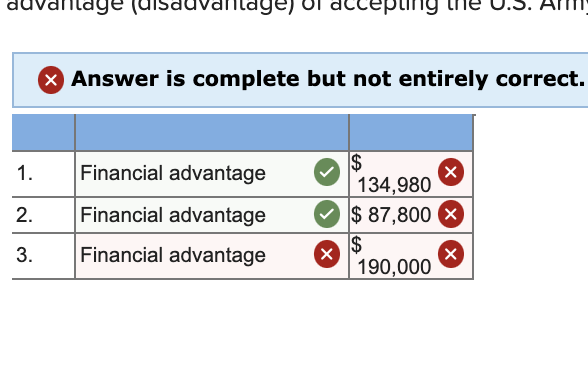

HELLO, I JUST ONE TO GET ANSWER TO SOME SPECIFIC ( some sections of certain questions) QUESTIONS!! i HAVE ANSWER THEN BEFORE IN CHEGG, BUT THEY WERE NOT CORRECT... I WILL TRYE AGAIN...

These are the questions ( WWhat you see in RED)

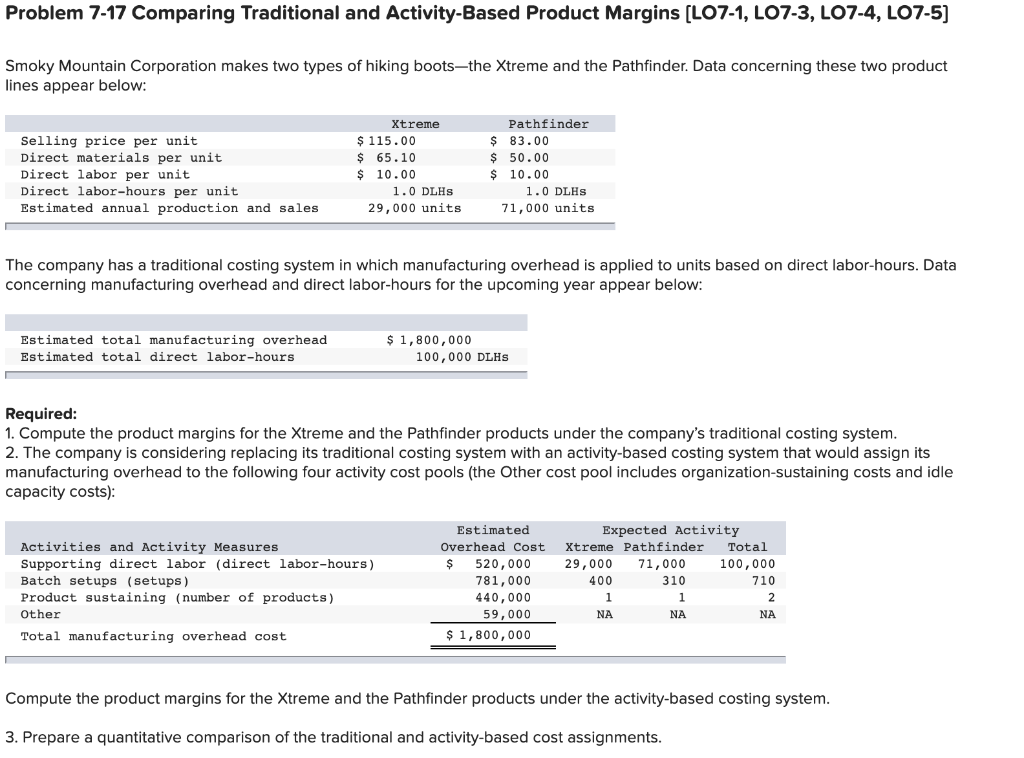

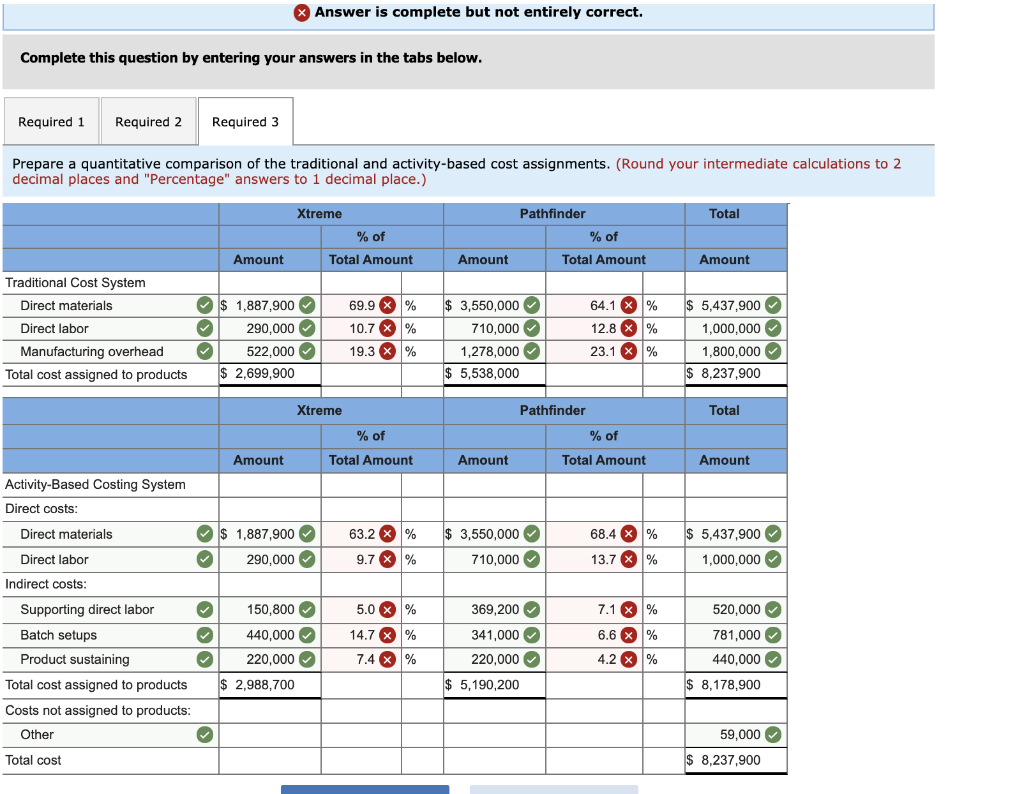

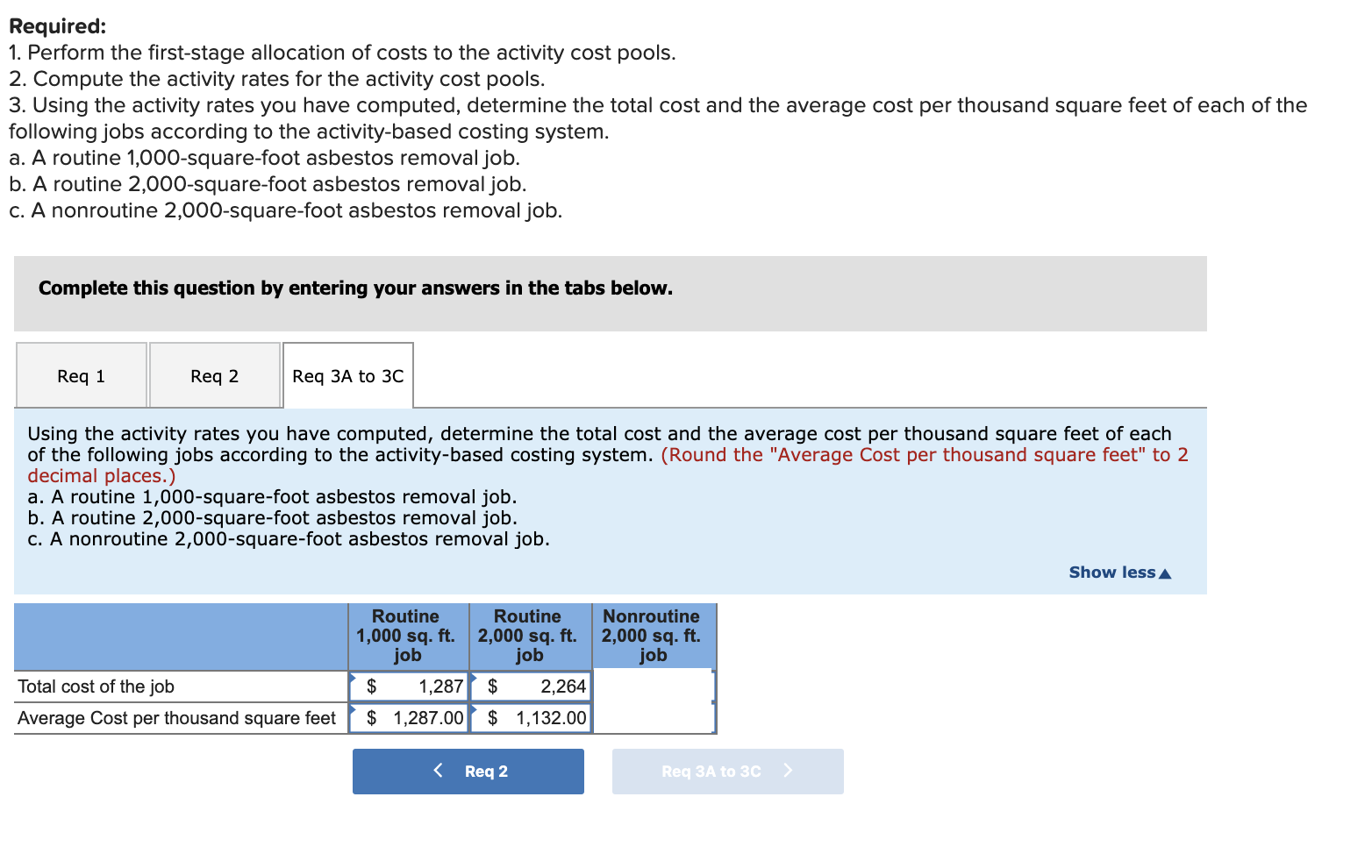

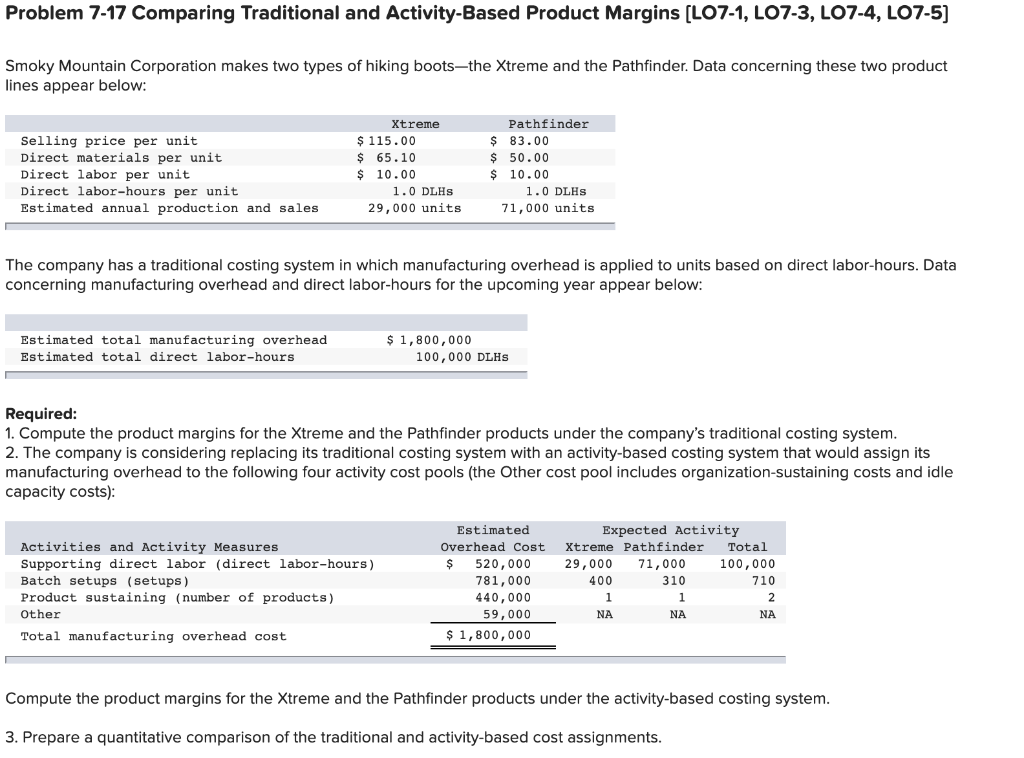

