Hello, I have provided a question, please answer the the question completely. I have provided information from link that is relevant for answering the question.

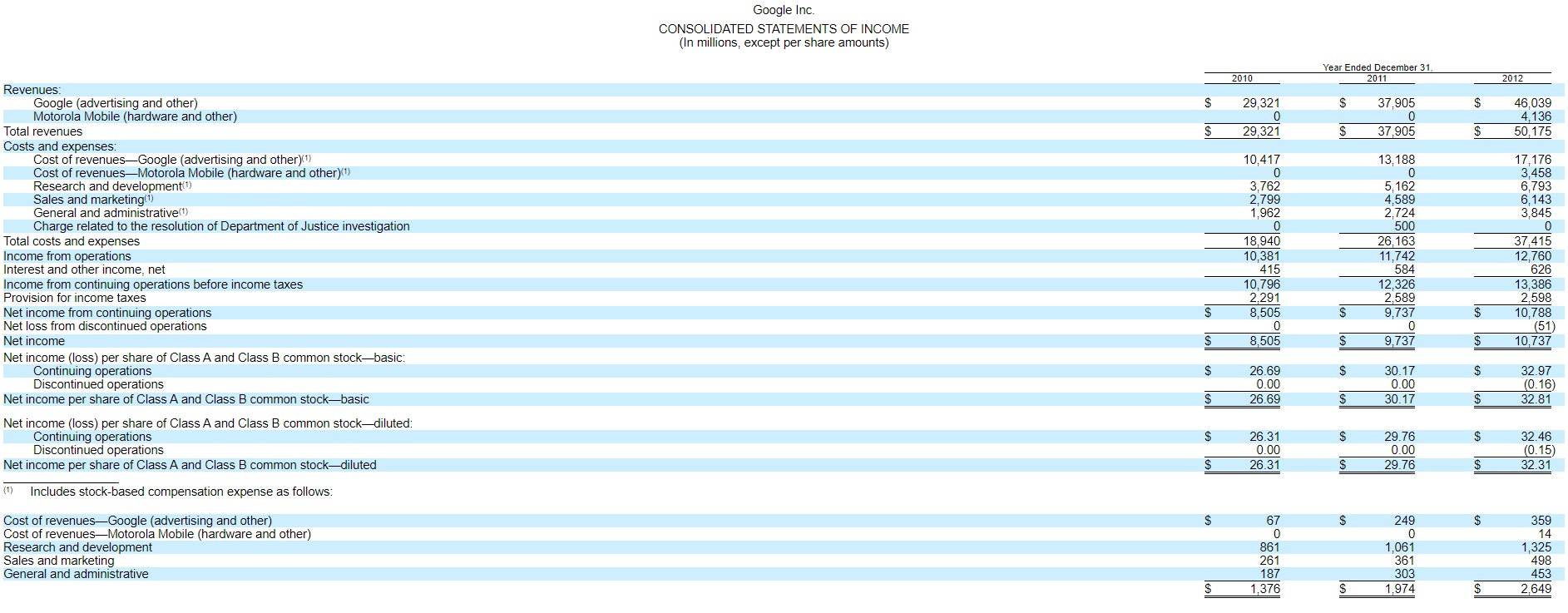

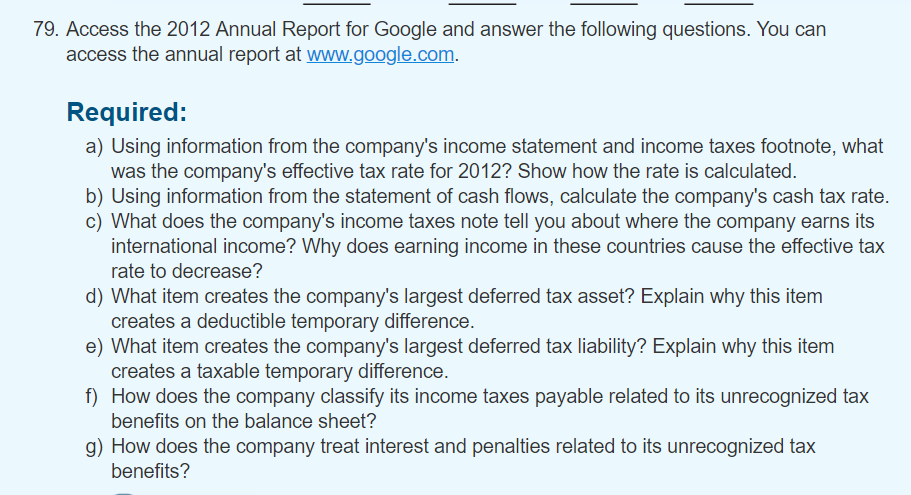

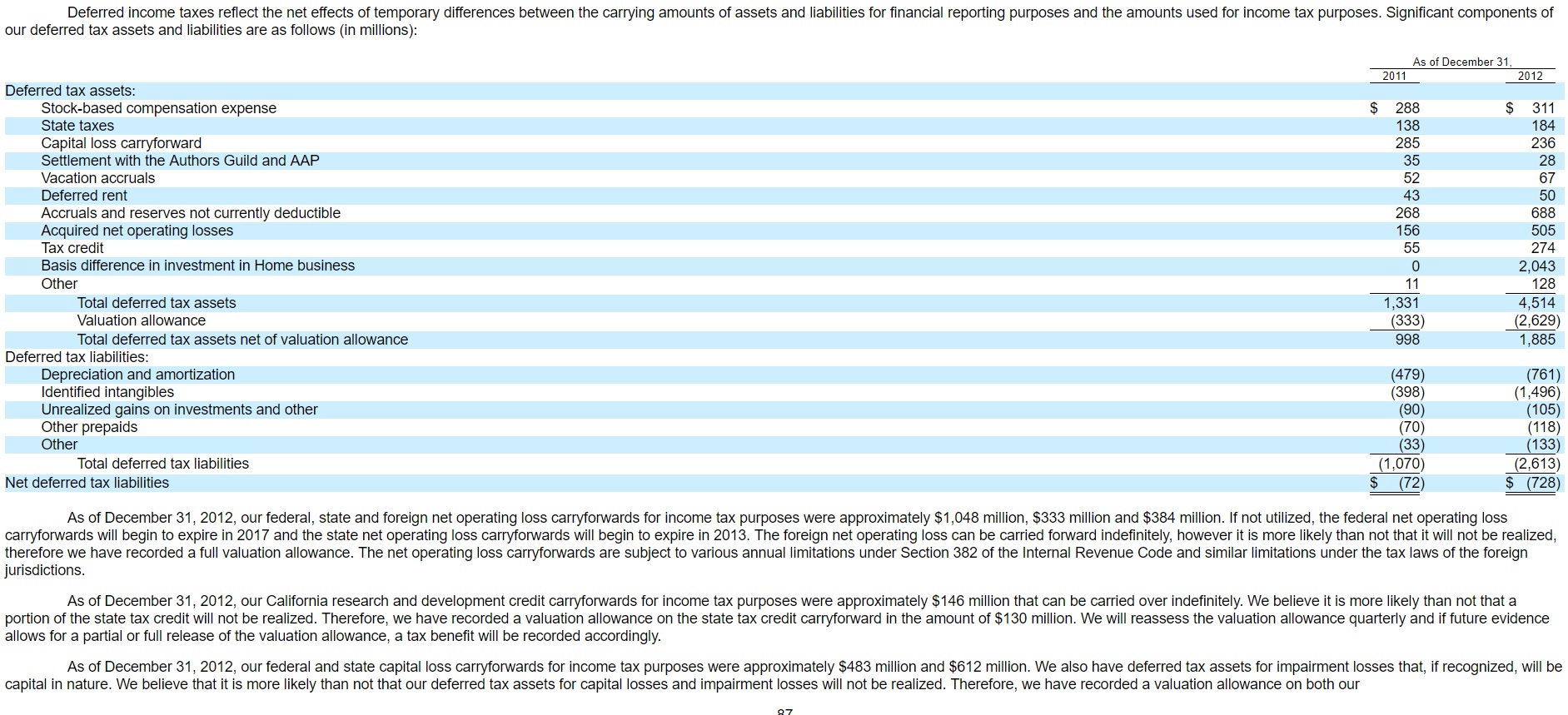

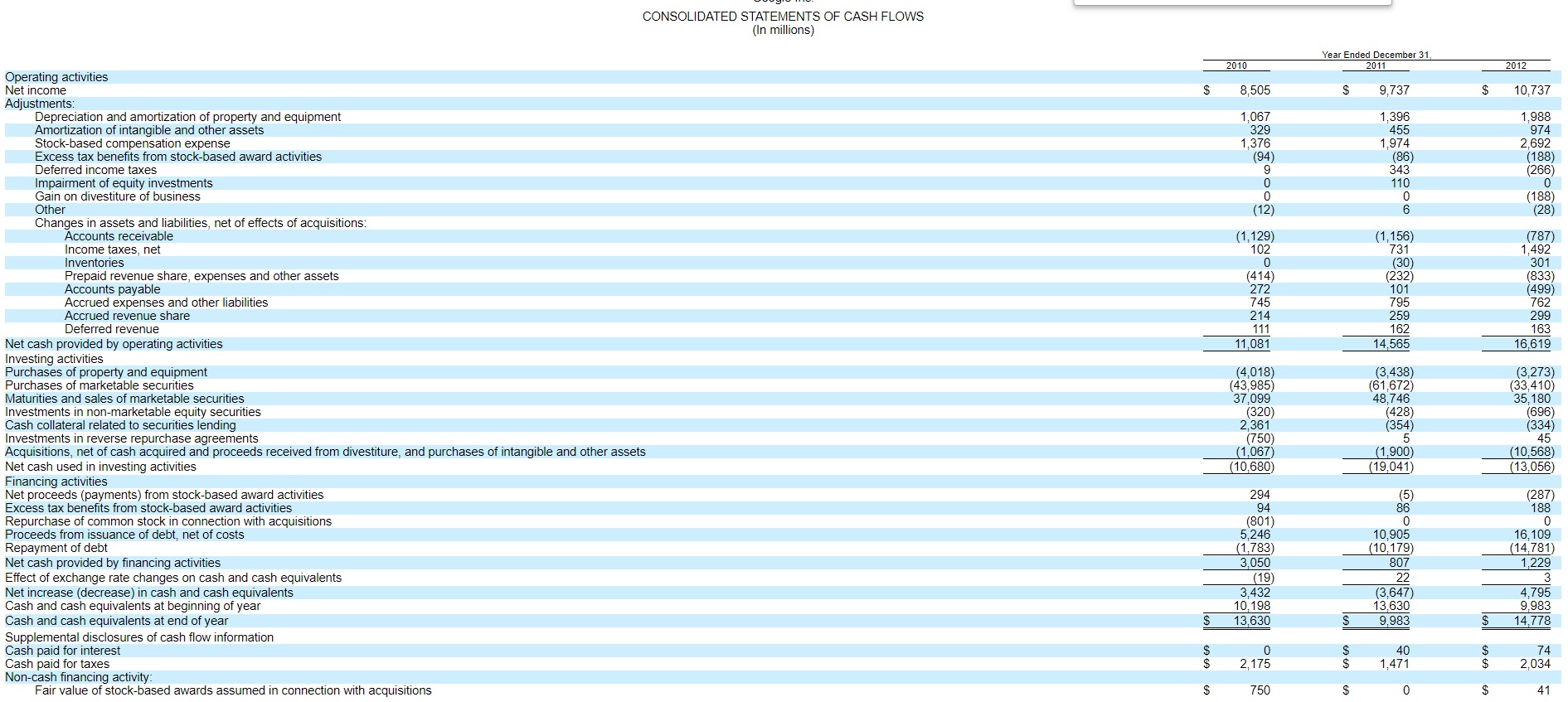

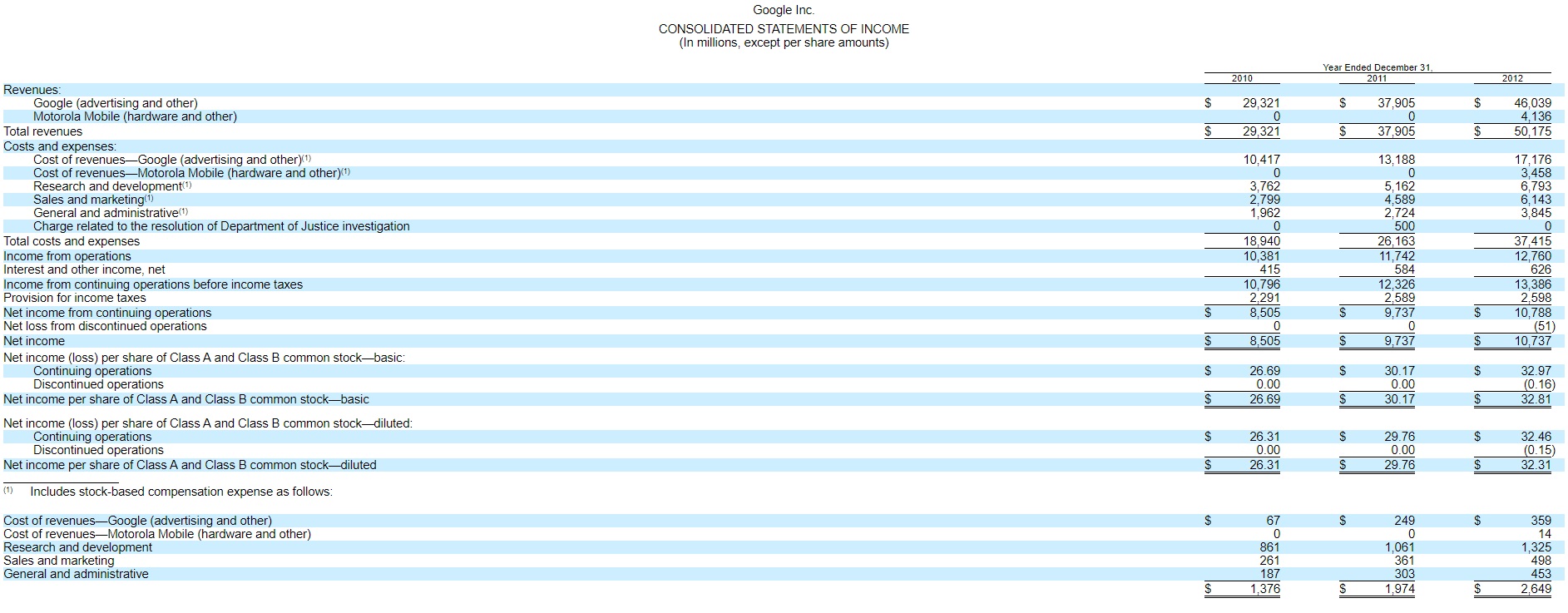

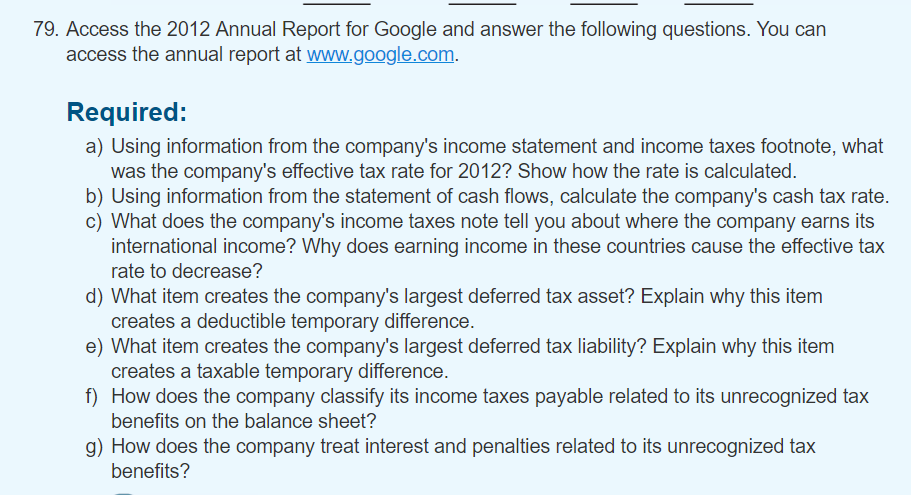

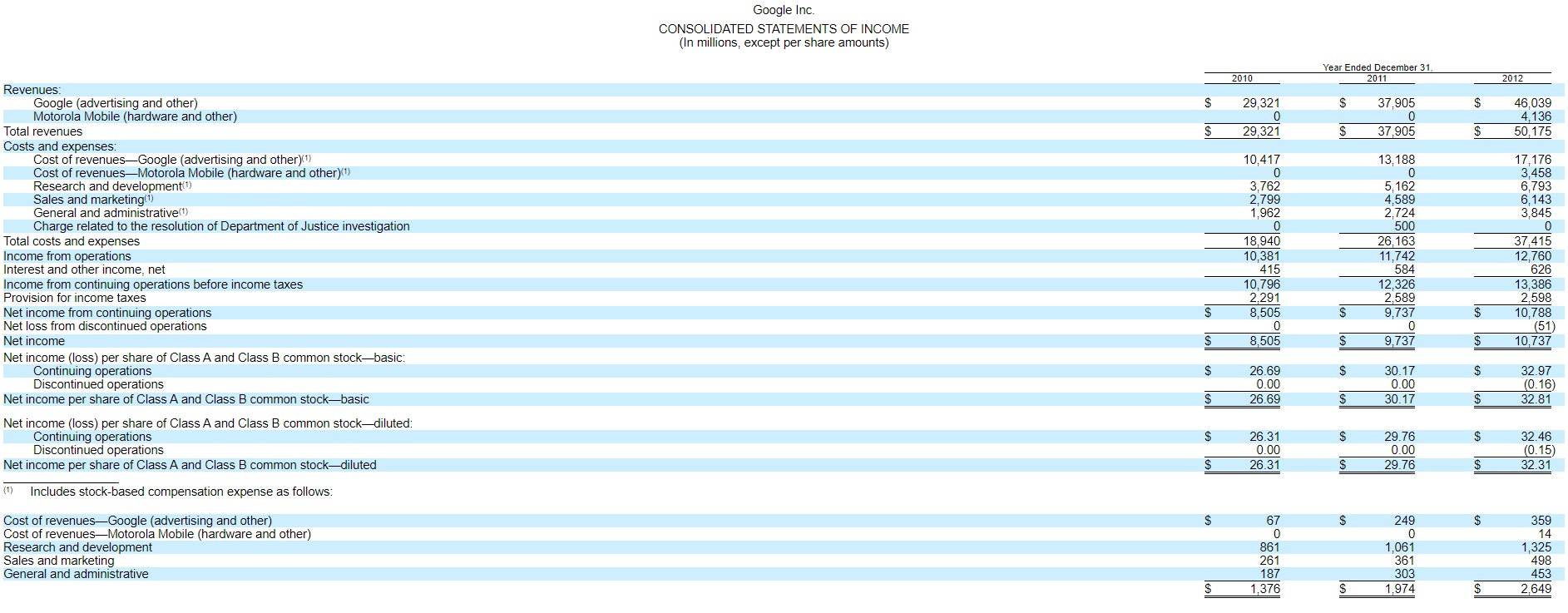

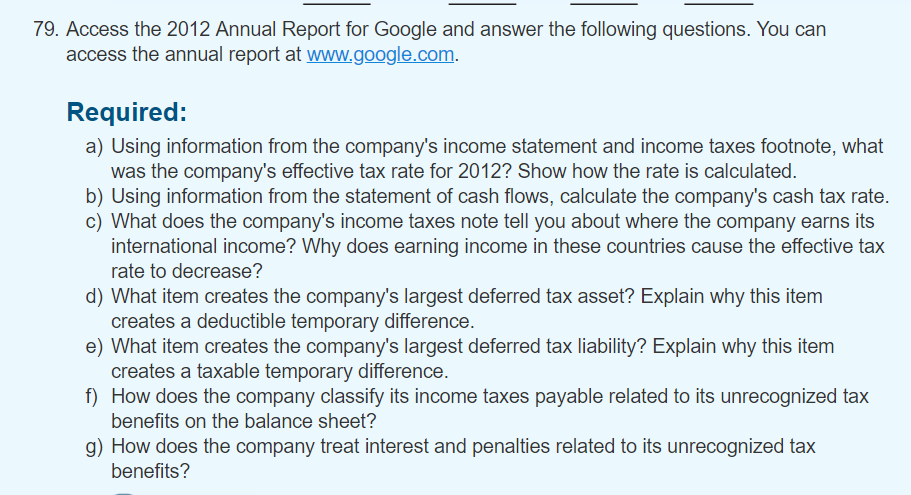

Deferred income taxes reect the net effects of temporary differences between the carrying amounts of assets and liabilities for nancial reporting purposes and the amounts used for income tax purposes. Signicant components of our deferred tax assets and liabilities are as follows (in millions): As at December 31, 2011 2012 Deferred tax assets: Stock-based compensation expense $ 288 $ 311 State taxes 138 184 Capital loss mrryforward 285 236 Settlement with the Authors Guild and AAP 35 28 Vacation accruals 52 67 Deferred rent 43 50 Accruals and reserves not currently deductible 268 6813 