Hello, I need help calculating the Payout Ratio and fix a few mistakes in the 1st part (only the 8 red boxes). My balance sheet is correct. Thank you so much!

Hello, I need help calculating the Payout Ratio and fix a few mistakes in the 1st part (only the 8 red boxes). My balance sheet is correct. Thank you so much!

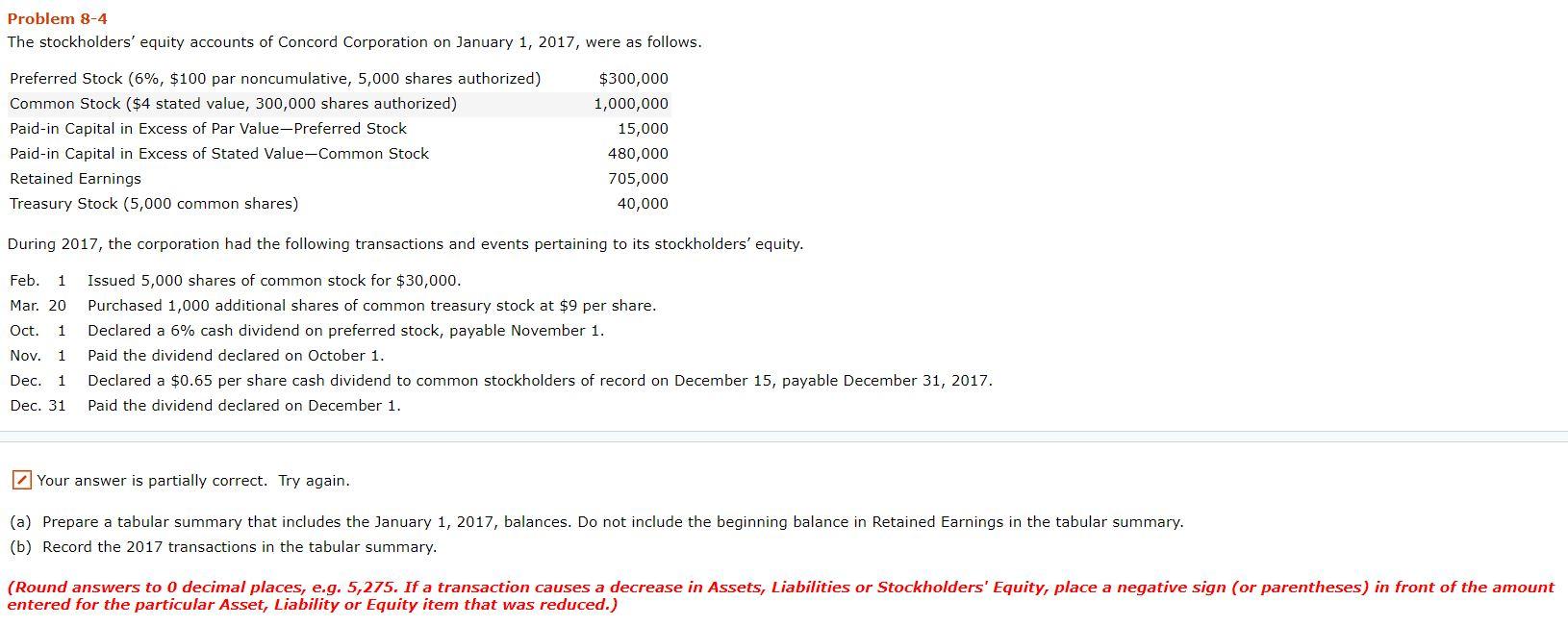

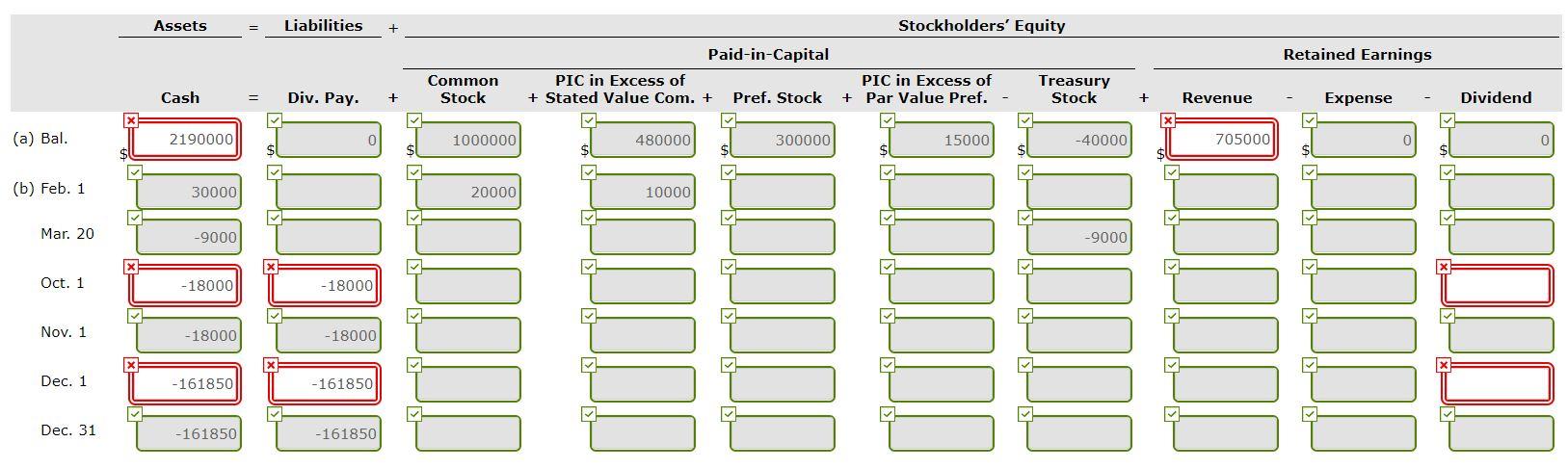

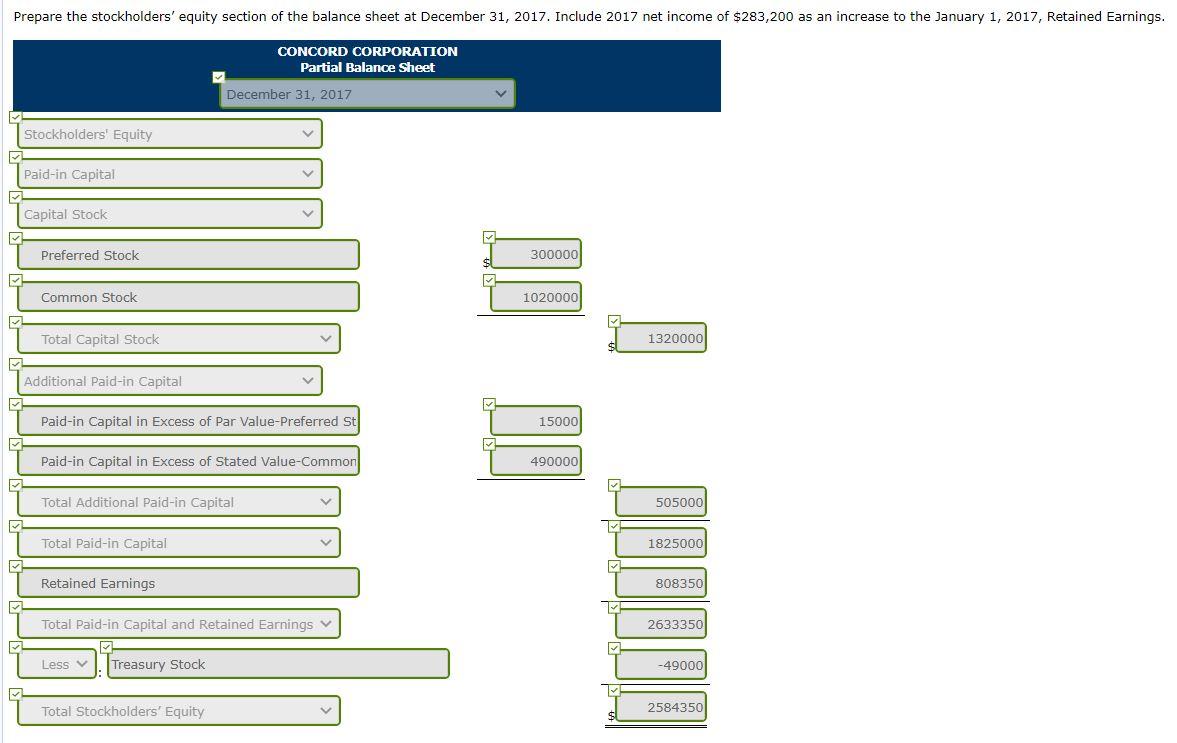

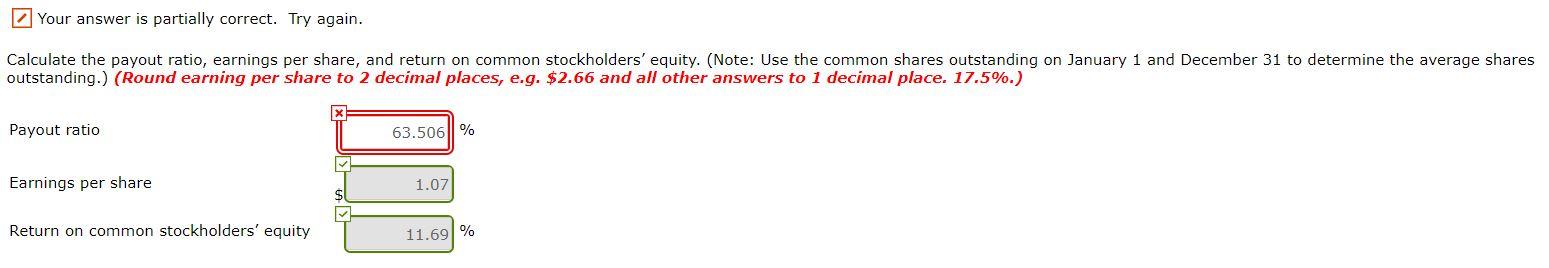

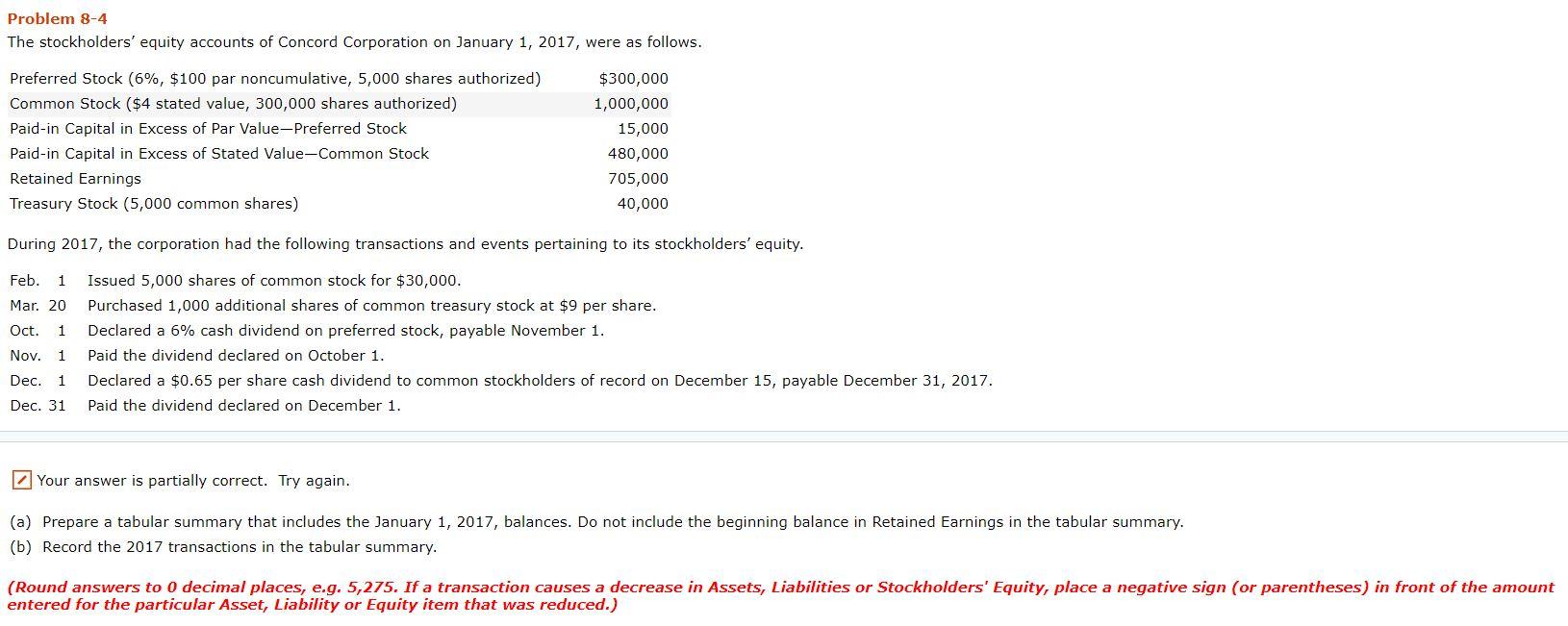

