Question

Hello, I just need help correcting my December's worksheet and Making a General Ledger from the following transactions: ---------------------------------------------------------------------------------------------------------- At the beginning of December, Madison

Hello,

I just need help correcting my December's worksheet and Making a General Ledger from the following transactions:

----------------------------------------------------------------------------------------------------------

At the beginning of December, Madison finds out that Batter Blender Supply Co. has raised the cost of their mixers to $615 each, so she will only make one more purchase from them this month. She was lucky enough to find comparable mixers at Garcia Co., a local manufacturer, so she has signed a contract to buy mixers from them this month. Garcia Co. also has a $610 cost for each mixer. She still plans to sell them for $ 1,200. Madison is running out of storage space in her small apartment, so she decides to rent a small office space to hold all of her supplies and inventory. Rent is due at the beginning of each month.

The following transactions occurred during the month of December.

Dec. 1 Paid $700 rent for the month of December. Check 166.

2 Purchased three mixers on account from Batter Blender Supply Co. for $1,845, terms n/30.

4 Paid $45 freight for the December 2 purchase. Check 167.

6 Sold three mixers for $3,600 on account to Seafood Shack, invoice 1012, terms n/30.

7 Bought four mixers on account from Garcia Co. for $2,440, terms n/30.

8 Collected the amount due from Peter's Pastries for the November 23 transaction.

Corresponding Transaction for November 23rd:

Three mixers are sold to Peter's Pastries on account for $3,600, terms n/30. Invoice 1011.

(Hint: You must record both the revenue and expense components on all sales transactions.)

The rest of December's Transactions--

9 Returned one of the mixers purchased on Dec 7th because it was damaged during shipping. Garcia Co. issues Sweet Treats credit for the cost of the mixer.

10 Paid Batter Blender the amount due for the December 2 purchase. Check 168.

12 Bought three mixers on account from Garcia Co. for $1,830, terms n/30.

13 Paid $45 freight for the December 7 purchase. Check 169.

16 Three mixers are sold on account for $3,600 to the Chop House, invoice 1013, terms n/30.

16 One mixer is sold to a new customer, Bagel Depot, on account for $1,200, invoice 1014, terms n/30.

18 Paid a $75 cell phone bill for December. Check 170.

19 Paid $45 freight for items received on the December 12 purchase. Check 171.

20 Taught a 3hr cupcake making class at Winslow Sweets for $150 per hour. Winslow Sweets paid in full at the end of the class.

20 Paid Garcia Co. the amount due for the December 7 purchase. Check 172.

20 Collected the amount due from Chop House for the December 16 transaction.

21 Purchased baking supplies for $350 cash. Check 173.

23 Issued a check to Madison's assistant for $960 for the first two weeks in December. Check 174.

23 Two mixers are sold on account for $2,400 to the Chop House, invoice 1015, terms n/30.

24 Taught a 2hr holiday cookie workshop at Young Souls, the local senior center. Madison offered her workshop at a discounted price of $50 per hour. She left invoice 1016 with the director of Young Souls after the workshop.

26 Collected the amount due from Bagel Depot for the December 16 transaction.

27 Madison withdrew $1,200 cash for personal use. Check 175.

As of December 31, the following adjusting entry data is available.

1. Accrued utilities total $340 for the current month.

2. Another month's worth of depreciation needs to be recorded on the baking equipment.

3. A count reveals that $135 of baking supplies are remaining in the supply room.

4. Another month's worth of insurance has expired.

5. Madison owes her assistant $960 for the last two weeks of December, but will not pay it until January 2.

6. Madison records another month of accrued interest on her grandma's loan.

At year end, Madison completes all the financial statements and closes out the year. Madison is making huge strides in her entrepreneurship program by starting up Sweet Treats and she cannot thank her friends and family enough for all their support. In the new year, Madison intends on continuing to sell mixers and provide classes on multiple baking needs. She is even considering attending culinary classes at CNM to learn new things she can incorporate into her business.

October's Adjustments:

1. A count reveals that $45 of baking supplies were used during October.

2. Madison estimates that her baking equipment depreciates $10 per month.

3. Madison has decided to accrue the interest each month just to be sure her books correctly reflect what needs to be repaid. She will accrue a full month's interest in October, since she wouldn't even be off the ground without her grandma's help.

4. Madison had a friend assist her with the Newbury Elementary School class. She decides to hire her friend as an employee. She owes her $45 for the October 30 class, that she will pay on November 15.

