Hello, I need help double checking my work on requirements 1-4

As far as requirements 4-8 how do I adjust the balances in the trial balances etc?

Thanks so much for your help!

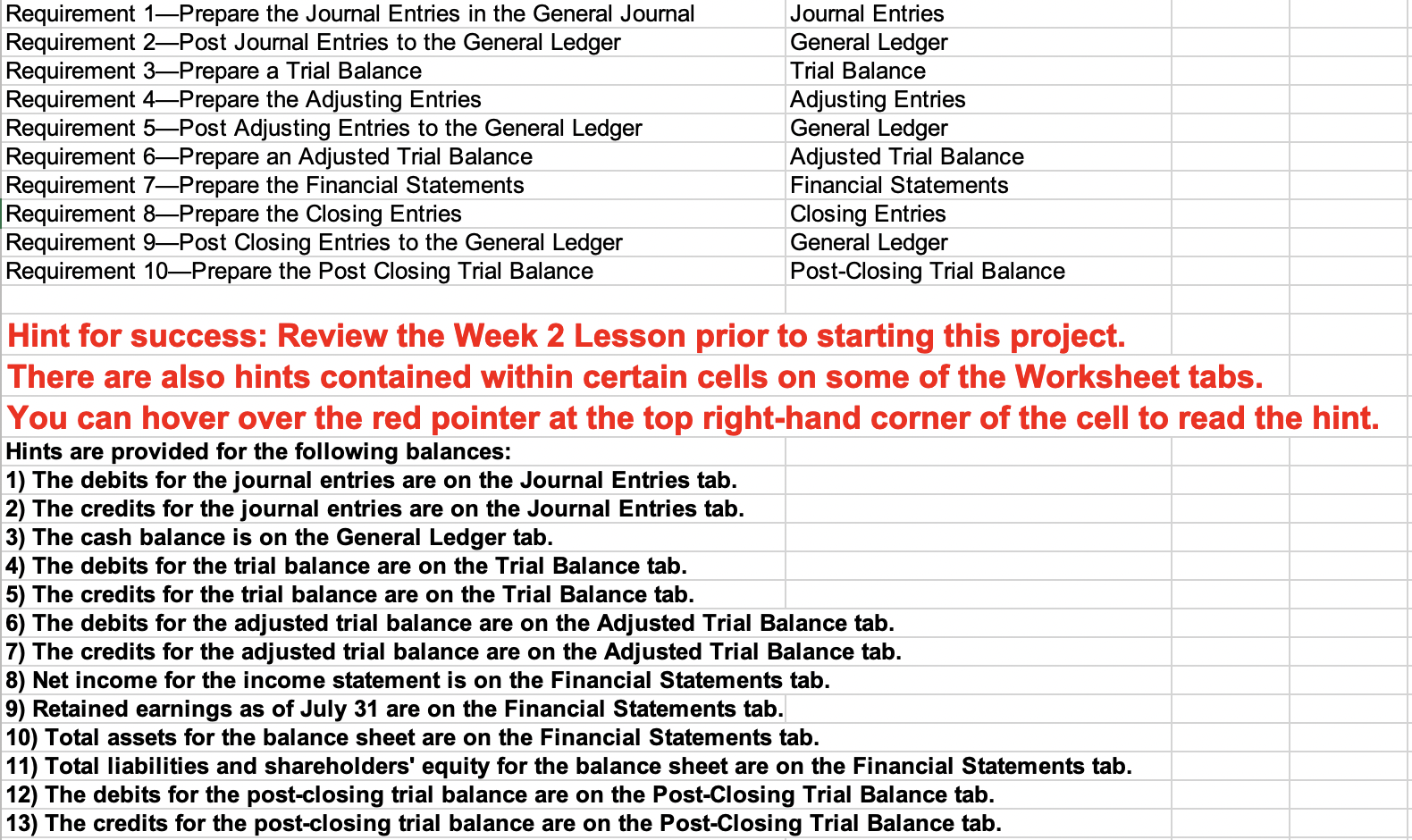

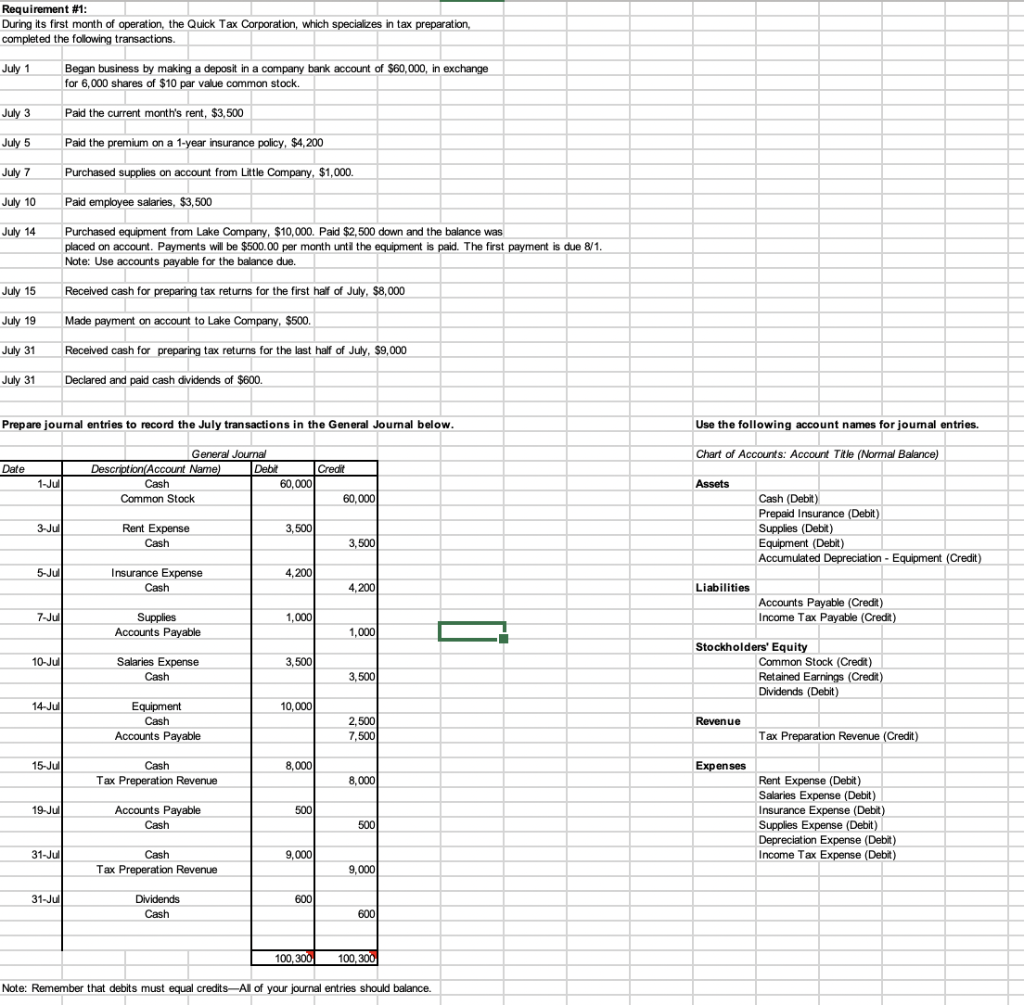

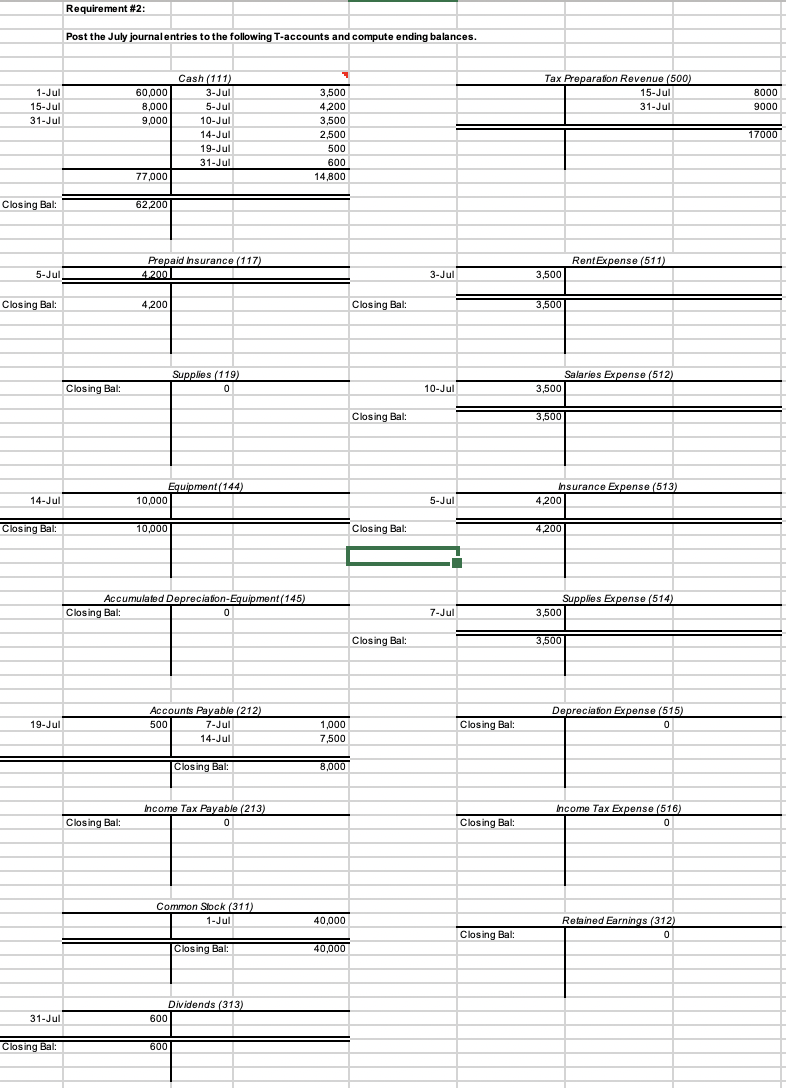

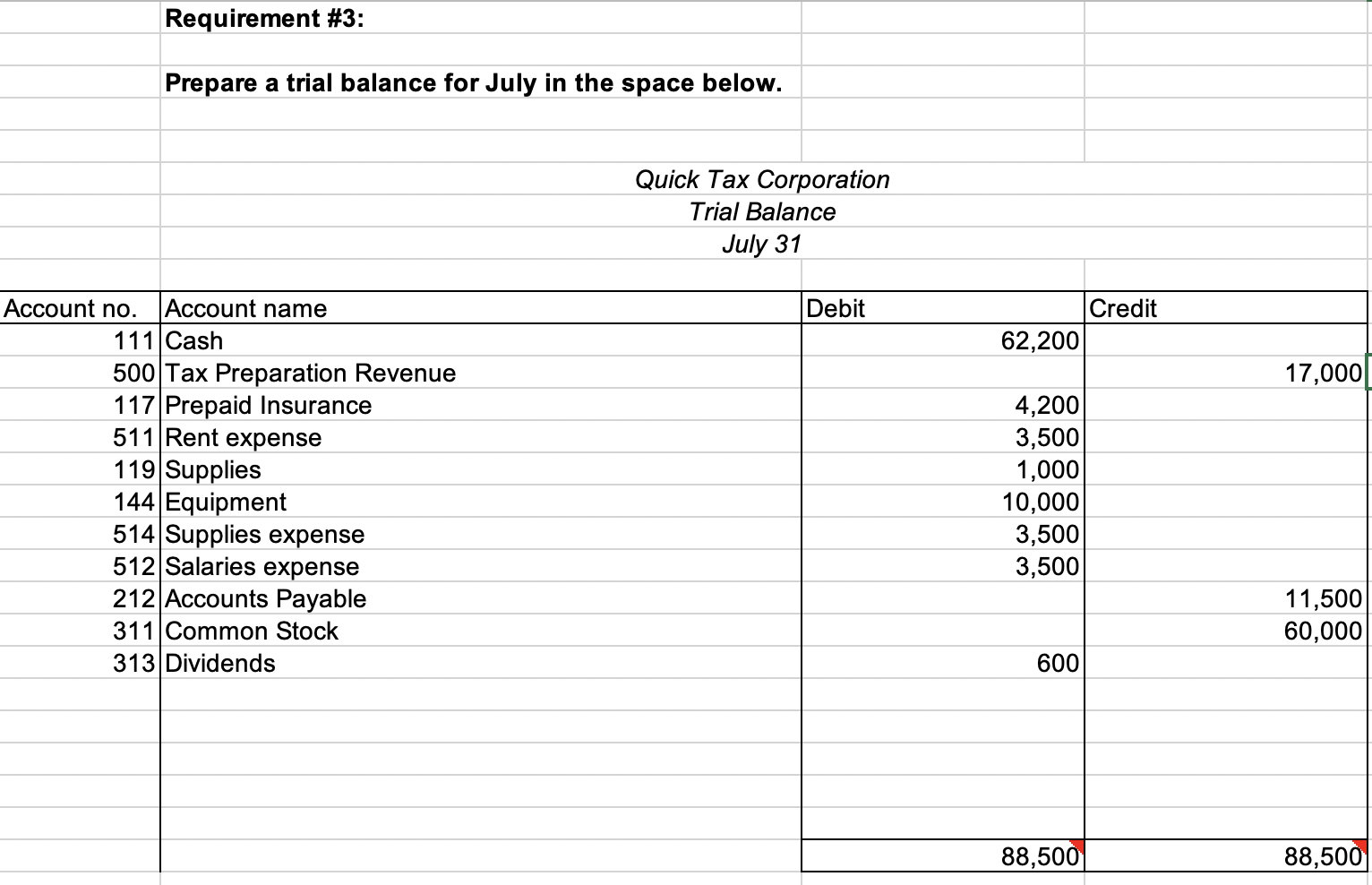

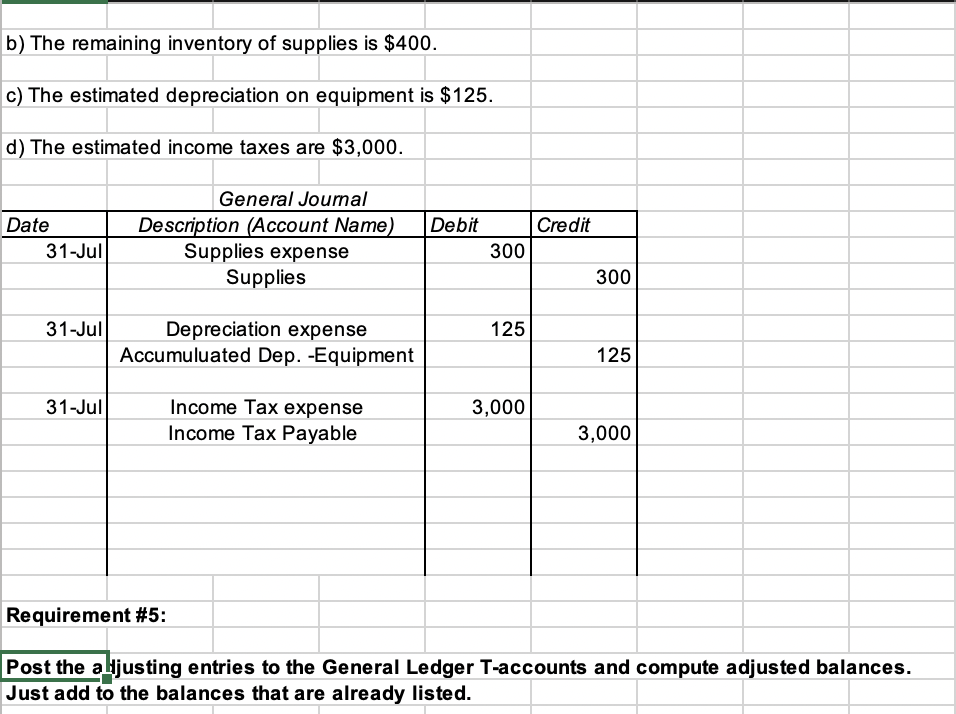

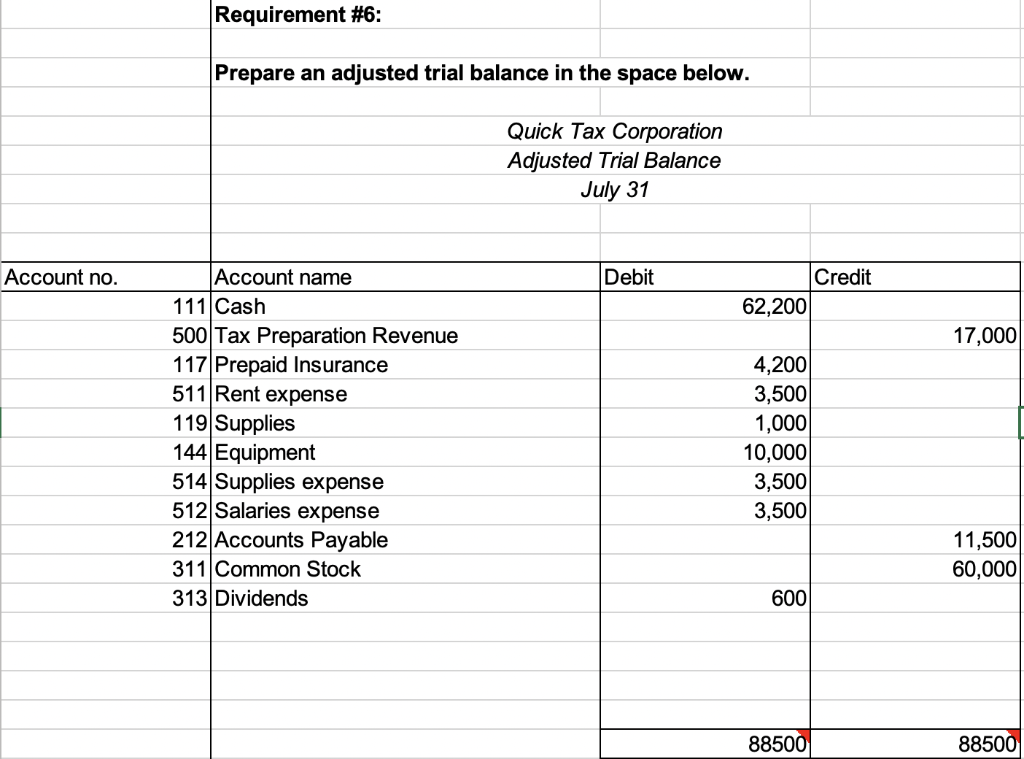

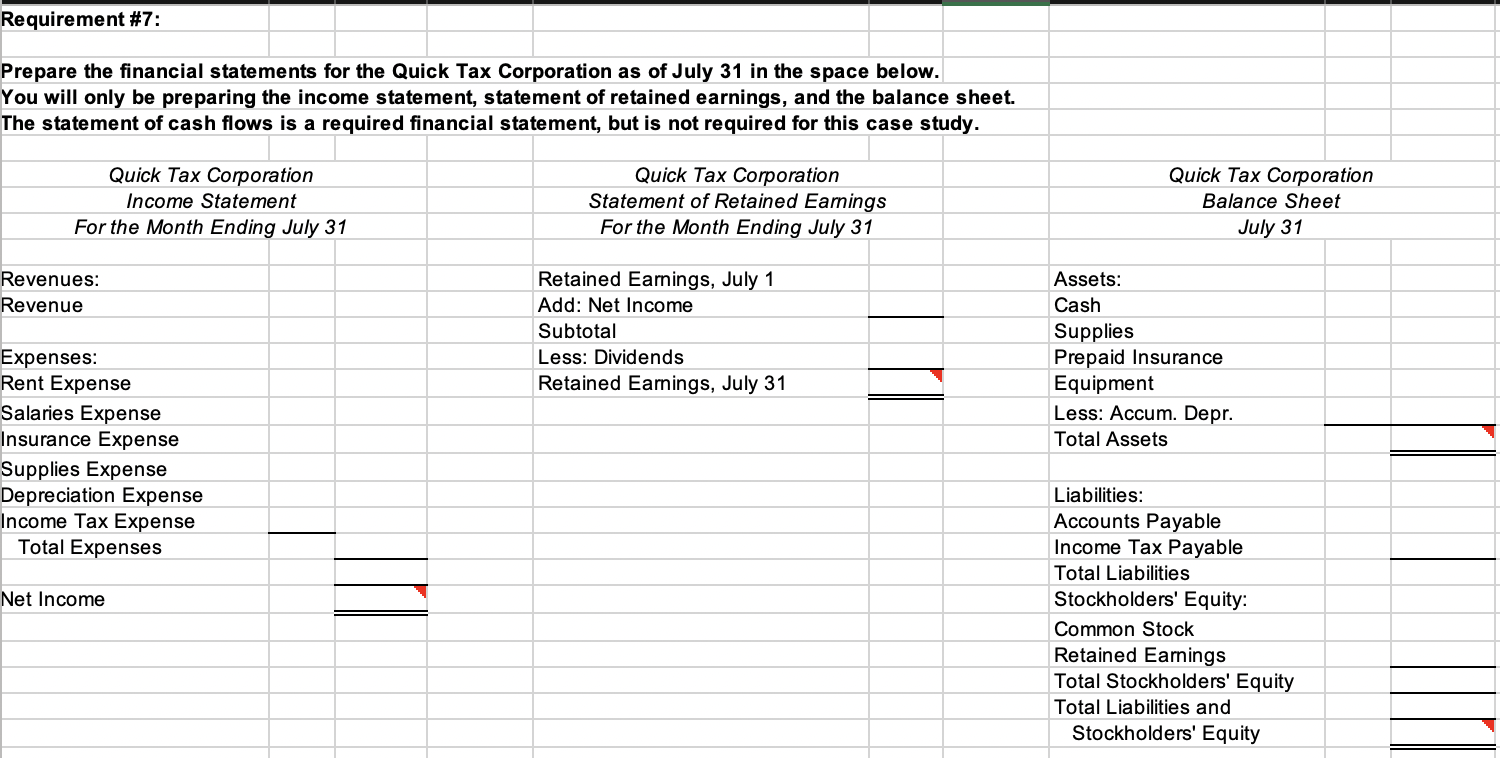

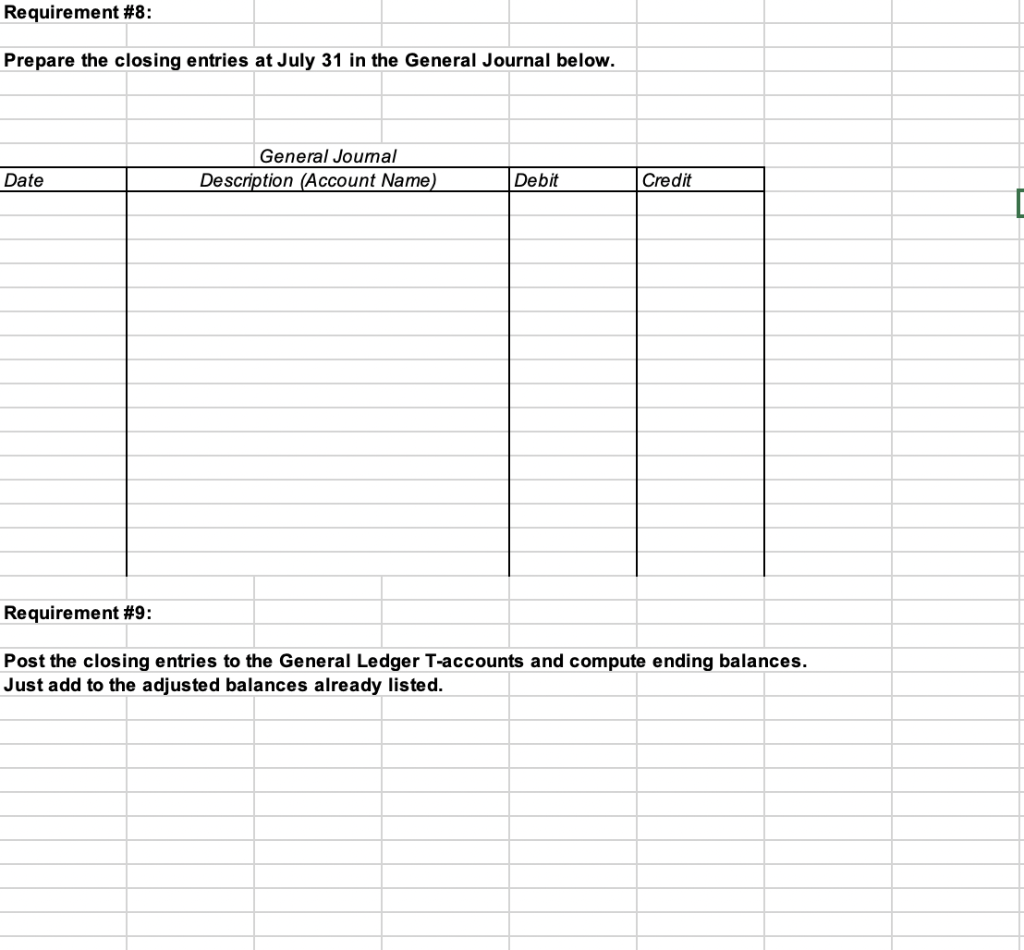

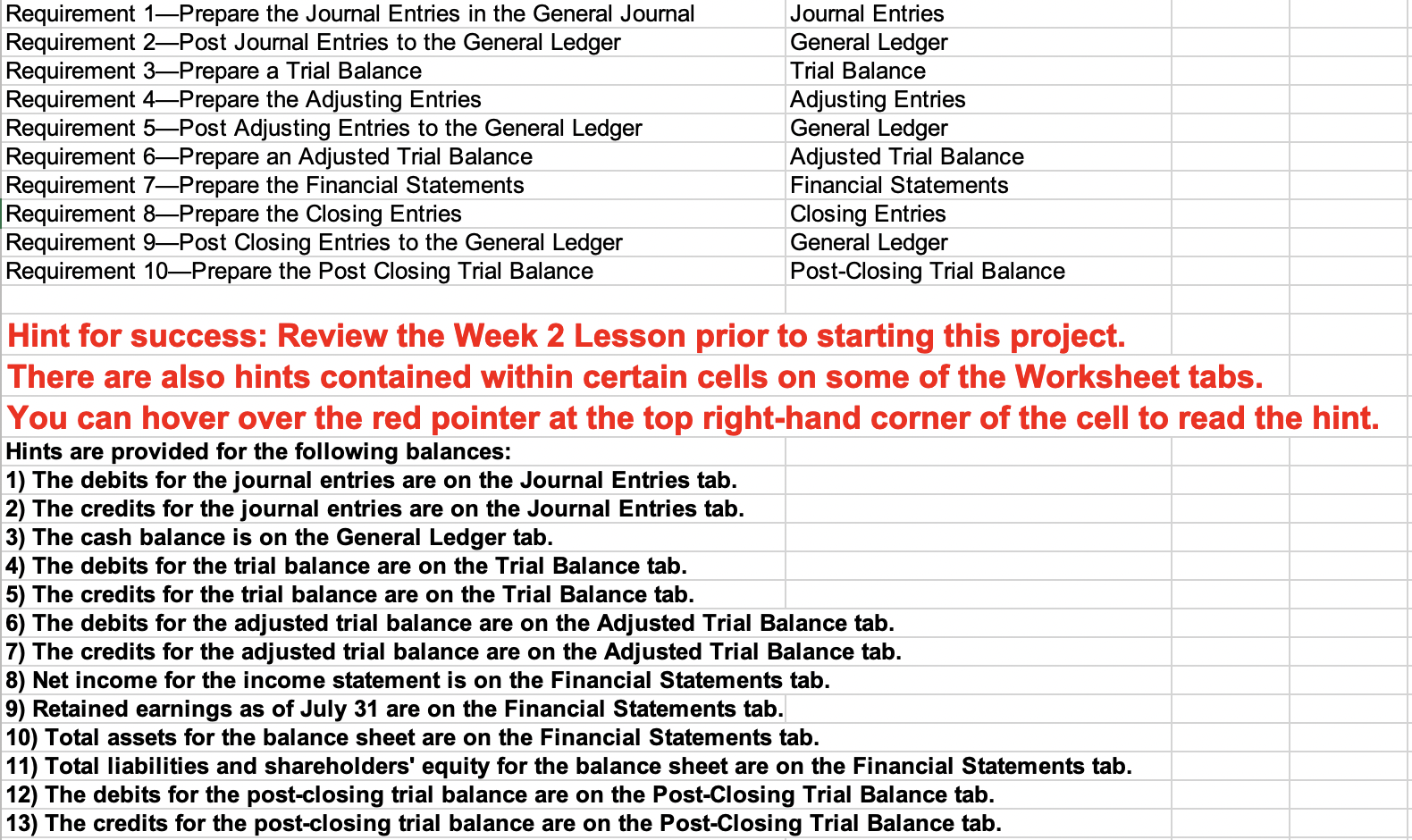

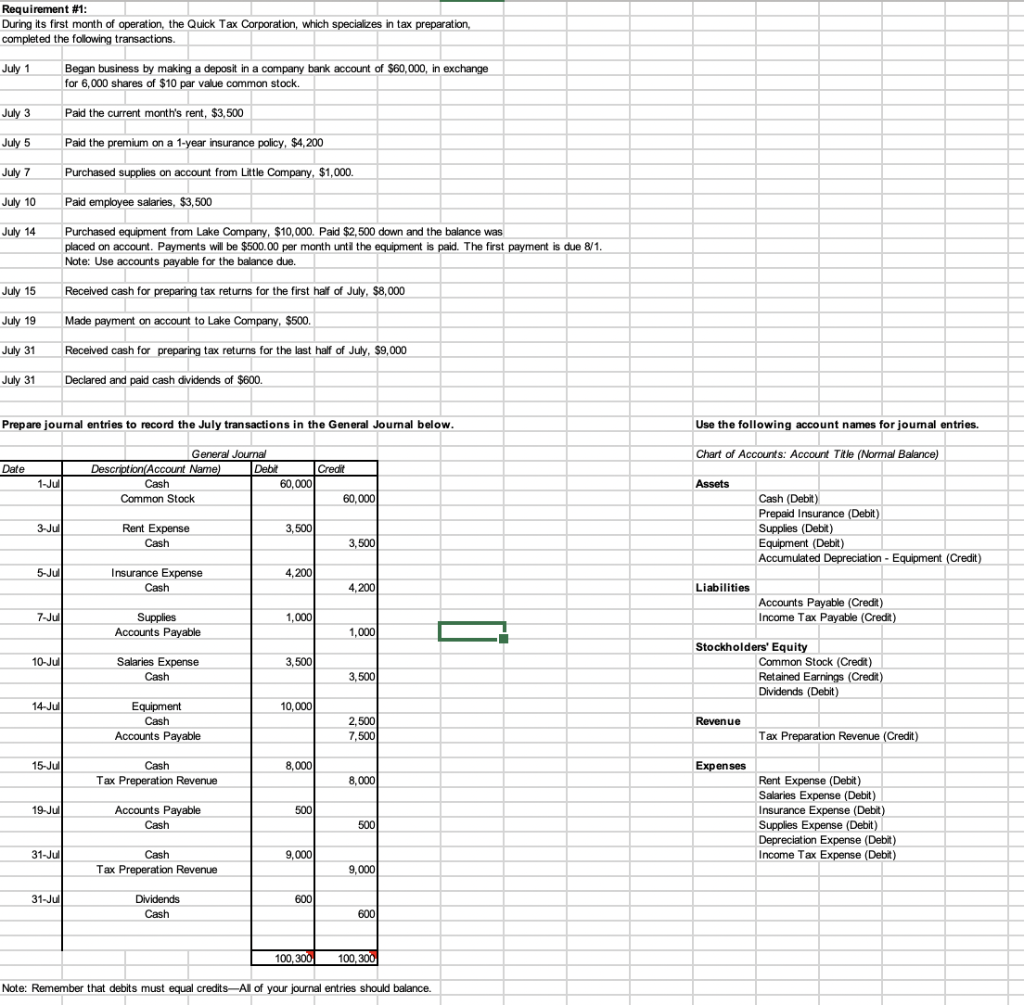

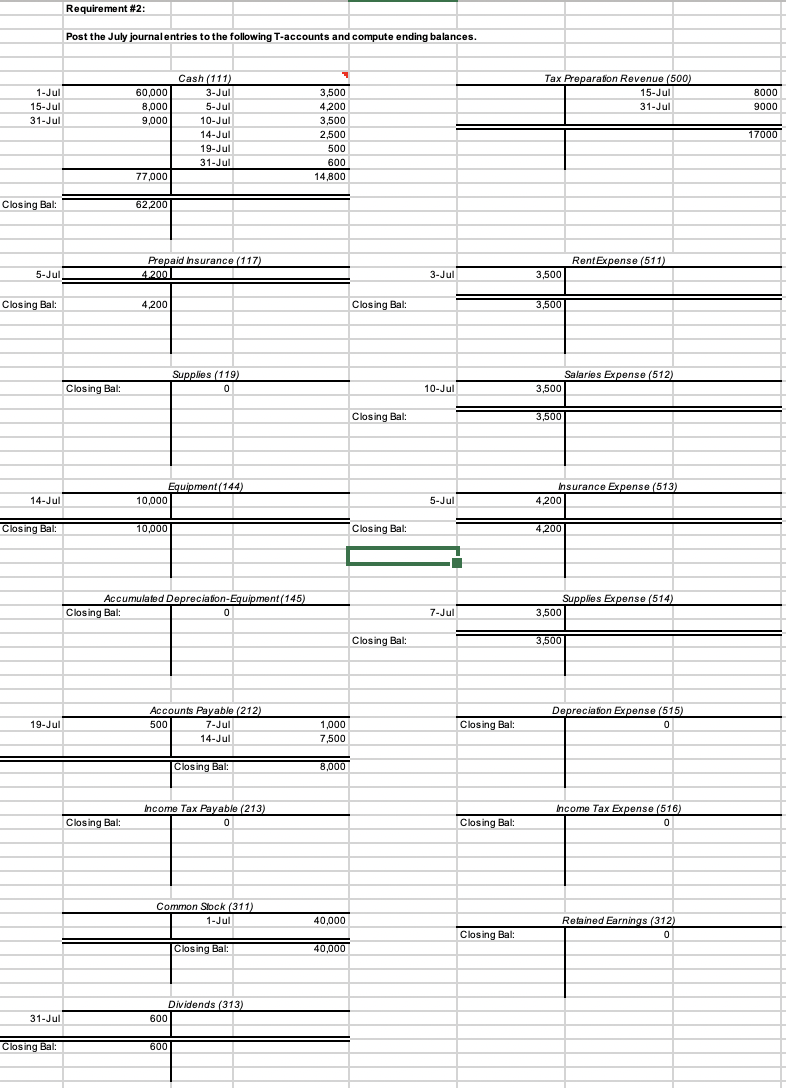

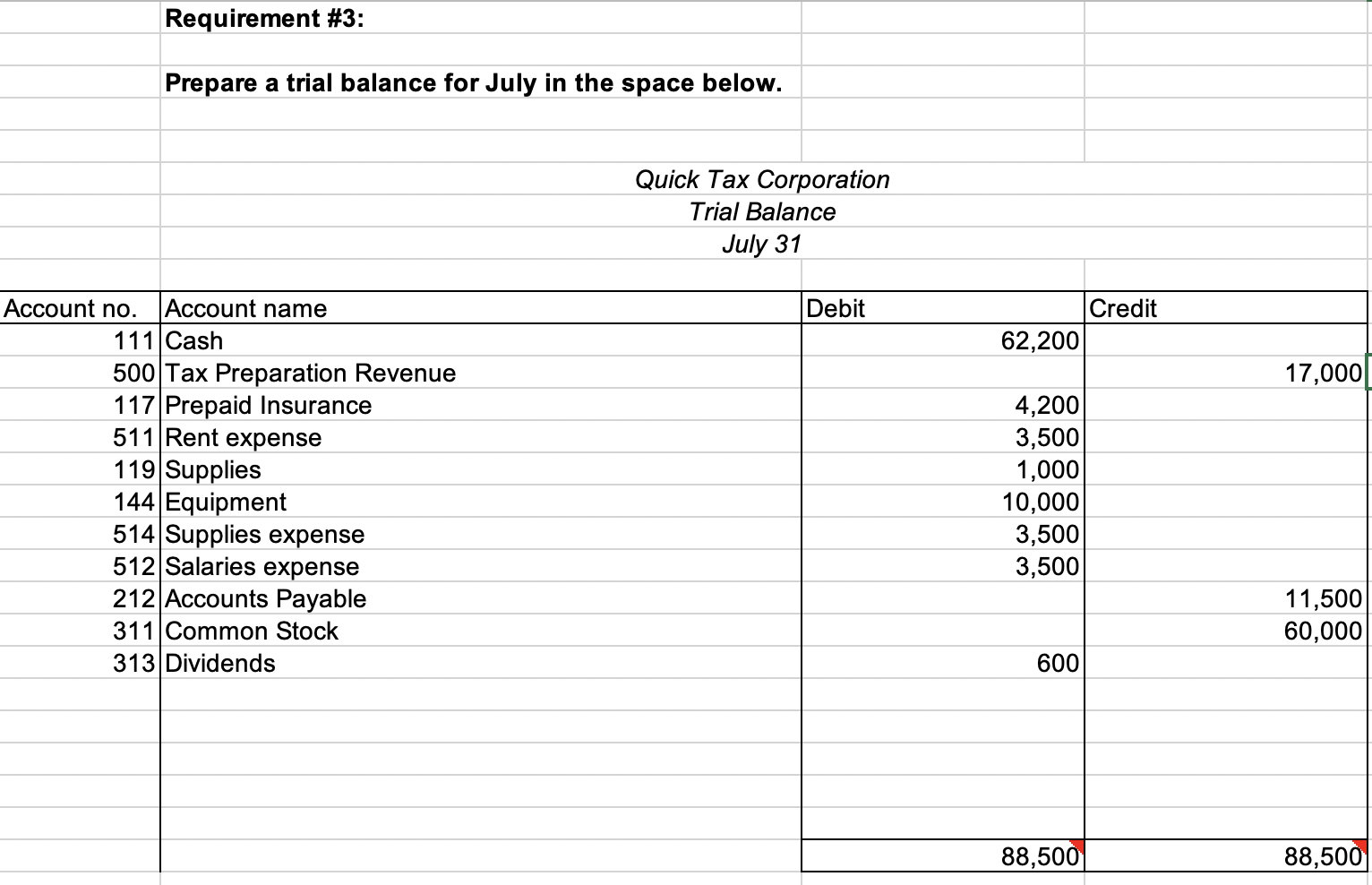

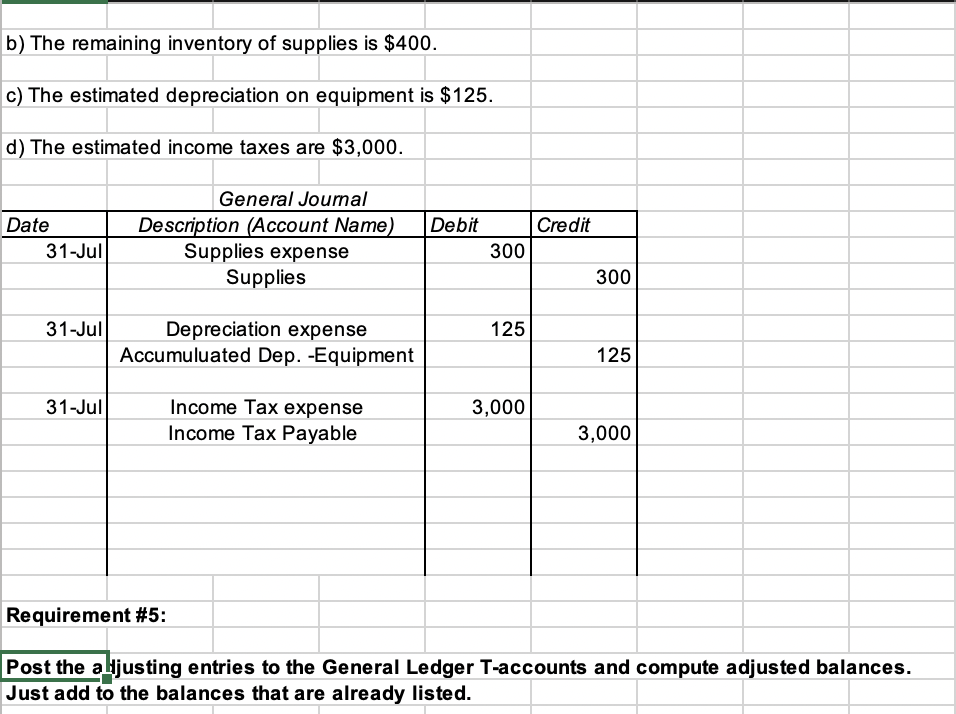

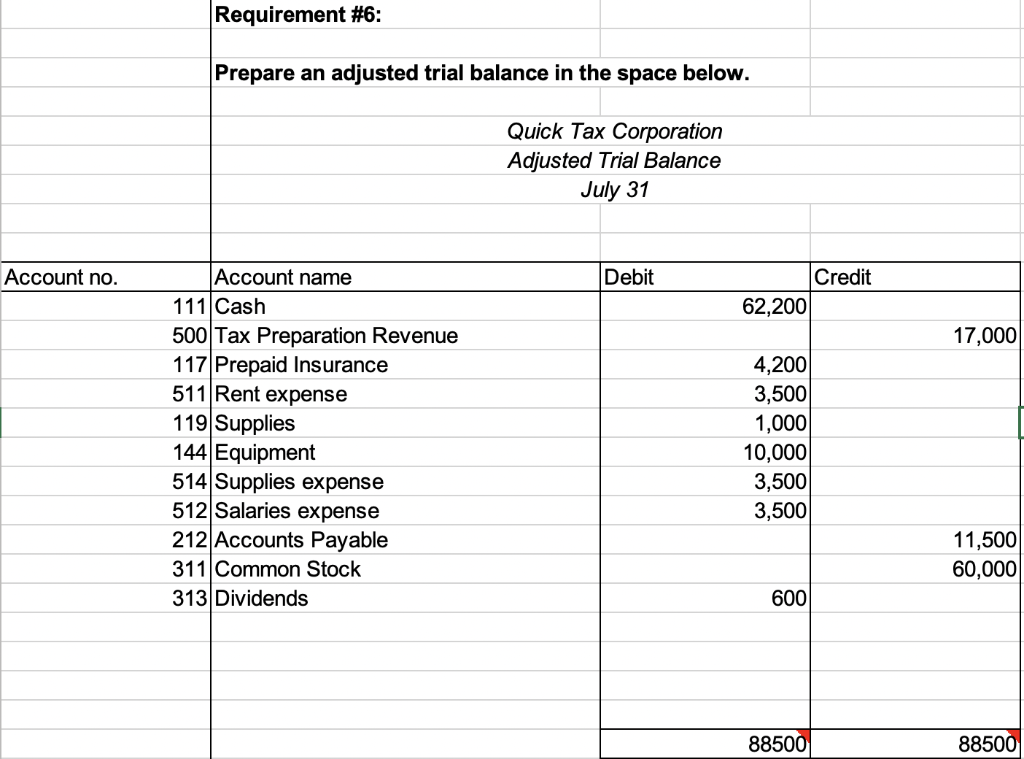

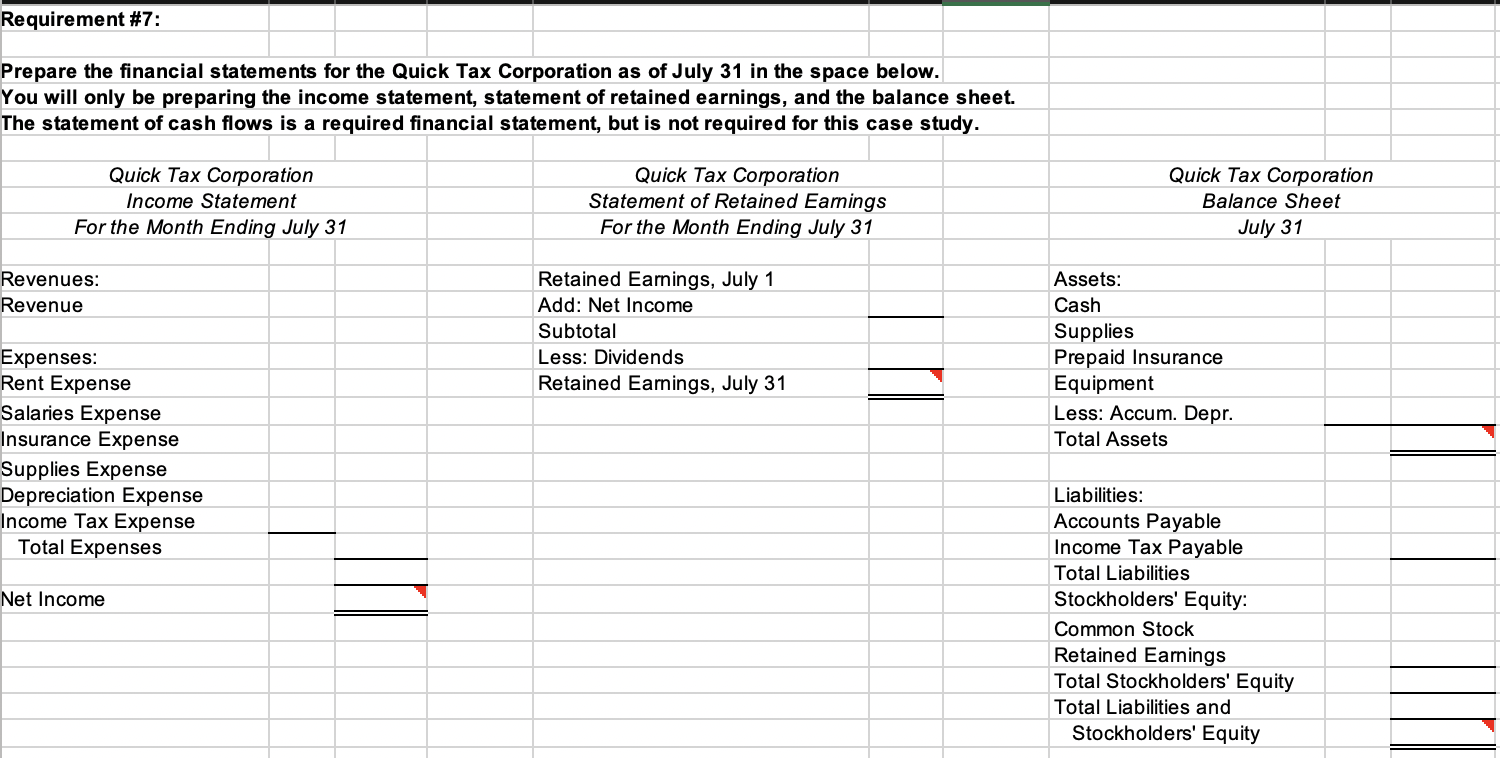

Requirement 1Prepare the Journal Entries in the General Journal Requirement 2Post Journal Entries to the General Ledger Requirement 3Prepare a Trial Balance Requirement 4Prepare the Adjusting Entries Requirement 5Post Adjusting Entries to the General Ledger