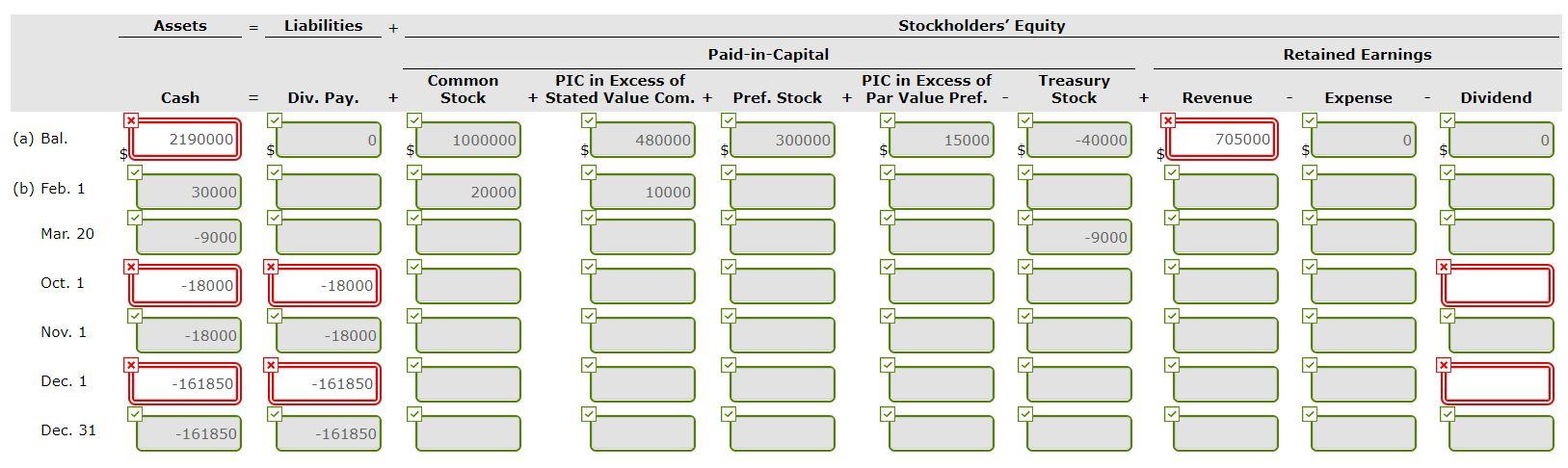

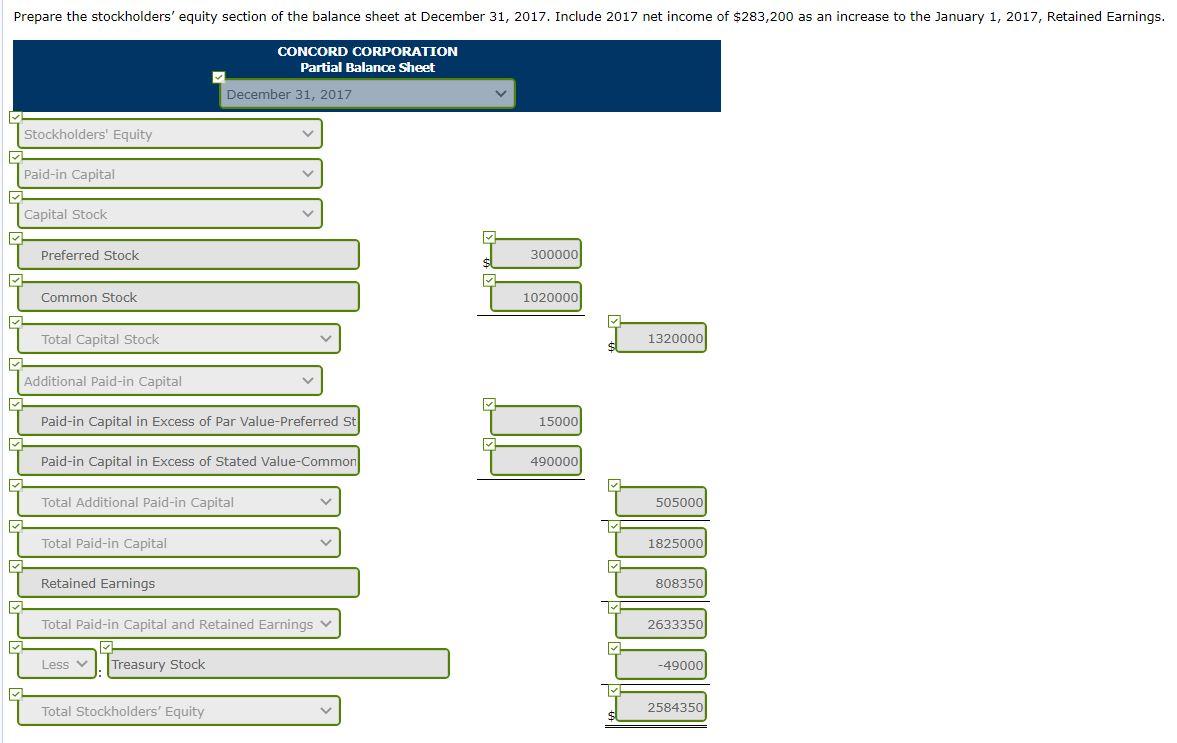

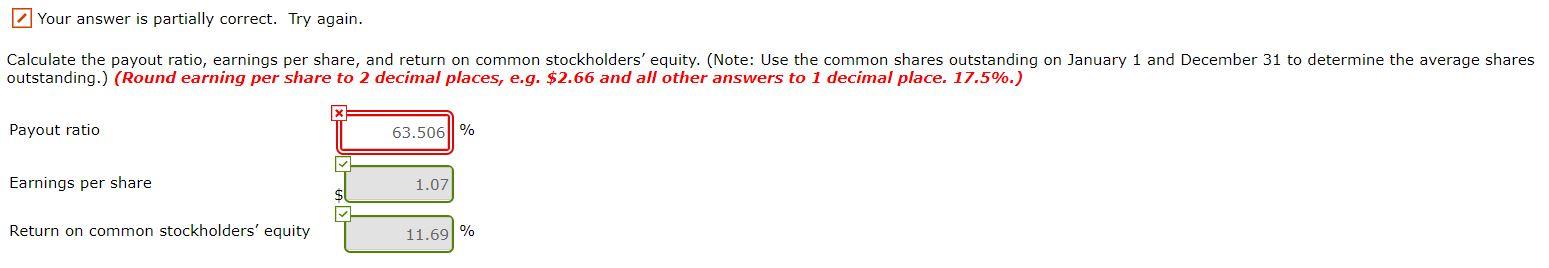

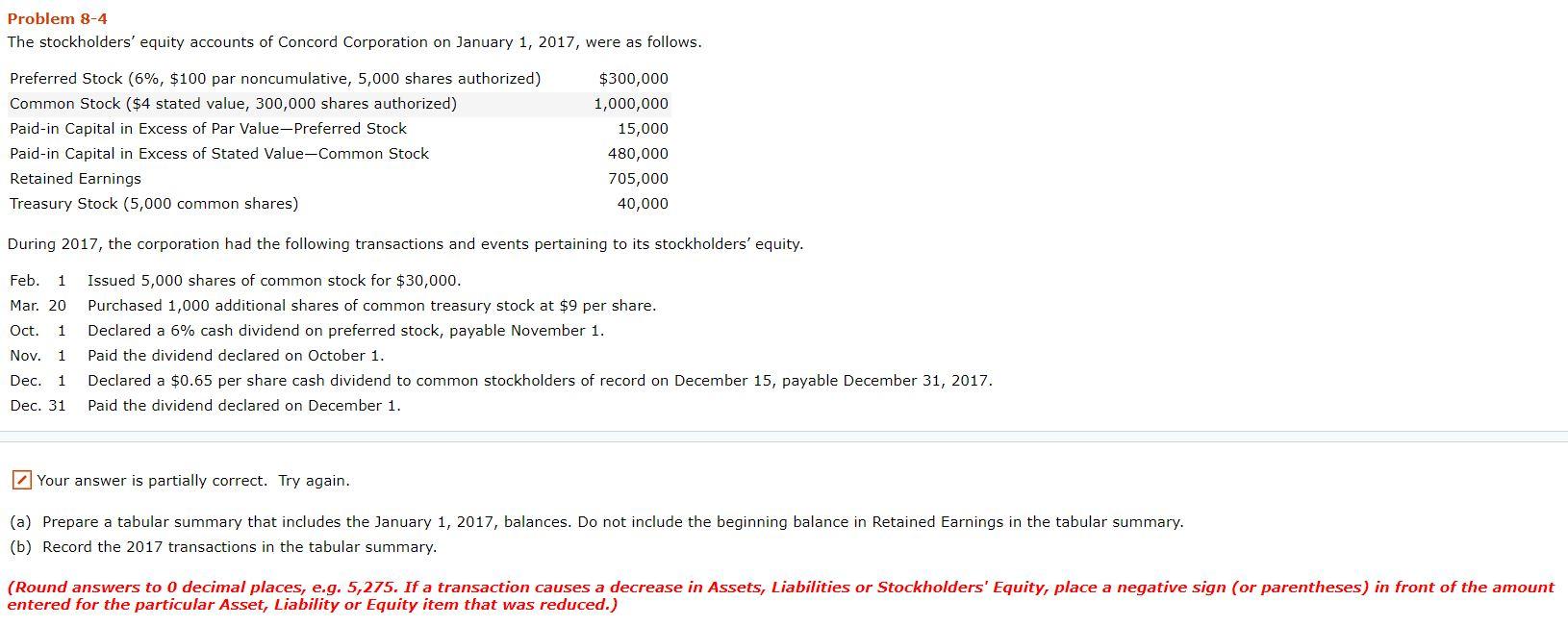

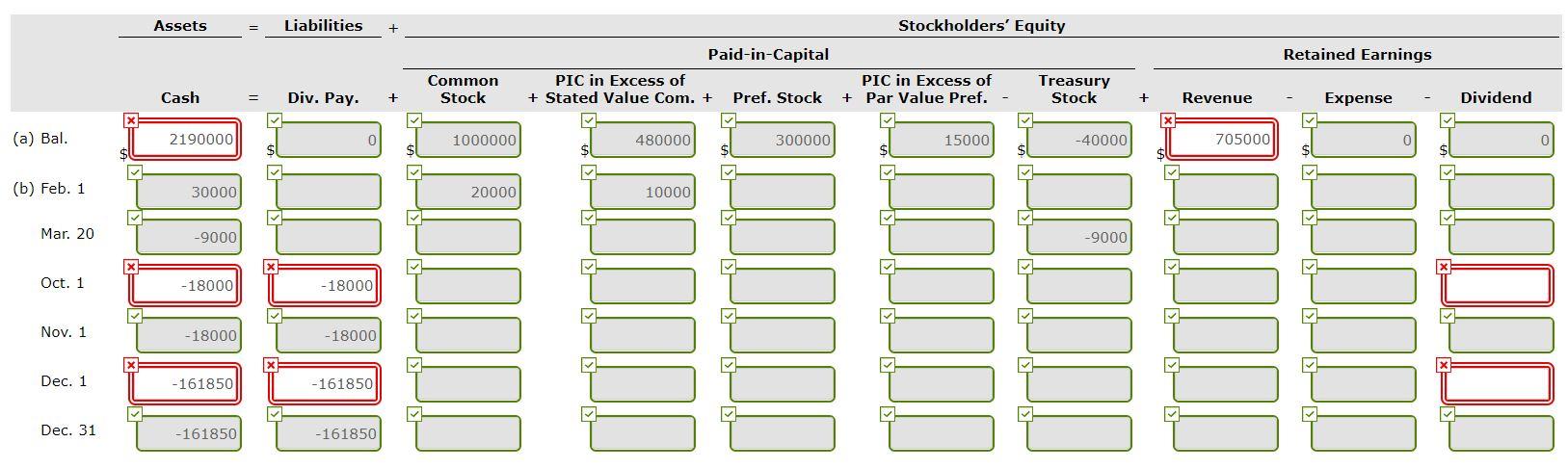

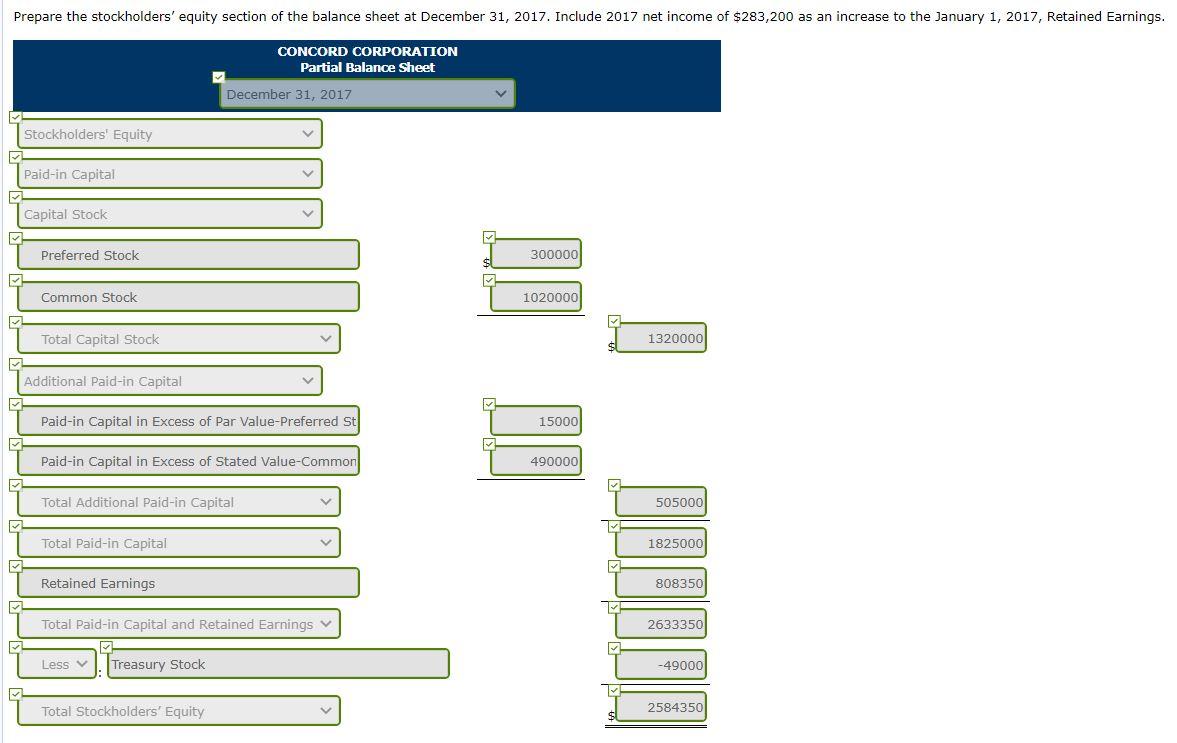

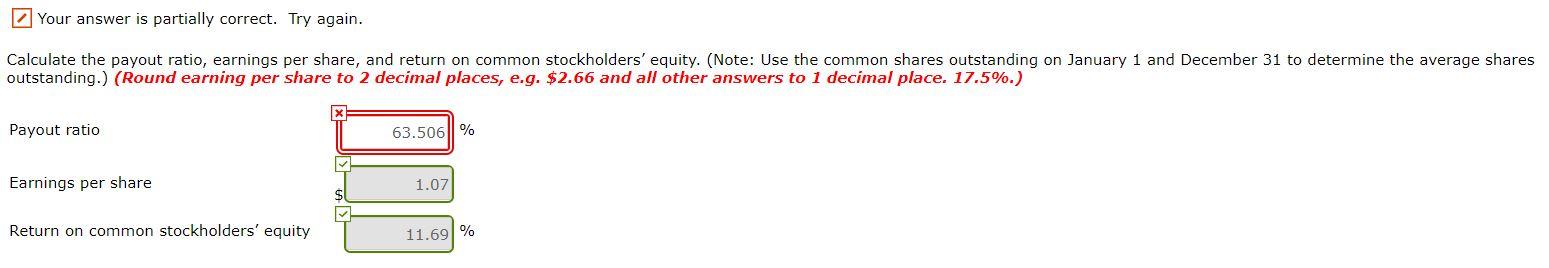

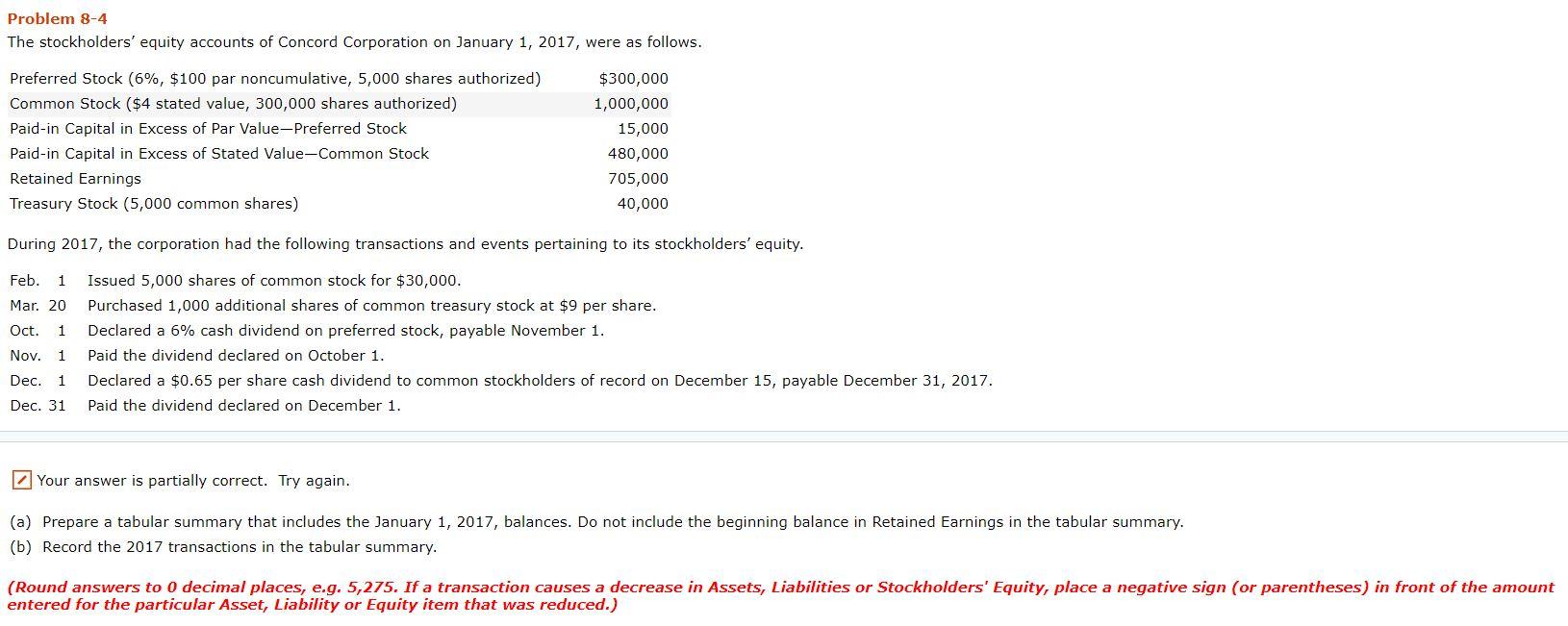

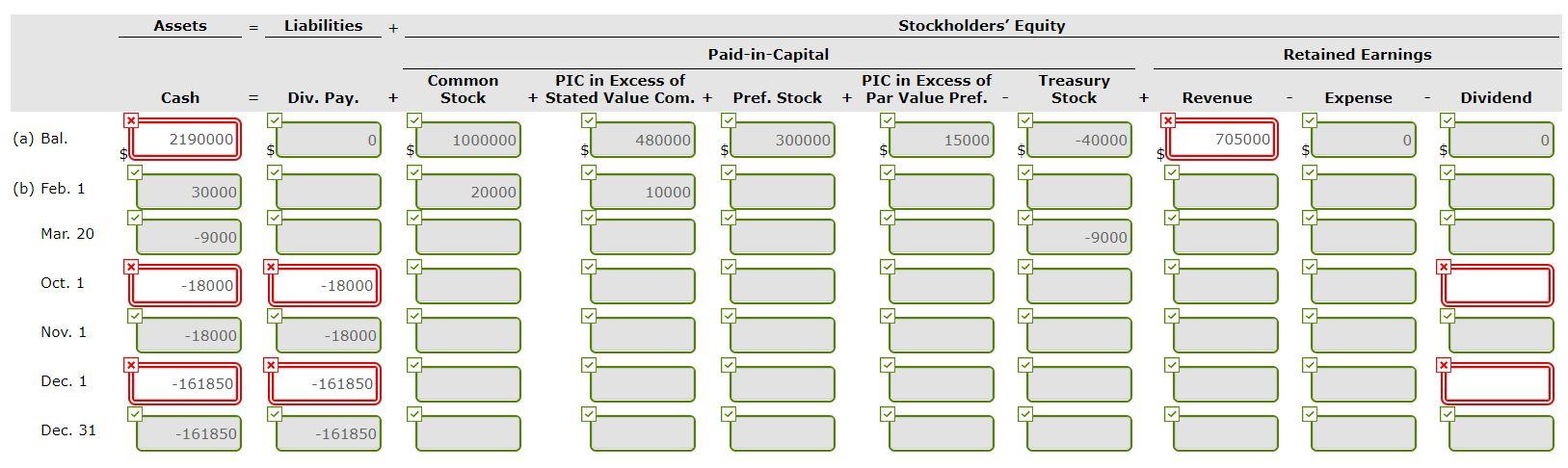

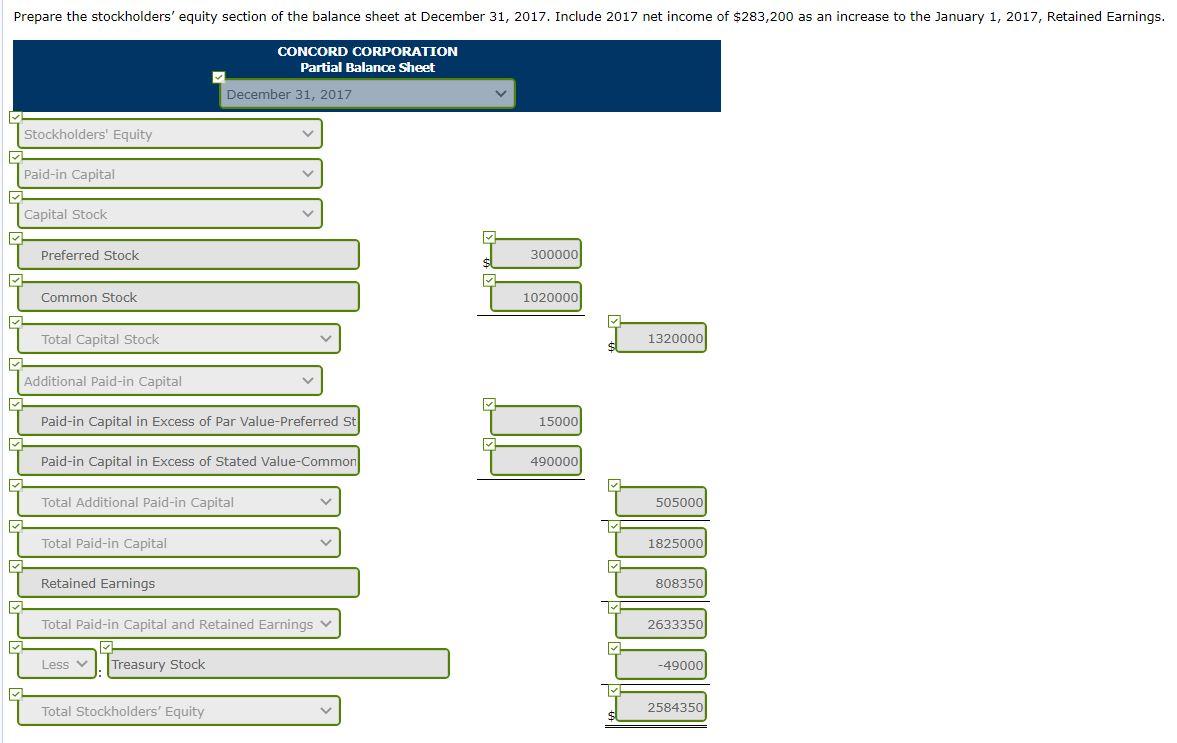

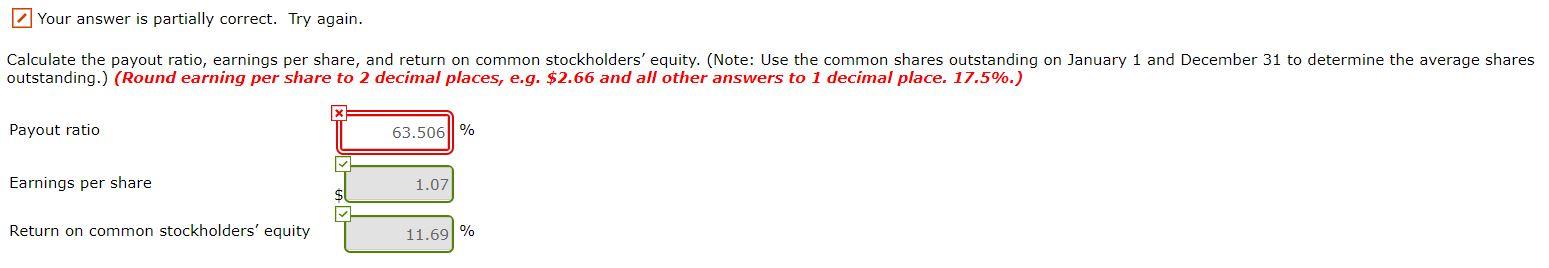

