Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello i did not get an answer to my assignment submission dead line is by 10 october 2021 please kindly help me with it thank

hello i did not get an answer to my assignment

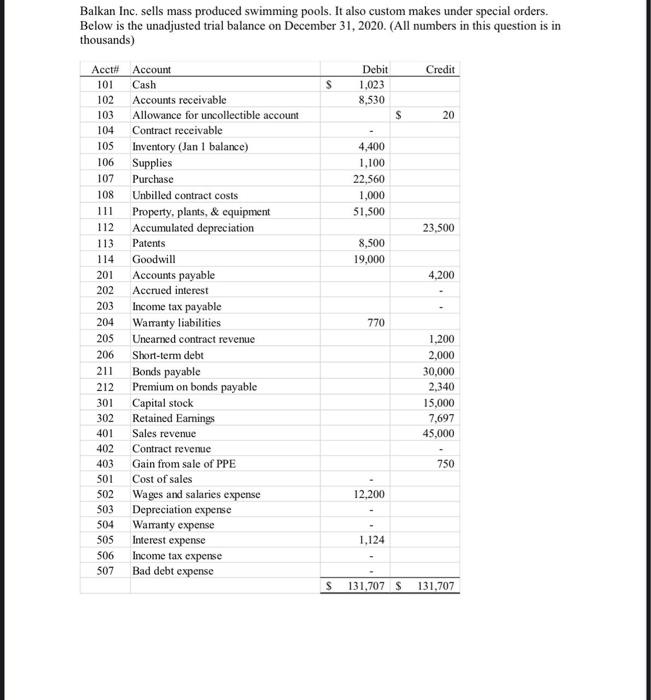

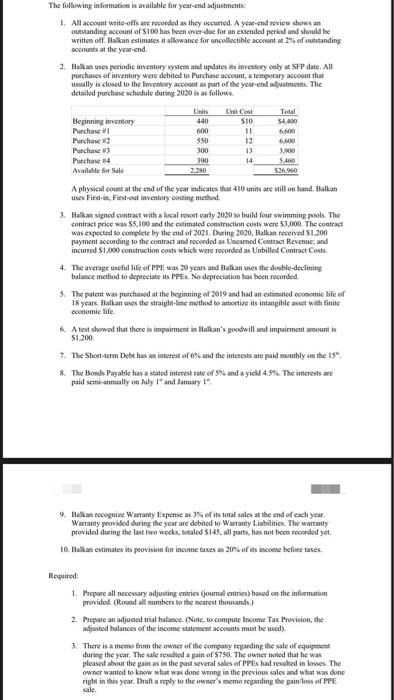

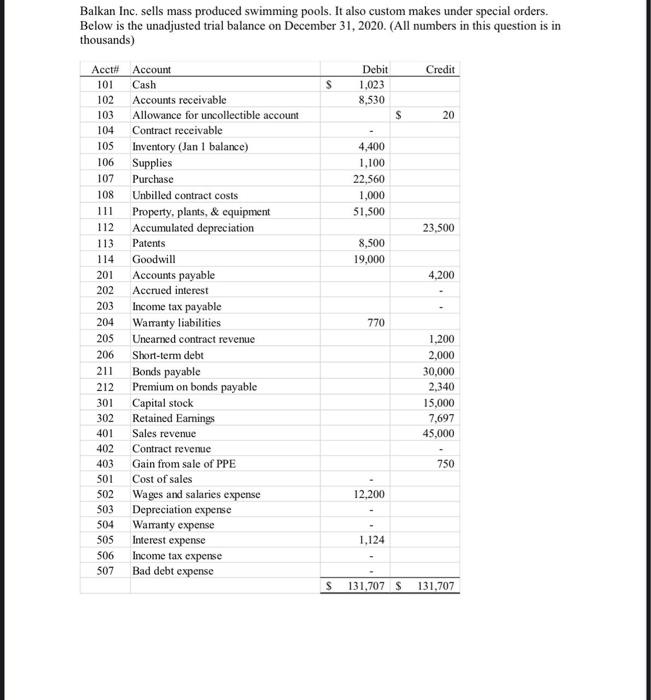

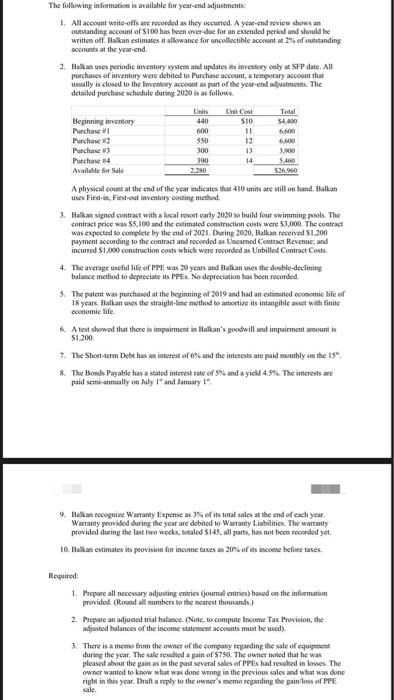

Balkan Inc. sells mass produced swimming pools. It also custom makes under special orders. Below is the unadjusted trial balance on December 31, 2020. (All numbers in this question is in thousands) Credit s Debit 1,023 8,530 S 20 4,400 1.100 22.560 1,000 51,500 23,500 8,500 19,000 4,200 Acct# Account 101 Cash 102 Accounts receivable 103 Allowance for uncollectible account 104 Contract receivable 105 Inventory (Jan 1 balance) 106 Supplies 107 Purchase 108 Unbilled contract costs 111 Property, plants, & cquipment 112 Accumulated depreciation 113 Patents 114 Goodwill 201 Accounts payable 202 Accrued interest 203 Income tax payable 204 Warranty liabilities 205 Unearned contract revenue 206 Short-term debt 211 Bonds payable 212 Premium on bonds payable 301 Capital stock 302 Retained Earnings 401 Sales revenue 402 Contract revenue 403 Gain from sale of PPE 501 Cost of sales 502 Wages and salaries expense 503 Depreciation expense 504 Warranty expense 505 Interest expense 506 Income tax expense 507 Bad debt expense 770 1,200 2.000 30,000 2.340 15,000 7.697 45,000 750 12.200 1.124 S 131,707 S 131,707 The following information is available for year-end adjustments I. All account write-offs are recorded as they occurred. A year-end review shores an outstanding account of 100 has been over due for an extended period and should be written off. Balkan estimates it allowance for uncollectible account at 2% of outstanding accounts at the year-end 2. Balkanuses periodic inventory system and updates its inventory caly SFP date. All purchases of inventory were debited to Purchase account, a temporary account that usually is closed to the Inventory account as part of the year-end adjustments. The detailed purchase schedule during 2030 is as follows 400 Una Cost Total Beginning inventory SIO 54.00 Purchase 600 11 Purchase #2 550 12 6100 Purchase 3 300 13 1.00 Purchase 14 390 14 5.460 Available for Sale 2280 $26.960 A physical count at the end of the year