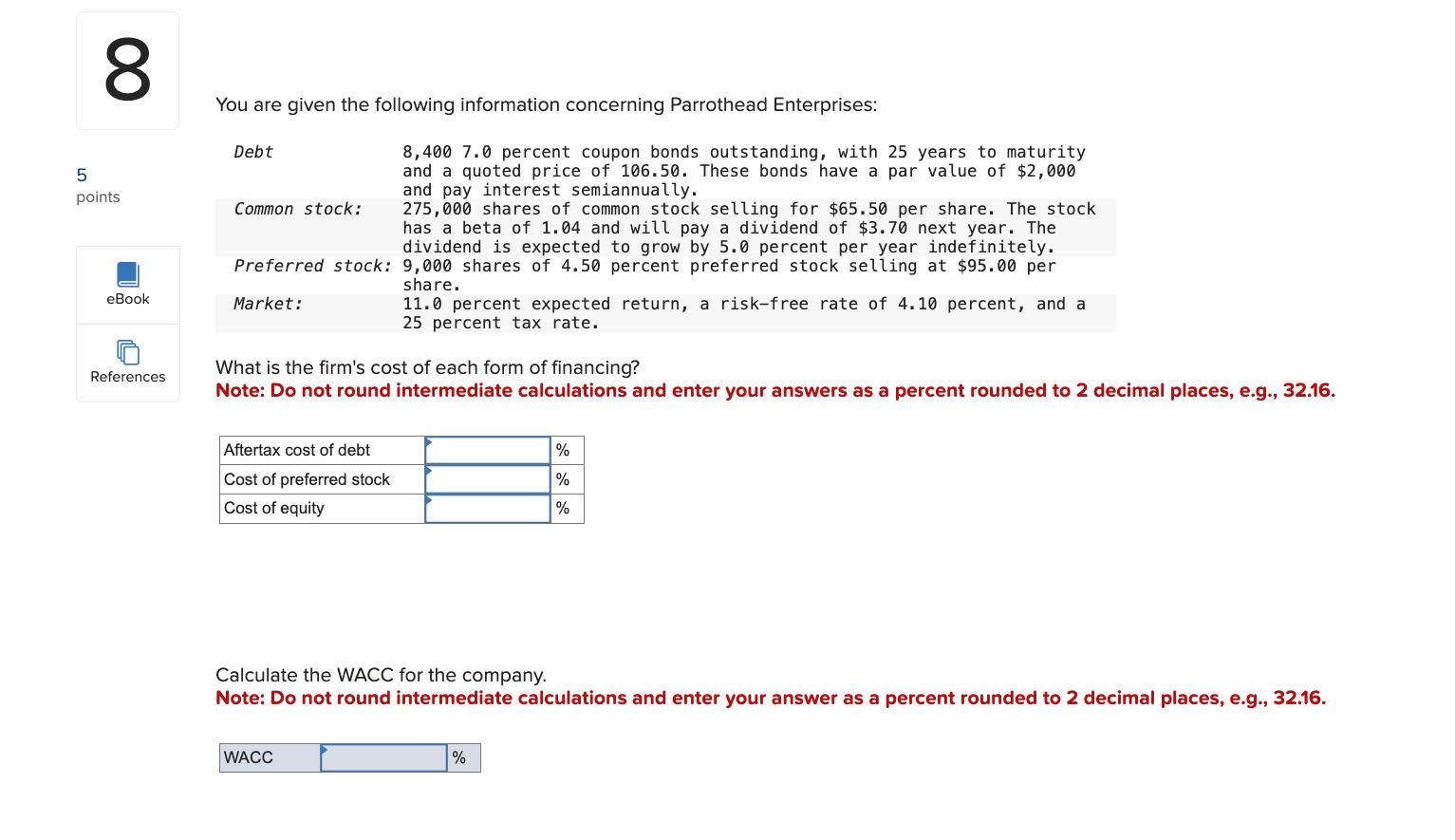

8 You are given the following information concerning Parrothead Enterprises: Debt 8.40. 7.0 percent coupon bonds outstanding, with 25 years to maturity 5 and a quoted price of 106.50. These bonds have a par value of $2,000 paws and pay interest semiannually. Common stock: 275,000 shares of common stock selling for $65.50 per share. The stock has a beta of 1.04 and will pay a dividend of $3.70 next year. The dividend is expected to grow by 5.0 percent per year indefinitely. El Preferred stock: 9,000 shares of 4.50 percent preferred stock selling at $95.00 per 7 share. 9500* Market: 11.0 percent expected return, a riskefree rate of 4.10 percent, and a 25 percent tax rate. ® References What is the firm's cost of each form of financing? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Afiertax cost of debt Cost of preferred stock Cost of equity Calculate the WACC for the company. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. WACC %