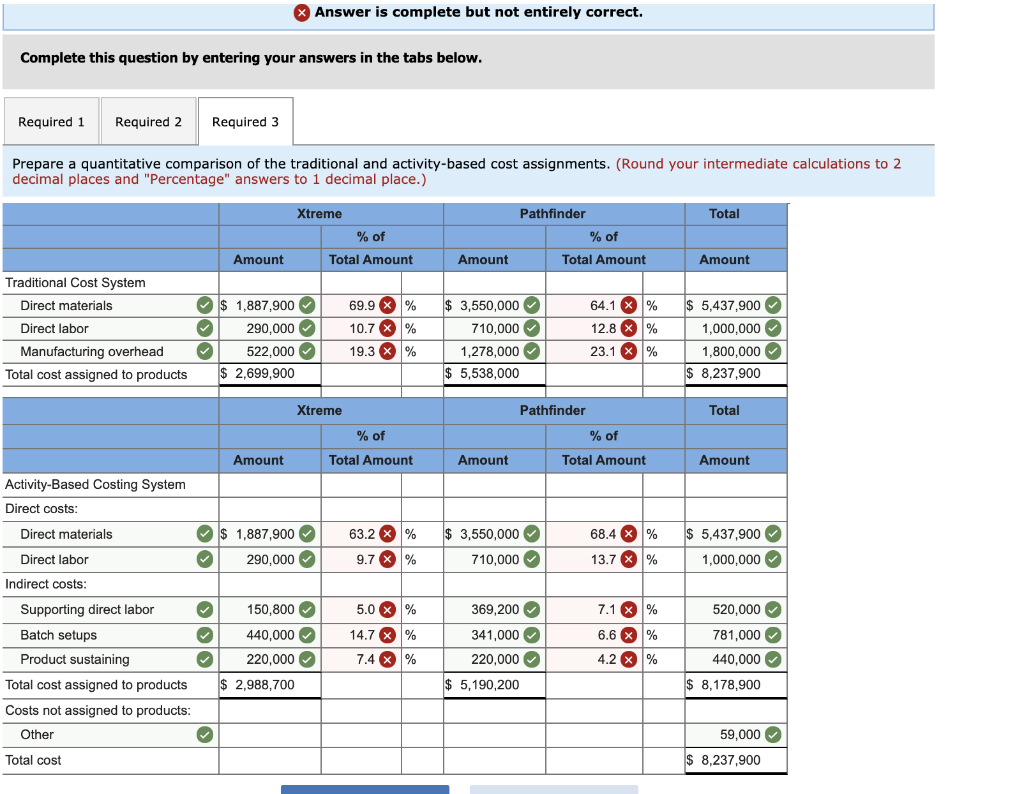

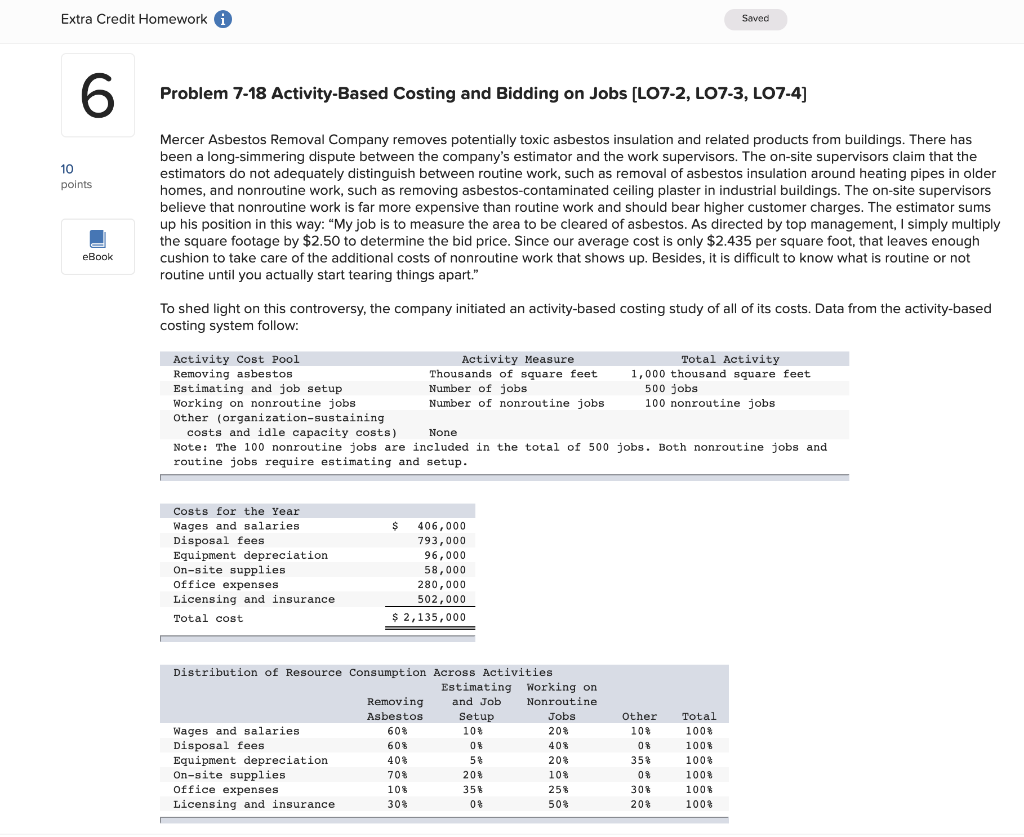

ONLY THE PERCENTAGES IN QUESTION 5 - 3 first images

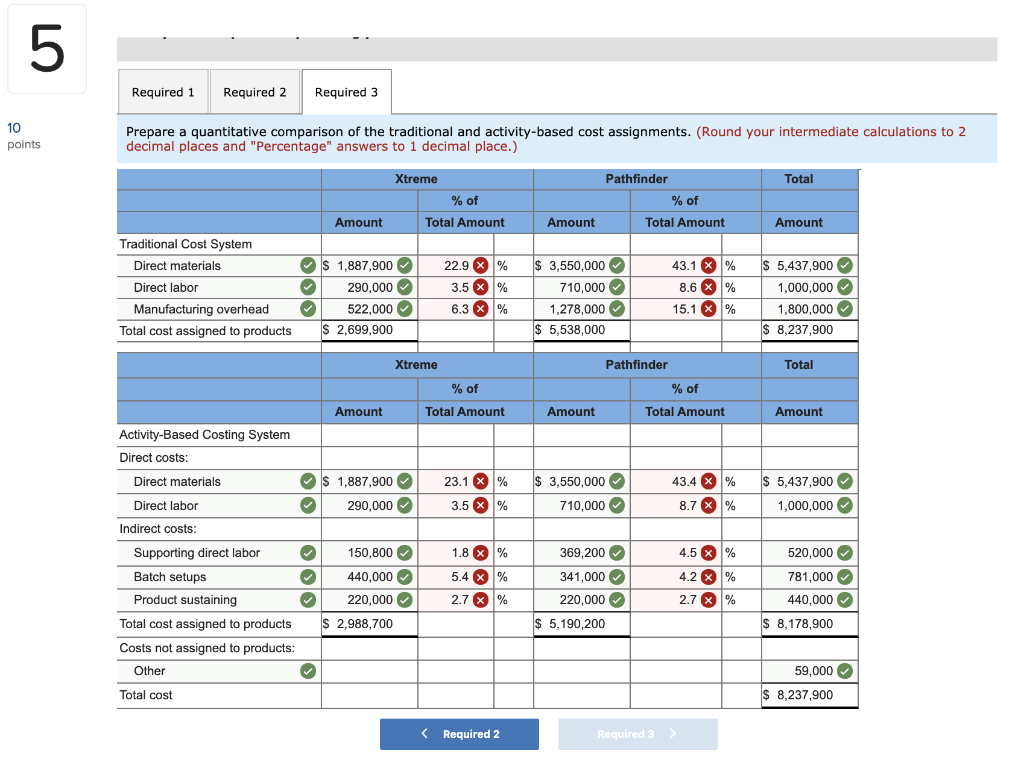

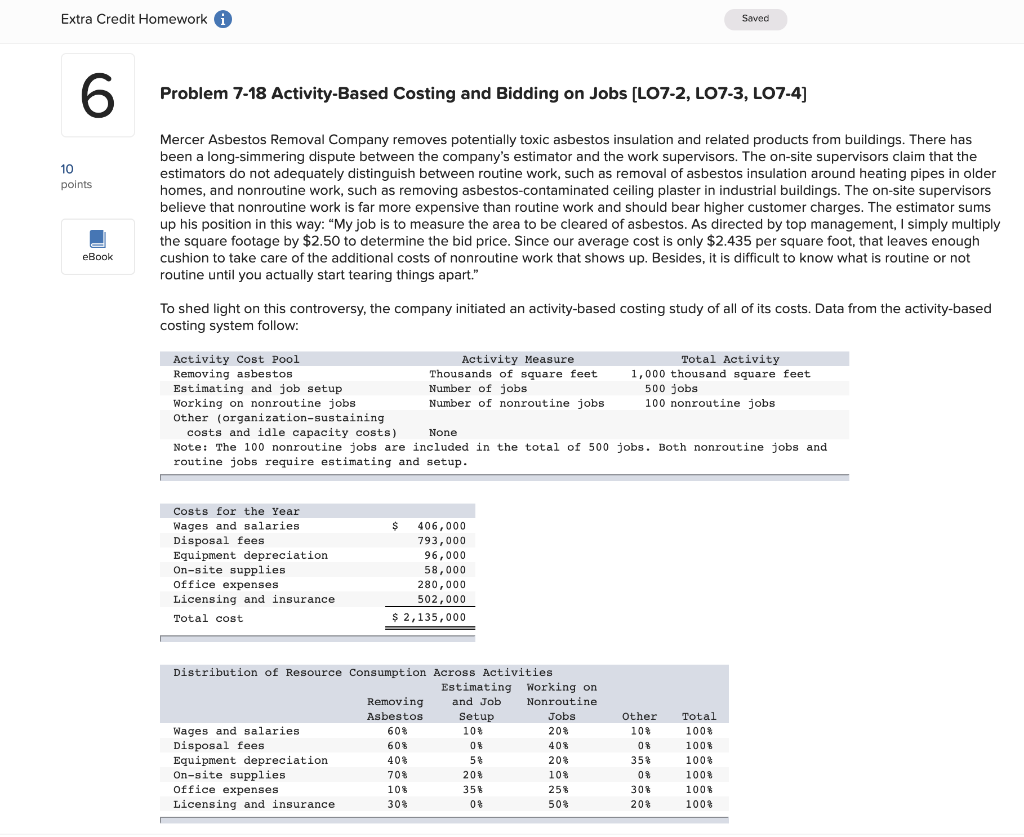