indicates that 410 units are still on hand. Balkan uses First First-out inventory cesting method. Balkan signed contract with a local resort early 2020 to build four swimming pools. The contract price was 55,100 and the estimated construction costs were 53,000. The contract was expected to complete by the end of 2001. During 2020, Balkan received $1.200 payment according to the contract and recorded as beamed Contract Revenue and incurred 1,000 construction costs which were recorded as Unbilled Contract Costs. 4. The average useful life of PPE was 20 years and Balkan uses the double-declining balance method to depreciate its PPE. No depreciation has been recorded 5. The patent was purchased at the beginning of 2019 and had an estimated economic life of 18 years Hallanwes the straight-line method to amortize its intangible act with finite conomic life A test showed that there is impairment in Balkans goodwill and impairment amount is $1.200 1. The Short-term Debt has an interest of 6% and the interests are paid monthlyce the 15" & The Beads Payable has a stated interest rate of 5% and a yield 4.5%. The interests are puid setti-annually on July 1" and January 1 9. Balkan recognise Warranty Expenses 3 of its total sales at the end of each year. Warranty provided during the year are debited to Warranty Liabilities. The warranty provided during the last two weeks, sealed 145, all parts, has not been recorded yet. 10. Halikan estimates its provision for income taxes as 20% of its income before taxes Required 1. Prepare all necessary adjusting entries (joumal entries) based on the information provided (Round all numbers to the nearest thousands) 2. Prepare an adjusted trial balance. (Note, to compute Income Tax Provision, the adjusted balances of the income statement accounts must be used 3.There is a meme from the owner of the company reading the sale of equipment during the year. The sale resulted again of S750. The owner noted that he was pleased about the pain as in the past several sales of PPEs had resulted in losses. The owner wanted to know what was done wrong in the previous sales and what was done right in this year. Draft a reply to the owner's meme regarding the pain loss of PPE sale submission dead line is by 10 october 2021

please kindly help me with it

thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started