hello i did the statement of cash flows just need the operating section redone using the direct method. please and thank you!!

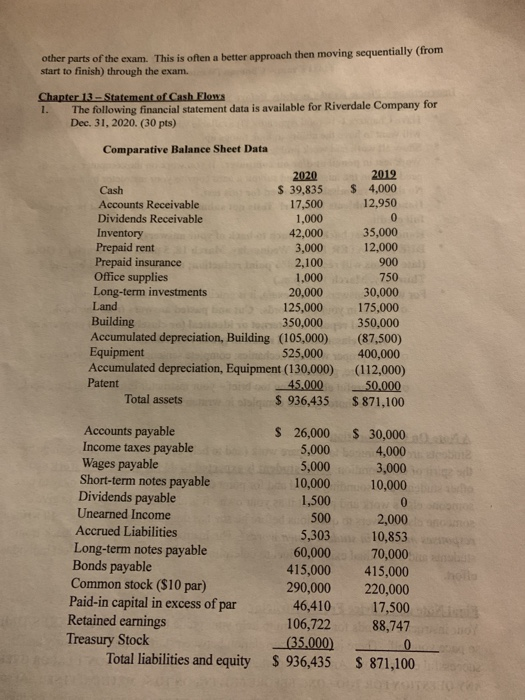

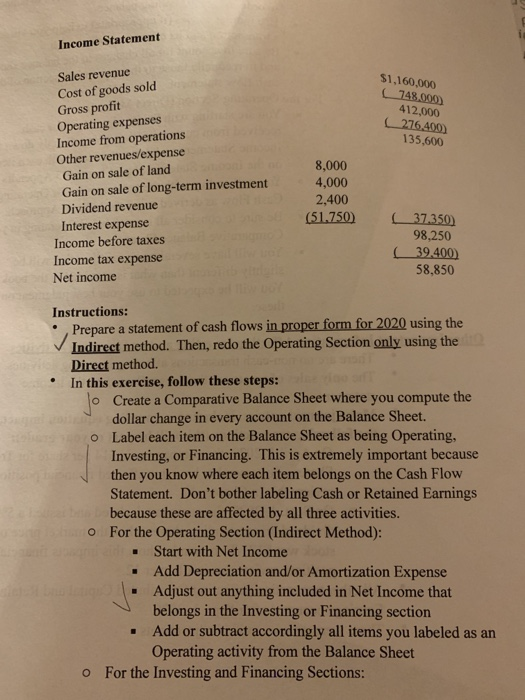

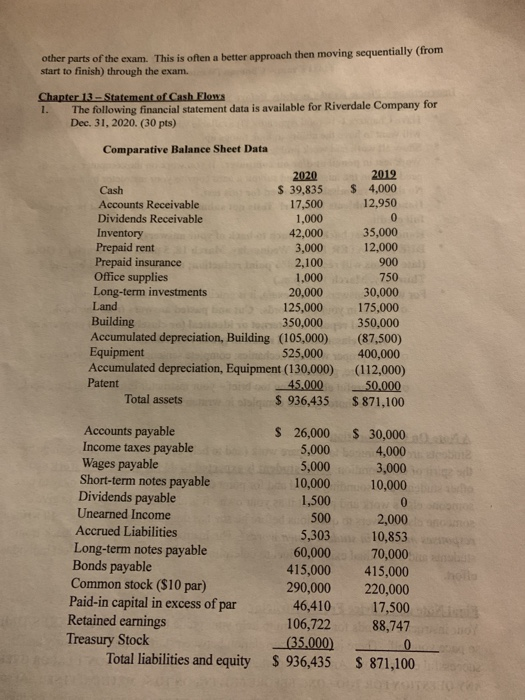

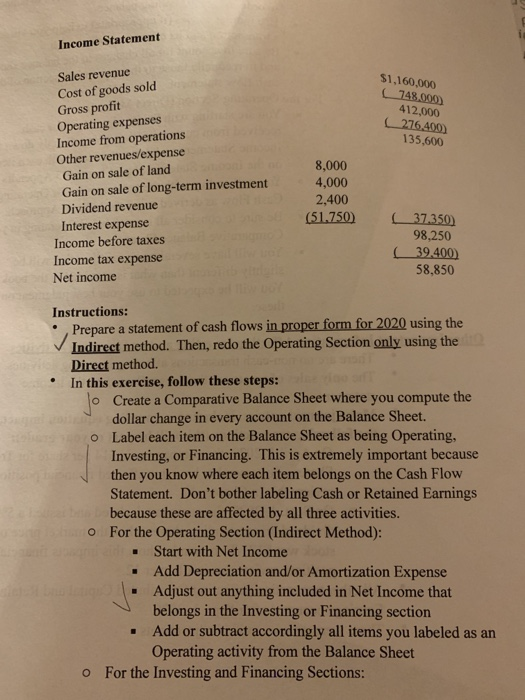

other parts of the exam. This is often a better approach then moving sequentially from start to finish) through the exam. Chapter 13 - Statement of Cash Flows 1. The following financial statement data is available for Riverdale Company for Dec. 31, 2020. (30 pts) Comparative Balance Sheet Data 2020 Cash $ 39,835 Accounts Receivable 17,500 Dividends Receivable 1,000 Inventory 42,000 42,000 Prepaid rent 3,000 Prepaid insurance 2,100 Office supplies 1,000 Long-term investments 20,000 Land 125,000 Building 350,000 Accumulated depreciation, Building (105,000) Equipment 525,000 Accumulated depreciation, Equipment (130,000) Patent 45.000 1 Total assets S 936,435 2019 $ 4.000 12,950 0 35,000 12,000 900 750 30,000 175.000 350,000 (87,500) 400,000 (112,000) 50.000 $ 871,100 $30,000 4,000 3,000 10,000 Accounts payable Income taxes payable Wages payable Short-term notes payable Dividends payable Unearned Income Accrued Liabilities Long-term notes payable Bonds payable Common stock ($10 par) Paid-in capital in excess of par Retained earnings Treasury Stock Total liabilities and equity $ 26,000 5,000 5,000 10,000 1,500 500 5,303 60,000 415,000 290,000 46,410 106,722 (35,000 $ 936,435 2,000 10,853 70,000 415,000 220,000 17,500 88,747 $ 871,100 Income Statement $1,160,000 748.000 412,000 276.400) 135,600 Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Other revenues/expense Gain on sale of land Gain on sale of long-term investment Dividend revenue Interest expense Income before taxes Income tax expense Net income 8,000 4,000 2,400 (51.750 37.350) 98,250 39.400) 58.850 Instructions: Prepare a statement of cash flows in proper form for 2020 using the Indirect method. Then, redo the Operating Section only using the Direct method. In this exercise, follow these steps: o Create a Comparative Balance Sheet where you compute the dollar change in every account on the Balance Sheet. o Label each item on the Balance Sheet as being Operating, Investing, or Financing. This is extremely important because then you know where each item belongs on the Cash Flow Statement. Don't bother labeling Cash or Retained Earnings because these are affected by all three activities. For the Operating Section (Indirect Method): Start with Net Income Add Depreciation and/or Amortization Expense Adjust out anything included in Net Income that belongs in the Investing or Financing section Add or subtract accordingly all items you labeled as an Operating activity from the Balance Sheet o For the Investing and Financing Sections