Answered step by step

Verified Expert Solution

Question

1 Approved Answer

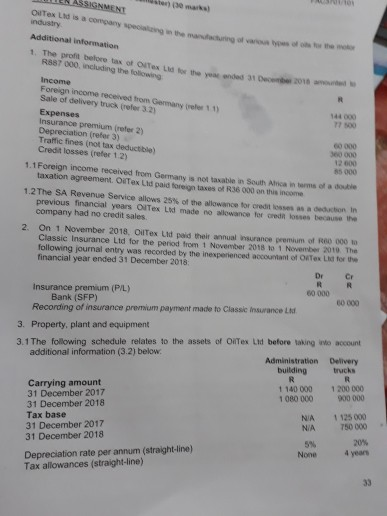

Hello. I need assistance with A and b EN ASSIGNMENT otex l industry a company Additional information 1. The profit before tax o RSS7000 including

Hello.

I need assistance with A and b

EN ASSIGNMENT otex l industry a company Additional information 1. The profit before tax o RSS7000 including the fol les w l ow the year anded 31 December 2010 amount 2016 Income Foreign income received from Germany refer 11) Sale of delivery truck refer 3.2) Expenses Insurance premium refer 2 Depreciation (refer 3) Traffic fines (not tax deductible) Credit losses (refer 12) 00 30 000 12 000 1.1 Foreign Income received from Germany is not lasati in South Africa in terms of a double taxation agreement. OlTex Lid paid foreign taxes of R36 000 on this income 1.2 The SA Revenue Service allows 25% of the previous financial years olTex Lid made no wowance for bred lowance for cre a company had no credit sales tion in osses because the 2On 1 November 2018, OuTex Lid paid the Classic Insurance Lid for the period from r ance premium of following journal entry was recorded by the inexperienced account of 000 1 November 2015 November 2010 The financial year ended 31 December 2018 Tex or the De Cr Insurance premium (PL) RR Bank (SFP) 60 000 Recording of insurance premium payment made to Classic Insurance Ltd 00000 3. Property, plant and equipment account Delivery trucks 1 200 000 900 000 3.1 The following schedule relates to the assets of OllTex Lid before taking additional information (3.2) below. Administration building Carrying amount 1 140 000 31 December 2017 1 000 000 31 December 2018 Tax base NIA 31 December 2017 NIA 31 December 2018 5% Depreciation rate per annum (straight-line) None Tax allowances (straight-line) 1125000 750 000 20% 4 year orary W aves t axable prolit erences can be utilised Nilure against which The deferred t comprised only of taxable temporary o 31 December 2017 amounted to R21 any differences relating to the delivery trucks 2015, wie The SA Normal tax rate changed from 29% in 2017 to 28% inclusion rate in BON. 2016. The capital 5 Assume amount to be material gnore the implications of Added Tax (VAT) REQUIRED Marks a) Using the additional information calculate the correct profit before tax in the statement of profit or loss and other comprehensive income of OuTex Lid for the year ended 31 December 2018 24 b) Calculate the deferred to balance in the statement of financial position of OuTex Ltd for the year ended 31 December 2018 using the statement of financial position method. Indicate of the balance is a deferred tax asset or deferred taxaby Your answer must comply with the requirements of IAS 12. Income taxe 6 c) Calculate the current tax expense in the statement of profit or loss and other comprehensive income of Oil Tex Lid for the year ended 31 December 2018 000 1 4 7 TAB 2 5 8 3 6 9 MC ME EN ASSIGNMENT otex l industry a company Additional information 1. The profit before tax o RSS7000 including the fol les w l ow the year anded 31 December 2010 amount 2016 Income Foreign income received from Germany refer 11) Sale of delivery truck refer 3.2) Expenses Insurance premium refer 2 Depreciation (refer 3) Traffic fines (not tax deductible) Credit losses (refer 12) 00 30 000 12 000 1.1 Foreign Income received from Germany is not lasati in South Africa in terms of a double taxation agreement. OlTex Lid paid foreign taxes of R36 000 on this income 1.2 The SA Revenue Service allows 25% of the previous financial years olTex Lid made no wowance for bred lowance for cre a company had no credit sales tion in osses because the 2On 1 November 2018, OuTex Lid paid the Classic Insurance Lid for the period from r ance premium of following journal entry was recorded by the inexperienced account of 000 1 November 2015 November 2010 The financial year ended 31 December 2018 Tex or the De Cr Insurance premium (PL) RR Bank (SFP) 60 000 Recording of insurance premium payment made to Classic Insurance Ltd 00000 3. Property, plant and equipment account Delivery trucks 1 200 000 900 000 3.1 The following schedule relates to the assets of OllTex Lid before taking additional information (3.2) below. Administration building Carrying amount 1 140 000 31 December 2017 1 000 000 31 December 2018 Tax base NIA 31 December 2017 NIA 31 December 2018 5% Depreciation rate per annum (straight-line) None Tax allowances (straight-line) 1125000 750 000 20% 4 year orary W aves t axable prolit erences can be utilised Nilure against which The deferred t comprised only of taxable temporary o 31 December 2017 amounted to R21 any differences relating to the delivery trucks 2015, wie The SA Normal tax rate changed from 29% in 2017 to 28% inclusion rate in BON. 2016. The capital 5 Assume amount to be material gnore the implications of Added Tax (VAT) REQUIRED Marks a) Using the additional information calculate the correct profit before tax in the statement of profit or loss and other comprehensive income of OuTex Lid for the year ended 31 December 2018 24 b) Calculate the deferred to balance in the statement of financial position of OuTex Ltd for the year ended 31 December 2018 using the statement of financial position method. Indicate of the balance is a deferred tax asset or deferred taxaby Your answer must comply with the requirements of IAS 12. Income taxe 6 c) Calculate the current tax expense in the statement of profit or loss and other comprehensive income of Oil Tex Lid for the year ended 31 December 2018 000 1 4 7 TAB 2 5 8 3 6 9 MC MEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started