Requirement 6Prepare an Adjusted Trial Balance Requirement 7Prepare the Financial Statements Requirement 8Prepare the Closing Entries Requirement 9Post Closing Entries to the General Ledger Requirement 10Prepare the Post Closing Trial Balance Journal Entries General Ledger Trial Balance Adjusting Entries General Ledger Adjusted Trial Balance Financial Statements Closing Entries General Ledger Post-Closing Trial Balance Hint for success: Review the Week 2 Lesson prior to starting this project. There are also hints contained within certain cells on some of the Worksheet tabs. You can hover over the red pointer at the top right-hand corner of the cell to read the hint. Hints are provided for the following balances: 1) The debits for the journal entries are on the Journal Entries tab. 2) The credits for the journal entries are on the Journal Entries tab. 3) The cash balance is on the General Ledger tab. 4) The debits for the trial balance are on the Trial Balance tab. 5) The credits for the trial balance are on the Trial Balance tab. 6) The debits for the adjusted trial balance are on the Adjusted Trial Balance tab. 7) The credits for the adjusted trial balance are on the Adjusted Trial Balance tab. 8) Net income for the income statement is on the Financial Statements tab. 9) Retained earnings as of July 31 are on the Financial Statements tab. 10) Total assets for the balance sheet are on the Financial Statements tab. 11) Total liabilities and shareholders' equity for the balance sheet are on the Financial Statements tab. 12) The debits for the post-closing trial balance are on the Post-Closing Trial Balance tab. 13) The credits for the post-closing trial balance are on the Post-Closing Trial Balance tab. Requirement #1: During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company bank account of $60,000, in exchange for 6,000 shares of $10 par value common stock. Paid the current month's rent, $3,500 , July 3 July 5 Paid the premium on a 1-year insurance policy, $4,200 a - July 7 Purchased supplies on account from Little Company, $1,000 July 10 Paid employee salaries, $3,500 July 14 Purchased equipment