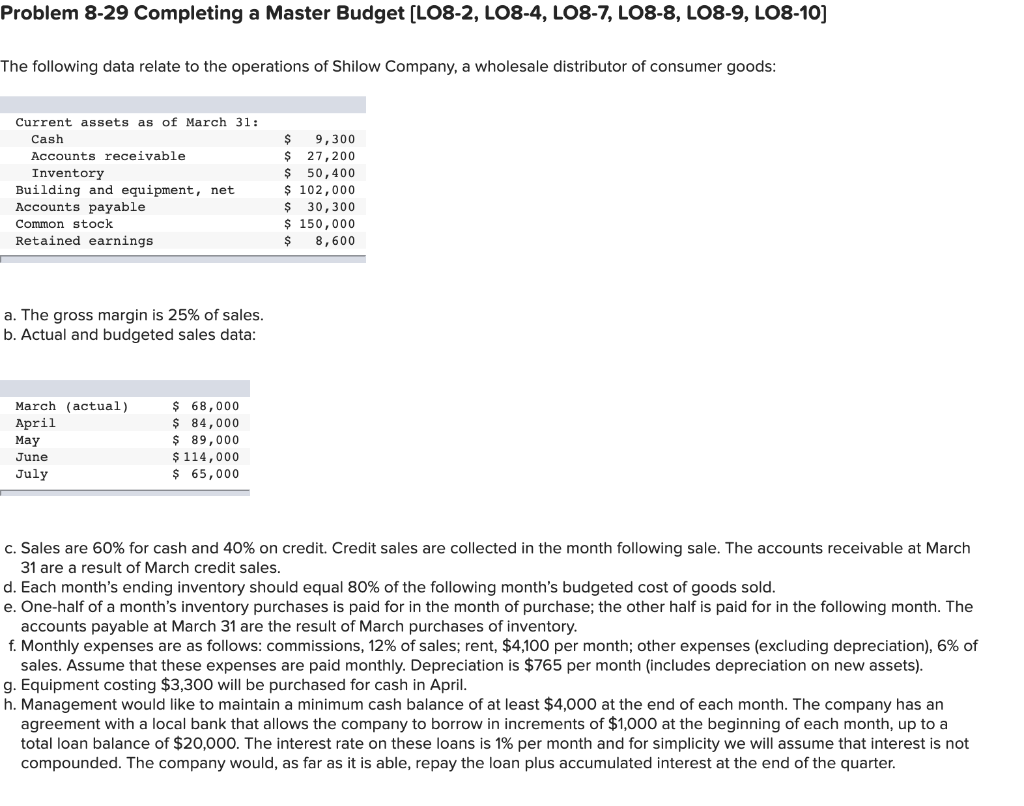

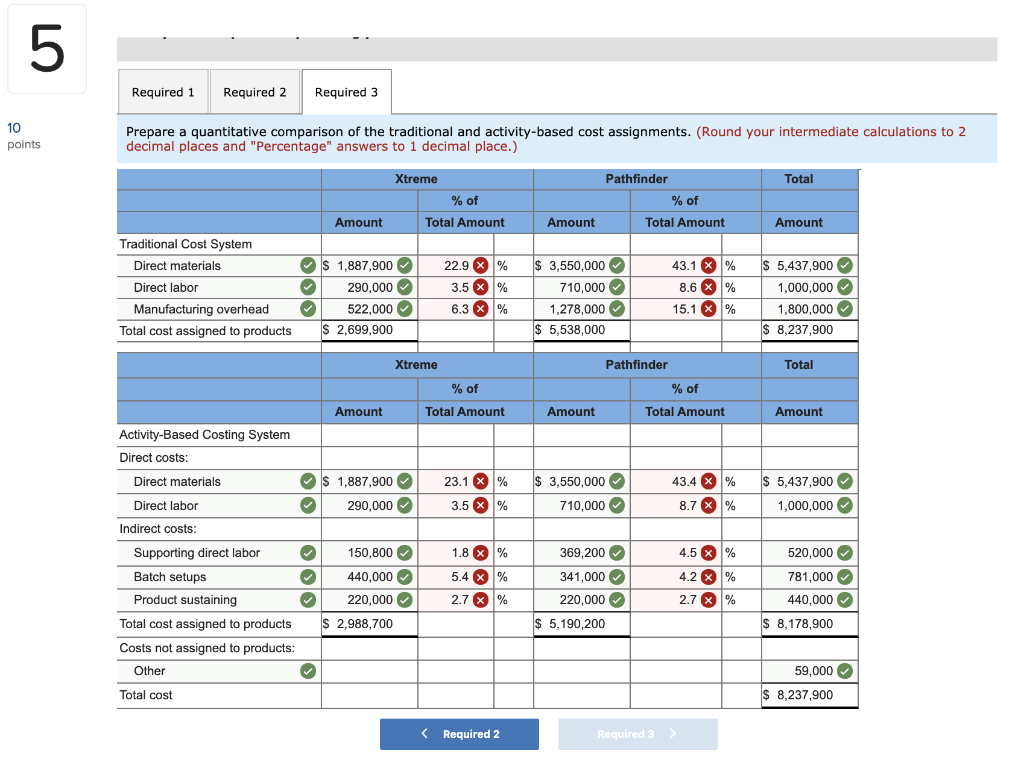

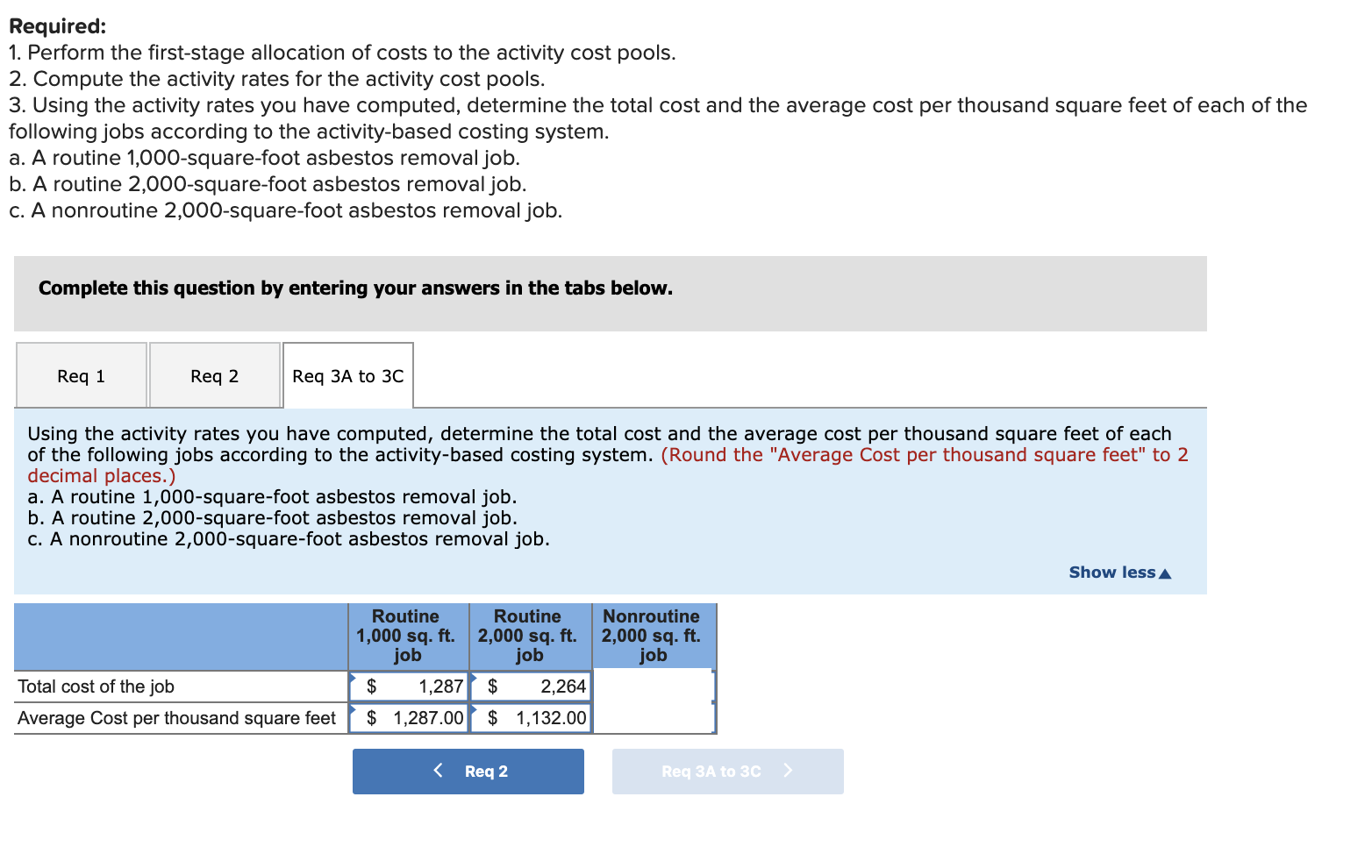

ONLY THE 2 LAST NUMBERS IN QUESTION 6 ( The result is not 7754 and 3877) - 2 next images