November's Adjustments:

1. A count of baking supplies reveals that none were used in November.

2. Another month's worth of depreciation needs to be recorded on the baking equipment bought in October.

3. One month's worth of insurance has expired.

Madison records another month of accrued interest on her grandma's loan

Thank you so much :)

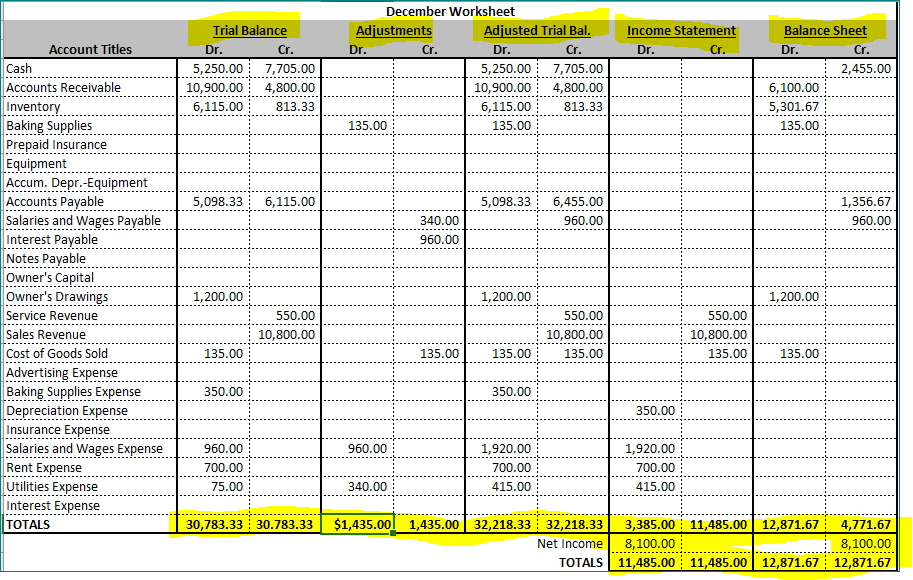

Income Statement Dr. Cr. Trial Balance Dr. Cr. 5,250.00 7,705.00 10,900.00 4,800.00 6,115.00 813.33 December Worksheet Adjustments Adjusted Trial Bal. Dr. Cr. Dr. Cr. 5,250.00 7,705.00 10,900.00 4,800.00 6,115.00 813.33 135.00 135.00 Balance Sheet Dr. Cr. 2,455.00 6,100.00 5,301.67 135.00 5,098.33 6,115.00 5,098.33 6,455.00 960.00 1,356.67 960.00 340.00 960.00 Account Titles Cash Accounts Receivable Inventory Baking Supplies Prepaid Insurance Equipment Accum. Depr.-Equipment Accounts Payable Salaries and Wages Payable Interest Payable Notes Payable Owner's Capital Owner's Drawings Service Revenue Sales Revenue Cost of Goods Sold Advertising Expense Baking Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense Rent Expense Utilities Expense Interest Expense TOTALS 1,200.00 1,200.00 1,200.00 550.00 10,800.00 550.00 10,800.00 135.00 550.00 10,800.00 135.00 135.00 135.00 135.00 135.00 350.00 350.00 350.00 960.00 960.00 700.00 75.00 1,920.00 700.00 415.00 1,920.00 700.00 415.00 340.00 30,783.33 30.783.33 $1,435.00! 1,435.00 32,218.33 32,218.33 3,385.00 11,485.00 12,871.67 4,771.67 Net Income 8,100.00 8,100.00 TOTALS 11,485.00 11,485.00 12,871.67 12,871.67 Income Statement Dr. Cr. Trial Balance Dr. Cr. 5,250.00 7,705.00 10,900.00 4,800.00 6,115.00 813.33 December Worksheet Adjustments Adjusted Trial Bal. Dr. Cr. Dr. Cr. 5,250.00 7,705.00 10,900.00 4,800.00 6,115.00 813.33 135.00 135.00 Balance Sheet Dr. Cr. 2,455.00 6,100.00 5,301.67 135.00 5,098.33 6,115.00 5,098.33 6,455.00 960.00 1,356.67 960.00 340.00 960.00 Account Titles Cash Accounts Receivable Inventory Baking Supplies Prepaid Insurance Equipment Accum. Depr.-Equipment Accounts Payable Salaries and Wages Payable Interest Payable Notes Payable Owner's Capital Owner's Drawings Service Revenue Sales Revenue Cost of Goods Sold Advertising Expense Baking Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense Rent Expense Utilities Expense Interest Expense TOTALS 1,200.00 1,200.00 1,200.00 550.00 10,800.00 550.00 10,800.00 135.00 550.00 10,800.00 135.00 135.00 135.00 135.00 135.00 350.00 350.00 350.00 960.00 960.00 700.00 75.00 1,920.00 700.00 415.00 1,920.00 700.00 415.00 340.00 30,783.33 30.783.33 $1,435.00! 1,435.00 32,218.33 32,218.33 3,385.00 11,485.00 12,871.67 4,771.67 Net Income 8,100.00 8,100.00 TOTALS 11,485.00 11,485.00 12,871.67 12,871.67Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started