Image transcription text

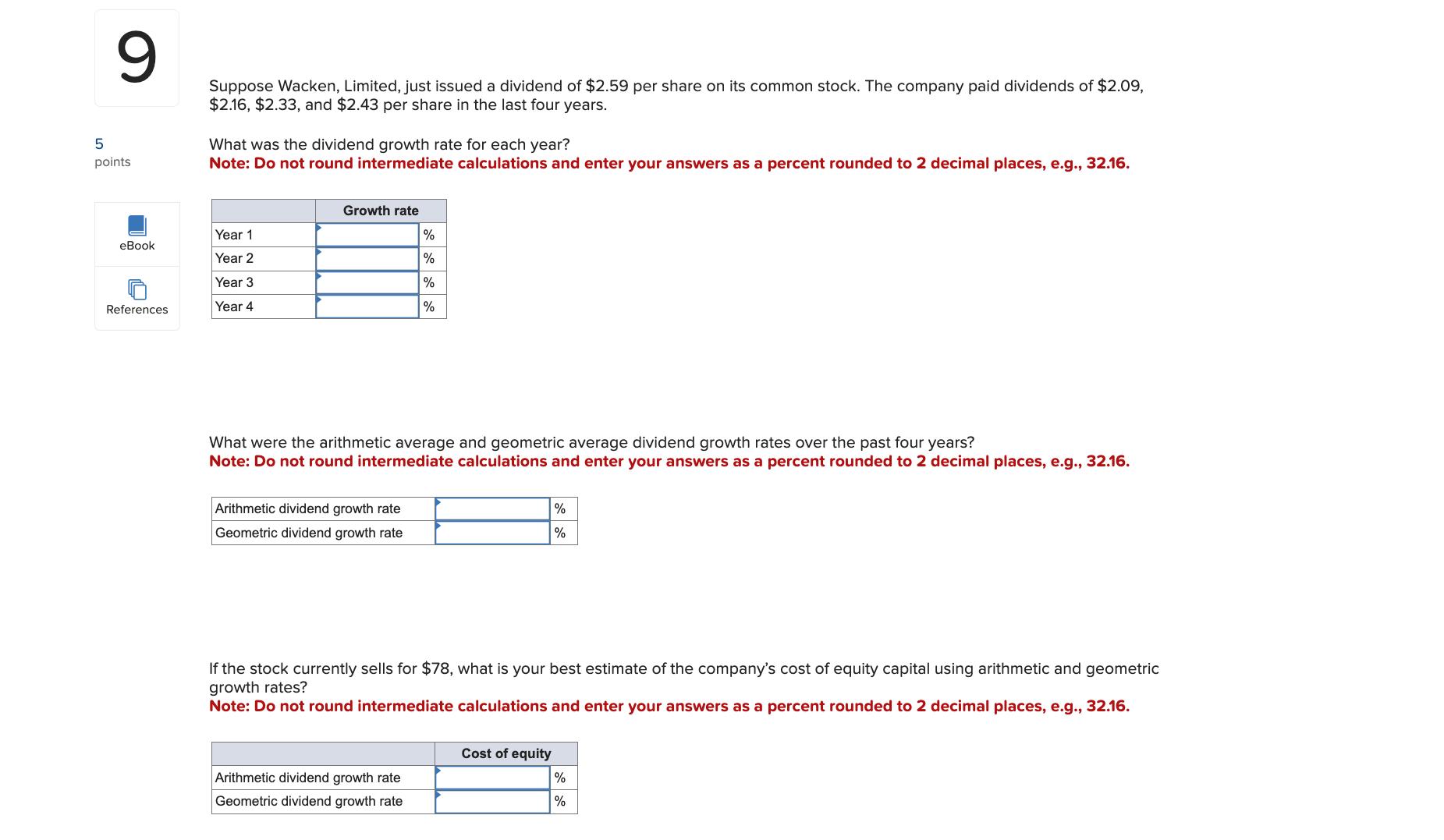

9 Suppose Wacken, Limited, just issued a dividend of $2.59 per share on its common stock. The company paid dividends of $2.09, $2.16, $2.33, and $2.43 per share in the last four years. 5 What was the dividend growth rate for each year? points Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Growth rate Year 1 % eBook Year 2 % Year 3 % References Year 4 What were the arithmetic average and geometric average dividend growth rates over the past four years? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Arithmetic dividend growth rate % Geometric dividend growth rate % If the stock currently sells for $78, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equity Arithmetic dividend growth rate % Geometric dividend growth rate %