from Lake Company, $10,000. Paid $2,500 down and the balance was placed on account. Payments will be $500.00 per month until the equipment is paid. The first payment is due 8/1. Note: Use accounts payable for the balance due. July 15 Received cash for preparing tax returns for the first half of July, $8,000 July 19 Made payment on account to Lake Company, $500 July 31 Received cash for preparing tax returns for the last half of July, $9,000 July 31 Declared and paid cash dividends of $600. Prepare journal entries to record the July transactions in the General Journal below. Use the following account names for journal entries. Chart of Accounts: Account Title (Normal Balance) Date 1-Jul General Journal Description (Account Name) Debt Credit Cash 60,000 Common Stock 60,000 Assets 3-Ju 3,500 Rent Expense Cash Cash (Debit) Prepaid Insurance (Debit) Supplies (Debit) Equipment (Debit) Accumulated Depreciation - Equipment (Credit) 3,500 5-Jul 4,200 Insurance Expense Cash 4,200 Liabilities Accounts Payable (Credit) Income Tax Payable (Credit) 7-Jul 1,000 Supplies Accounts Payable 1.000 10-Jul Salaries Expense 3,500 Stockholders' Equity Common Stock (Credit) Retained Earnings (Credit) Dividends (Debit) ( Cash 3,500 14-Jul 10,000 Equipment Cash Accounts Payable Revenue 2,500 7,500 Tax Preparation Revenue (Credit) 15-Jul 8,000 Expenses Cash Tax Preperation Revenue 8,000 19-Jul 500 Accounts Payable Cash Rent Expense (Debit) Salaries Expense (Debit) Insurance Expense (Debit) Supplies Expense (Debit) Depreciation Expense (Debit) Income Tax Expense (Debit) 500 31-Jul 9,000 Cash Tax Preperation Revenue 9,000 31-Ju 600 Dividends Cash 600 100,300 100,300 Note: Remember that debits must equal credits-Al of your journal entries should balance Requirement #2: Post the July journal entries to the following T-accounts and compute ending balances. 1-Jul 15-Jul 31-Jul 60,000 8,000 9,000 Tax Preparation Revenue (500) 15-Jul 31-Jul 8000 9000 Cash (111) 3-Jul 5-Jul 10-Jul 14-Jul 19-Jul 31-Jul 3,500 4,200 3,500 2,500 500 600 14,800 17000 77,000 Closing Bal: 62,200 Rent Expense (511) Prepaid Insurance (117) 4.200 5-Jul 3-Jul 