Acquired net operating losses 156 505 Tax credit 55 274 Basis difference in investment in Home business 0 2,043 Other 11 1 28 Total deferred tax assets 1,331 4,514 Valuation allowance (333) (2,529) Total deferred tax assets net of valuation allowance 998 1,885 Deferred tax liabilities: Depreciation and amortization (479) (761) Identied intangibles (393) (1 ,496) Unrealized gains on investments and other (90) (105) Other prepaids (70) (118) Other (33) (133) Total deferred tax liabilities (1,070) (2,613) Net deferred tax liabilities s (72) s (728) As of December 31, 2012, our federal, state and foreign net operating loss carryforwards for income tax purposes were approximately $1,048 million, $333 million and $384 million. If not utilized, the federal net operating loss oarryforwards will begin to expire in 201T and the stale net operating loss carryforwards will begin to expire in 2013. The foreign net operating loss can be carried forward indenitely, however it is more likely than not that it will not be realized, therefore we have recorded a full valuation allowance. The net operating loss carryfonivards are subject to various annual limitations under Section 362 of the Internal Revenue Code and similar limitations under the tax laws of the foreign jurisdictions. As of December 31, 2012, our California research and development credit carryfonivards for income tax purposes were approximately $146 million that can be carried over indenitely. We believe it is more likely than not that a portion of the state tax credit will not be realized. Therefore, we have recorded a valuation allowance on the state tax credit carryfonivard in the amount of $130 million. We will reassess the valuation allowance quarterly and if future evidence allows for a partial or full release of the valuation allowance, a tax benet will be recorded accordingly. M of December 31, 2012, our federal and state capital loss oarryforwards for income tax purposes were approximately $483 million and $612 million. We also have deterred tax assets for impairment losses that, it recognized, will be capital in nature. We believe that it is more likely than not that our deferred tax assets for