Problem 8-4 The stockholders' equity accounts of Concord Corporation on January 1, 2017, were as follows. Preferred Stock (6%, $100 par noncumulative, 5,000 shares authorized) Common Stock ($4 stated value, 300,000 shares authorized) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (5,000 common shares) $300,000 1,000,000 15,000 480,000 705,000 40,000 During 2017, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Mar. 20 Oct. 1 Nov. 1 Issued 5,000 shares of common stock for $30,000. Purchased 1,000 additional shares of common treasury stock at $9 per share. Declared a 6% cash dividend on preferred stock, payable November 1. Paid the dividend declared on October 1. Declared a $0.65 per share cash dividend to common stockholders of record on December 15, payable December 31, 2017. Paid the dividend declared on December 1. Dec. 1 Dec. 31 Your answer is partially correct. Try again. (a) Prepare a tabular summary that includes the January 1, 2017, balances. Do not include the beginning balance in Retained Earnings in the tabular summary. (b) Record the 2017 transactions in the tabular summary. (Round answers to 0 decimal places, e.g. 5,275. If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Stockholders' Equity Retained Earnings Paid-in-Capital PIC in Excess of + Stated Value Com. + Pref. Stock Cash Common Stock Treasury Stock Div. Pay. + PIC in Excess of + Par Value Pref. + Revenue Expense Dividend x (a) Bal. 2190000 1000000 480000 300000 15000 -40000 705000 S su 0 (b) Feb. 1 30000 20000 10000 Mar. 20 -9000 -9000 Oct. 1 -18000 -18000 Nov. 1 -18000 - 