3,500 Closing Bal: 4,200 Closing Bal 3,500 Supplies (119) 0 Salaries Expense (512) 3,500 Closing Bal: 10-Jul Closing Bal: 3,500 Equipment(144) 10,000 Insurance Expense (513) 4,200 14-Jul 5-Jul Closing Bal: 10.000 Closing Bal: 4.2001 . Accumulated Depreciabon-Equipment (145) Closing Bal: 0 Supplies Expense (514) 3,500 7-Jul Closing Bal: 3,500 Accounts Payable (212) 500 7-Jul 14-Jul Depreciation Expense (515) 0 19-Jul 1,000 7,500 Closing Bal: Closing Bal: 8,000 Income Tax Payablo (213) 0 Closing Bal: Closing Bal: Income Tax Expense (516) 0 Common Stock (311) 1-Jul 1 40,000 Retained Earnings (312) 0 Closing Bal: Closing Ball 40,000 Dividends (313) 600 31-Jul Closing Bal: 600 Requirement #3: Prepare a trial balance for July in the space below. Quick Tax Corporation Trial Balance July 31 Debit Credit 62,200 17,000 Account no. Account name 111 Cash 500 Tax Preparation Revenue 117 Prepaid Insurance 511 Rent expense 119 Supplies 144 Equipment 514 Supplies expense 512 Salaries expense 212 Accounts Payable 311 Common Stock 313 Dividends 4,200 3,500 1,000 10,000 