hello! I need help figuring out the proper calculations driven by a proper cell-referenced excel forumla.Ive attached the problem, the solution, and what i have on my excel sheet currently. I'm not sure which cells are needed correction but PLZ HELP I'LL GIVE THE BIGGEST THUMBS UP:))))

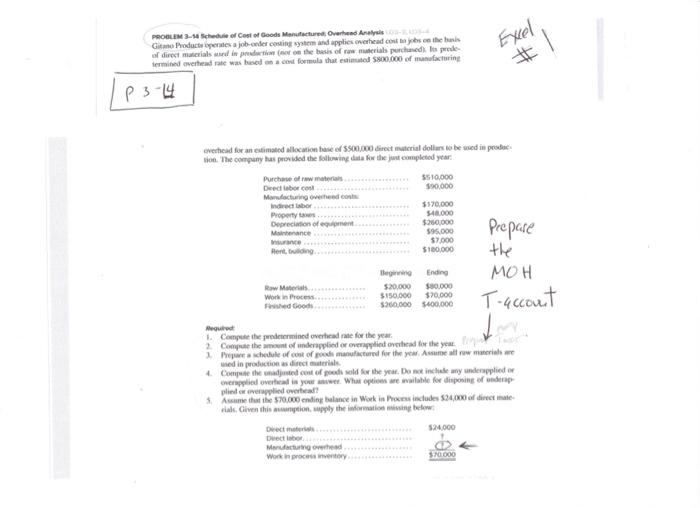

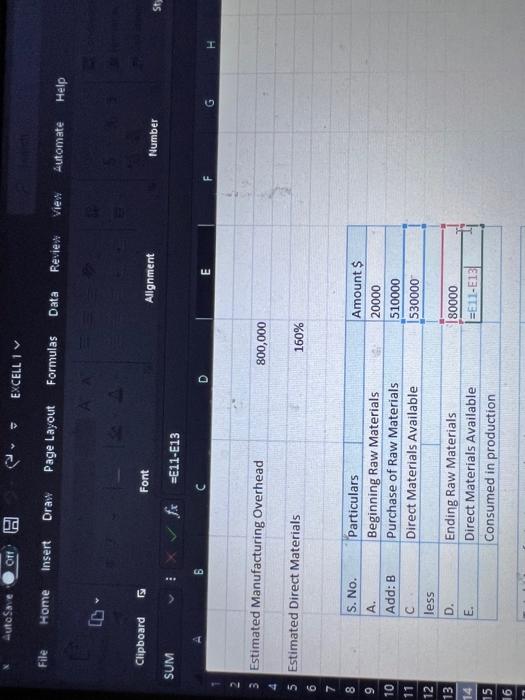

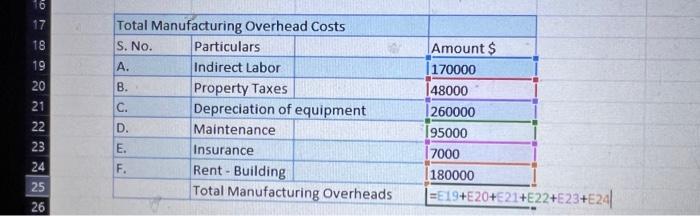

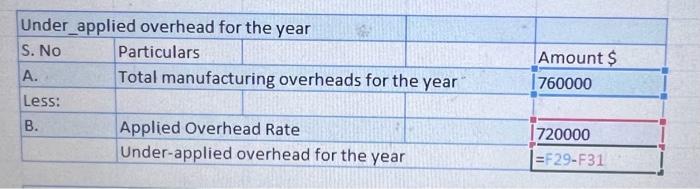

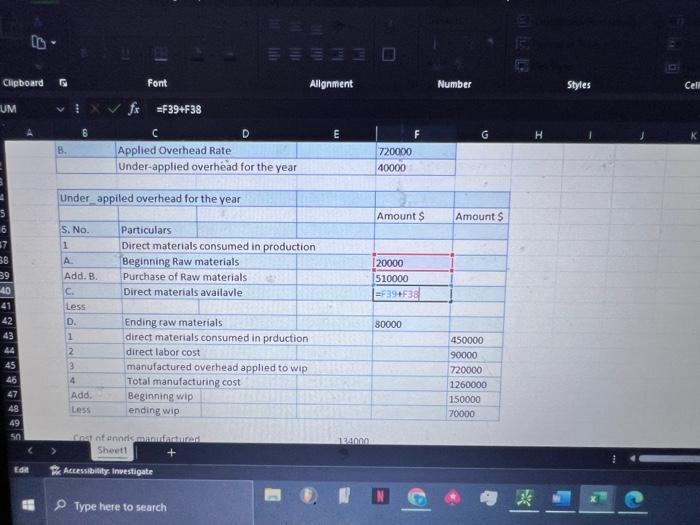

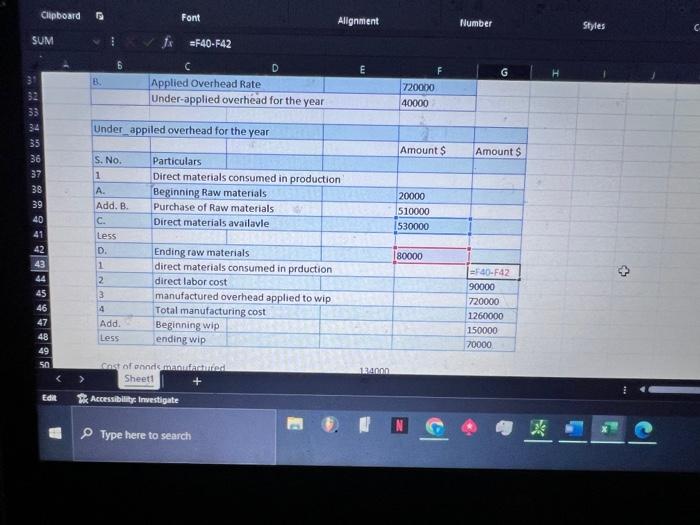

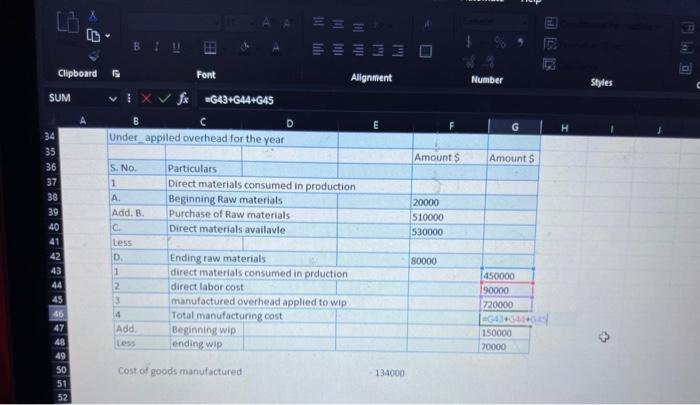

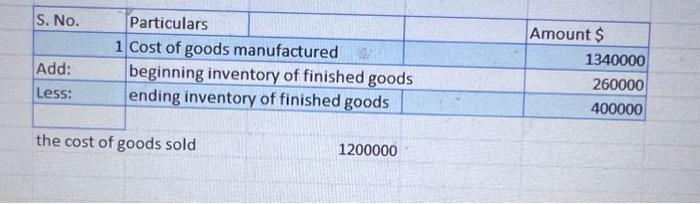