18000 X Dec. 1 -161850 -161850 Dec. 3 Dec. 31 -161850 -161850 Prepare the stockholders' equity section of the balance sheet at December 31, 2017. Include 2017 net income of $283,200 as an increase to the January 1, 2017, Retained Earnings. CONCORD CORPORATION Partial Balance Sheet December 31, 2017 Stockholders' Equity Paid-in Capital Capital Stock M Preferred Stock 300000 Common Stock 1020000 Total Capital Stock 1320000 Additional Paid-in Capital Paid-in Capital in Excess of Par Value-Preferred St 15000 Paid-in Capital in Excess of Stated Value-Common 490000 Total Additional Paid-in Capital 7 505000 Total Paid-in Capital 1825000 Retained Earnings 808350 Total Paid-in Capital and Retained Earnings 2633350 Less Treasury Stock -49000 Total Stockholders' Equity 2584350 Your answer is partially correct. Try again. Calculate the payout ratio, earnings per share, and return on common stockholders' equity. (Note: Use the common shares outstanding on January 1 and December 31 to determine the average shares outstanding.) (Round earning per share to 2 decimal places, e.g. $2.66 and all other answers to 1 decimal place. 17.5%.) Payout ratio 63.506|| % Earnings per share 1.07 Return on common stockholders' equity 11.69%

Hello, I need help calculating the Payout Ratio and fix a few mistakes in the 1st part (only the 8 red boxes). My balance sheet is correct. Thank you so much!

Hello, I need help calculating the Payout Ratio and fix a few mistakes in the 1st part (only the 8 red boxes). My balance sheet is correct. Thank you so much!