3,500 3,500 11,500 60,000 600 88,500 88,500 b) The remaining inventory of supplies is $400. c) The estimated depreciation on equipment is $125. d) The estimated income taxes are $3,000. Debit Date 31-Jul General Journal Description (Account Name) Supplies expense Supplies Credit 300 300 31-Jul 125 Depreciation expense Accumuluated Dep. -Equipment 125 31-Jul Income Tax expense Income Tax Payable 3,000 3,000 Requirement #5: Post the alijusting entries to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. Requirement #6: Prepare an adjusted trial balance in the space below. Quick Tax Corporation Adjusted Trial Balance July 31 Account no. Debit Credit 62,200 17,000 Account name 111 Cash 500 Tax Preparation Revenue 117 Prepaid Insurance 511 Rent expense 119 Supplies 144 Equipment 514 Supplies expense 512 Salaries expense 212 Accounts Payable 311 Common Stock 313 Dividends 4,200 3,500 1,000 10,000 3,500 3,500 11,500 60,000 600 88500 88500 Requirement #7: Prepare the financial statements for the Quick Tax Corporation as of July 31 in the space below. You will only be preparing the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is a required financial statement, but is not required for this case study. Quick Tax Corporation Income Statement For the Month Ending July 31 Quick Tax Corporation Statement of Retained Earnings For the Month Ending July 31 Quick Tax Corporation Balance Sheet July 31 Revenues: Revenue Retained Earnings, July 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, July 31 Assets: Cash Supplies Prepaid Insurance Equipment Less: Accum. Depr. Total Assets Expenses: Rent Expense Salaries Expense Insurance Expense Supplies Expense Depreciation Expense Income Tax Expense Total Expenses Net Income Liabilities: Accounts Payable Income Tax Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Requirement #8: Prepare the closing entries at July 31 in the General Journal below. General Journal Description (Account Name) Date Debit Credit D Requirement #9: Post the closing entries to the General Ledger T-accounts and compute ending balances. Just add to the adjusted balances already listed