capital losses and impairment losses will not be realized. Therefore, we have recorded a valuation allowance on both our 9-: CONSOLIDATED STATEMENTS OF CASH FLOWS ( In milions ) Year Ended December 3 Operating activities Net income 8 9737 Adjustments Depreciation and amortization of property and equipment Amortization of intangible and other as Stock - based compensation expen Excess tax benefits from stock - based award activities Deferred income taxes Impairment of equity investment Gain on divestiture of business Changes in asset Sand liabilities , net of effects of acquisitions Accounts receivable income taxes net Inventories Prepaid revenue share , expenses and other assets Accounts payable Accrued expenses and other liabilities avenue share Deterred revenue Net cash provided by operating activities Investing activities Purchases of property and equipment Purchases of marketable securities (43 985) ( 61 672 ) (33 410) Maturities and sales of marketable securities Investments in non- marketable equity securities Cash collateral related to securities lending ( 890 ) Investments in reverse repurchase agreements Acquisitions , net of cash acqu red and proceeds received from divestiture and purchases of intang ases of intangible and other asset Net cash used in investing activities Financing activities Net proceeds ( payments ) from stock - based award activities Excess tax benefits from stock - based award activities Repurchase of common stock in connection with acquisitions Proceeds from issuance of debt net of costs Repayment of debt Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalents Net increase ( decrease ) in cash and cash equivalents Cash and cash cauive equivalents at beginning of yea Cash and cash equivalents at end of year Supplemental disclosures of cash flow information Cash paid for interest Cash paid for taxes 8 1471 Non cash financing activity Fair value of stock - based awards assumedGoogle Inc CONSOLIDATED STATEMENTS OF INCOME ( In millions , except per share amounts ) ear Ended December 35 Revenues Google ( advertising and other ) 5 37 905 Motorola Mobile ( hardware and other ) Total revenues Costs and expenses Cost of