Question

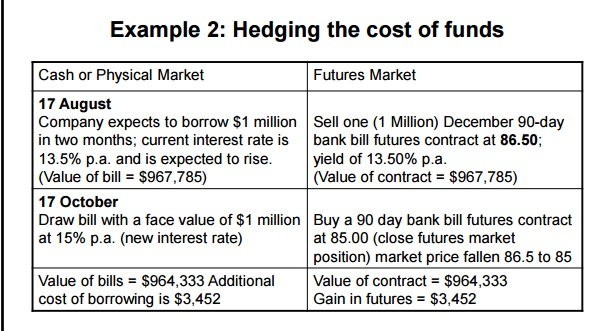

Hello, I have a few issues undersatnding this example an I would appreciate a bit of help please. Where it says in the bottom left

Hello, I have a few issues undersatnding this example an I would appreciate a bit of help please.

Where it says in the bottom left Valuue of bills = $964,333 Additional cost...I don't understand why is there a cost? Also I don't get where they got the value of $3,452

In the right-hand column, they say "Sell one (1 Million) December 90-day bank bill futures contract at 86.50;"...my question here is where did they get the 86.50 value? Is it only picked up just as a fictive number for this example?

Also, where they say: "Buy a 90 day bank bill futures contract at 85.00 (close futures market position) market price fallen 86.5 to 85"...wher did they get the 85 from?

And also, the last one is: "Value of contract = $964,333 Gain in futures = $3,452"...my question is why here this number is a gain? I also don't know how they got the value $3,452

Thank you very much!

PS - There is no discounting factor given in the question, it's all that it is right there. Thanks

Example 2: Hedging the cost of funds Cash or Physical Market Futures Market 17 August Company expects to borrow $1 million Sell one (1 Million) December 90-day in two months; current interest rate is bank bill futures contract at 86.50 13.5% p.a. and is expected to rise yield of 13.50% p.a. (Value of contract $967,785) (Value of bill $967,785) 17 October Draw bill with a face value of $1 million Buy a 90 day bank bill futures contract at 15% p.a. (new interest rate) at 85.00 (close futures market position) market price fallen 86.5 to 85 Value of bills J $964,333 Additional Value of contract J $964,333 Gain in futures $3,452 cost of borrowing is $3,452Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started