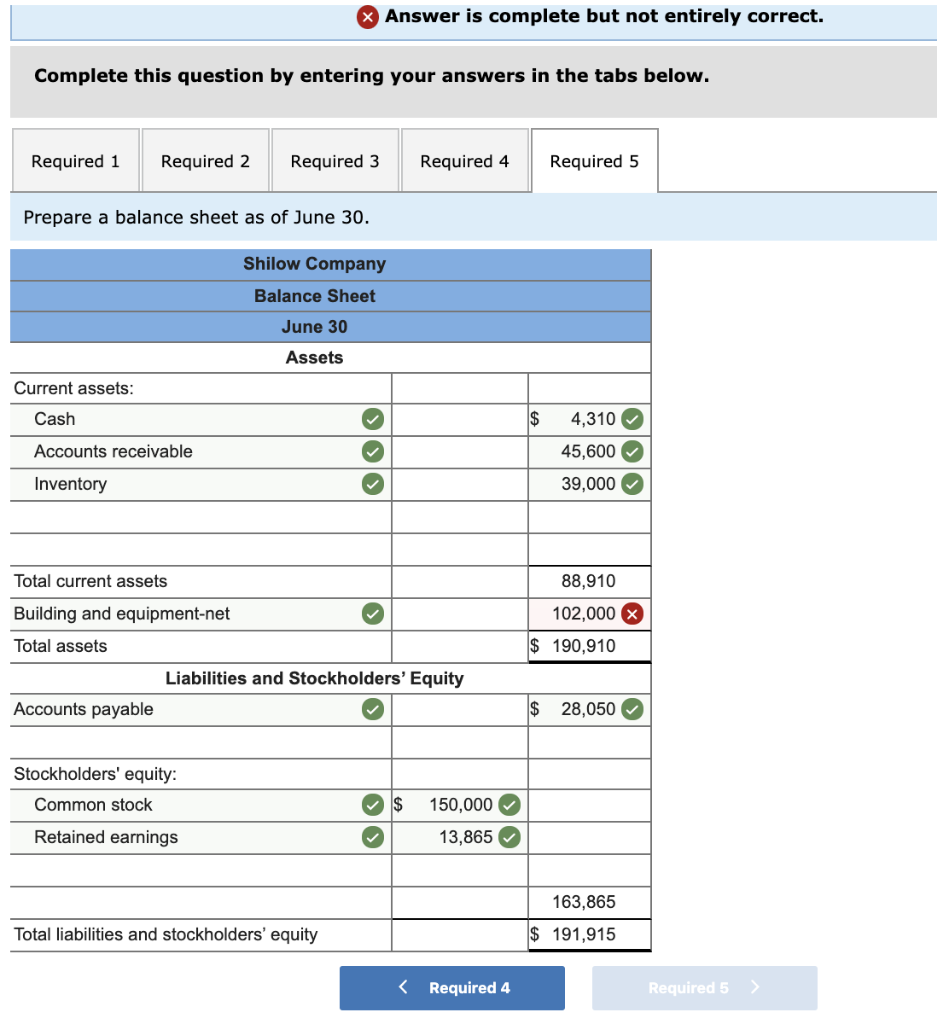

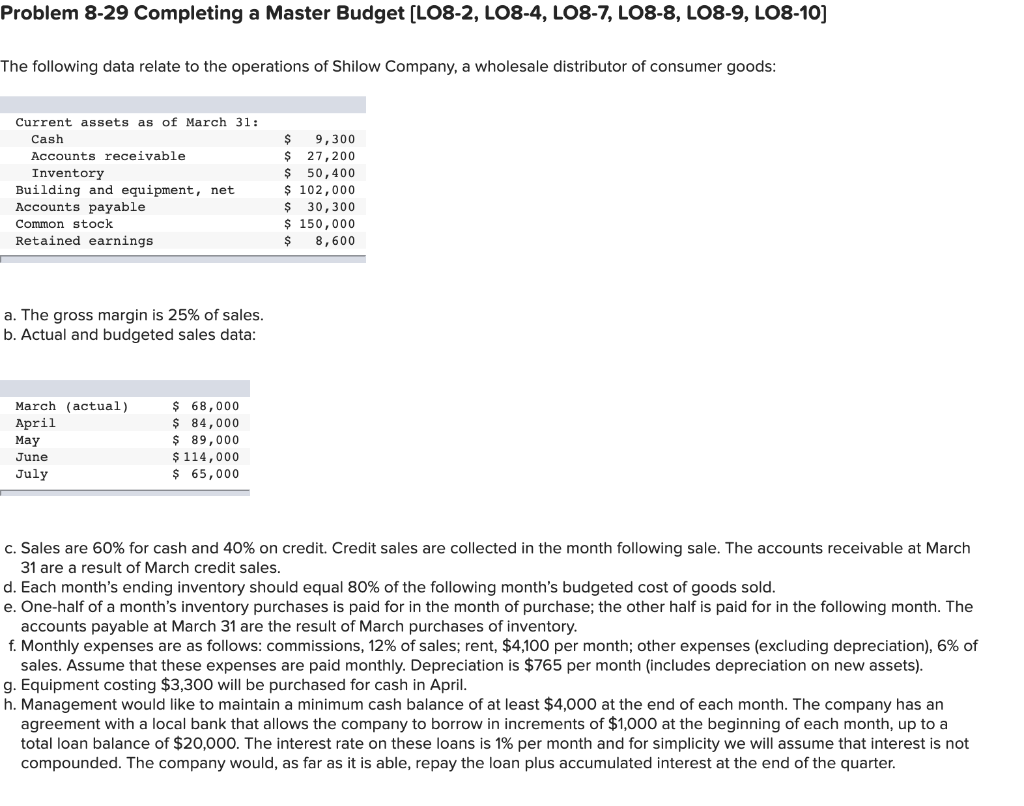

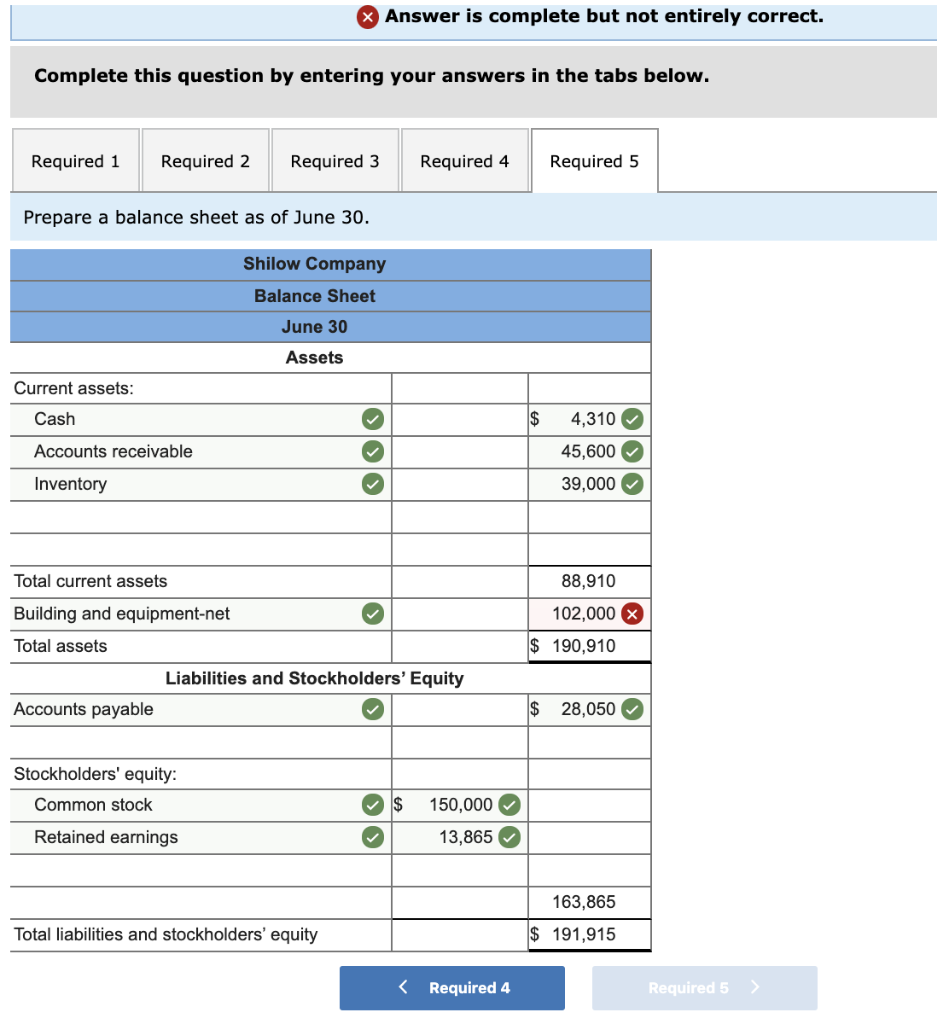

ONLY THE NUMBER OF BUILDING EQUIPMENT IN ANWSER 7 - 2 next images

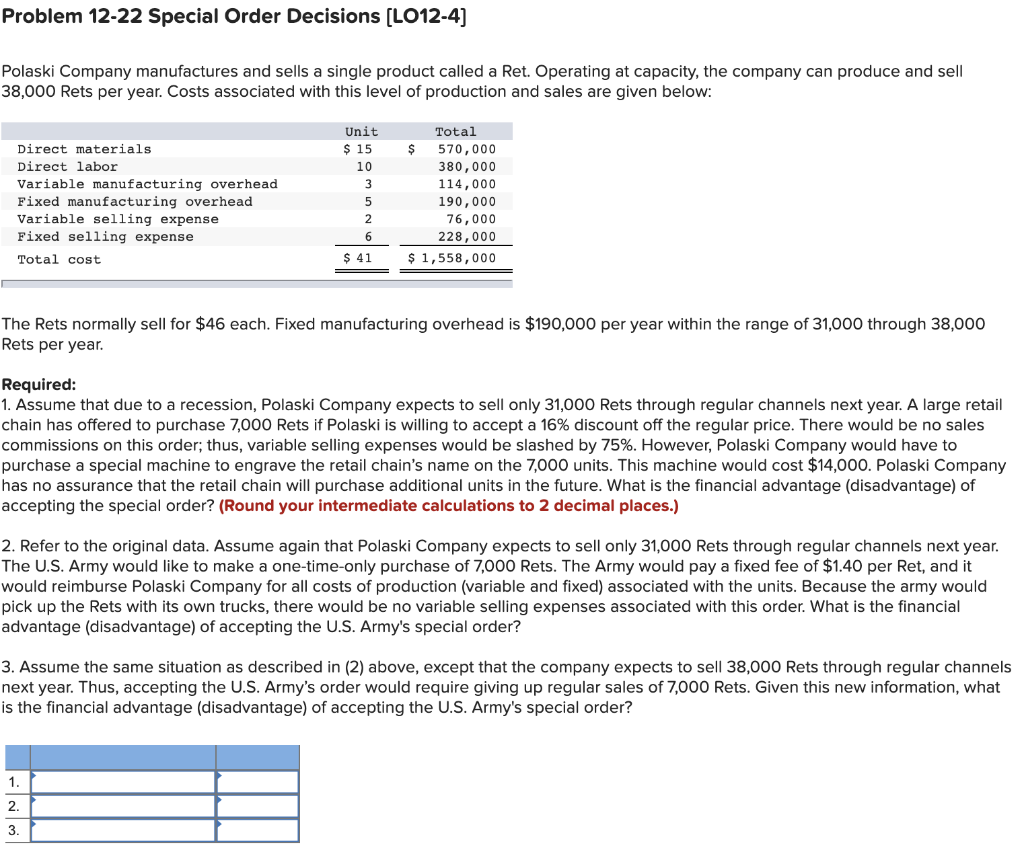

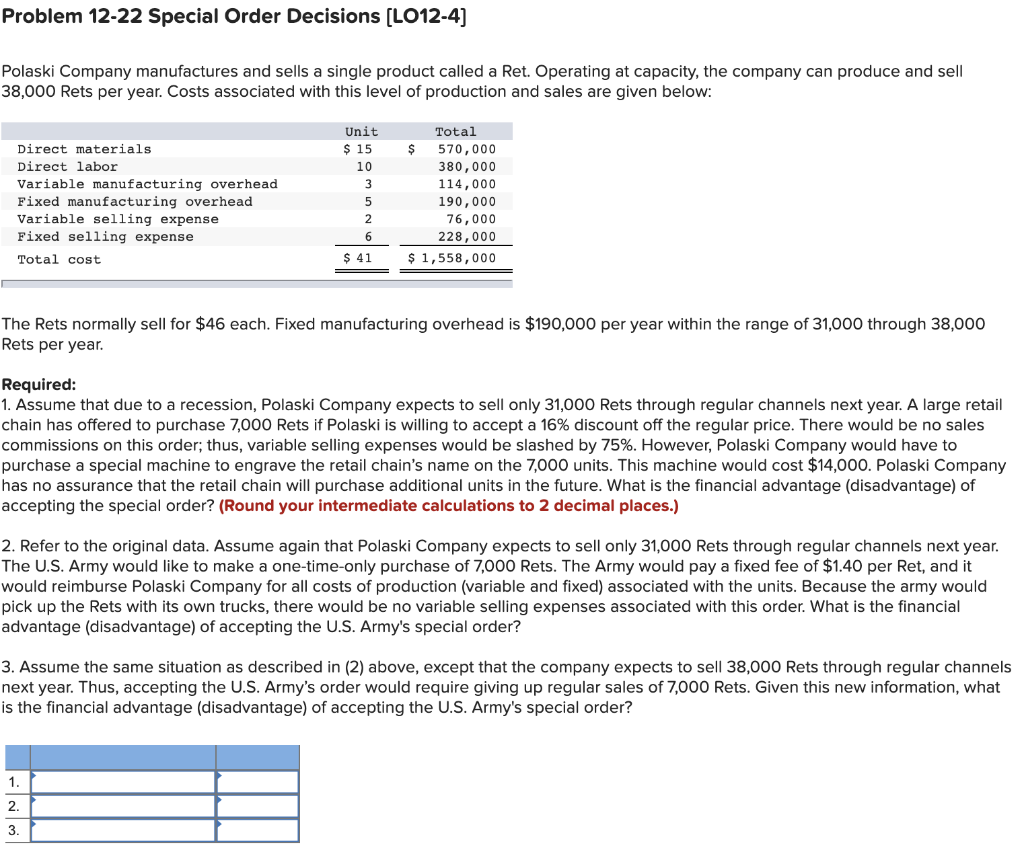

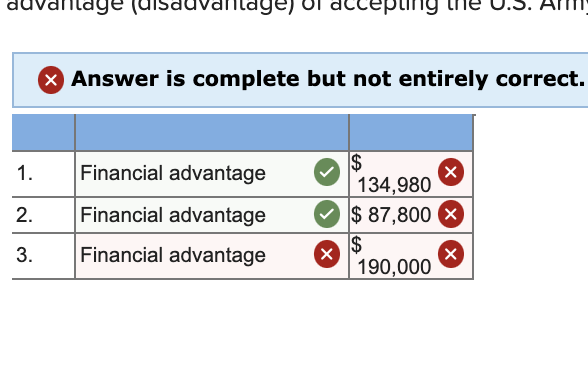

ONLY QUESTION 12 numbers in red - 2 next images

Thank you,

Problem 7-17 Comparing Traditional and Activity-Based Product Margins (LO7-1, LO7-3, L07-4, LO7-5] Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Selling price per unit Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production and sales Xtreme $ 115.00 $ 65.10 $ 10.00 1.0 DLHS 29,000 units Pathfinder $ 83.00 $ 50.00 $ 10.00 1.0 DLHS 71,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $ 1,800,000 100,000 DLHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Estimated Overhead Cost $ 520,000 781,000 440,000 59,000 $1,800,000 Activities and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) Other Total manufacturing overhead cost Expected Activity Xtreme Pathfinder Total 29,000 71,000 100,000 400 310 1 NA NA NA 710 1 Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to 2 decimal places and "Percentage" answers to 1 decimal place.) Xtreme Total % of Pathfinder % of Total Amount Amount Total Amount Amount Amount Traditional Cost System Direct materials Direct labor Manufacturing overhead Total cost assigned to products $ 1,887,900 290,000 522,000 $ 2,699,900 69.9 % 10.7 19.3 % % % $ 3,550,000 710,000 1,278,000 $ 5,538,000 64.1 X 12.8 23.1 % % % $ 5,437,900 | 1,000,000 1,800,000 $ 8,237,900 Xtreme Total % of Total Amount Pathfinder % of Total Amount Amount Amount Amount $ 1,887,900 290,000 63.2 9.7 % % % $ 3,550,000 710,000 68.4 13.7 % % % $ 5,437,900 1,000,000 5.0 X % 520,000 Activity-Based Costing System Direct costs: Direct materials Direct labor Indirect costs: Supporting direct labor Batch setups Product sustaining Total cost assigned to products Costs not assigned to products: Other Total cost 150,800 440,000 220,000 $ 2,988,700 14.7 X 7.4 X % % 369,200 341,000 220,000 $ 5,190,200 7.1 % 6.6 4.2 % % % 781,000 440,000 $ 8,178,900 59,000 $ 8,237,900 Required 1 Required 2 Required 3 10 points Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to 2 decimal places and "Percentage" answers to 1 decimal place.) Total Xtreme % of Total Amount Pathfinder % of Total Amount Amount Amount Amount Traditional Cost System Direct materials Direct labor Manufacturing overhead Total cost assigned to products $ 1,887,900 290,000 522,000 $ 2,699,900 22.9 X 3.5 X 6.3 % % % % $ 3,550,000 710,000 1,278,000 $ 5,538,000 43.1 X % 8.6 X % 15.1 % % $ 5,437,900 1,000,000 1,800,000 $ 8,237,900 Total Xtreme % of Total Amount Pathfinder % of Total Amount Amount Amount Amount $ 1,887,900 290,000 23.1 X 3.5 % % $ 3,550,000 710,000 43.4 % 8.7 % % $ 5,437,900 1,000,000 Activity-Based Costing System Direct costs: Direct materials Direct labor Indirect costs: Supporting direct labor Batch setups Product sustaining Total cost assigned to