revenues - Google . ( advertising and other ) Cast of revenues Motorola Mobile ( hardware and other ) . " Research and development Sales and marketing" General and administrative Charge related to the resolution of Department o of Justice investigation Total costs and expenses Income from operations Interest and other income Income from continuing operations before fore income taxes Provision for income taxes Net income from continuing operations Net loss from discontinued operations Net income Net income ( loss ) per share of Class A and Class B common stock - basic Continuing operations Discontinued operations Net income per sha share of Class A and Class B common stock - basic Net income ( loss ) per share of Class A lass A and Class B common stock - diluted Continuing operations Discontinued operations Net income per share of Class A and Class B common stock - diluted Includes stock -based compensation expense as follows Cost of revenues - Google ( advertising and other ) Cost of revenues- Motorola Mobile ( hardware and other ) Research and development Sales and marketing General and administrative7'9. Access the 2012 Annual Report for Google and answer the following questions. You can access the annual report at www.go_ogle.com. Required: a} Using information from the company's income statement and income taxes footnote, what was the company's effective tax rate for 2012? Show how the rate is calculated. b} Using information from the statement of cash ows, calculate the company's cash tax rate. c} What does the company's income taxes note tell you about where the company earns its international income? Why does earning income in these countries cause the effective tax rate to decrease? cl} What item creates the company's largest deferred tax asset? Explain why this item creates a deductible temporary difference. e} What item creates the company's largest deferred tax liability? Explain why this item creates a taxable temporary difference. f) Howr does the company classify its income taxes payable related to its unrecognized tax benets on the balance sheet? Q} How does the company treat interest and penalties related to its unrecognized tax benets