Image transcription text

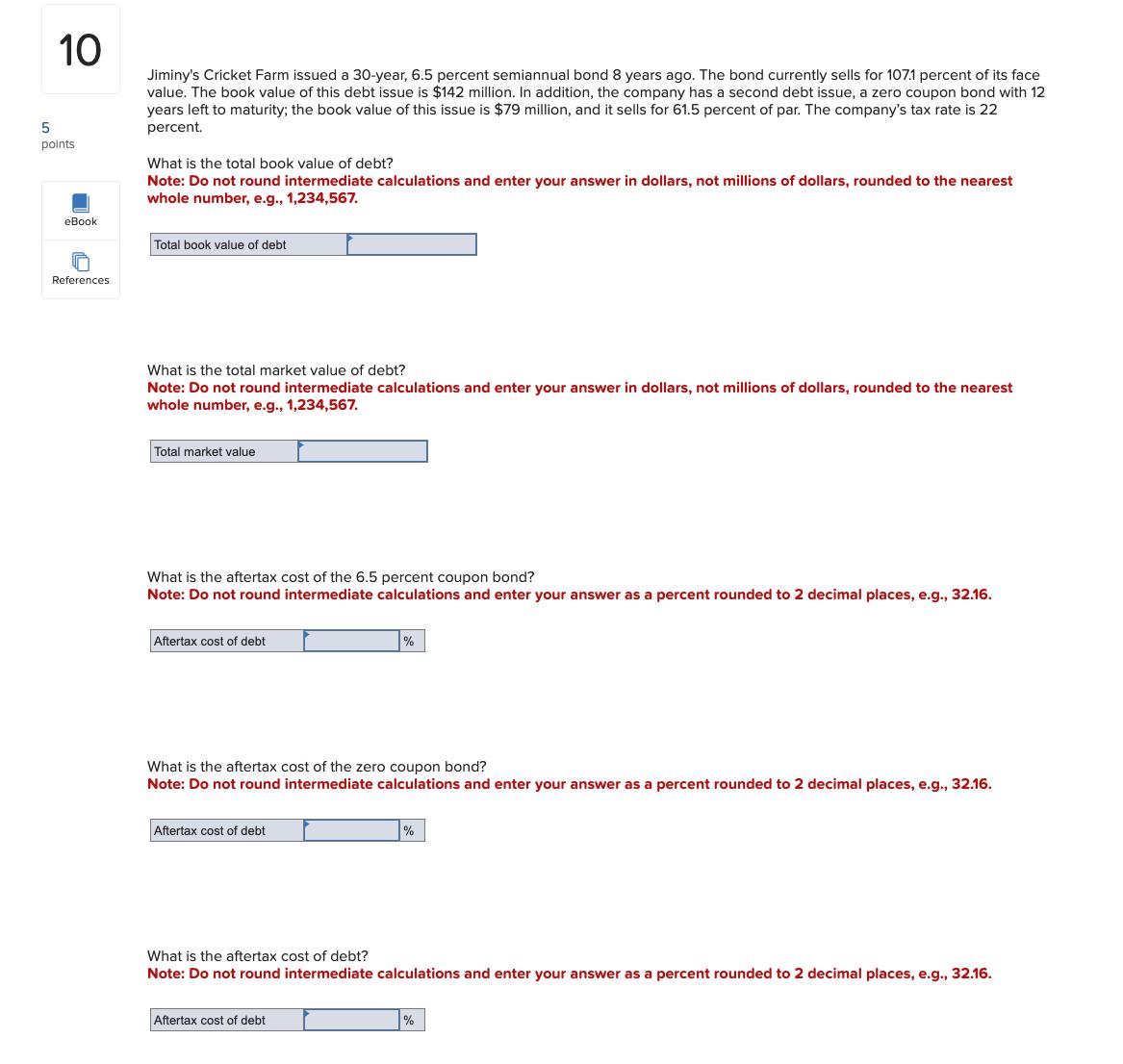

10 Jiminy's Cricket Farm issued a 30-year, 6.5 percent semiannual bond 8 years ago. The bond currently sells for 1071 percent of its face value. The book value of this debt issue is $142 million. In addition, the company has a second debt issue, a zero coupon bond with 12 years left to maturity; the book value of this issue is $79 million, and it sells for 61.5 percent of par. The company's tax rate is 22 5 percent. points What is the total book value of debt? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. eBook Total book value of debt References What is the total market value of debt? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. Total market value What is the aftertax cost of the 6.5 percent coupon bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Aftertax cost of debt % What is the aftertax cost of the zero coupon bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Aftertax cost of debt % What is the aftertax cost of debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Aftertax cost of debt6 Branson Manufacturing has a target debt-equity ratio of .75. Its cost of equity is 10 percent, and its pretax cost of debt is 6 percent. If the tax rate is 22 percent, what is the company's WACC? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 5 points WACC eBook Hint %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started