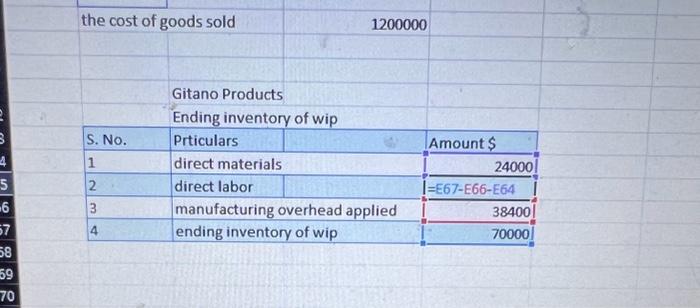

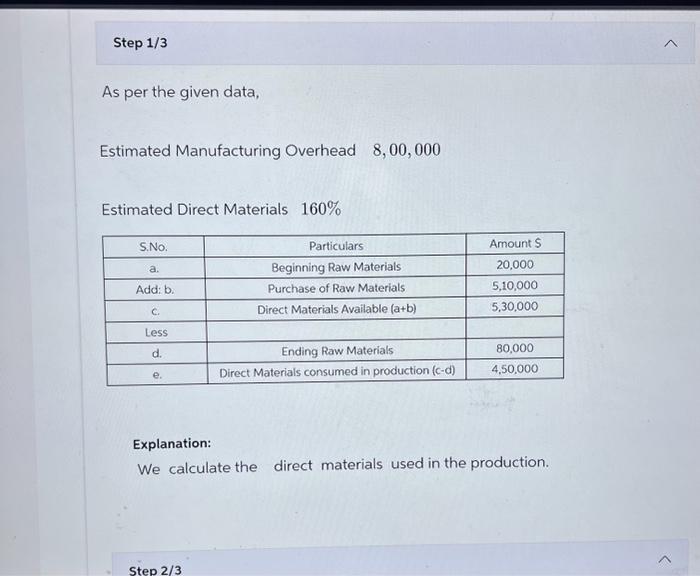

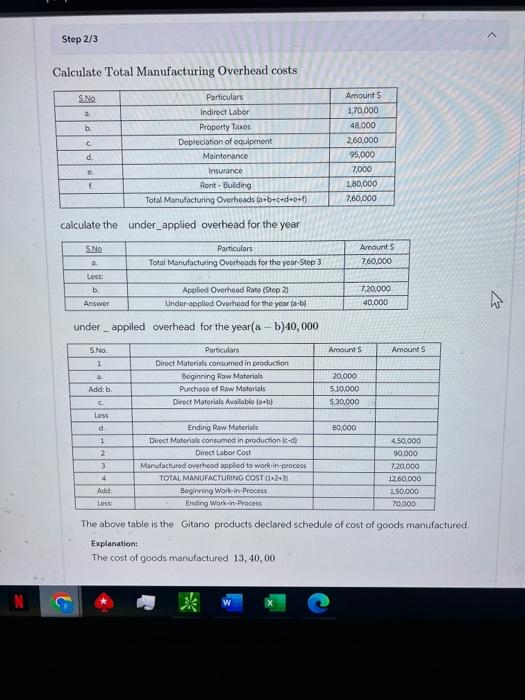

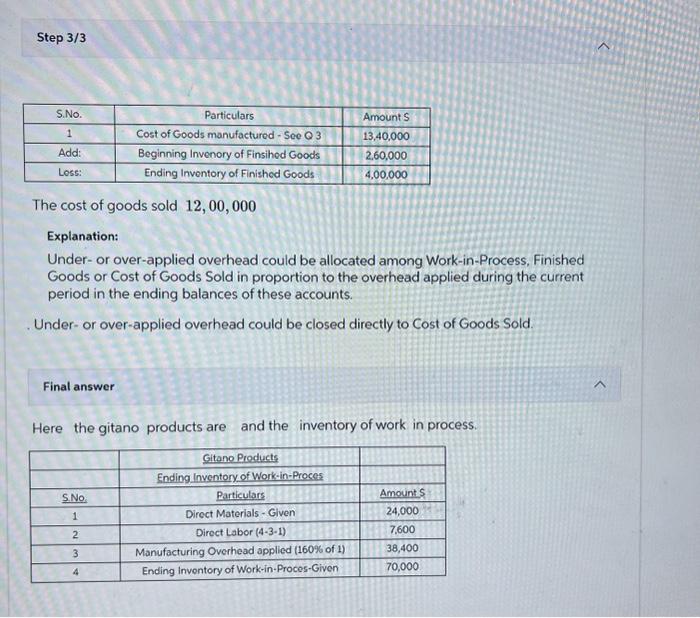

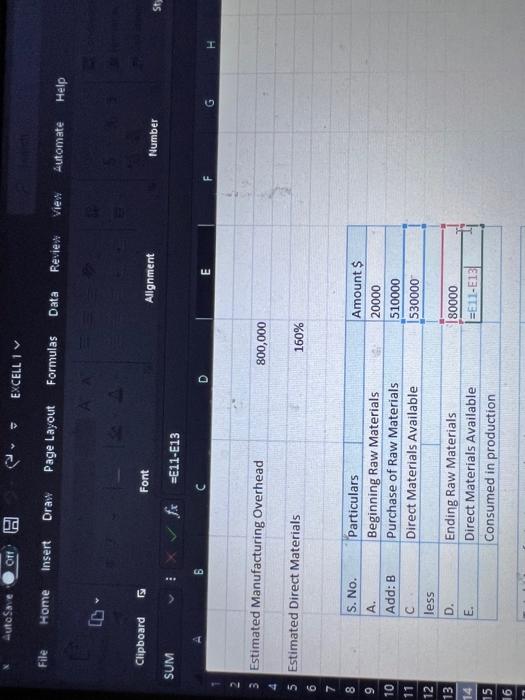

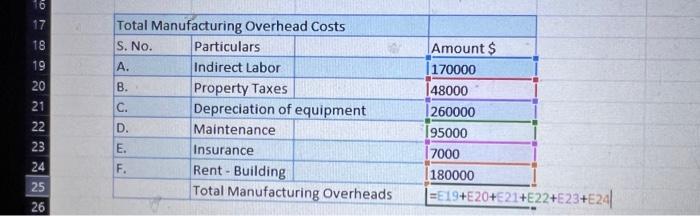

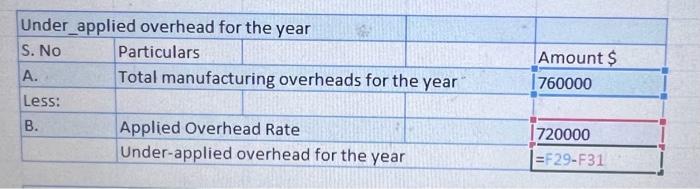

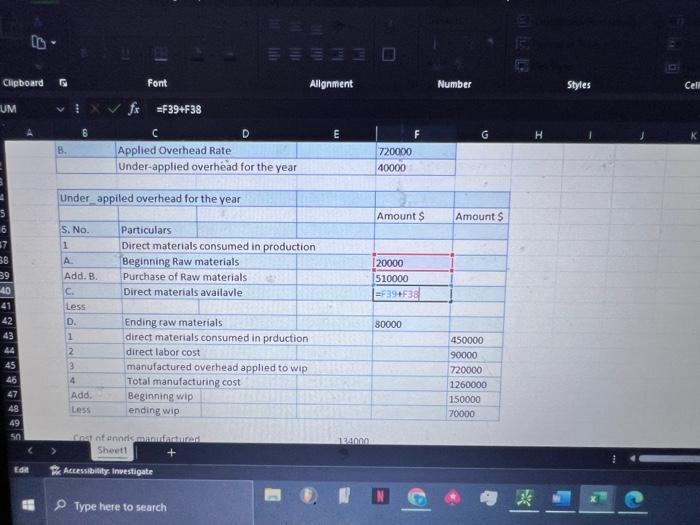

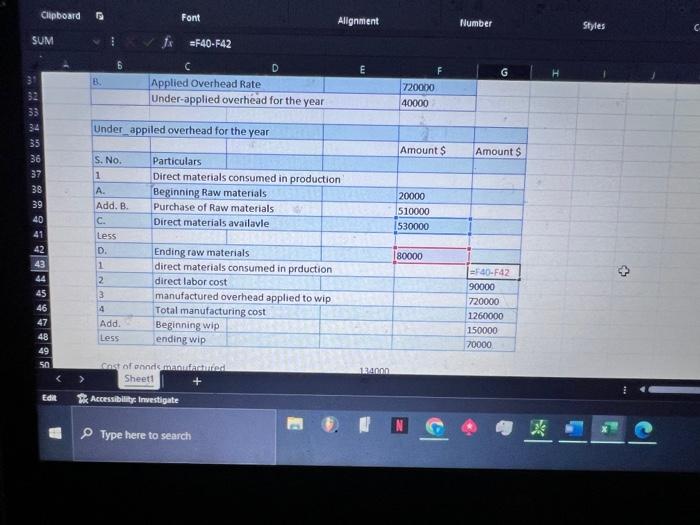

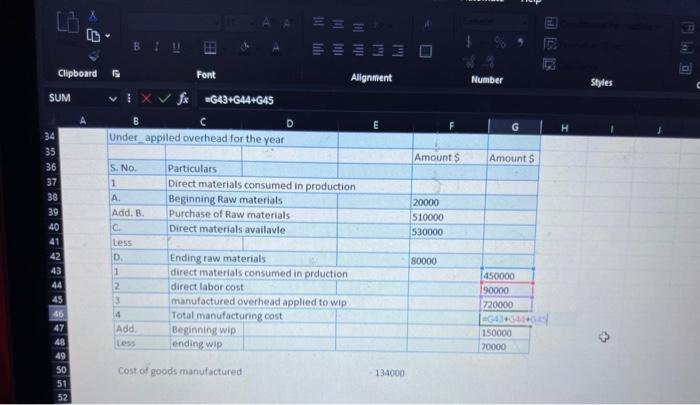

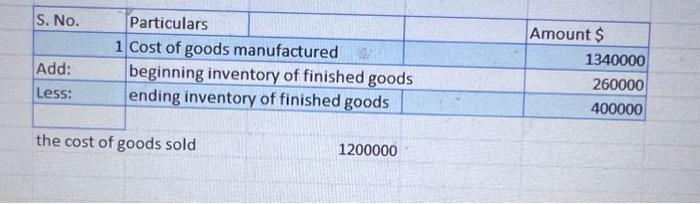

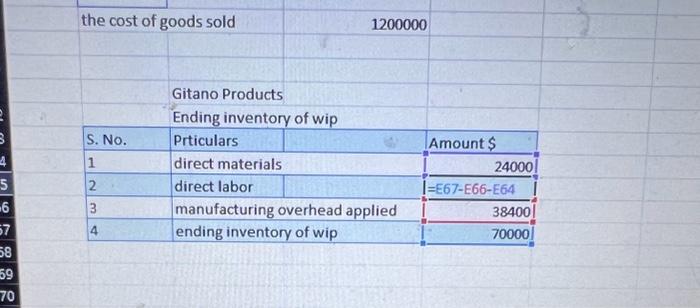

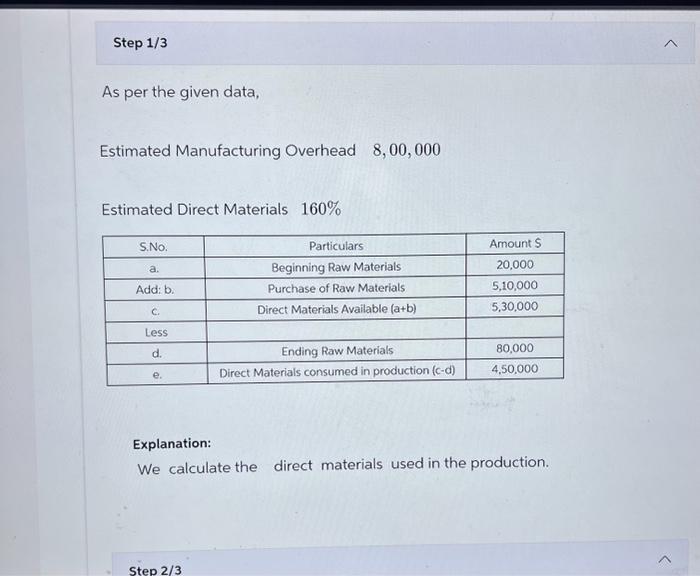

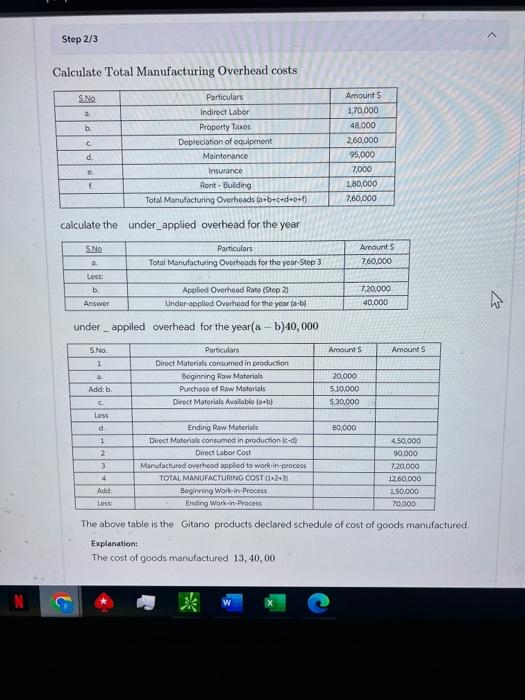

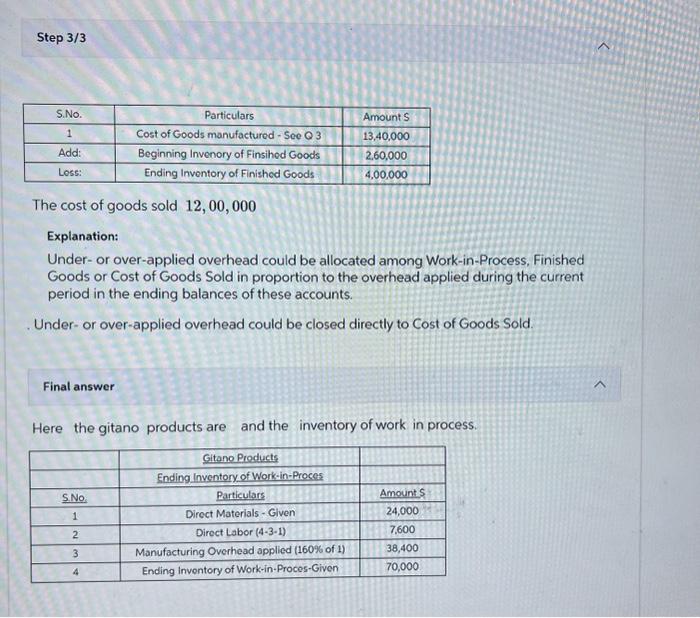