products Costs not assigned to products: Other Total cost 150,800 440,000 220,000 $ 2,988,700 1.8 5.4 2.7 % % % 369,200 341,000 220,000 $ 5,190,200 4.5 % 4.2 2.7 % % % 520,000 781,000 440,000 $ 8,178,900 59,000 $ 8,237,900 Required 2 Required 3 > Extra Credit Homework A Saved Problem 7-18 Activity-Based Costing and Bidding on Jobs (L07-2, LO7-3, LO7-4] 10 points Mercer Asbestos Removal Company removes potentially toxic asbestos insulation and related products from buildings. There has been a long-simmering dispute between the company's estimator and the work supervisors. The on-site supervisors claim that the estimators do not adequately distinguish between routine work, such as removal of asbestos insulation around heating pipes in older homes, and nonroutine work, such as removing asbestos-contaminated ceiling plaster in industrial buildings. The on-site supervisors believe that nonroutine work is far more expensive than routine work and should bear higher customer charges. The estimator sums up his position in this way: "My job is to measure the area to be cleared of asbestos. As directed by top management, I simply multiply the square footage by $2.50 to determine the bid price. Since our average cost is only $2.435 per square foot, that leaves enough cushion to take care of the additional costs of nonroutine work that shows up. Besides, it is difficult to know what is routine or not routine until you actually start tearing things apart." eBook To shed light on this controversy, the company initiated an activity-based costing study of all of its costs. Data from the activity-based costing system follow: Activity Cost Pool Activity Measure Total Activity Removing asbestos Thousands of square feet 1,000 thousand square feet Estimating and job setup Number of jobs 500 jobs Working on nonroutine jobs Number of nonroutine jobs 100 nonroutine jobs Other (organization-sustaining costs and idle capacity costs) None Note: The 100 nonroutine jobs are included in the total of 500 jobs. Both nonroutine jobs and routine jobs require estimating and setup. Costs for the Year Wages and salaries Disposal fees Equipment depreciation On-site supplies Office expenses Licensing and insurance Total cost 406,000 793,000 96,000 58,000 280,000 502,000 $ 2,135,000 Distribution of Resource Consumption Across Activities Estimating Working on Removing and Job Nonroutine Asbestos Setup Jobs Wages and salaries 60% 10% 20% Disposal fees 608 408 Equipment depreciation 40% 5% 20% On-site supplies 708 20% 108 Office expenses 108 35% 25% Licensing and insurance 30% 50% 0 Other 108 0% 35% 08 30% 20% Total 100% 100% 100% 100% 100% 100% 0% Required: 1. Perform the first stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based costing system. a. A routine 1,000-square-foot asbestos removal job. b. A routine 2,000-square-foot asbestos removal job. c. A nonroutine 2,000-square-foot asbestos removal job. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3A to 30 Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based costing system. (Round the "Average Cost per thousand square feet" to 2 decimal places.) a. A routine 1,000-square-foot asbestos removal job. b. A routine 2,000-square-foot asbestos removal job. C. A nonroutine 2,000-square-foot asbestos removal job. Show less Nonroutine 2,000 sq. ft. job Routine 1,000 sq. ft. job Total cost of the job $ 1,287 Average Cost per thousand square feet | $ 1,287.00 Routine 2,000 sq. ft. job $ 2,264 $ 1,132.00 Req2 Req 3A to 30 ) Problem 8-29 Completing a Master Budget (LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Building and equipment, net Accounts payable Common stock Retained earnings $ 9,300 $ 27,200 $ 50,400 $ 102,000 $ 30,300 $ 150,000 $ 8,600 a. The gross margin is 25% of sales. b. Actual and budgeted sales data: March (actual) April May June July $ 68,000 $ 84,000 $ 89,000 $ 114,000 $ 65,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. f. Monthly expenses are as follows: commissions, 12% of sales; rent, $4,100 per month; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $765 per month (includes depreciation on new assets). g. Equipment costing $3,300 will be purchased for cash in April. h. Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 5 Prepare a balance sheet as of June 30. Shilow Company Balance Sheet June 30 Assets Current assets: Cash $ Accounts receivable Inventory 4,310 45,600 39,000 88,910 Total current assets Building and equipment-net Total assets Liabilities and Stockholders' Equity Accounts payable 102,000 X $ 190,910 $ 28,050 Stockholders' equity: Common stock Retained earnings $ 150,000 13,865 163.865 Total liabilities and stockholders' equity $ 191,915 Extra Credit Homework A Saved Problem 7-18 Activity-Based Costing and Bidding on Jobs (L07-2, LO7-3, LO7-4] 10 points Mercer Asbestos Removal Company removes potentially toxic asbestos insulation and related products from buildings. There has been a long-simmering dispute between the company's estimator and the work supervisors. The on-site supervisors claim that the estimators do not adequately distinguish between routine work, such as removal of asbestos insulation around heating pipes in older homes, and nonroutine work, such as removing asbestos-contaminated ceiling plaster in industrial buildings. The on-site supervisors believe that nonroutine work is far more expensive than routine work and should bear higher customer charges. The estimator sums up his position in this way: "My job is to measure the area to be cleared of asbestos. As directed by top management, I simply multiply the square footage by $2.50 to determine the bid price. Since our average cost is only $2.435 per square foot, that leaves enough cushion to take care of the additional costs of nonroutine work that shows up. Besides, it is difficult to know what is routine or not routine until you actually start tearing things apart." eBook To shed light on this controversy, the company initiated an activity-based costing study of all of its costs. Data from the activity-based costing system follow: Activity Cost