\begin{tabular}{|l|l|r|r|} \hline S. No. & Particulars & & Amount \$ \\ \hline & 1 & Cost of goods manufactured & 1340000 \\ \hline Add: & beginning inventory of finished goods & 260000 \\ \hline Less: & ending inventory of finished goods & & 400000 \\ \hline \end{tabular} the cost of goods sold 1200000 As per the given data, Estimated Manufacturing Overhead 8,00,000 Estimated Direct Materials 160% Explanation: We calculate the direct materials used in the production. Calculate Total Manufacturing Overhead costs calculate the under_applied overhead for the year under_appiled overhead for the year (ab)40,000 The above table is the Gitano products declared schedule of cost of goods manufactured Explanation: The cost of goods manufactured 13,40,00 \begin{tabular}{l} Under_applied overhead for the year \\ \begin{tabular}{|l|l|} \hline S. No & Particulars \\ \hline A. & Total manufacturing overheads for the year \\ \hline Less: & \\ \hline B. & Applied Overhead Rate \\ \hline & Under-applied overhead for the year \end{tabular} \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \hline 17 & \multicolumn{3}{|l|}{ Total Manufacturing Overhead Costs } \\ \hline 18 & S. No. & Particulars \\ \hline 19 & A. & Indirect Labor \\ \hline 20 & B. & Property Taxes \\ \hline 21 & C. & Depreciation of equipment \\ \hline 22 & D. & Maintenance & 170000 \\ \hline 23 & E. & Insurance & 18000 \\ \hline 24 & F. & Rent - Building \\ \hline 25 & & Total Manufacturing Overheads \\ \hline 26 & & & 180000 \\ \hline \end{tabular} The cost of goods sold 12,00,000 Explanation: Under- or over-applied overhead could be allocated among Work-in-Process, Finished Goods or Cost of Goods Sold in proportion to the overhead applied during the current period in the ending balances of these accounts. Under- or over-applied overhead could be closed directly to Cost of Goods Sold. Final answer Here the gitano products are and the inventory of work in process. tion. The company tus provided the folliwing data for the just oompletod ytar: Prepare the MoH Anouint 1. Cempete ife prodericrininod overticad rate for the year: uned in profuction as difect materials. plied er averapplied overtead? 5. Acsime that the $70.000 endiey balance in Work in Rocras includes $24,000 of dinect inate- the cost of goods sold Gitano Products Ending inventory of wip \begin{tabular}{|l|l|} \hline S. No. & Prticulars \\ \hline 1 & direct materials \\ \hline 2 & direct labor \\ \hline 3 & manufacturing overhead applied \\ \hline 4 & ending inventory of wip \\ \hline \end{tabular}