Pool Activity Measure Total Activity Removing asbestos Thousands of square feet 1,000 thousand square feet Estimating and job setup Number of jobs 500 jobs Working on nonroutine jobs Number of nonroutine jobs 100 nonroutine jobs Other (organization-sustaining costs and idle capacity costs) None Note: The 100 nonroutine jobs are included in the total of 500 jobs. Both nonroutine jobs and routine jobs require estimating and setup. Costs for the Year Wages and salaries Disposal fees Equipment depreciation On-site supplies Office expenses Licensing and insurance Total cost 406,000 793,000 96,000 58,000 280,000 502,000 $ 2,135,000 Distribution of Resource Consumption Across Activities Estimating Working on Removing and Job Nonroutine Asbestos Setup Jobs Wages and salaries 60% 10% 20% Disposal fees 608 408 Equipment depreciation 40% 5% 20% On-site supplies 708 20% 108 Office expenses 108 35% 25% Licensing and insurance 30% 50% 0 Other 108 0% 35% 08 30% 20% Total 100% 100% 100% 100% 100% 100% 0% Required: 1. Perform the first stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based costing system. a. A routine 1,000-square-foot asbestos removal job. b. A routine 2,000-square-foot asbestos removal job. c. A nonroutine 2,000-square-foot asbestos removal job. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3A to 30 Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based costing system. (Round the "Average Cost per thousand square feet" to 2 decimal places.) a. A routine 1,000-square-foot asbestos removal job. b. A routine 2,000-square-foot asbestos removal job. C. A nonroutine 2,000-square-foot asbestos removal job. Show less Nonroutine 2,000 sq. ft. job Routine 1,000 sq. ft. job Total cost of the job $ 1,287 Average Cost per thousand square feet | $ 1,287.00 Routine 2,000 sq. ft. job $ 2,264 $ 1,132.00 Req2 Req 3A to 30 ) Problem 8-29 Completing a Master Budget (LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Building and equipment, net Accounts payable Common stock Retained earnings $ 9,300 $ 27,200 $ 50,400 $ 102,000 $ 30,300 $ 150,000 $ 8,600 a. The gross margin is 25% of sales. b. Actual and budgeted sales data: March (actual) April May June July $ 68,000 $ 84,000 $ 89,000 $ 114,000 $ 65,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. f. Monthly expenses are as follows: commissions, 12% of sales; rent, $4,100 per month; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $765 per month (includes depreciation on new assets). g. Equipment costing $3,300 will be purchased for cash in April. h. Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 5 Prepare a balance sheet as of June 30. Shilow Company Balance Sheet June 30 Assets Current assets: Cash $ Accounts receivable Inventory 4,310 45,600 39,000 88,910 Total current assets Building and equipment-net Total assets Liabilities and Stockholders' Equity Accounts payable 102,000 X $ 190,910 $ 28,050 Stockholders' equity: Common stock Retained earnings $ 150,000 13,865 163.865 Total liabilities and stockholders' equity $ 191,915